Expert analysis: How to approach battery energy storage systems

What are the opportunities and challenges for business cases for stand-alone battery energy storage systems (BESS) in European markets like Germany, Italy, France, The

Get Price

Revenue Analysis for Energy Storage Systems in the United

This study examines the potential revenue of energy storage systems, using both historical reported revenue data and price-taker analysis of historical and projected future prices.

Get Price

Solar Energy Storage Market Size, Share and Latest

Global Solar Energy Storage Market Size is valued at USD 93.3 Bn in 2024 and is predicted to reach USD 475.3 Bn by the year 2034 at a

Get Price

Operation Strategy for Maximizing Revenue of an Energy Storage System

Operation Strategy for Maximizing Revenue of an Energy Storage System With a Photovoltaic Power Plant Considering the Incentive for Forecast Accuracy in South Korea May

Get Price

Financial analysis of utility scale photovoltaic plants with battery

Battery energy storage is a flexible and responsive form of storing electrical energy from Renewable generation. The need for energy storage mainly stems from the intermittent

Get Price

Economic Analysis of a Typical Photovoltaic and Energy Storage System

This paper establishes three revenue models for typical distributed Photovoltaic and Energy Storage Systems. The models are developed for the pure photovoltaic system

Get Price

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties evaluate the various sources of

Get Price

Solar Energy Storage Market Size & Share Report, 2025 – 2034

The global solar energy storage market was valued at USD 93.4 billion in 2024. The market is expected to reach USD 378.5 billion in 2034, at a CAGR of 17.8%, driven by growing energy

Get Price

Photovoltaic Energy Storage System Market Size, Competitive

Photovoltaic Energy Storage System Market Revenue was valued at USD 3.5 Billion in 2024 and is estimated to reach USD 12.1 Billion by 2033, growing at a CAGR of 15.4% from 2026 to 2033.

Get Price

Economic Analysis of a Typical Photovoltaic and Energy Storage

This paper establishes three revenue models for typical distributed Photovoltaic and Energy Storage Systems. The models are developed for the pure photovoltaic system

Get Price

Solar Energy Systems Market Size to Cross USD

The solar energy systems market size was evaluated at USD 255.40 billion in 2024 and is expected to cross around USD 1,146.25 billion by

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

The German PV and Battery Storage Market

The German PV and Battery Storage Market The first of its kind, this study offers an overview of the photovoltaics and battery storage market in Germany. It

Get Price

A review on battery energy storage systems: Applications,

1. Introduction Modern power systems face the challenge of sustaining and expanding the development of Renewable Energy (RE) technologies, particularly of

Get Price

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties

Get Price

Photovoltaic Energy Storage System Market Size, Demand,

As of 2022, the global photovoltaic energy storage system market was valued at approximately $8 billion and is anticipated to expand at a compound annual growth rate (CAGR) of around 20%

Get Price

Solar Energy Storage Market Size, Share and Latest Trends to 2034

Global Solar Energy Storage Market Size is valued at USD 93.3 Bn in 2024 and is predicted to reach USD 475.3 Bn by the year 2034 at a 17.8% CAGR during the forecast

Get Price

Residential solar market in the U.S.

Tesla''s energy generation and storage revenue 2015-2024 Revenue from Tesla''s energy generation and storage segment from financial

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

The rise of bankable BESS projects in Europe

The rise of bankable BESS projects in Europe As the renewable energy sector rapidly evolves, battery energy storage systems (BESS) are

Get Price

Photovoltaic Energy Storage System Unlocking Growth Potential:

The photovoltaic energy storage system (PVESS) market is experiencing robust growth, driven by increasing demand for renewable energy sources and the need for grid

Get Price

Unlocking Energy Storage: Revenue streams and regulations

rgy storage additions expected to reach 137 GW (442 GWh). This expansion is largely fuelled by technological advancements, especially in lithium-ion batteries, which dominate the ma.

