Georgia Power ompany''s 2023 Integrated Resource Plan Upda

One result of the extraordinary economic growth taking place in Georgia is that the state''s energy needs have significantly increased. Many of the businesses coming to Georgia are now

Get Price

Distributed Resource Utilization | Department of Energy

Distributed resource utilization involves maturing a set of regulatory, business, and technical capabilities to more fully enable decentralized resources to

Get Price

The Economics of Integrating Distributed Energy

This chapter provides a broad overview of current economic issues related to integrating distributed energy resources (DERs)—primarily

Get Price

Georgia Power to Keep Coal, Gas Power Plants Running Longer as Demand

Southern Co. subsidiary Georgia Power has proposed a pivot toward extending the life of several existing coal and natural gas-fired power plants into the late 2030s—well beyond

Get Price

Georgia Power updates IRP, seeking additional

Georgia Power filed an update to its Integrated Resource Plan (IRP) to request additional generation resources in the face of mounting

Get Price

Peach State power play: Georgia''s blueprint for grid-scale energy

This article highlights Georgia''s blueprint for grid-scale energy storage, demonstrating how targeted planning, infrastructure optimization, and domestic manufacturing

Get Price

Georgia Power files plan to reliably, economically

Solutions to meet increasing customer demand for emission-free, sustainable, and resilient energy including a new solar plus storage program

Get Price

Georgia Power updates IRP, seeking additional generation

Georgia Power filed an update to its Integrated Resource Plan (IRP) to request additional generation resources in the face of mounting projected energy needs for the state.

Get Price

Georgia Power, PSC staff reach agreement on request for more

Georgia Power also is proposing an expansion of its battery energy storage capacity and new and expanded distributed energy resources, such as rooftop solar, and

Get Price

PSC approves Georgia Power''s long-term energy plan to meet

Customer-focused initiatives include solar-plus-storage programs, distributed energy resource demand response, and increased funding for energy efficiency efforts

Get Price

Georgia Power Files Update To 2023 Integrated

Georgia Power has filed an update to its 2023 Integrated Resource Plan (IRP) seeking approval to deploy additional generation resources

Get Price

Georgia Power seeks more energy generation capacity

"While energy storage resources continue to grow as a percentage of Georgia Power''s portfolio and to support renewable integration, the company cannot overly rely on

Get Price

Integrated Resource Plan

Resources approved in the final plan included battery energy storage systems (BESS), including BESS charged with solar energy; new and expanded

Get Price

Let the Market Lead: Aligning Georgia''s Energy Plan with

Across the state, Georgia''s major employers — including manufacturers, data centers, and logistics firms — are seeking more clean energy to meet customer expectations

Get Price

Georgia Power''s first battery energy storage system reaches

Georgia Power leaders joined elected officials from the Georgia Public Service Commission (PSC), Georgia legislature, and Talbot and Muscogee counties on Thursday to

Get Price

Georgia Power Company''s 2025 Integrated Resource Pl

peline of potential and committed large load customers. Georgia Power''s risk-adjusted load forecast from the winter of 2024/20253 through the winter of 2030/2031 reflects approximately

Get Price

Georgia PSC Approves Plan to Reliably, Economically Meet the Energy

The Georgia Public Service Commission (PSC) today approved Georgia Power''s 2025 Integrated Resource Plan (IRP). The final, approved plan will allow the company to

Get Price

Energy Storage Regulations and Deployment in Georgia

Overall, Georgia has a supportive regulatory environment for distributed energy storage, allowing for individual ownership and usage while also providing incentives for its adoption.

Get Price

Georgia PSC Approves Plan to Reliably, Economically Meet the

The Georgia Public Service Commission (PSC) today approved Georgia Power''s 2025 Integrated Resource Plan (IRP). The final, approved plan will allow the company to

Get Price

Georgia Power''s 2025 IRP: Further shift towards battery storage

State resourcing plans are increasingly updating battery energy storage systems (BESS) plans, especially those tied to solar.

