National energy armenia energy storage project

In 2021, several parallel efforts were under way to create a comprehensive policy framework for energy efficiency in Armenia.1 The government''''s new National Programme on Energy Saving

Get Price

ARMENIA RENEWABLE RESOURCES AND ENERGY

Expected Outcome: The Government of Armenia will have access to technical and economic information to decide whether and how to move ahead with an energy storage Projects.

Get Price

Energy system transformation – Armenia energy

Renewable energy resources, including hydro, represented 7.1% of Armenia''s energy mix in 2020. Almost one-third of the country''s electricity generation

Get Price

New Energy Storage Project in Gyumri Armenia Powering a

Summary: Armenia''s new energy storage project in Gyumri marks a transformative step toward renewable energy integration and grid stability. This article explores its technical

Get Price

ARMENIA ENERGY STORAGE PROGRAM

Currently, Armenia is in the initial stages of developing a pilot project on battery storage, with plans for a utility-scale project with an estimated installed storage capacity of 1,200 MWh to be

Get Price

Energy Storage Market Outlook 2024 | StartUs Insights

The 2024 Energy Storage Industry Report explores current trends, investments, and tech advancements shaping the global market. This report examines the

Get Price

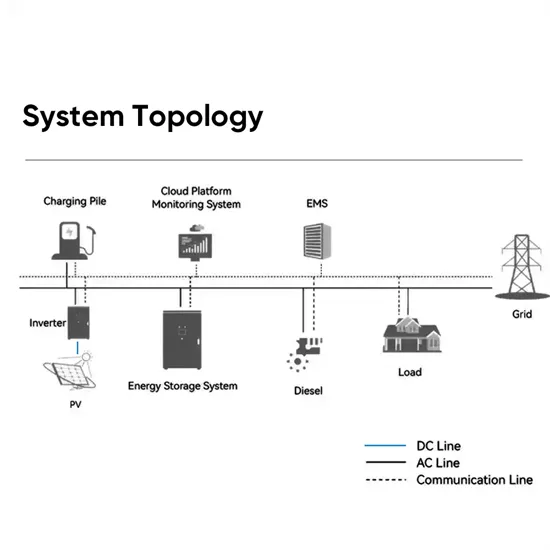

Armenia Smart Energy Storage Cabinet Solution: Powering the

You''re enjoying Armenia''s stunning mountain views when suddenly—bam!—a power outage hits. Sound familiar? This scenario explains why the smart energy storage

Get Price

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get Price

Armenia Energy Storage Legal and Regulatory Review Report

The objective of the present report is to assess Armenia''s legal and regulatory framework for energy storage and provide recommendations for reforms that would be needed to

Get Price

Armenia smart energy storage cabinet parameters

Smart String Energy Storage System | FusionSolar. Huawei Smart String Energy Storage System has passed the German VDE AR-E 2510-50 safety certification, which is a highly recognized

Get Price

Armenia energy storage systems comparison

As the photovoltaic (PV) industry continues to evolve, advancements in Armenia energy storage systems comparison have become critical to optimizing the utilization of renewable energy

Get Price

AboitizPower switches on Armenia solar plant in Tarlac

Aboitiz Power Corporation (AboitizPower), through its renewable energy arm Aboitiz Renewables Inc. (ARI), energized the 45-megawatt peak (MWp) Armenia Solar Project in

Get Price

Armenia''s energy sector: current developments and

Currently, Armenia is in the initial stages of developing a pilot project on battery storage, with plans for a utility-scale project with an estimated installed storage

Get Price

Armenian Power Plant Energy Storage: Innovations Lighting Up

That''s Armenia today. With aging infrastructure and growing energy demands, Armenian power plant energy storage isn''t just tech jargon—it''s become the nation''s electricity

Get Price

National Energy Group Photovoltaic Energy Storage Project

National Energy Commission of the Dominican Republic grants a definitive concession for the Santa Clara Energy Group''''s photovoltaic project, signaling a significant step in the country''''s

Get Price

ARMENIA ENERGY STORAGE PROGRAM

In the short term, the Government of Armenia should focus on laying the groundwork to enable the later development of battery storage in the country, by developing a sound legal and

Get Price

Armenia

As Armenia works toward the Government''s ambitious renewable energy targets and the share of variable renewable generation increases, the country needs to install battery .

