Regulatory Review of the Electricity Market in Angola

Angola does not provide a comprehensive Grid Code, rather it governs the technical aspects of connection to and management of the grid through individual pieces of regulation dedicated to

Get Price

Swals Angola-Your Trusted Import and Export Partner

Swals Angola, LDA is a leading import-export company established in 2023 in Luanda, and a subsidiary of Swals Global. We specialize in sourcing and

Get Price

Government-Created Monopolies

Exclusion of Competitors Government-created monopolies are characterized by the exclusion of potential competitors from the market. This exclusion can be achieved through various

Get Price

Angola Eliminates State Monopoly on Electricity Transmission

The Angolan government has decided to eliminate the state monopoly on the transmission of electricity to make private investment viable, with changes to the General

Get Price

Buy Outdoor Power Deals Products Online in Luanda at Best

Shop for Outdoor Power Deals products online in Luanda, a leading shopping store for Outdoor Power Deals products at discounted prices along with great deals and offers on desertcart

Get Price

Voltage in Angola

Angola is currently a non-operating member of the Southern African Power Pool, but plans exist to connect to the pool through Namibia and the

Get Price

Angola Outdoor Power BMS Development Trends and Solutions

In Angola, the demand for outdoor power BMS development is surging as the nation accelerates its transition to renewable energy.

Get Price

Angola

Angola has numerous options for the generation of power. The present document considers the key options - hydro, thermal and new renewable– individually

Get Price

Angola ends state monopoly on electricity transmission

Angola''s amended General Electricity Law ends the state monopoly, inviting private investment to expand electricity access.

Get Price

Angola Eliminates State Monopoly on Electricity

The Angolan government has decided to eliminate the state monopoly on electricity transmission in order to make private investment

Get Price

GRID EXPANSION | Angola Energy 2025

Planning the electrical system in the long term requires knowledge of how potential demand is distributed along the territory. This distribution will depend

Get Price

The Project for Power Development Master Plan in the

Here we consider the power supply composition that minimizes the total cost in the year 2040, the final year of the power master plan. We examine the most economical configuration in 2040

Get Price

EXECUTIVE SUMMARY | Angola Energy 2025

Angola has numerous options for the generation of power. The present document considers the key options - hydro, thermal and new renewable– individually and combined in scenarios that

Get Price

Angola Opens Electricity Transmission to Private Investment

The Angolan government has approved amendments to the General Electricity Law, removing the state''s monopoly on electricity transmission.

Get Price

Angola Outdoor

POWER Bear''s range of designer bins have been crafted to be both functional and aesthetic in their environment. Our collection of litter bins and recycling

Get Price

Angola Outdoor Power BMS Development Trends and Solutions

In Angola, the demand for outdoor power BMS development is surging as the nation accelerates its transition to renewable energy. This article targets: Solar/wind project developers seeking

Get Price

Angola Rotary Uninterruptible Power Supply (UPS) Market (2024

Historical Data and Forecast of Angola Rotary Uninterruptible Power Supply (UPS) Market Revenues & Volume By Power Rating for the Period 2020-2030 Historical Data and Forecast

Get Price

Voltage in Angola

Discover all the information you need for Voltage in Angola, from electricty power supply rates to the quality of the power. Find out more

Get Price

Hitachi Power Grids partners with consortium in Angola on

Hitachi Power Grids scope of work will include the design, main power equipment supplies, testing and commissioning of the project. It is based on an in-depth grid impact study into the

Get Price

Angola Opens Electricity Transmission to Private

The Angolan government has approved amendments to the General Electricity Law, removing the state''s monopoly on electricity

Get Price

Angola Eliminates State Monopoly on Electricity Transmission

The Angolan government has decided to eliminate the state monopoly on electricity transmission in order to make private investment viable, with changes to the General

Get Price

DEMAND FORECAST | Angola Energy 2025

Although available generation capacity has grown significantly over the past years, power demand is still suppressed. Suppressed demand results in

Get Price

Angola

Angola is currently a non-operating member of the Southern African Power Pool, but plans exist to connect to the pool through Namibia (Baynes Dam). Namibia and Angola are set

Get Price

Angola Outdoor Power Equipment Market (2025-2031)

Angola Outdoor Power Equipment Industry Life Cycle Historical Data and Forecast of Angola Outdoor Power Equipment Market Revenues & Volume By Equipment Type for the Period

Get Price

Voltage in Angola

Angola is currently a non-operating member of the Southern African Power Pool, but plans exist to connect to the pool through Namibia and the Democratic Republic of Congo.

