Strategy for energy storage in Spain for 2050

The results of this thesis demonstrate that the storage strategy in Spain must be based on the technologies of pumped hydro, batteries and deposits of molten salts as they are technologies

Get Price

BESS Sizing and Placement in a Distribution Network

This article examines methods for sizing and placing battery energy storage systems in a distribution network.

Get Price

Spain Energy Storage Aid: Funding Plans and

Discover Spain''s €700 million energy storage aid plan, its regional distribution, and how it supports large-scale renewable energy projects for a

Get Price

Unlocking Opportunity

LCP Delta and Santander have combined their expertise to provide this report into the opportunity for investment in battery energy storage systems (BESS) in Spain.

Get Price

5 Trends Shaping M&A in Spain''s Energy Storage

Spain is rapidly becoming a hotspot for investment in energy storage. As the country continues its transition to renewable energy sources,

Get Price

Spain proposes Andalusia get almost half of EU''s

The draft rules published by Spain''s Ministry for the Ecological Transition and the Demographic Challenge (MITECO) suggest Andalusia

Get Price

Spain Electric Energy Storage Battery Market: Analyzing

Spain Electric Energy Storage Battery Market has both EU-wide and national regulations that affect various industries. The report outlines key compliance requirements,

Get Price

5 Trends Shaping M&A in Spain''s Energy Storage Market

Spain is rapidly becoming a hotspot for investment in energy storage. As the country continues its transition to renewable energy sources, demand for flexible grid

Get Price

Unstoppable Power: Top 10 Spanish Energy-Storage Battery

Exera, in strategic partnership with Cospowers, provides turnkey installation, operation, and maintenance of battery energy storage systems (BESS) across Spain. They deliver tailored

Get Price

Iberia: Why are there no batteries in Spain?

Spain''s battery energy storage market is at a critical point. Despite being a leader in renewable energy deployment in Europe, the country has only 18 MW of standalone batteries installed,

Get Price

Spain second country in world for stand-alone battery-based

Renewable energy will cover almost half of the world''s electricity demand by 2030, according to the Renewables 2024 report by the International Energy Agency (IEA), thanks to

Get Price

Energy storage in Spain

Find out all about how Iberdrola España is revolutionising energy storage with advanced solutions for a future of sustainable energy in Spain.

Get Price

part 4: Spain''s BESS market is heating up

In this report, we delve into the developments in the regulatory framework of the Spanish electricity system and explore the potential of Spain''s battery energy storage systems

Get Price

Iberdrola will install six new storage batteries in Spain

Iberdrola España will install six Battery Energy Storage Systems (BESS) with a combined capacity of 150 MW. This is an innovative solution for

Get Price

Spain Energy Storage Growth: How €699M Funding is

Spain''s energy storage sector is set to expand with €699M in funding, supporting up to 3.5GW of capacity. Discover key opportunities and

Get Price

BESS in Spain: the situation of the energy storage

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic

Get Price

BESS in Spain: the situation of the energy storage market

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic and accelerated evolution.

Get Price

Top five energy storage projects in Spain

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Spain had 88MW of capacity in

Get Price

Battery Energy Storage System Placement And Sizing In

Abstract. The article discusses the methodology for selecting installation locations and parameters of battery energy storage systems (BESS) in electrical distribution networks. The methodology

Get Price

Spain Battery Market: A Stronghold for Sustainable Energy and

The Spain Battery Market spans a diverse range of applications, including electric vehicles (EVs), renewable energy storage, consumer electronics, and industrial applications. The dominance

Get Price

Energy storage – a key driver for a sustainable future

Energy storage applications Energy storage systems are divided into two categories: short-duration applications, which can adjust the power output in

Get Price

SPAIN

Spain''s battery storage market is dominated by customer-sited systems. Utility-scale storage remains nascent. Currently, Spain''s storage market is mainly composed of small-scale

Get Price

Spain awards EUR 156.4m in subsidies to energy

The new initiatives are expected to increase Spain''s storage power by more than 779 MW and capacity by over 3,400 MWh, the ministry

Get Price

Energy storage trends – Spotlight on Spain

Energy storage trends Spotlight on SpainIntroduction In Spain, the National Integrated Energy and Climate Plan 2021-2030 (" PNIEC ") aims to

Get Price

5 FAQs about [Distribution of energy storage battery applications in Spain]

Why do we need battery energy storage systems in Spain?

Due to the large capacity of installed hydroelectric and thermal storage systems and the resilience of the Spanish power grid, the need for Battery Energy Storage Systems (BESS) in Spain has been relatively low. The lack of a clear regulatory framework for BESS has also hindered its development in Spain so far.

What is Spain's regulatory framework for energy storage?

Spain’s regulatory framework for BESS is set in its Strategy for Energy Storage. The Strategy identifies the required regulatory measures – such as grid access, market structure, and addressing double tolling – that are currently needed to ensure the deployment of a solid energy storage market.

How does Spain's pumped hydro energy storage compete with Bess?

Spain's pumped hydro energy storage competes directly against BESS, limiting the battery storage opportunity in wholesale markets. 3. Missing ancillary markets Unlike Great Britain or Texas, Spain never created ancillary service markets that net-zero systems need:

Can batteries improve the business case of wind and solar projects?

