Energy Storage Rides a Wave of Growth but Uncertainty Looms:

This report comes to you at the turning of the tide for energy storage: after two years of rising prices and supply chain disruptions, the energy storage industry is starting to see price

Get Price

Advanced Lithium-Ion Energy Storage Battery Manufacturing

Energy storage batteries are manufactured devices that accept, store, and discharge electrical energy using chemical reactions within the device and that can be

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

Read on to learn about some of the top energy storage stocks on the market and why you should consider investing in them. As the world shifts towards renewable energy,

Get Price

Energy Storage Manufacturing | Advanced

NREL research is investigating flexibility, recyclability, and manufacturing of materials and devices for energy storage, such as lithium-ion

Get Price

Energy Storage Technology Stocks & Investments (List)

Energy storage technology stocks offer a promising investment opportunity in the growing clean energy sector. Companies like Tesla and Panasonic are leaders in battery

Get Price

Energy Storage | ACP

The energy storage industry has announced a historic commitment to invest $100 billion in building and buying American-made grid batteries, including capital for new battery

Get Price

Manufacturing

Manufacturing Manufacturing the Evolution of Solid-State Graphene Energy Storage Emtel Energy USA is leading the charge in advanced energy storage

Get Price

U.S. Energy Storage Industry Commits $100 Billion Investment in

The U.S. energy storage industry is committed to investing $100 billion in American grid batteries, including both capital for building new battery manufacturing facilities and

Get Price

The standalone energy storage market in India | IEEFA

Standalone Energy Storage Systems (ESS) are rapidly emerging as a key market, with 6.1 gigawatts of tenders issued in the first quarter of

Get Price

Energy Storage Technology Stocks & Investments (List)

Energy storage technology stocks offer a promising investment opportunity in the growing clean energy sector. Companies like Tesla and

Get Price

U.S. Battery Storage Manufacturers Commit $100B to Production

U.S.-based battery storage technology firms are uniting to commit to investing $100 billion toward building and buying American-made energy storage. This week, the American

Get Price

Energy Storage Grand Challenge Energy Storage Market

Foreword As part of the U.S. Department of Energy''s (DOE''s) Energy Storage Grand Challenge (ESGC), DOE intends to synthesize and disseminate best-available energy storage data,

Get Price

Advanced Materials and Devices for Stationary Electrical

Stationary energy storage technologies promise to address the growing limitations of U.S. electricity infrastructure. A variety of near-, mid-, and long-term storage options can

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid

Get Price

Energy Storage: 10 Things to Watch in 2024

By Yayoi Sekine, Head of Energy Storage, BloombergNEF Battery overproduction and overcapacity will shape market dynamics of the energy

Get Price

Energy-Storage.News

Subscribe to Newsletter Energy-Storage.news meets the Long Duration Energy Storage Council Editor Andy Colthorpe speaks with Long Duration Energy

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

U.S.-based battery storage technology firms are uniting to commit to investing $100 billion toward building and buying American-made energy

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get Price

Energy Storage & Conversion Manufacturing

To establish public-private partnerships that address manufacturing challenges for advanced battery materials and devices, with a focus on de-risking, scaling, and accelerating adoption of

Get Price

Energy Storage Manufacturing | Advanced Manufacturing Research | NREL

NREL research is investigating flexibility, recyclability, and manufacturing of materials and devices for energy storage, such as lithium-ion batteries as well as renewable

Get Price

Energy Storage Systems: Types, Pros & Cons, and

Energy storage systems (ESS) are vital for balancing supply and demand, enhancing energy security, and increasing power system efficiency.

Get Price

Energy Storage Investments – Publications

Through the first three quarters of 2024, 83 energy storage financing and investment deals were reported completed for a total of $17.6 billion invested [1]. Of these

Get Price

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get Price

Analysis of trends in the European energy storage market 2024

This article will briefly analyze the development trends of the European energy storage market from 2024 to 2028, focusing on the strong growth of several key European markets over the

Get Price

U.S. Department of Energy Selects 11 Projects to

WASHINGTON, D.C. — The U.S. Department of Energy (DOE) today announced an investment of $25 million across 11 projects to advance

Get Price

U.S. Energy Storage Industry to Invest $100 Billion in

Today''s investment commitment aims to advance a manufacturing expansion in the United States that could enable American-made batteries to satisfy 100% of domestic energy storage project

Get Price

Energy storage deployment and innovation for the clean energy

The clean energy transition requires a co-evolution of innovation, investment, and deployment strategies for emerging energy storage technologies.

Get Price

Energy Storage Stocks: Investment Opportunities in Renewables

As the world increasingly transitions towards renewable energy, the importance of energy storage has never been more pronounced. This article explores various energy storage

Get Price

6 FAQs about [Energy storage device manufacturing investment]

What are energy storage stocks?

