What is Monocrystalline Silicon?

Monocrystalline silicon, also referred to as single-crystal silicon, is a semiconductor widely used in various industries, especially in electronics

Get Price

Crystalline Silicon Photovoltaics Research

Monocrystalline silicon represented 96% of global solar shipments in 2022, making it the most common absorber material in today''s solar modules. The remaining 4% consists of other

Get Price

Silicon Solar Cells: Trends, Manufacturing

We discuss the major challenges in silicon ingot production for solar applications, particularly optimizing production yield, reducing costs, and

Get Price

Photovoltaic Cell Generations and Current Research Directions

We also present the latest developments in photovoltaic cell manufacturing technology, using the fourth-generation graphene-based photovoltaic cells as an example.

Get Price

Monocrystalline vs. Polycrystalline Solar Cells

In the production of monocrystalline silicon, great care is taken to ensure a uniform crystal structure is grown with minimal impurities and defects.

Get Price

What are the monocrystalline silicon for solar power generation

The role of monocrystalline silicon in solar power generation involves a multifaceted approach that includes economic, environmental, and technological considerations.

Get Price

What are the monocrystalline silicon for solar power

The role of monocrystalline silicon in solar power generation involves a multifaceted approach that includes economic, environmental, and

Get Price

Comprehensive investigation of rooftop photovoltaic power plants

In this study, a comprehensive 3E analysis of an existing rooftop PV power plant combining monocrystalline and polycrystalline silicone PV cell technologies has been carried out.

Get Price

Monocrystalline Silicon Cell

Monocrystalline silicon cells are defined as photovoltaic cells produced from single silicon crystals using the Czochralski method, characterized by their high efficiency of 16 to 24%, dark colors,

Get Price

Solar Photovoltaic

A solar photovoltaic system or PV system is an electricity generation system with a combination of various components such as PV panels, inverter, battery, mounting structures, etc. Nowadays,

Get Price

Enhancement of efficiency in monocrystalline silicon solar cells

With the development of silicon materials and cut-silicon wafer technologies, monocrystalline products have become more cost-effective, accelerating the replacement of polycrystalline

Get Price

(PDF) Comparison between the Energy Required for

It was taken into account the generation of environmental aspects and impacts in the manufacture of monocrystalline silicon PV modules

Get Price

Life Cycle Assessment of Monocrystalline Silicon Solar Cells

Crystalline silicon solar cells used crystalline silicon as the photovoltaic conversion material to convert solar energy into direct current electricity. At that time, there were two main

Get Price

Life Cycle Analysis of High-Performance Monocrystalline

In this paper we summarize the results of a life-cycle analysis of SunPower high efficiency PV modules, based on process data from the actual production of these modules, and compare

Get Price

A comprehensive evaluation of solar cell technologies,

At present, crystalline silicon modules are less expensive than modules composed of other materials. The large production scale of silicon feedstock, wafers, cells, and modules

Get Price

Enhancement of efficiency in monocrystalline silicon

As the representative of the first generation of solar cells, crystalline silicon solar cells still dominate the photovoltaic market, including

Get Price

Monocrystalline silicon solar photovoltaic power generation

This work reports on efforts to enhance the photovoltaic performance of standard p-type monocrystalline silicon solar cell (mono-Si) through the application of ultraviolet spectral down

Get Price

Research on the conversion efficiency and preparation technology

Monocrystalline silicon solar cells are still one of the best choices for large-scale commercial use, and occupy a dominant position in large-scale applications and industrial

Get Price

Life Cycle Analysis of High-Performance Monocrystalline

Higher efficiencies are produced by innovative cell designs and material and energy inventories that are different from those in the production of average crystalline silicon panels. On the

Get Price

Photovoltaic Cell Generations and Current Research

We also present the latest developments in photovoltaic cell manufacturing technology, using the fourth-generation graphene-based photovoltaic cells as

Get Price

Solar Photovoltaic Manufacturing Basics

Solar manufacturing encompasses the production of products and materials across the solar value chain. While some concentrating solar-thermal manufacturing exists, most solar

Get Price

Life Cycle Greenhouse Gas Emissions from Solar Photovoltaics

Published results from 400 studies of PV systems including crystalline silicon (c-Si) (mono-crystalline and multi-crystalline) and thin film (TF) (amorphous silicon [a-Si], cadmium telluride

Get Price

Monocrystalline vs Polycrystalline Solar Cells and How to Choose

Monocrystalline and polycrystalline silicon solar panels With the rapid development of solar photovoltaic energy storage, its solar panel technology update iteration is also very

Get Price

Health and Safety Concerns of Photovoltaic Solar Panels

The primary output from this purification process is polysilicon, the precursor to the silicon wafers used to manufacture the integrated circuits at the heart of most electronics as well as

Get Price

Progress in n-type monocrystalline silicon for high

ABsTrACT Future high efficiency silicon solar cells are expected to be based on n-type monocrystalline wafers. Cell and module photovoltaic conversion efficiency increases are

Get Price

6 FAQs about [Photovoltaic power generation production of monocrystalline silicon panels]

Which crystalline solar cells dominate the photovoltaic market?

