Photovoltaic Energy Storage Power Station Market Disruption

The photovoltaic energy storage power station market is experiencing robust growth, driven by the increasing adoption of renewable energy sources and the need for grid stability. The market''s

Get Price

Canada Energy Storage Systems Market Size & Outlook

This country databook contains high-level insights into Canada energy storage systems market from 2018 to 2030, including revenue numbers, major trends,

Get Price

Ontario Completes Largest Battery Storage

TORONTO – The Ontario government has concluded the largest battery storage procurement in Canada''s history and secured the necessary

Get Price

RES | Global Renewable Energy Solutions

We''re committed to using our innovative energy storage solutions to power flexible ways to facilitate clean energy. Through partnerships and our collective expertise, we''re helping

Get Price

Unlocking Profit Potential: A Deep Dive into Independent Energy Storage

You''re at a cocktail party when someone asks "How do battery storage systems actually make money?" Suddenly, everyone''s martini glasses stop clinking. That''s how hot this topic is right

Get Price

Stochastic optimal allocation of grid-side independent

The integration of large-scale intermittent renewable energy generation into the power grid imposes challenges to the secure and

Get Price

The rise of utility-scale storage in Canada

Utility-scale energy storage in Canada is undergoing a transformative shift, marked by a surge in market engagement over the past three years. In Canada, provinces wield a

Get Price

Global Independent Energy Storage Power Station Sales Market

An Independent Energy Storage Power Station refers to a facility or installation that is capable of storing energy from various sources and then supplying that stored energy to meet power

Get Price

By the Numbers

Canada''s total wind, solar and storage installed capacity grew 46% in the past 5 years (2019-2024), including nearly 5 GW of new wind, 2 GW of new utility

Get Price

Market Snapshot: Energy storage in Canada may multiply by 2030

BESS is the fastest growing energy storage technology in Canada and is also the dominant storage technology in terms of capacity and number of sites. All but four projects

Get Price

Canada Energy Storage Systems Market Size & Outlook

This country databook contains high-level insights into Canada energy storage systems market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Get Price

Energy Storage in Canada: Recent Developments in a Fast

The energy storage market in Canada is poised for exponential growth. Increasing electricity demand to charge electric vehicles, industrial electrification, and the production of hydrogen

Get Price

Analysis of Independent Energy Storage Business Model Based

As the hottest electric energy storage technology at present, lithium-ion batteries have a good application prospect, and as an independent energy storage power station, its business model

Get Price

Operation strategy and profitability analysis of

This mechanism applies to independent electrochemical energy storage stations with a power capacity of 5 MW and a continuous discharge

Get Price

A snapshot of Canada''s energy storage market in 2023

Energy Storage Canada''s 2022 report, Energy Storage: A Key Net Zero Pathway in Canada indicates Canada will need a minimum of 8 to 12GW of energy storage to ensure

Get Price

Energy storage in Canada: energizing the transition

The stated goal is to recognize energy storage facilities as independent assets (i.e., not generation or load) while continuing to pay these assets for the energy they provide to the grid.

Get Price

By the Numbers

Canada''s total wind, solar and storage installed capacity grew 46% in the past 5 years (2019-2024), including nearly 5 GW of new wind, 2 GW of new utility-scale solar, 600 MW of new on

Get Price

Independent Energy Storage Power Station Decoded:

These regulations, combined with the increasing demand for reliable and sustainable energy sources, are driving the growth of the independent energy storage power

Get Price

A study on the energy storage market in Canada

The current and future market for energy storage will be a function of the costs and revenue streams for storage. While energy storage can facilitate the use of renewable energy, it can

Get Price

Standalone Solutions: 22.88%CAGR Analysis for Independent Energy

As global energy systems transition toward cleaner, more resilient, and decentralized structures, independent energy storage power stations are playing an

Get Price

New Energy Storage Technologies Empower Energy

Independent energy storage stations can meet the needs for energy storage by generators and for peak shaving and frequency regulation by power grids, expanding their channels for

Get Price

Goreway Power Station

Located in Brampton, Ontario, the Goreway Power Station (GPS) is an 875 MW natural gas fueled, combined cycle facility. The facility can provide electricity to Ontario''s power grid 24

Get Price

Independent Power Plants Will Become The Main Force!

