Comparing Central vs String Inverters for Utility-Scale PV Projects

The utility-scale PV market is maturing. Last year, 22.5 GW of utility-scale PV was installed in the US, a 77% jump from 2022. Solar PV accounted for over half (53%) of all new

Get Price

Solar Installed Capacity New Breakthrough In the US

The agency''s latest preliminary monthly generator inventory report (EIA-860M) shows that the total new capacity in 2025 will reach about 63 GW,

Get Price

CPS Series Photovoltaic Grid Connection Inverter

Scope This Installation and Operation manual contains important information, safety guidelines, detailed planning and setup information for installation, as well as information about

Get Price

Quarterly Solar Industry Update | Department of Energy

Each quarter, the National Renewable Energy Laboratory conducts the Quarterly Solar Industry Update, a presentation of technical

Get Price

Spring 2024 Solar Industry Update

According to EIA data, 40% of 2023 installed U.S. solar capacity occurred in Q4—relatively consistent with previous years, though much greater in absolute terms.

Get Price

Residential PV | Electricity | 2022 | ATB | NREL

The data in (Barbose et al., 2021) represent 79% of all U.S. residential PV and commercial PV capacity installed through 2020. Historical Sources: (Barbose et al., 2021); (Ramasamy et al.,

Get Price

US adds 17.9GW of solar in the first half of the year

3 days ago· The US installed 17.92GW of new capacity in the first half of 2025, with Q-on-Q declines in additions for utility-scale and residential solar.

Get Price

Solar Market Insight Report – SEIA

4 days ago· Solar accounted for 69% of all new electricity-generating capacity added to the US grid in Q1 2025. The US added 8.6 GW of solar module

Get Price

SolarEdge Home Hub Inverters: Empowering Your

Install confidently with advanced safety features like SafeDC and Sense Connect Backup-ready inverter* When pairing our inverters with the SolarEdge Home

Get Price

Solar Market Insight Report Q2 2023

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S.

Get Price

Solar inverters guide: How to decide what''s right for you

What is a solar inverter and why do you need one? A solar inverter is a critical aspect of most photovoltaic (PV) power systems, in which energy from direct sunlight is

Get Price

Solar Market Insight Report 2022 Year in Review – SEIA

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S.

Get Price

Power Electronics plans 20 GW inverter factory in

Power Electronics products are present in almost 2,000 plants in 35 countries around the world. The company closed the year 2023 with an

Get Price

Residential PV | Electricity | 2021 | ATB | NREL

The data in (Barbose et al., 2020) represent 82% of all U.S. residential PV and commercial PV capacity installed through 2019. Historical trends, current estimates, and future projections,

Get Price

Solar Market Insight Report Q4 2023

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S.

Get Price

Solar plants typically install more panel capacity relative to their

A solar photovoltaic (PV) system''s panel capacity is often reported in direct current (DC), while operating capacity in the United States is reported as it is delivered to the grid in

Get Price

Residential PV | Electricity | 2024 | ATB | NREL

U.S. average capacity factor for each resource category is weighted by the population of each county within the GHI resource category. The county estimated populations are provided by

Get Price

U.S. Photovoltaic Database

The United States Large-Scale Solar Photovoltaic Database (USPVDB) provides the locations and array boundaries of U.S. photovoltaic (PV) facilities with capacity of 1 megawatt or more. It

Get Price

Fall 2024 Solar Industry Update

The United States installed approximately 14.1 GWh (4.3 GWac) of energy storage onto the electric grid in Q1/Q2 2024—its largest first half on record. Though thin-film PV represented

Get Price

US adds 50GW of new solar PV capacity in 2024

Solar and storage projects accounted for 84% of electricity generating capacity added in 2024, with solar seeing 50GW of new capacity.

Get Price

Solar plants typically install more panel capacity

A solar photovoltaic (PV) system''s panel capacity is often reported in direct current (DC), while operating capacity in the United States is reported

Get Price

Solar Market Insight Report – SEIA

4 days ago· Solar accounted for 69% of all new electricity-generating capacity added to the US grid in Q1 2025. The US added 8.6 GW of solar module manufacturing capacity in Q1, bringing

Get Price

Solar Installed Capacity New Breakthrough In the US

The agency''s latest preliminary monthly generator inventory report (EIA-860M) shows that the total new capacity in 2025 will reach about 63 GW, the highest annual

Get Price

Solar Market Insight Report 2024 Year in Review – SEIA

Installation momentum from 2024 will continue into 2025, but installed capacity will start to plateau and decline starting in 2026 from a contraction in the overall pipeline.

Get Price

North America PV Inverter Market Size, Share & Trends, 2033

This trend is expected to continue, with projections indicating that the U.S. solar could reach 100 GW of installed capacity by 2024.

Get Price

H1 2021 Solar Industry Update

SEIA reported that in 2020 the U.S. community solar market installed 826 MWDC of community solar installations—a 30% increase y/y—bringing cumulative capacity to 3 GWDC. Based on

Get Price

6 FAQs about [U S PV inverter installed capacity]

How much solar power did the US solar industry install in 2024?