[email protected] Abstract. As the representative of the first generation of solar cells, crystalline silicon solar cells still dominate the photovoltaic market, including monocrystalline and polycrystalline silicon cells.

What are crystalline silicon solar cells?

Crystalline silicon solar cells used crystalline silicon as the photovoltaic conversion material to convert solar energy into direct current electricity. At that time, there were two main types of silicon-based solar cells: monocrystalline silicon and polycrystalline silicon.

Why are solar cells dominated by monocrystalline silicon?

It is noted that the solar cell market is dominated by monocrystalline silicon cells due to their high efficiency. About two decades ago, the efficiency of crystalline silicon photovoltaic cells reached the 25% threshold at the laboratory scale. Despite technological advances since then, peak efficiency has now increased very slightly to 26.6%.

What is a monocrystalline silicon solar module?

Monocrystalline silicon represented 96% of global solar shipments in 2022, making it the most common absorber material in today’s solar modules. The remaining 4% consists of other materials, mostly cadmium telluride. Monocrystalline silicon PV cells can have energy conversion efficiencies higher than 27% in ideal laboratory conditions.

Are photovoltaic cells crystalline or monocrystalline?

Photovoltaic cells have therefore become a popular research direction. Among them, photovoltaic cells made of silicon with a crystalline structure account for exceeding 90% of the photovoltaic market. Meanwhile, monocrystalline silicon has a perfect crystal structure and large abundance.

What is a monocrystalline solar cell?

A monocrystalline solar cell is fabricated using single crystals of silicon by a procedure named as Czochralski progress. Its efficiency of the monocrystalline lies between 15% and 20%. It is cylindrical in shape made up of silicon ingots.

More related information

-

Power generation efficiency of bifacial monocrystalline photovoltaic panels

Power generation efficiency of bifacial monocrystalline photovoltaic panels

-

Silicon panels for photovoltaic power generation

Silicon panels for photovoltaic power generation

-

High efficiency monocrystalline silicon photovoltaic panels

High efficiency monocrystalline silicon photovoltaic panels

-

Czech monocrystalline silicon photovoltaic panels

Czech monocrystalline silicon photovoltaic panels

-

Photovoltaic panels on rural rooftops for power generation

Photovoltaic panels on rural rooftops for power generation

-

European photovoltaic power generation single silicon panel

European photovoltaic power generation single silicon panel

-

The impact of photovoltaic panels on power generation

The impact of photovoltaic panels on power generation

-

Connection of monocrystalline silicon photovoltaic panels

Connection of monocrystalline silicon photovoltaic panels

Commercial & Industrial Solar Storage Market Growth

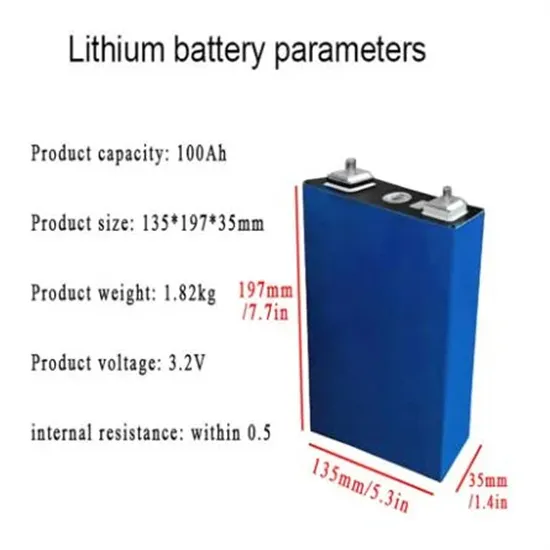

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

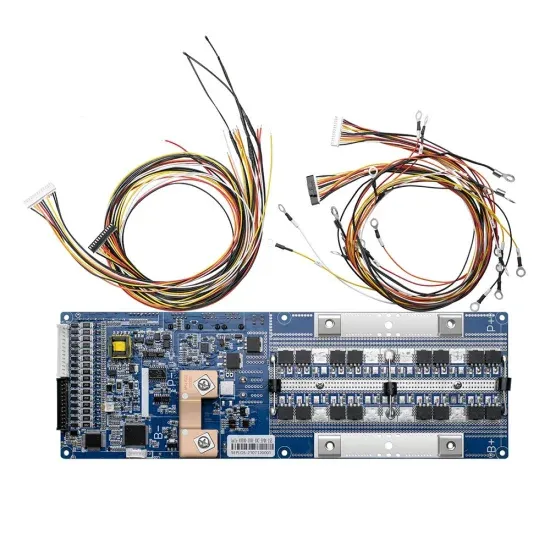

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.