Huai armenia xin energy storage power plant

Armenia''''s energy sector: current developments and A flexible power system with storage technologies and increased connectivity with neighbouring countries are essential to

Get Price

Armenia solar energy: Stunning 2036 Goal of 66% Renewable

2 days ago· Armenia plans to increase its renewable energy capacity to 66% by 2036. The government aims to add 1,500 MW of new capacity from solar and wind energy, with

Get Price

Energy system transformation – Armenia energy profile –

According to the Armenian Wind Atlas developed in 2002‑2003 by the US National Renewable Energy Laboratory in collaboration with SolarEn of Armenia, the most favourable areas for grid

Get Price

Meralco PowerGen, KEPCO eye wind, energy storage projects

18 hours ago· Meralco PowerGen Corp. (MGEN) and Korea Electric Power Corp. (KEPCO) are looking to expand their collaboration beyond solar energy into wind and energy storage

Get Price

Armenia Smart Energy Storage Cabinet Center: Powering the

a country where solar panels and wind turbines generate clean energy by day, but the lights still flicker at night. That''s the paradox Armenia faces as it races toward renewable energy

Get Price

Wind Energy Resource Atlas of Armenia

This wind energy resource atlas identifies the wind characteristics and distribution of the wind resource in the country of Armenia. The detailed wind resource maps and other information

Get Price

Wind Power Energy Storage: Harnessing the Breeze for a

Harnessing the Power of Urban Wind Energy Urban areas pose challenges and opportunities for renewable energy with high population densities and energy demands. Urban

Get Price

Renewable Energy: Armenia''s Opportunities and Limits

Armenia''s wind energy sector is minuscule. The entire country has just four wind farms with an installed capacity of 4.23 MW and an average annual generation of 3.97 GWh.

Get Price

Renewable Energy: Armenia''s Opportunities and Limits

Armenia''s wind energy sector is minuscule. The entire country has just four wind farms with an installed capacity of 4.23 MW and an average

Get Price

Armenia solar energy: Stunning 2036 Goal of 66% Renewable Power

2 days ago· Armenia plans to increase its renewable energy capacity to 66% by 2036. The government aims to add 1,500 MW of new capacity from solar and wind energy, with

Get Price

Armenia wind turbines batteries

Wind Power at Home: Turbines and Battery Storage Basics Integrating Battery Storage with Wind Energy Systems: Battery storage is vital for maximizing wind energy utilization. It stores the

Get Price

RENEWABLE ENERGY IN ARMENIA: STATE-OF-THE-ART

ed paper mined the current status and development paths of wind, solar, and energy applications in Armenia. Following points, which presented interest, are in the focus: in what extent

Get Price

Armenia Energy Storage Economic and Financial Analysis

ABSTRACT As the share of variable renewable energy generation increases, Armenia might need to install battery storage systems to ensure the reliable and smooth operation of its power

Get Price

ARMENIA ENERGY STORAGE PROGRAM

If storage is considered an energy consumer for taxation purposes, energy offtake by storage will constitute a taxable event. Subsequently, the discharge energy will be taxed once again when

Get Price

Armenia Energy Storage Legal and Regulatory Review Report

The objective of the present report is to assess Armenia''s legal and regulatory framework for energy storage and provide recommendations for reforms that would be needed to

Get Price

Wind power in Armenia

Wind power generates less than 1% of Armenia''s electricity annually, as there were only four wind farms in 2023 and less than 10 MW is installed. According to a study sponsored by the United States Department of Energy (DOE) and the United States Agency for International Development (USAID) in 2002–2003, the theoretical wind power potential of Armenia is 4,900 MWe in four zones with a total area of 979 km . According to this r

Get Price

Wind power in Armenia

The most promising areas for wind power plants are Zod pass, Bazum Mountain, Jajur pass, the territory of Geghama Mountains, Sevan Pass, Aparan, the highlands between Sisian and