In 2024, the US solar industry installed nearly 50 gigawatts direct current (GWdc) of capacity, a 21% increase from 2023. This was the second consecutive year of record-breaking capacity. Solar accounted for 66% of all new electricity-generating capacity added to the US grid in 2024, as the industry continued experiencing record growth.

What is the DC capacity factor of a solar PV facility?

This approach applies to not just capacity values but also to costs and operation characteristics. For example, the AC capacity factor for solar PV facilities operating in 2017 was 27%. If this value were estimated using DC capacity, the DC capacity factor would be about 22%.

What is the US large-scale solar photovoltaic database?

The U.S. Large-Scale Solar Photovoltaic Database provides the locations and array boundaries of U.S. photovoltaic facilities, with capacity of 1 megawatt or more.

How much solar capacity will the US have?

Our annual Year in review report includes a 10-year outlook for every segment. We expect cumulative US solar capacity to more than triple from 236 GWdc installed at year-end 2024, to 739 GWdc installed by 2035, with average annual capacity additions of more than 45 GWdc.

How much does solar PV cost per watt?

If this value were estimated using DC capacity, the DC capacity factor would be about 22%. Similarly, the average capital costs for utility-scale solar PV facilities installed in 2015 were $2.91 per watt in terms of AC capacity and about $2.33 per watt in terms of the DC capacity of the PV modules.

What is the average solar inverter loading ratio?

Inverter loading ratios are higher for larger solar power plants. At the end of 2016, smaller plants—those one megawatt (MW) or less in size—had an average ILR of 1.17, while larger plants—those ranging from 50 MW to 100 MW—had an ILR of 1.30. As solar plants have gotten larger, inverter loading ratios have increased.

More related information

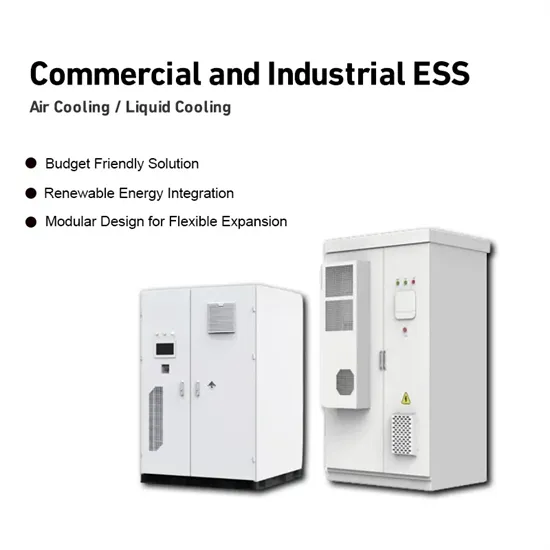

Commercial & Industrial Solar Storage Market Growth

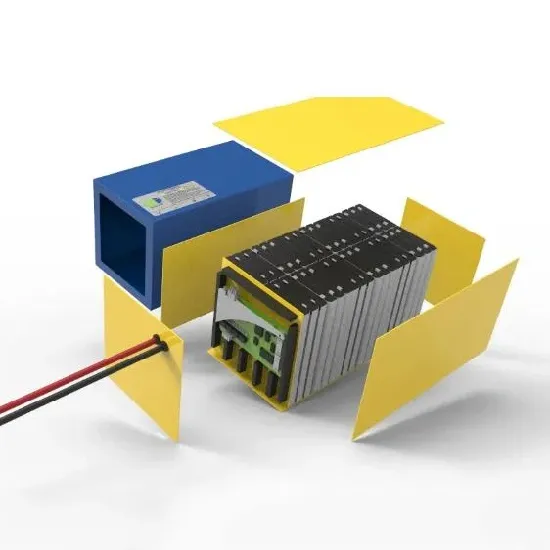

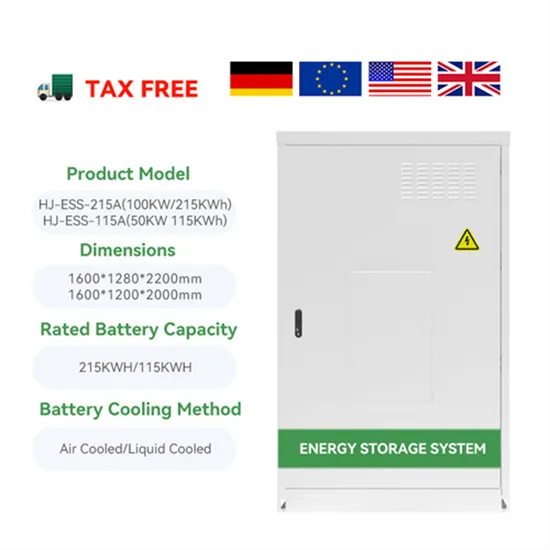

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.

Italy PV inverter market capacity

Italy PV inverter market capacity

70 PV inverter price

70 PV inverter price

Türkiye PV dedicated off-grid inverter

Türkiye PV dedicated off-grid inverter

Côte d Ivoire Micro PV Inverter

Côte d Ivoire Micro PV Inverter

PV inverter export volume

PV inverter export volume

PV inverter account number

PV inverter account number

PV panel inverter connection

PV panel inverter connection

Optimizer PV Inverter

Optimizer PV Inverter