Cost Analysis for Energy Storage: A Comprehensive

Discover essential trends in cost analysis for energy storage technologies, highlighting their significance in today''s energy landscape.

Get Price

Pumped Storage Hydropower Valuation Guidebook

The project team collaborated with Absaroka Energy and Rye Development, whose proposed pumped storage hydropower (PSH) projects (Banner Mountain by Absaroka Energy and

Get Price

Economic evaluation of kinetic energy storage

Based on the research conducted, the LCC method was selected in this study as the most appropriate method to evaluate the economic

Get Price

THE ECONOMICS OF BATTERY ENERGY STORAGE

The prevailing behind-the-meter energy-storage business model creates value for customers and the grid, but leaves significant value on the table. Currently, most systems are deployed for

Get Price

Economic Evaluation of Energy Storage Projects: Metrics,

Ever wondered why energy storage projects are suddenly hotter than a lithium-ion battery in July? As renewable energy explodes globally (pun intended), economic evaluation of

Get Price

ENERGY STORAGE PROJECTS

The Department of Energy (DOE) Loan Programs Office (LPO) is working to support deployment of energy storage solutions in the United States to

Get Price

Economic evaluation of kinetic energy storage systems as key

Based on the research conducted, the LCC method was selected in this study as the most appropriate method to evaluate the economic efficiency of a high-speed FESS used

Get Price

Economic Analysis Case Studies of Battery Energy Storage

Behind-the-meter electric-energy storage has been considered recently as a possible means of enabling higher amounts of renewable energy on the grid. States such as California have

Get Price

Financial and economic modeling of large-scale gravity energy

This work models and assesses the financial performance of a novel energy storage system known as gravity energy storage. It also compares its performance with alternative

Get Price

Energy Storage Feasibility and Lifecycle Cost Assessment

To evaluate the technical, economic, and operational feasibility of implementing energy storage systems while assessing their lifecycle costs. This analysis identifies optimal storage

Get Price

Cost Analysis for Energy Storage: A Comprehensive Step-by

Discover essential trends in cost analysis for energy storage technologies, highlighting their significance in today''s energy landscape.

Get Price

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get Price

StoreFAST: Storage Financial Analysis Scenario Tool | Energy Storage

The Storage Financial Analysis Scenario Tool (StoreFAST) model enables techno-economic analysis of energy storage technologies in service of grid-scale energy applications.

Get Price

Image Quality Enhancement Using Pixel-Wise Gamma

In this study, a techno-economic model is provided to assess the economic feasibility of a Building-Integrated Battery Energy Storage System (BI-BESS) in commercial projects.

Get Price

Financial and economic modeling of large-scale gravity energy storage

This work models and assesses the financial performance of a novel energy storage system known as gravity energy storage. It also compares its performance with alternative

Get Price

Levelized Cost of Energy (LCOE)

The levelized cost of energy (LCOE), also referred to as the levelized cost of electricity, is used to assess and compare alternative methods of energy

Get Price

The Economics of BESS: Calculate ROI for Your Energy Storage

Battery Energy Storage Systems (BESS) are a smart solution for businesses that want to cut electricity costs, avoid peak charges, and get more from renewable energy. But

Get Price

How to calculate the cost of energy storage | NenPower

When calculating the total costs of energy storage, it is crucial to account for operating and maintenance expenses (O&M). These ongoing

Get Price

Frontiers | Economic Analysis of Transactions in the

Aiming at the impact of energy storage investment on production cost, market transaction and charge and discharge efficiency of energy

Get Price

How to calculate the cost of energy storage | NenPower

When calculating the total costs of energy storage, it is crucial to account for operating and maintenance expenses (O&M). These ongoing costs account for routine care

Get Price

Determining the profitability of energy storage over its life cycle

Levelized cost of storage (LCOS) can be a simple, intuitive, and useful metric for determining whether a new energy storage plant would be profitable over its life cycle and to

Get Price

A Simplified Approach to Battery Project Economics

Energy Toolbase''sDeveloper product has revolutionized the economic analysis of solar and energy storage projects. It provides a rapid way to model project economics accurately.

Get Price

Understanding the Return of Investment (ROI) of Energy Storage

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To

Get Price

Energy Storage Financial Model in Excel [Updated 2025]

Our ready-made Energy Storage financial model in Excel alleviates numerous financial pain points for users, offering a comprehensive solution for Energy

Get Price

New Guidebook and Tool Help Developers Calculate

National laboratory team details approaches and develops a tool for developers and other stakeholders to value a full range of pumped storage hydropower services and

Get Price

CREST: Cost of Renewable Energy Spreadsheet Tool

CREST: Cost of Renewable Energy Spreadsheet Tool The Cost of Renewable Energy Spreadsheet Tool (CREST) contains economic, cash-flow models designed to assess

Get Price

Economic calculation and analysis of industrial and

This article will provide an economic analysis of six different avenues for industrial and commercial energy storage.

Get Price

Functional-Combination-Based Comprehensive

In order to verify the role of functional combination in the benefit improvement of ESPs, a scientific comprehensive benefit evaluation can be

Get Price

6 FAQs about [Economic calculation of energy storage projects]

What is energy storage analysis?