Get Price

What Are Distributed Energy Resources (DER)? | IBM

Distributed energy resources, or DER, are small-scale energy systems that power a nearby location. DER can be connected to electric grids

Get Price

Georgia Follows Ohio''s Lead in Moving Energy Costs to Data

Keeping Ahead of Anticipated Energy Demand This regulatory change reflects Georgia''s proactive approach to managing the increasing energy demands associated with the

Get Price

Georgia utility projects ''extraordinary'' load growth in newest plan

Georgia Power has filed its 2025 Integrated Resource Plan (IRP) with the Georgia Public Service Commission (PSC), a roadmap for how the utility intends to meet the energy

Get Price

Peach State power play: Georgia''s blueprint for grid-scale energy storage

This article highlights Georgia''s blueprint for grid-scale energy storage, demonstrating how targeted planning, infrastructure optimization, and domestic manufacturing

Get Price

PSC approves Georgia Power''s long-term energy plan

Customer-focused initiatives include solar-plus-storage programs, distributed energy resource demand response, and increased funding for

Get Price

SEIA recommends US reach 700GWh of storage

SEIA''s whitepaper provides recommendations for accelerating BESS deployment in the US. Image: SEIA The Solar Energy Industries

Get Price

Distributed Energy Storage

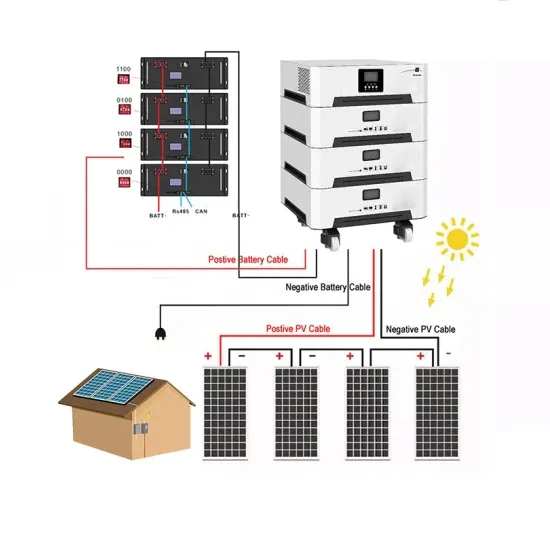

Distributed energy storage (DES) is defined as a system that enhances the adaptability and reliability of the energy grid by storing excess energy during high generation periods and

Get Price

SEIA Sets Ambitious Goal Of 700 GWh Of US Energy

SEIA recently announced a major goal: 700 gigawatt-hours (GWh) of energy storage installed across the country by 2030, and the deployment of

Get Price

6 FAQs about [Georgia s Distributed Energy Storage Demand]

Does Georgia Power own energy storage?

Georgia Power first examined energy storage in its 2019 IRP, with approval to build, own and operate 80 MW of BESS at the time. Tristan is an Electrical Engineer with experience in consulting and public sector works in plant procurement. He has previously been Managing Editor and Founding Editor of tech and other publications in Australia.

Will Georgia Power add more energy storage in 2028?

Also notable is that Georgia Power is looking at longer duration energy storage, with 3,000 MW per year of 4-hour energy storage is projected to be added starting in 2028, while 3,000 MW per year of 12-hour energy storage is planned from 2033. Small-scale BESS boost

How many MW will Georgia Power Add to its renewable portfolio?

If realized, this would bring Georgia Power’s renewable portfolio to roughly 11,000 MW by that year. Additionally, battery energy storage systems (BESS) will be integrated into future competitive bids. Georgia Power currently plans to add more than 1,500 MW of BESS in the coming years.

How much electrical load growth will Georgia have in 2023?

Over the next six years, the utility projects approximately 8.2 GW of electrical load growth, up more than 2.2 GW overall when compared to projections in its 2023 IRP Update, an update that was approved by the Georgia state body, the Public Service Commission or PSC, in April 2024.

Does Georgia Power have a demand-side resource mix?

In addition to investments in its transmission and generation systems and assets, Georgia Power stressed the importance of demand-side resources, such as energy efficiency programs and demand response programs, to its resource mix and customers’ overall experience.

Where can I find information about Georgia Power's long-term energy strategy?

For more information about the IRP and Georgia Power’s long-term energy strategy, visit The Source: Georgia Power, a Southern Company, provided the details for this article. Georgia Power's 2025 Integrated Resource Plan emphasizes reliability, affordability, and cleaner energy sources.