Energy storage stocks are companies that produce or develop energy storage technologies, such as batteries, capacitors, and flywheels. These technologies can store energy from renewable sources like solar and wind power, or from traditional sources like coal and natural gas.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Are energy storage stocks a good investment?

Currently, energy storage stocks are a relatively safe investment to make for the future, and if trends hold, they have solid potential for growth. However, if this doesn’t appear to be a good fit for your investment portfolio, then it’s best to look at other options.

Is Enphase Energy a good stock to buy?

When you combine it with its growth prospects, it appears to be a good company to buy amid the present stock market downturn. Enphase Energy is a leading provider of solar energy storage systems for homes and businesses and is also considered one of the top renewable energy stocks.

Why should you choose AES for your energy storage system?

AES has implemented energy storage systems that can be used by homes or businesses when needed — even at peak times. The firm is constantly leveraging its position as a pioneer in the development of the electrical sector.

Is Bloom Energy a good energy storage stock?

Bloom Energy is one of the smaller picks on this list, but it may be the most dynamic energy storage stock out there. It specializes in advanced fuel cell energy platforms, which use a proprietary solid oxide technology to convert natural gas, biogas or hydrogen into electricity with low or even zero carbon emissions.

More related information

-

Mobile is an energy storage device

Mobile is an energy storage device

-

How much energy storage device is needed for 500A DC current

How much energy storage device is needed for 500A DC current

-

Slope energy storage device

Slope energy storage device

-

Djibouti phase change energy storage device

Djibouti phase change energy storage device

-

Structural design of energy storage device

Structural design of energy storage device

-

Is the energy storage device 200 degrees

Is the energy storage device 200 degrees

-

Cambodia emergency energy storage vehicle manufacturing price

Cambodia emergency energy storage vehicle manufacturing price

-

Asian Energy Storage Equipment Manufacturing

Asian Energy Storage Equipment Manufacturing

Commercial & Industrial Solar Storage Market Growth

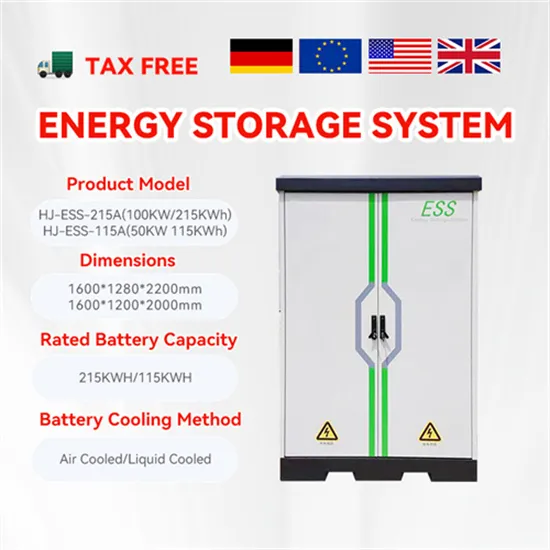

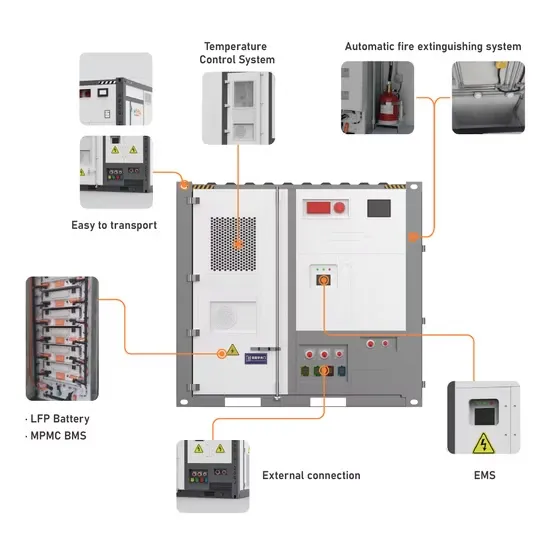

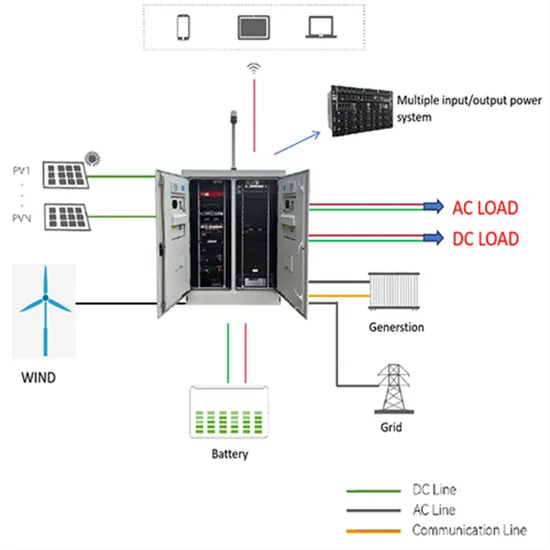

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.