Get Price

Wind Power Development in Armenia

1.1 Wind Power Potential of Armenia According to the Armenian Wind Atlas developed in 2002-03 by The United States National Renewable Energy Laboratory (NREL) in collaboration with

Get Price

Energy system transformation – Armenia energy

According to the Armenian Wind Atlas developed in 2002‑2003 by the US National Renewable Energy Laboratory in collaboration with SolarEn of

Get Price

ARMENIA RENEWABLE RESOURCES AND ENERGY

The main objective: of this study is to analyse the requirements of the electricity system to ensure its reliable and smooth operation of storages with the integration of large-scale variable

Get Price

Wind power in Armenia

Wind power generates less than 1% of Armenia''s electricity annually, [1] as there were only four wind farms in 2023 [2] and less than 10 MW is installed. [3] According to a study sponsored by

Get Price

Untapped Potential of Wind Energy in Armenia – GEFF in Armenia

With favorable geographical conditions and growing international interest, wind power has the potential to transform Armenia''s energy landscape, diversify its energy market, and reduce its

Get Price

Armenian Power Plant Energy Storage: Innovations Lighting Up

That''s Armenia today. With aging infrastructure and growing energy demands, Armenian power plant energy storage isn''t just tech jargon—it''s become the nation''s electricity

Get Price

6 FAQs about [Armenia Wind Power Energy Storage]

How much wind power does Armenia have?

A 2003 study by the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) estimated Armenia’s land areas with “good-to-excellent” wind resource potential to be around 1,000 km². With a conservative assumption of 5 MW per km², the authors noted that the area could support almost 5,000 MW of potential installed capacity.

How many wind farms are there in Armenia?

Armenia’s wind energy sector is minuscule. The entire country has just four wind farms with an installed capacity of 4.23 MW and an average annual generation of 3.97 GWh.

How big is Armenia's solar power?

In 2017, Tamara Babayan, a sustainable energy expert, estimated the potential of Armenia’s distributed solar power at 1,280 MW and almost 1,800 GWh in annual generation.

What percentage of Armenia's Energy is renewable?

Renewable energy resources, including hydro, represented 7.1% of Armenia’s energy mix in 2020. Almost one-third of the country’s electricity generation (30% in 2021) came from renewable sources. Forming the foundation of Armenia’s renewable energy system as of 6 January 2022 were 189 small, private HPPs (under 30 MW), mostly constructed since 2007.

How much electricity does Armenia produce a year?

Last year Armenia produced 8,907.9 GWh of electricity, up 16% from 2021. The vast majority came from thermal power plants in Yerevan and Hrazdan (43.5%) and the Metsamor Nuclear Power Plant (32%). Hydropower accounted for 21.8%, while solar stood at 2.7% and wind power at just 0.02%.

What is Armenia's long-term energy strategy?

In its long-term strategy (up to 2040) for the energy sector, adopted in January 2021, the Armenian government identified the maximum utilization of renewable energy potential as a priority.