More related information

-

Georgia Distributed Energy Storage Cabinet

Georgia Distributed Energy Storage Cabinet

-

Is there a high demand for energy storage batteries in South Africa

Is there a high demand for energy storage batteries in South Africa

-

Energy storage battery demand manufacturers

Energy storage battery demand manufacturers

-

Distributed Energy Storage Procurement

Distributed Energy Storage Procurement

-

Distributed liquid hybrid energy storage

Distributed liquid hybrid energy storage

-

Distributed photovoltaic energy storage power station in Chile

Distributed photovoltaic energy storage power station in Chile

-

Zimbabwe distributed energy storage system

Zimbabwe distributed energy storage system

-

Off-grid distributed photovoltaic energy storage

Off-grid distributed photovoltaic energy storage

Commercial & Industrial Solar Storage Market Growth

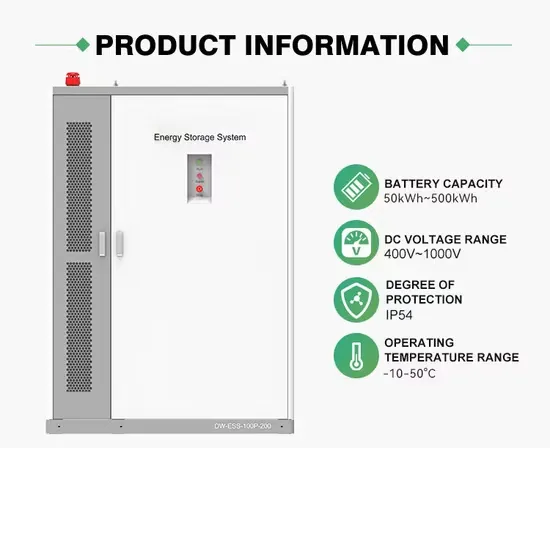

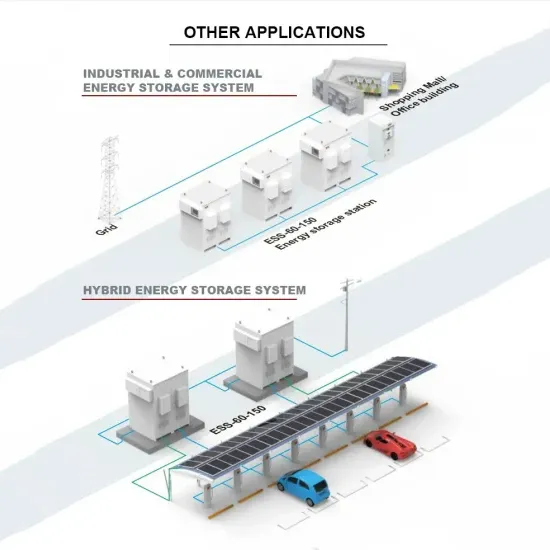

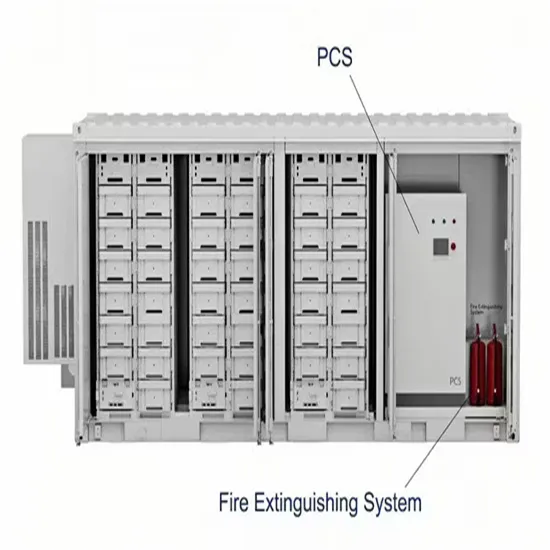

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

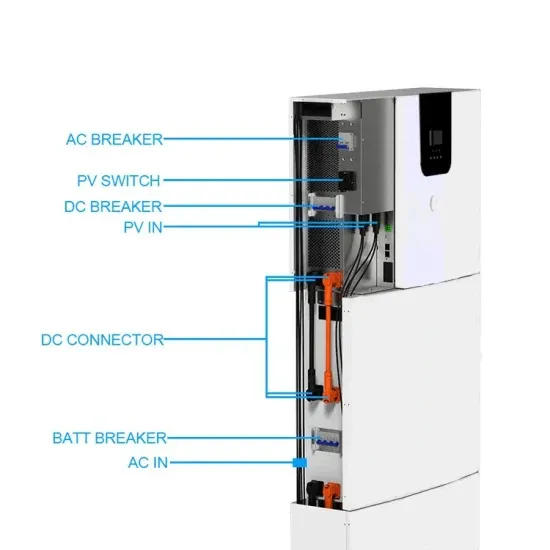

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.