Get Price

Power Supply Monopoly

How to deal with the Monopoly of Power Supply As South Africans we have all been here before, In 2008 South Africa suffered a rash of black outs that cost the country

Get Price

6 FAQs about [Angola Outdoor Power Supply Monopoly]

How much does Angola spend on electricity?

The portion of the Angolan government budget dedicated to the electricity production, transmission and distribution sectors increased to US$ 817.2 million in 2023 from US$490 million in 2022. Angola’s national budget for electricity assessment allocated is around US$ 249.4 million.

What are the options for power generation in Angola?

Angola has numerous options for the generation of power. The present document considers the key options - hydro, thermal and new renewable– individually and combined in scenarios that meet the required levels of safety and redundancy.

Will Angola be a part of the southern African Power Pool?

Plans exist to link the grids through a north-central-south backbone and expand the grid from 3,354 km to 16,350 km by 2025. Angola is currently a non-operating member of the Southern African Power Pool, but plans exist to connect to the pool through Namibia and the Democratic Republic of Congo.

What can US companies do in Angola?

The tenders, the first of many to be released by the Angolan government and AfDB through 2024, could present new opportunities for U.S. companies to provide power sector goods and services in Angola, particularly in power transmission and distribution, while expanding Angolans’ access to electricity.

Which countries supply power equipment to Angola?

In addition, European companies (Germany, Portugal) supply equipment to the energy sector. Portuguese, Brazilian, and Chinese construction companies generally lead in project construction. Electric power-related equipment (HTS 8411) exported to Angola in 2022, was valued at US$ 14.8 million.

How much power does Angola need?

In order to ensure a safe power supply, even in years of lower hydro flow, Angola should have 9.9 GW of installed capacity – through increasing power capacity in all sub-systems and through a strong reliance on hydro and gas (which will correspond, respectively, to 66% and 19% of installed power capacity).

More related information

-

Panama Outdoor Energy Storage Power Supply Monopoly

Panama Outdoor Energy Storage Power Supply Monopoly

-

Huawei Burkina Faso outdoor power supply

Huawei Burkina Faso outdoor power supply

-

New brand of outdoor power supply

New brand of outdoor power supply

-

Outdoor power supply application solution

Outdoor power supply application solution

-

259W outdoor power supply

259W outdoor power supply

-

Niue Outdoor Communication Power Supply BESS Platform

Niue Outdoor Communication Power Supply BESS Platform

-

Huawei Libya outdoor power supply

Huawei Libya outdoor power supply

-

How to charge the energy storage cabinet outdoor power supply with solar energy

How to charge the energy storage cabinet outdoor power supply with solar energy

Commercial & Industrial Solar Storage Market Growth

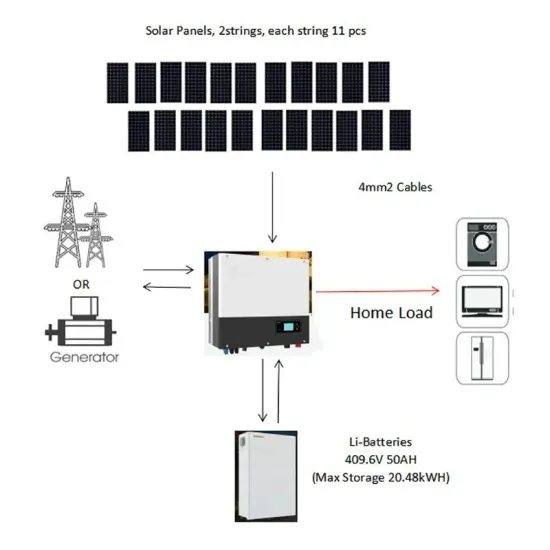

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.