More related information

-

Malaysia s largest wind and solar energy storage power station

Malaysia s largest wind and solar energy storage power station

-

South Ossetia Wind Power Energy Storage Project

South Ossetia Wind Power Energy Storage Project

-

The difference between energy storage and wind power

The difference between energy storage and wind power

-

Wind power communication energy storage cabinet base station

Wind power communication energy storage cabinet base station

-

Wind and solar power generation and lithium battery energy storage

Wind and solar power generation and lithium battery energy storage

-

Burkina Faso Wind Power Energy Storage

Burkina Faso Wind Power Energy Storage

-

Wind power energy storage installed capacity

Wind power energy storage installed capacity

-

Huawei Photovoltaic Wind Power Energy Storage

Huawei Photovoltaic Wind Power Energy Storage

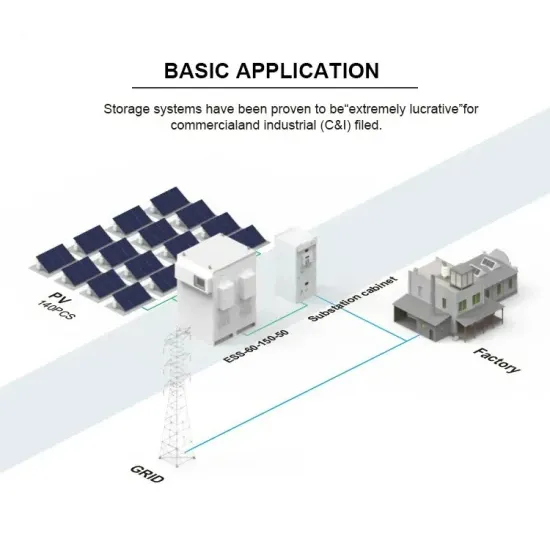

Commercial & Industrial Solar Storage Market Growth

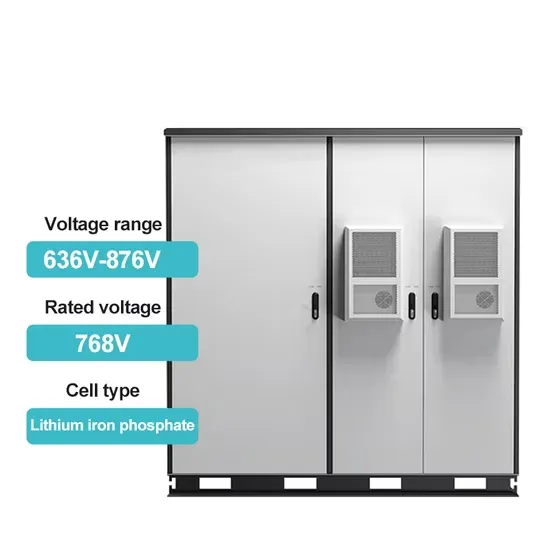

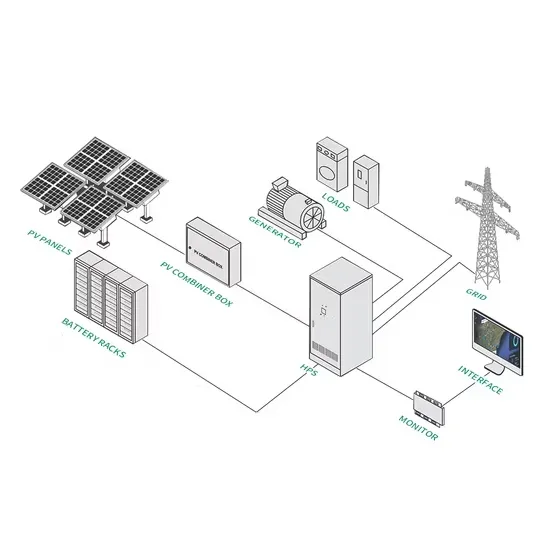

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

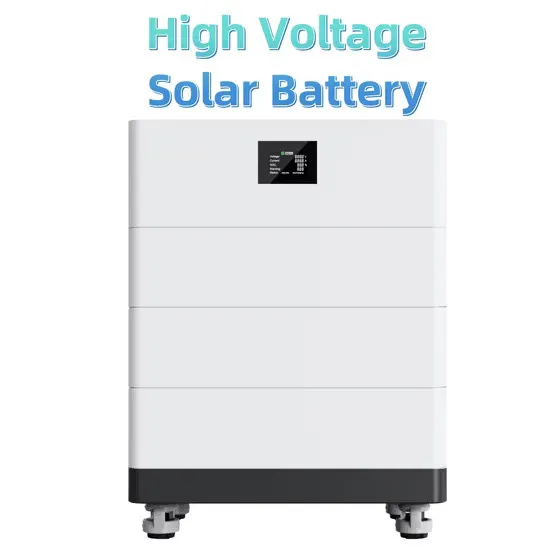

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.