Complete Guide to Solar Rooftop Subsidies in India

Subsidy applicable for plants installed through empaneled vendors/installers. CFA disbursed only after installation and commissioning. So check if your rooftop

Get Price

Federal Solar Tax Credit: How it works in 2025

To qualify for the federal solar tax credit, you must purchase the solar panels with cash or a loan, have taxable income, and it must be installed at your primary

Get Price

Homeowner''s Guide to Going Solar | Department of Energy

There are a number of mapping services that have been developed by SETO awardees that will help you determine if your roof is suitable for solar and can even provide you with quotes from

Get Price

Solar Rooftop Calculator

The Recommended capacity for Rooftop Solar Plant as per your inputs is: Calculation is indicative in nature. Actual numbers may vary. Maximum capacity for availing subsidy is 10kW. Capacity

Get Price

Solar Information & Programs

Many people have the misconception that solar (PV) systems do not work in Massachusetts, due to New England''s diverse weather conditions. However, the experts agree that Massachusetts

Get Price

Government Grants for Solar Panels in 2025: A Complete Guide

In this guide, we''ll walk you through the best government grants, benefits, panel types, and financing options— all in a simple, conversational tone that actually helps you make

Get Price

Solar Energy Systems Tax Credit | ENERGY STAR

Solar Panels or Photovoltaic Systems are solar cells that capture light energy from the sun and convert it directly into electricity. Use this buying guidance to learn more about your options,

Get Price

Solar Subsidy in India 2025 – PM Surya Ghar Muft

Are you planning to install solar panels at home and want the government to pay for it? If yes, then you need to know about the Solar

Get Price

Biden-Harris Administration Launches $7 Billion Solar for All

WASHINGTON (June 28, 2023) – Today, the U.S. Environmental Protection Agency (EPA) launched a $7 billion grant competition through President Biden''s Investing in America agenda

Get Price

Maximize Solar Savings with U.S. Government

These programs can provide funding for solar panel installation in affordable housing projects, community development projects, and single-family homes.

Get Price

PM Solar Rooftop: Cost, Subsidy & How to Apply

If you''re considering both solar and roof upgrades, combining new roof with solar panels may help reduce long-term maintenance costs. The

Get Price

Solar Tax Credit By State – Forbes Home

Most notably, it extended the timeline to 2035 and increased the credit amount from 22% to 30% through 2032. Those who installed a system in 2022 and haven''t claimed the credit yet can

Get Price

Rebates for solar panels and battery storage

Battery storage rebates Battery storage allows you to store your excess renewable energy to power your home on cloudy days, overnight, or in

Get Price

Homeowner''s Guide to the Federal Tax Credit for Solar

Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming

Get Price

California Solar Incentives, Tax Credits and Rebates

In California, a typical 7-kilowatt residential system costs $16,010 before any financial incentives. On the bright side, compared with those in

Get Price

Government introduced Solar For Rakyat Incentive

According to the media statement released by the YAB Deputy Prime Minister and Minister of Energy Transition and Water Transformation

Get Price

Federal solar tax credit in 2025: How does it work?

The federal solar tax credit, commonly referred to as the investment tax credit or ITC, allows you to claim 30% of the cost of your solar panel system as a credit to your federal

Get Price

Federal Solar Tax Credit: How it works in 2025 | SolarReviews

To qualify for the federal solar tax credit, you must purchase the solar panels with cash or a loan, have taxable income, and it must be installed at your primary or secondary residence.

Get Price

Solar Panels | Prices & Subsidies 2025 in Luxembourg

Discover all the 2025 prices and subsidies for your photovoltaic installation in the Grand Duchy. Guide, latest figures and free 2025 simulator.

Get Price

How To Get Free Solar Panels from the Government in 2025

Looking to have solar panels installed on your home for free? Learn how federal, state, and local incentives can pay for all or most of the installation cost.

Get Price

How Government Subsidies Help Homeowners Afford Solar

Navigate solar incentives with our guide to government subsidies. Learn how tax credits, rebates, and grants can dramatically reduce installation costs.

Get Price

California Solar Incentives, Tax Credits and Rebates (2025

In California, a typical 7-kilowatt residential system costs $16,010 before any financial incentives. On the bright side, compared with those in other states, California

Get Price

Solar Panel Subsidy in Uttarakhand, 2023

Solar Panels: Solar panels are the heart of any solar system. These panels are made up of photovoltaic cells that convert sunlight into electricity. Solar panels come in many

Get Price

Solar Tax Credit By State – Forbes Home

Most notably, it extended the timeline to 2035 and increased the credit amount from 22% to 30% through 2032. Those who installed a system in 2022 and

Get Price

Government Grants for Solar Panels in 2025: A

In this guide, we''ll walk you through the best government grants, benefits, panel types, and financing options— all in a simple, conversational

Get Price

Residential Clean Energy Credit

Public utility subsidies for buying or installing clean energy property are subtracted from qualified expenses. This is true whether the subsidy comes directly to you or to a

Get Price

6 FAQs about [How much subsidy is there for a photovoltaic panel installed on the roof ]

Do solar panels qualify for a tax credit?

Under the new tax credit timeline, solar panel systems installed by December 31, 2025, will still qualify for the full 30% credit. But systems installed after that date wouldn’t qualify for any tax credit at all. The federal solar tax credit is valuable because it's a dollar-for-dollar reduction of your federal tax bill.

Will solar panels be tax deductible in 2025?

In 2025, the federal Investment Tax Credit (ITC) allows homeowners to claim 30% of their solar panel system costs as a tax credit on their federal taxes. Starting January 1, 2026, the residential solar tax credit will disappear completely.

Are solar panels tax deductible?