Batteries can improve the business case of wind and solar projects by providing a better utilization of the grid connection. This particularly holds in the context of Power Purchase Agreements (PPAs). PPAs are crucial to making wind and solar bankable, and Spain has been the biggest market for PPAs in Europe for years.

Will ERDF funds support storage deployment in Spain?

The recent approval of the use of the European Regional Development Fund (ERDF) funds to support the storage deployment in Spain opens the door for a first batch of around 2GW distributed in close to 100 projects, heavily supported by public financing.

More related information

-

Distribution of energy storage battery applications in the United States

Distribution of energy storage battery applications in the United States

-

Distribution of energy storage battery applications in South Korea

Distribution of energy storage battery applications in South Korea

-

How much does a battery energy storage system cost in Spain

How much does a battery energy storage system cost in Spain

-

Energy storage battery price distribution

Energy storage battery price distribution

-

Installation of lithium battery energy storage cabinet for power distribution cabinet

Installation of lithium battery energy storage cabinet for power distribution cabinet

-

Solar energy storage battery prices in Spain

Solar energy storage battery prices in Spain

-

Lithium battery energy storage applications

Lithium battery energy storage applications

-

Colombia Portable Energy Storage Battery Applications

Colombia Portable Energy Storage Battery Applications

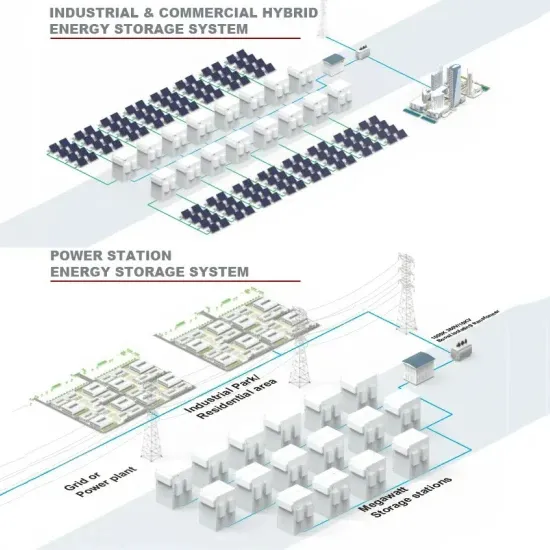

Commercial & Industrial Solar Storage Market Growth

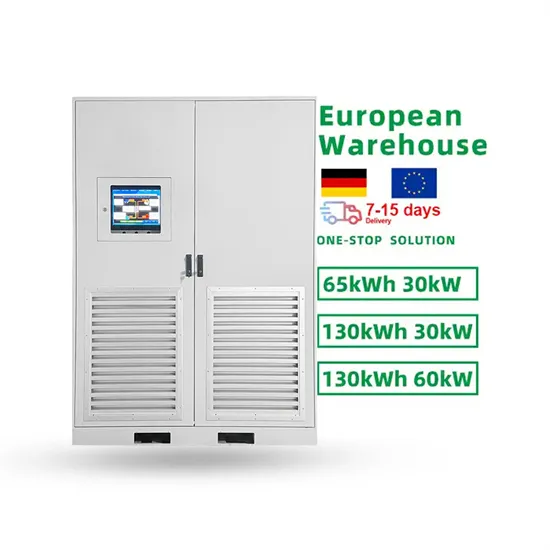

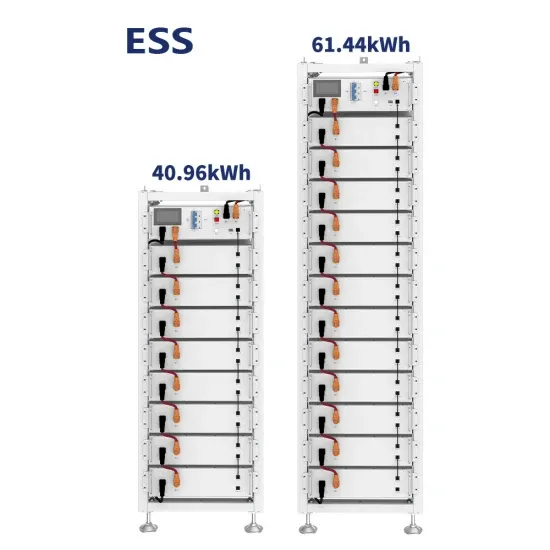

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

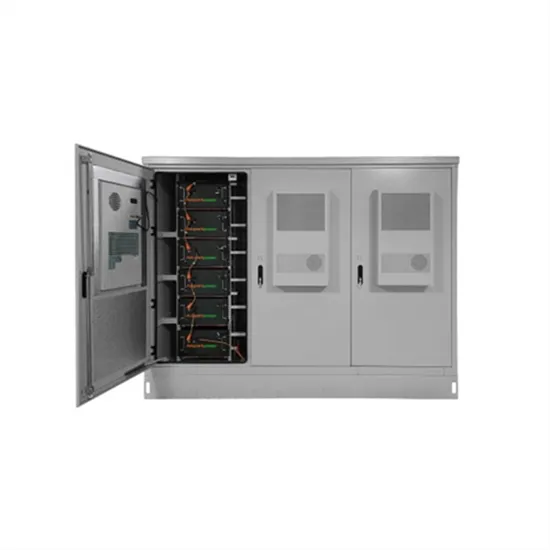

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.