This analysis identifies optimal storage technologies, quantifies costs, and develops strategies to maximize value from energy storage investments. Energy demand and generation profiles, including peak and off-peak periods.

How are financial and economic models used in energy storage projects?

Financial and economic modeling are undertaken based on the data and assumptions presented in Table 1. Table 1. Project stakeholder interests in KPIs. To determine the economic feasibility of the energy storage project, the model outputs two types of KPIs: economic and financial KPIs.

What are energy storage costs?

Typically, these costs are expressed as a levelised annual cost, that is, they represent the amount that an investor would expect to pay annually for the entire operation of the energy storage system, including the repayment of the initial capital costs.

How do you value energy storage projects?

The central tool for valuing an energy storage project is the project valuation model. Many still use simple Excel models to evaluate projects, but to capture the opportunities in the power market, it is increasing required to utilize something with far greater granularity in time and manage multiple aspects of the hardware.

What is energy storage project valuation methodology?

Energy storage project valuation methodology is ower sector projects through evaluating various revenue and cost typical of p assumptions in a project economic model.

What economic inputs are included in the energy storage model?

The economic inputs into the model will include both the revenue and costs for the project. Revenue for the energy storage project will either be expressed as a contracted revenue stream from a PPA (Power Purchase Agreement), derived from merchant activity by the facility, or some combination thereof.

More related information

-

New investment projects in Taipei energy storage

New investment projects in Taipei energy storage

-

Construction of new energy storage projects in Costa Rica

Construction of new energy storage projects in Costa Rica

-

Cook Islands Energy Storage Projects 2025

Cook Islands Energy Storage Projects 2025

-

Peak and valley electricity prices for Danish energy storage projects

Peak and valley electricity prices for Danish energy storage projects

-

Huawei s energy storage projects in Latvia

Huawei s energy storage projects in Latvia

-

PV projects without energy storage

PV projects without energy storage

-

Energy storage projects help

Energy storage projects help

-

Prospects for Myanmar Energy Storage Projects

Prospects for Myanmar Energy Storage Projects

Commercial & Industrial Solar Storage Market Growth

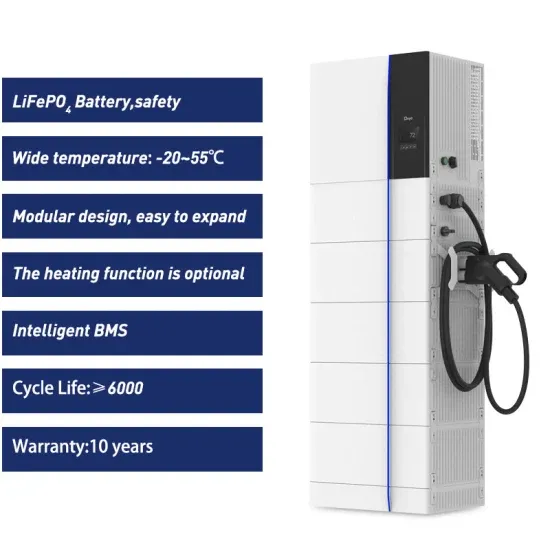

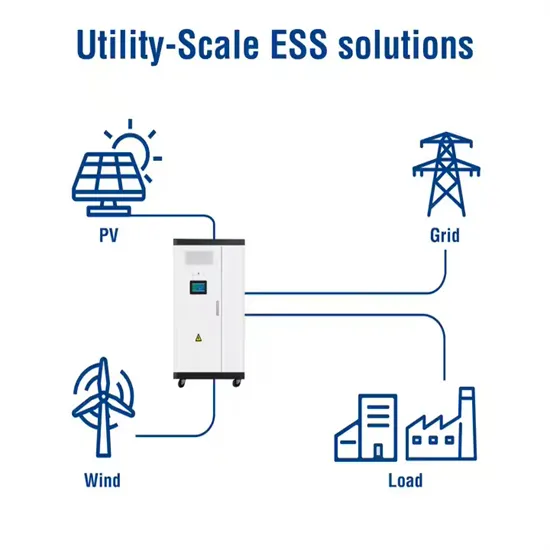

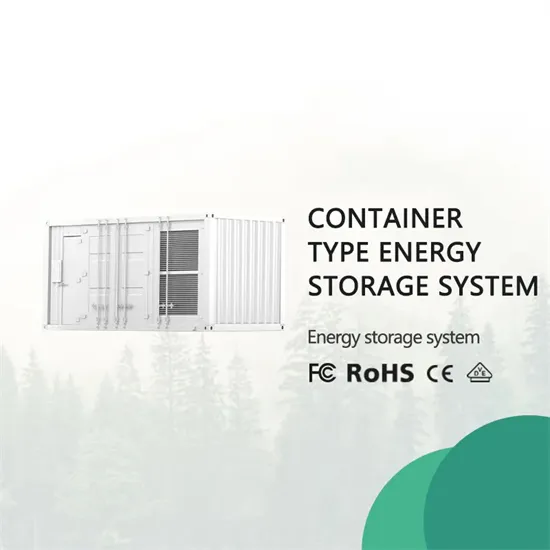

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.