Readers interested in installing solar products should use their best judgment and seek advice from a licensed tax professional. In 2025, the federal Investment Tax Credit (ITC) allows homeowners to claim 30% of their solar panel system costs as a tax credit on their federal taxes.

Can I claim a solar PV tax credit in 2021?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house (assuming the builder did not claim the tax credit)—in other words, you may claim the credit in 2021.

Can I claim a tax credit on a solar installation?

Solar panels installed on houseboats, mobile homes, and condominiums can claim the federal tax credit if the borrower and the system meet all other eligibility requirements. Secondary residences like vacation homes can also qualify. Can I claim the tax credit on a DIY solar installation?

Are photovoltaic systems tax deductible?

Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. The home served by the system does not have to be the taxpayer's principal residence. Find products that are eligible for this tax credit.

More related information

-

How much does a photovoltaic panel on a Danish roof cost

How much does a photovoltaic panel on a Danish roof cost

-

Photovoltaic panel installation on island roof

Photovoltaic panel installation on island roof

-

How much does a photovoltaic panel cost in the Cook Islands

How much does a photovoltaic panel cost in the Cook Islands

-

One BESS panel on a photovoltaic roof

One BESS panel on a photovoltaic roof

-

The whole process of photovoltaic panel installation on the roof

The whole process of photovoltaic panel installation on the roof

-

Photovoltaic roof 70 per panel

Photovoltaic roof 70 per panel

-

How much electricity does a 20W photovoltaic panel generate in a day

How much electricity does a 20W photovoltaic panel generate in a day

-

How much electricity does a 445w photovoltaic panel generate in a day

How much electricity does a 445w photovoltaic panel generate in a day

Commercial & Industrial Solar Storage Market Growth

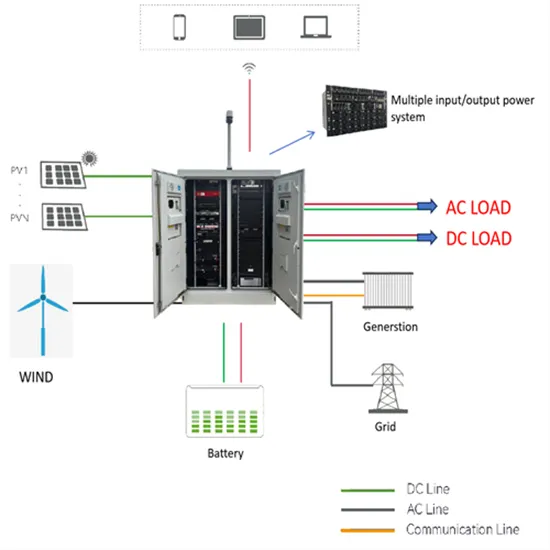

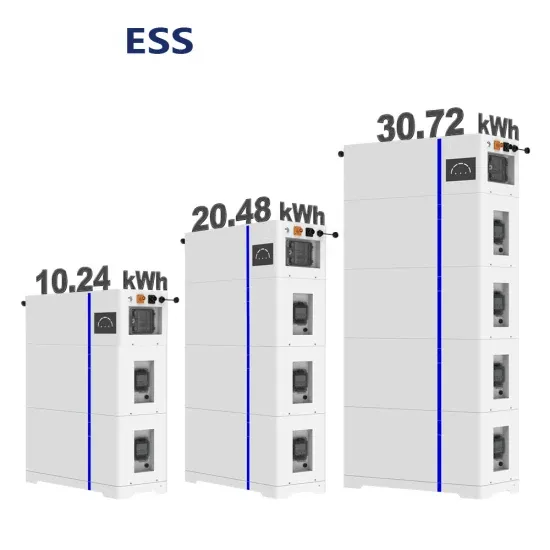

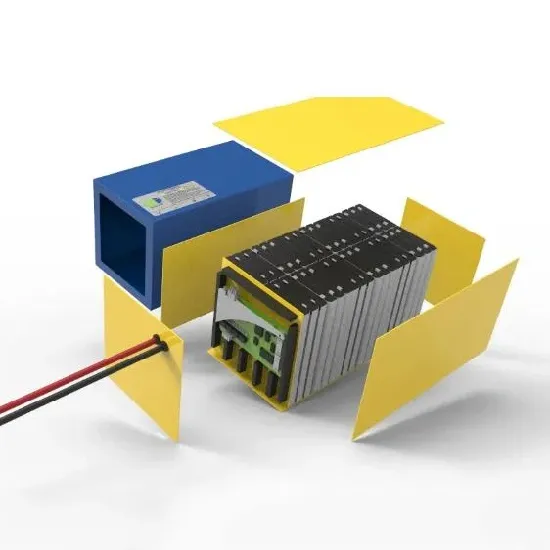

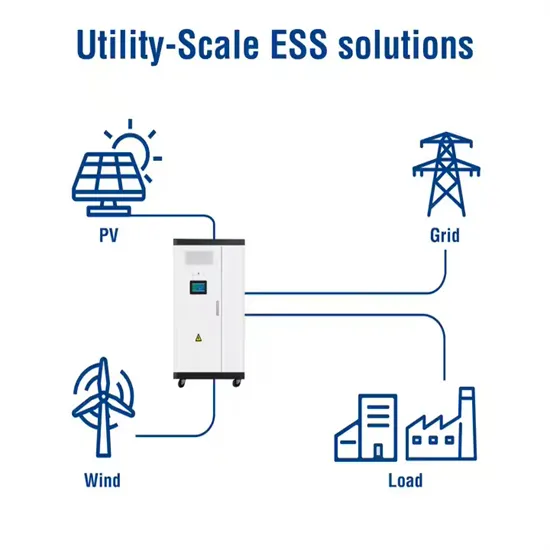

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.