Get Price

New market armenia energy storage power station

Industry Overview. The global battery storage power station market share is anticipated to grow at a 29.5% CAGR during the forecast period will reach USD 20.1 billion by 2030 from USD 4.1

Get Price

New market armenia energy storage power station

New market armenia energy storage power station Will Armenia''s energy sector transition through 2040? The Armenian government approved the Energy Sector Development Strategic

Get Price

Kazakhstan Unveils $1.5 Billion Energy Projects with China

2 days ago· Kazakhstan concluded over $1.5 billion worth of oil and gas projects with Chinese companies during President Kassym-Jomart Tokayev''s visit to China. At a meeting with oil and

Get Price

AboitizPower Launches Armenia Solar Plant in Tarlac, Philippines

AboitizPower integrates the 45-MWp Armenia Solar in Tarlac to its growing portfolio of renewable energy assets.Aboitiz Power Corporation (AboitizPower), through its

Get Price

GET_ARM_PS_01_2025_EN

Armenia imports 81% of its primary energy supply and 100% of its fossil and nuclear fuels. These imports stem mainly from Russia and to a lesser extent also from Iran. Expansion in cross

Get Price

Armenia''s energy sector: current developments and challenges

Currently, Armenia is in the initial stages of developing a pilot project on battery storage, with plans for a utility-scale project with an estimated installed storage capacity of 1,200 MWh to be

Get Price

Armenia s Energy Storage Boom Powering a Sustainable Future

With increasing investments in renewable energy and grid modernization, the country''s energy storage sector is experiencing unprecedented growth. This article explores the driving forces,

Get Price

6 FAQs about [Armenia New Energy Storage Industry Project]

Is Armenia developing a battery storage project?

Currently, Armenia is in the initial stages of developing a pilot project on battery storage, with plans for a utility-scale project with an estimated installed storage capacity of 1,200 MWh to be tendered in the coming years.

How did Armenia reform its energy sector?

After enduring a severe energy crisis in the mid-1990s, Armenia initiated substantial reforms in its energy sector. Partial privatization, restructuring of company ownership, and the introduction of cost-reflective tariffs were implemented.

What is Armenia's nuclear capacity?

However, due to an aging power park, the available capacity is comparatively lower at 3.1 GW. The entirety of Armenia’s 448 MW nuclear capacity is housed in the Metsamor nuclear power plant. Initially reactivated during the mid-1990s energy crisis, decommissioning of Metsamor has been repeatedly delayed.

Can Armenia reduce its reliance on energy imports?

Additionally, a second gas pipeline from Iran provides another import route, primarily utilized through a barter agreement where Armenia exchanges electricity for natural gas, only partially using the imported volumes for domestic consumption. Presently, Armenia is actively seeking ways to diminish its reliance on energy imports.

What is Armenia's Energy Policy?

Diversifying energy sources and reducing import dependencies are key Armenian policy priorities. With no significant domestic fossil fuel reserves, hydroelectric power is the primary local energy source. Yerevan aims to expand renewables to meet decarbonization targets and decrease import reliance.

Does Armenia have a gird stability?

Although Armenia’s energy program for 2022-2030 includes plans to evaluate wind energy potential, tangible projects not yet on the pipeline, and the installed wind capacity remains negligible at 8.2 MW. As solar capacity continues to rapidly expand in the country, concerns regarding gird stability have commenced to rise.

More related information

-

Energy storage configuration for Armenia s new energy project

Energy storage configuration for Armenia s new energy project

-

Flywheel energy storage new energy industry

Flywheel energy storage new energy industry

-

Huawei Island New Energy Storage Project

Huawei Island New Energy Storage Project

-

New energy storage project in Afghanistan

New energy storage project in Afghanistan

-

Poland promotes new energy storage industry

Poland promotes new energy storage industry

-

Russian New Energy Storage Configuration Project

Russian New Energy Storage Configuration Project

-

Maldives New Energy Project Energy Storage Configuration

Maldives New Energy Project Energy Storage Configuration

-

Huawei Georgia Energy Storage Industry Project

Huawei Georgia Energy Storage Industry Project

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.