Strategy of 5G Base Station Energy Storage Participating in

The energy storage of base station has the potential to promote frequency stability as the construction of the 5G base station accelerates. This paper proposes a control strategy for

Get Price

The largest 5G smart grid in China has been built, using 5G base

In August 2019, China Telecom Qingdao Branch, State Grid Qingdao Power Supply Company and Huawei jointly established the 5G Application Joint Innovation Laboratory to jointly

Get Price

Base Station Microgrid Energy Management in 5G Networks

The number of 5G base stations (BSs) has soared in recent years due to the exponential growth in demand for high data rate mobile communication traffic from various

Get Price

Multi‐objective interval planning for 5G base station virtual

As an emerging load, 5G base stations belong to typical distributed resources [7]. The in‐depth development of flexi-bility resources for 5G base stations, including their internal energy

Get Price

Battery for 5G Base Station Market Size, Investment-Oriented

Battery for 5G Base Station Market size was valued at USD 1.2 Billion in 2024 and is projected to reach USD 3.

Get Price

fenrg-2022-943189 1..4

A Hierarchical Distributed Operational Framework for Renewables-Assisted 5G Base Station Clusters and Smart Grid Interaction Yifang Fan1, Bozhong Wang2,3, Juan Wei1*, Man Tan1

Get Price

Largest domestic 5G smart grid built in Qingdao

State Grid has completed the largest domestic 5G smart grid project, which could save 20 percent of power consumption per 5G base station through a peak-shaving and valley

Get Price

5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact, and powerful base station

Get Price

The State of 5G 2024

However, compared to the leading markets, this group lags behind in the network and experience pillars, which underscores the need to improve on indicators such as the deployment of 5G

Get Price

China''s CBN, State Grid to Issue 5G Cooperation Plan as Soon

China will open more than 130,000 5G base stations by the end of this year, according to Ministry of Industry and Information Technology data. Next year will be a large-scale construction

Get Price

5G Energy Modeling and Power Saving Schemes in ns-3

We have developed a comprehensive framework for UE RRC state-based energy modeling and power-saving schemes in the ns-3 network simulator. Our study evaluates 3GPP power

Get Price

Two-Stage Robust Optimization of 5G Base Stations

However, the uncertainty of distributed renewable energy and communication loads poses challenges to the safe operation of 5G base

Get Price

A Hierarchical Distributed Operational Framework for Renewables

Therefore, considering the configuration of renewable energy, the adjustability of energy storage battery, and the space-time characteristics of communication load, this study

Get Price

Coordinated scheduling of 5G base station energy

With the rapid development of 5G base station construction, significant energy storage is installed to ensure stable communication.

Get Price

5G network deployment and the associated energy consumption

The simulation results show that 700 MHz and 26 GHz will play an important role in 5G deployment in the UK, which allow base stations to meet short-term and long-term data

Get Price

The business model of 5G base station energy storage

The main participants of 5G base station energy storage participating in grid demand response are base station operators and power grid companies, both of which have sufficient motivation

Get Price

5G Base Station

5G base station is the core equipment of 5G network, which provides wireless coverage and realizes wireless signal transmission between

Get Price

China''s largest 5G smart grid completed-EEWORLD

This is another milestone in the win-win situation between State Grid Qingdao Power Supply Company and China Telecom Qingdao Branch. 5G base stations consume more power than

Get Price

Multi‐objective interval planning for 5G base station virtual power

Large-scale deployment of 5G base stations has brought severe challenges to the economic operation of the distribution network, furthermore, as a new type of adjustable load,

Get Price

State Grid, China Unicom, Huawei, and...

With more than 30,000 5G base stations deployed, the network provides over 100,000 5G connections to embed 5G into the full electric power

Get Price

Investigating the Sustainability of the 5G Base Station Overhaul

5G is a high-bandwidth low-latency communication technology that requires deploying new cellular base stations. The environmental cost of deploying a 5G cellula.

Get Price

State Grid, China Unicom, Huawei, and...

With more than 30,000 5G base stations deployed, the network provides over 100,000 5G connections to embed 5G into the full electric power process, from power

Get Price

5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact,

Get Price

(PDF) Architecture design of wireless access system in power grid

In order to solve these problems, the architecture design of wireless access system in the application scenario of power grid based on 5G small base station is proposed.

Get Price

5G Base Station Growth: How Many Are Active? | PatentPC

While China leads in sheer numbers, the U.S. is making steady progress. By late 2023, the country had between 150,000 and 200,000 active 5G base stations. The deployment strategy

Get Price

State Grid

In response, State Grid has introduced customized services to support the operation of 5G base stations, and some power infrastructure has been integrated with 5G

Get Price

6 FAQs about [State Grid invests in 5G base stations]

How many 5G base stations are there in the United States?

While China leads in sheer numbers, the U.S. is making steady progress. By late 2023, the country had between 150,000 and 200,000 active 5G base stations. The deployment strategy in the U.S. is different from China’s, as it relies on private investment rather than government-led initiatives. Is this article too long?

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

Does 5G work in power grids?

This shows the industry’s recognition of their achievements in applying 5G in power grids as 5G smart grids enter the stage of large-scale commercial rollout. The inclusive 5G smart grid solution was jointly developed by the State Grid, China Unicom, Huawei, and TD Tech based on the extensive 5G networks built by China Unicom.

How many 5G smart grids will there be in 2024?

