Huawei Awarded the World''s First Carbon Footprint

[Shanghai, China, June 28, 2022] Huawei was awarded the world''s first Carbon Footprint Verification (CFV) for solar inverter products issued by the British

Get Price

Fornecedora líder de soluções solares

Podemos oferecer soluções solares poderosas sob medida para atender às necessidades dos nossos clientes a nivel Global.

Get Price

HUAWEI SOLAR INVERTER REVIEW

Huawei photovoltaic inverter sales Huawei has shipped 52 GW of solar PV inverters in 2021. The Chinese conglomerate and inverter maker shipped 2 GW of storage systems last year..

Get Price

Huawei Photovoltaic Inverters in 2025: Leading the Global Solar

Huawei remains a top-tier producer of photovoltaic inverters, commanding 23% of global market share as of Q1 2025 according to Wood Mackenzie''s latest renewable energy

Get Price

Huawei invests in solar energy in Portugal and Spain

So far, Huawei has supplied inverters for over 118 GW of photovoltaic projects globally, of which 8.5 GW in Europe. In Spain, it has already installed 1.5 GW. The next target

Get Price

Huawei Solar inverters | Huawei Inverter for Solar

Shop Huawei solar inverter for your PV system. Huawei solar inverters for every system size at the best price with worldwide delivery on Europe-SolarStore

Get Price

HUAWEI

The Huawei SUN2000-20KTL-M0 is a high-efficiency three-phase solar hybrid inverter designed for large-scale solar installations, such as commercial projects or larger residential systems.

Get Price

What Are the Advantages and Disadvantages of

What Are the Key Advantages of Huawei Inverters in Solar Systems? Huawei inverters are recognized for their cutting-edge technology, high efficiency, and

Get Price

Uma gama de produtos que fornecem soluções

40%+ mais energia utilizável a mais com 15 anos de vida útil Atualização revolucionária de desempenho e eficiência Proteção de segurança bem concebida de 5 camadas O

Get Price

EU Restricts Chinese Inverters In The Name Of Safety

Short-term risks Rising supply chain costs: US tariffs have led to a 12% reduction in global installed capacity, and EU carbon tariffs have increased cost pressure on Chinese

Get Price

Huawei and Sungrow retain inverter market dominance

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in shipments respectively compared with

Get Price

China-made solar parts under scrutiny after Spain

Huawei produces around a third of inverters used in Europe. The tech giant was expelled from SolarPower Europe on April 28 after the

Get Price

Huawei Dominates the Solar Inverter Market in

Huawei, the Chinese technology giant, continues to dominate the solar inverter market in Europe, according to a new report by Wood

Get Price

Empowering Your Home: The Complete Guide to

Dive into the world of solar hybrid inverters: understand how they work, their features, benefits, and how they compare to normal inverters.

Get Price

Residential Products List | HUAWEI Smart PV Global

Residential Products List covers all household photovoltaic products, including inverters, energy storage, optimizers, controllers and other household

Get Price

Powering A Sustainable Future: Huawei Digital Power Philippines

The inverter is engineered with Huawei''s "4T" technologies— Bit, Watt, Heat, and Battery innovations—to ensure comprehensive protection and optimal performance in a variety

Get Price

Huawei Solar Inverter Review

Huawei is considered a leader in the communications and mobile telephony industries, and for several years it has also been one of the leading

Get Price

China-made solar parts under scrutiny after Spain-Portugal power

Huawei produces around a third of inverters used in Europe. The tech giant was expelled from SolarPower Europe on April 28 after the European Commission said it would

Get Price

Find Distributors | HUAWEI Smart PV Global

CSP-certified partners are fully equipped to provide expert services, including installation, deployment, and O&M of Huawei equipment and solutions.

Get Price

Huawei Inverter Review – Are They Good?

Huawei is famous for manufacturing digital appliances and communication technologies. However, this technology brand also offers a

Get Price

THE ROLE OF HUAWEI AND ITS IMPACT IN

Huawei''s key collaborations span across various sectors, including professional, scientific and technical activities, business services, IT, manufacturing, wholesale and retail.

Get Price

Huawei and Sungrow retain inverter market

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in

Get Price

Unlocking the Benefits of Huawei Solar Inverters for Efficient

In recent years, the demand for renewable energy solutions has surged, with solar power leading the charge. Huawei, a global leader in technology, has made significant strides

Get Price

Inversor Trifásico Huawei 4kW

Escolha o Inversor Híbrido Trifásico Huawei 4kW para máxima eficiência e fiabilidade em sistemas solares. Ideal para instalações de médio porte.

Get Price

Intelligent Electric Power | Smart Grid Solutions | Huawei Enterprise

Huawei Grid Solutions: smart grids to empower electric power industry. Build a reliable, efficient and intelligent grid with Huawei. Get started.