Based on the demand for new energy consumption, it is expected that independent energy storage power stations will be the main force of new

Get Price

Energy Storage in Canada: Recent Developments in a

The energy storage market in Canada is poised for exponential growth. Increasing electricity demand to charge electric vehicles, industrial

Get Price

Energy storage in Canada: energizing the transition

The stated goal is to recognize energy storage facilities as independent assets (i.e., not generation or load) while continuing to pay these assets for the

Get Price

Oneida Energy Storage

Oneida Energy Storage facility is a 250 MW/1,000 MWh lithium-ion battery energy storage facility, representing the largest grid-scale battery energy storage

Get Price

Research on Optimal Decision Method for Self Dispatching of

Abstract. This article analyzes the current situation of energy storage participating in market transactions as an independent market entity, and proposes a decision-making

Get Price

Ontario''s electricity system moves forward with largest energy storage

Ontario''s electricity system moves forward with largest energy storage procurement ever in Canada May 16, 2023 Independent Electricity System Operator

Get Price

6 FAQs about [Independent energy storage power station revenue in Canada]

What is the fastest growing energy storage technology in Canada?

BESS is the fastest growing energy storage technology in Canada and is also the dominant storage technology in terms of capacity and number of sites. All but four projects proposed to be commissioned by 2030 are battery storage, with two CAES and two PHS projects also proposed.

Where are energy storage projects happening in Canada?

Energy Storage Canada 2, a non-profit organization that promotes energy storage, reports that energy storage projects are operating in each of Ontario, Alberta, Saskatchewan, and PEI, with additional projects under development in these provinces as well as in New Brunswick and Nova Scotia 3.

Is utility-scale energy storage increasing in Canada?

Utility-scale storage is increasing in the rest of Canada as well, especially when considered in relative terms to the current assets online in each province. Figure 1: provincial energy storage targets.

What is the largest battery energy storage facility in Canada?

Once built, the Oneida Energy Storage Project would be the largest battery energy storage facility in Canada. This project is a joint venture between NRStor Inc. and Six Nations of the Grand River Development Corporation, with funding from the Canada Infrastructure Bank and a consortium of private lenders.

Why is energy storage so important in Canada?

Utility-scale energy storage in Canada is undergoing a transformative shift, marked by a surge in market engagement over the past three years. In Canada, provinces wield a strong constitutional authority in energy matters.

How many energy storage projects are there in Alberta?

While there are nearly 50 energy storage projects currently listed within the Alberta Electric System Operator (AESO)’s projects list, the development of a 600MW portfolio of five solar-plus-storage projects by Westbridge Renewable Energy Corp. is underway.

More related information

-

Italian independent energy storage power station

Italian independent energy storage power station

-

Philippines Independent Energy Storage Power Station

Philippines Independent Energy Storage Power Station

-

Guangqian Energy Storage Power Station Project Revenue

Guangqian Energy Storage Power Station Project Revenue

-

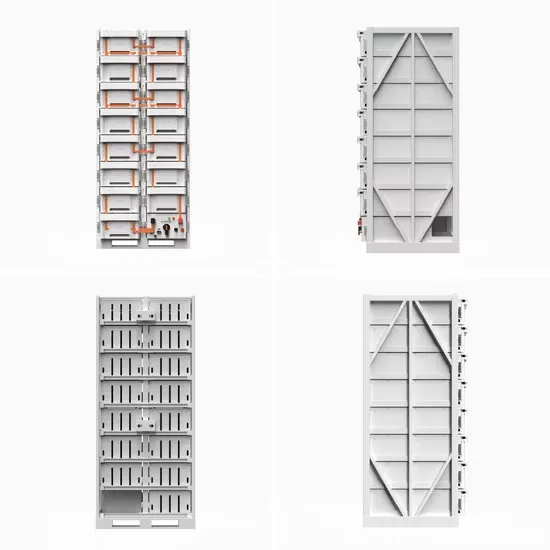

Independent power station energy storage equipment

Independent power station energy storage equipment

-

Independent energy storage power station project equipment

Independent energy storage power station project equipment

-

Vanuatu Independent Energy Storage Power Station

Vanuatu Independent Energy Storage Power Station

-

Independent Energy Storage Power Station Application Development Model

Independent Energy Storage Power Station Application Development Model

-

Somalia Independent Energy Storage Power Station

Somalia Independent Energy Storage Power Station

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.