ENERGY STORAGE IN TOMORROW''S ELECTRICITY

cap-and-floor regimes or targeted support schemes. Along with support mechanisms, electricity markets need to be tailored for storage resources and their inter-temporal nature and provide

Get Price

Electricity Markets: A Comprehensive Guide

A complex network connects electricity market participants, enabling them to produce, transmit, and distribute electricity to consumers. How do these

Get Price

Review on bidding strategies for renewable energy power

The increase in the installed capacity of renewable energy and the development of electricity spot markets make it an inevitable trend for renewable energy power producers

Get Price

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

Get Price

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

The role of electricity market design for energy storage in cost

However, in reality, energy storage participates in electricity markets with a profit-driven motive, its impact on reducing system costs or emissions is dependent on market

Get Price

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand

Get Price

A comprehensive review of large-scale energy storage participating

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

Methods of participating power spot market bidding and

To meet their customers'' energy demands, load-serving companies bid on the electricity generated by their power plants in an energy market. Electric suppliers offer to sell

Get Price

Is the Japanese energy storage market moving forward?

Japan''s energy storage market needs restructuring to balance the books. So, can new ancillary and capacity services bridge the feasibility gap?

Get Price

Top 10: Energy Storage Companies | Energy Magazine

In this week''s Top 10, Energy Digital takes a deep dive into energy storage and profile the world''s leading companies in this space who are leading the charge towards a more

Get Price

Global energy storage

To support the global transition to clean electricity, funding for development of energy storage projects is required. Pumped hydro, batteries, hydrogen, and thermal storage

Get Price

Virtual power plant models and electricity markets

In addition, when a greater amount of renewable generation is produced, it is more profitable for the VPP to sell energy in the day-ahead market or recharge the storage systems

Get Price

Top 10: Energy Storage Companies | Energy Magazine

In this week''s Top 10, Energy Digital takes a deep dive into energy storage and profile the world''s leading companies in this space who are

Get Price

capacity-markets-explained-key-insights-for-the-future

In a capacity market, power companies or energy storage operators commit to providing a certain amount of electricity capacity at a future time.

Get Price

What is Energy Arbitrage – gridX

Energy arbitrage is the practice of purchasing electricity when prices are low and then storing or reselling it when prices are higher, thereby generating a profit from the price difference. In the

Get Price

Bidding modes for renewable energy considering electricity

Considering electricity-carbon integrated market mechanism, this paper constructs a hybrid game model to study the evolutionary process of renewable energy generation

Get Price

Improving Market Design for Energy Storage

In many parts of the U.S., such as New York, California, and Texas, private companies are responsible for owning and operating energy storage systems.

Get Price

The Economic Value of Independent Energy Storage Power

Finally, it is suggested that the construction of energy storage facilities should actively switch to independent energy storage and that independent energy storage facilities

Get Price

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get Price

Energy storage systems in South Korea

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more

Get Price

Energy Storage Participation in Electricity Markets

Storage systems can be employed for different applications, which can be categorized in energy, grid, and reliability services. Energy services include arbitrage and

Get Price

How can energy storage participate in the electricity market?

By participating in the electricity market, energy storage solutions like batteries can store excess energy generated during low-demand periods and release it during high-demand

Get Price

Improving Market Design for Energy Storage

In many parts of the U.S., such as New York, California, and Texas, private companies are responsible for owning and operating energy storage systems. These businesses participate in

Get Price

A Transition Mechanism for the Participation of

Through adjusting subsidy policies, the developed transition mechanism can stimulate the renewable energy generation companies to

Get Price

Utilities report batteries are most commonly used for arbitrage and

In arbitrage, utilities charge batteries by buying electricity during low-cost periods and then sell that electricity when electricity prices increase. Utilities can also make use of

Get Price

A Beginner''s Guide to Energy Storage Arbitrage

Energy storage arbitrage, like a financial wizardry trick with batteries, involves storing electricity when it''s abundant and cheap to release it

Get Price

More related information

-

Gabon energy storage power station participates in electricity market transactions

Gabon energy storage power station participates in electricity market transactions

-

Is energy storage the storage of photovoltaic electricity

Is energy storage the storage of photovoltaic electricity

-

Four Danish energy storage project investment companies

Four Danish energy storage project investment companies

-

Home energy storage products are now on the market

Home energy storage products are now on the market

-

Pakistan photovoltaic energy storage companies

Pakistan photovoltaic energy storage companies

-

Japanese imported energy storage battery companies

Japanese imported energy storage battery companies

-

Japan s photovoltaic energy storage product market

Japan s photovoltaic energy storage product market

-

Energy storage battery electricity price standard

Energy storage battery electricity price standard

Commercial & Industrial Solar Storage Market Growth

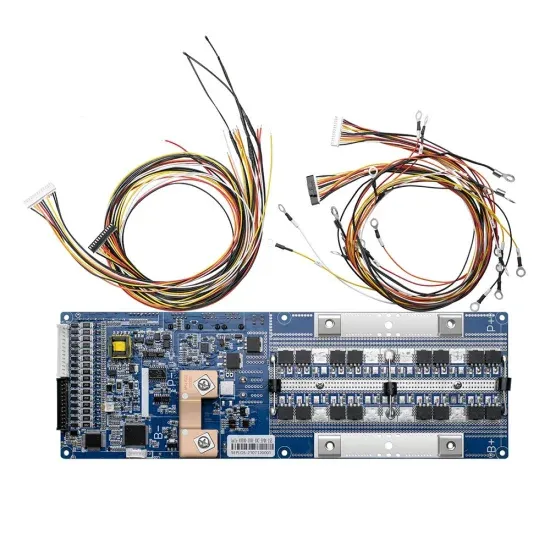

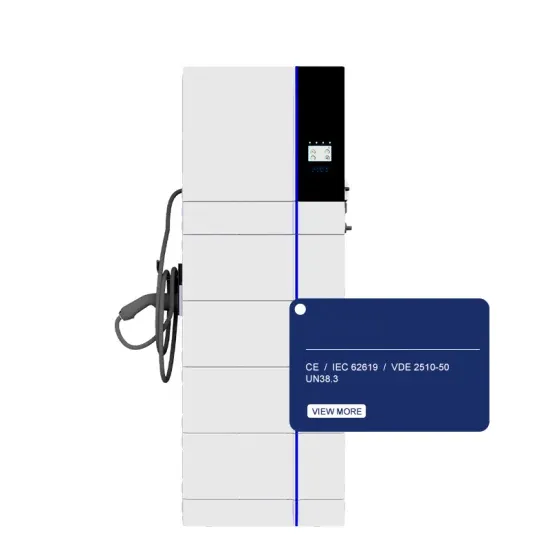

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.