Get Price

Huawei Photovoltaic Inverter Production Key Locations and

Summary: Explore how Huawei''s strategic photovoltaic inverter production facilities drive innovation in renewable energy. Learn about their manufacturing hubs, technological

Get Price

Huawei Dominates the Solar Inverter Market in Europe

Huawei, the Chinese technology giant, continues to dominate the solar inverter market in Europe, according to a new report by Wood Mackenzie. The company has been

Get Price

6 FAQs about [Huawei inverter production in Portugal]

Does Huawei have a photovoltaic inverter?

So far, Huawei has supplied inverters for over 118 GW of photovoltaic projects globally, of which 8.5 GW in Europe. In Spain, it has already installed 1.5 GW. The next target is Portugal.

Is Huawei fusion solar a good investment in Portugal?

Bruno Santo, responsible for Huawei Fusion Solar in Portugal, says this is a strong investment of the company in the country with the objective of “gaining a very relevant position with the main national players in this market, reflecting the success of Huawei in Spain”. In his opinion, “the next ten years are very promising in Portugal”.

Why was Huawei expelled from Solarpower Europe?

The tech giant was expelled from SolarPower Europe on April 28 after the European Commission said it would restrict meetings with associations affiliated with Huawei. Several Huawei executives are being investigated -- some charged -- in Brussels for alleged corruption involving EU lawmakers.

Does Huawei have a role in Europe?

Huawei declined to comment about its role in Europe. Brussels last year also launched a probe into uncompetitive practices by Chinese solar panel manufacturers, which resulted in two companies withdrawing their bids in a Romanian public tender last year. Workers in the autonomous region of Ningxia carry solar panels on their backs to a solar farm.

Is Huawei fusion solar a good investment?

The entire European market and also the Japanese market are in the spotlight. Bruno Santo, responsible for Huawei Fusion Solar in Portugal, says this is a strong investment of the company in the country with the objective of “gaining a very relevant position with the main national players in this market, reflecting the success of Huawei in Spain”.

Who is the largest inverter supplier?

Today Huawei is the largest inverter supplier, distinguishing itself by the offer of decentralized inverters (even for larger, 1GW plants) and solutions that include artificial intelligence and 5G networks.

More related information

-

Huawei Portugal Energy Storage Production Project

Huawei Portugal Energy Storage Production Project

-

Huawei inverter production in Georgia

Huawei inverter production in Georgia

-

Huawei inverter production

Huawei inverter production

-

Huawei Micro Inverter Processing Plant

Huawei Micro Inverter Processing Plant

-

Huawei Cape Verde inverter

Huawei Cape Verde inverter

-

Armenia Huijue Photovoltaic Inverter Production

Armenia Huijue Photovoltaic Inverter Production

-

High-frequency 40W inverter production

High-frequency 40W inverter production

-

Huawei Energy Storage Power Station Inverter

Huawei Energy Storage Power Station Inverter

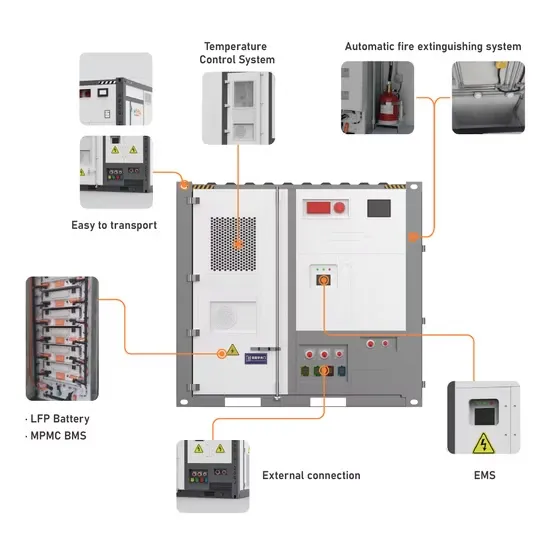

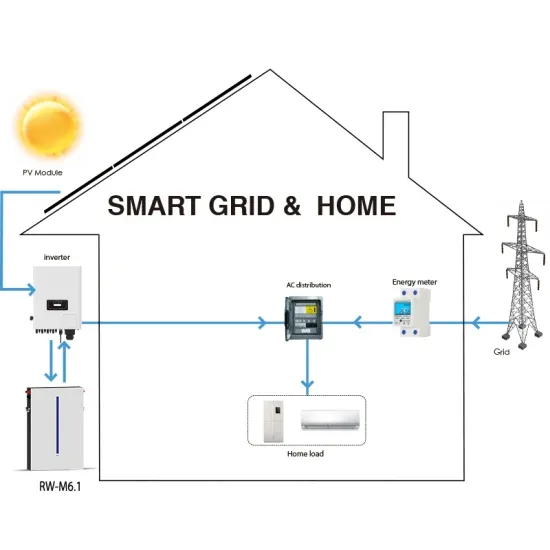

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.