“We will continue to work with China Unicom and Huawei to expand the footprint of 5G smart grids in the electric power sector,” added Wang, who estimates that there will be 300,000 5G connections and 150,000 RedCap devices in the sector by June 2024.

How many base stations will 5G have in 2025?

The U.S. has ambitious plans for 5G expansion, aiming to have more than 300,000 active base stations by 2025. This goal is being driven by investment from private telecom providers and government initiatives like the Rural 5G Fund. For businesses in the U.S., this means increasing access to high-speed connectivity.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

More related information

-

State Grid and China Hybrid Energy jointly build 5G base stations

State Grid and China Hybrid Energy jointly build 5G base stations

-

Distributed power generation at State Grid communication base stations

Distributed power generation at State Grid communication base stations

-

Composition of Kosovo Power Grid Communication Base Stations

Composition of Kosovo Power Grid Communication Base Stations

-

The first batch of hybrid energy 5G base stations

The first batch of hybrid energy 5G base stations

-

How much is the lithium battery needed for 5G base stations worth

How much is the lithium battery needed for 5G base stations worth

-

What are the grid-connected inverters for 5G communication base stations in Spain

What are the grid-connected inverters for 5G communication base stations in Spain

-

Why do 5G base stations consume more power

Why do 5G base stations consume more power

-

China s 5G base stations exceed 600 000

China s 5G base stations exceed 600 000

Commercial & Industrial Solar Storage Market Growth

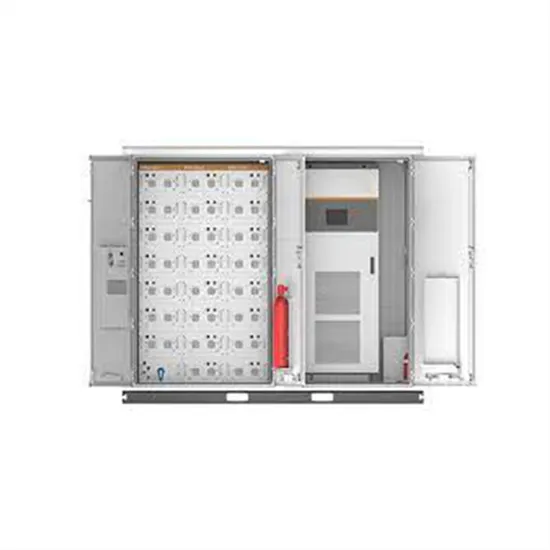

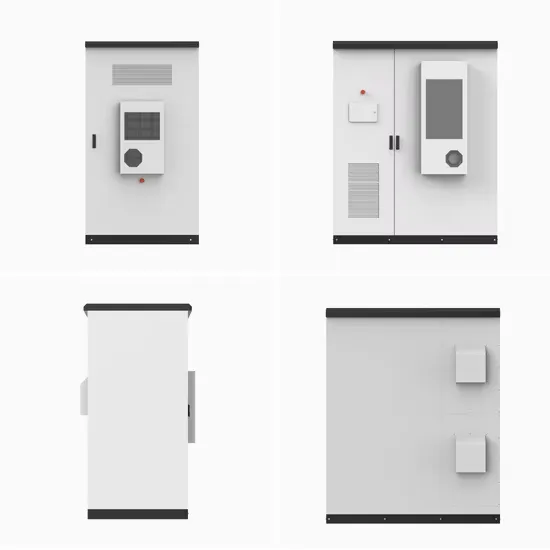

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

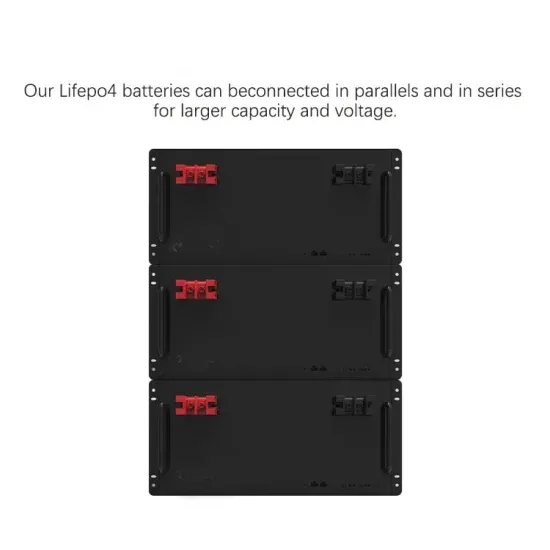

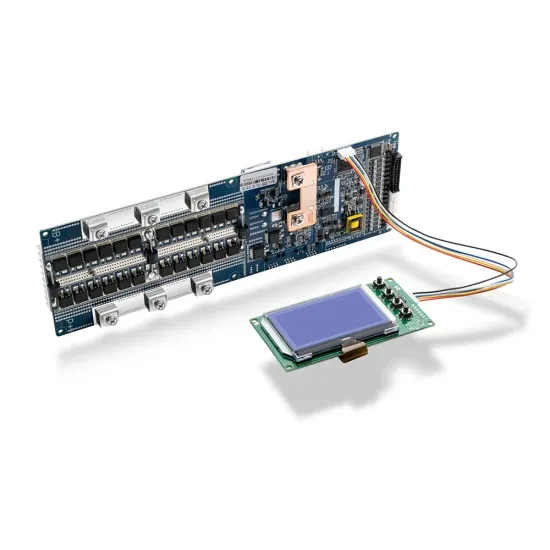

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.