Get Price

Business Models and Profitability of Energy Storage

As the reliance on renewable energy sources rises, intermittency and limited dispatchability of wind and solar power generation evolve as crucial challenges in the

Get Price

Solar Energy Storage Market Size & Share Report, 2025 – 2034

These projects will have long-term predictable revenue streams. In addition, lenders may be willing to finance merchant cashflows, but with less

Get Price

Project Financing and Energy Storage: Risks and

The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Get Price

Large-scale Photovoltaic Energy Storage System Market

The large-scale photovoltaic energy storage system (PV ESS) market is experiencing robust growth, driven by the increasing adoption of renewable energy sources

Get Price

Solar Industry Research Data – SEIA

Solar energy in the United States is booming. Along with our partners at Wood Mackenzie Power & Renewables, SEIA tracks trends and trajectories in the solar industry that demonstrate the

Get Price

Project Financing and Energy Storage: Risks and Revenue

These projects will have long-term predictable revenue streams. In addition, lenders may be willing to finance merchant cashflows, but with less leverage and subject to detailed

Get Price

Solar Energy Systems Market Size, Share Report,

Solar Energy Systems Market Summary The global solar energy systems market size was valued at USD 160.3 billion in 2021 and is projected to reach USD

Get Price

6 FAQs about [Photovoltaic energy storage system revenue]

How will the solar energy storage industry evolve?

As the solar energy storage industry evolves, there is a shift towards more advanced and higher-performing technologies and alternatives which is set to influence the industry outlook.

Can you finance a solar energy storage project?

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and cashflows of an energy storage project. However, there are certain additional considerations in structuring a project finance transaction for an energy storage project.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is solar energy storage a future-proofing energy system?

The transition to renewable energy and the integration of energy storage are seen as key components of future-proofing energy systems and ensuring energy security. Governments and organizations continue to recognize the value and potential of solar energy storage for enabling a sustainable and resilient energy future.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Are solar and wind projects a good investment?

These projects will have long-term predictable revenue streams. In addition, lenders may be willing to finance merchant cashflows, but with less leverage and subject to detailed market studies and cash sweeps. These trends for solar and wind projects also apply to energy storage projects.

More related information

-

Malawi photovoltaic energy storage 20kw inverter merchant

Malawi photovoltaic energy storage 20kw inverter merchant

-

Bangladesh photovoltaic power generation and energy storage manufacturers

Bangladesh photovoltaic power generation and energy storage manufacturers

-

Barbados Photovoltaic Energy Storage System Wholesaler

Barbados Photovoltaic Energy Storage System Wholesaler

-

Suriname organic photovoltaic energy storage

Suriname organic photovoltaic energy storage

-

Vanuatu container photovoltaic energy storage production plant

Vanuatu container photovoltaic energy storage production plant

-

Huawei Finland Photovoltaic Power Generation and Energy Storage Project

Huawei Finland Photovoltaic Power Generation and Energy Storage Project

-

Photovoltaic energy storage cabinet supplier ranking

Photovoltaic energy storage cabinet supplier ranking

-

Croatia s latest photovoltaic energy storage battery

Croatia s latest photovoltaic energy storage battery

Commercial & Industrial Solar Storage Market Growth

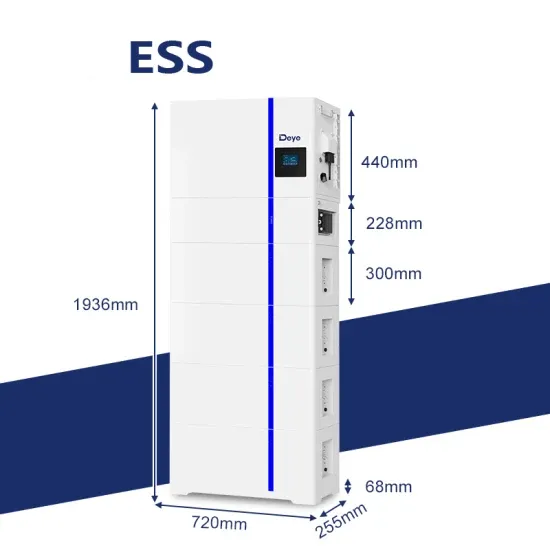

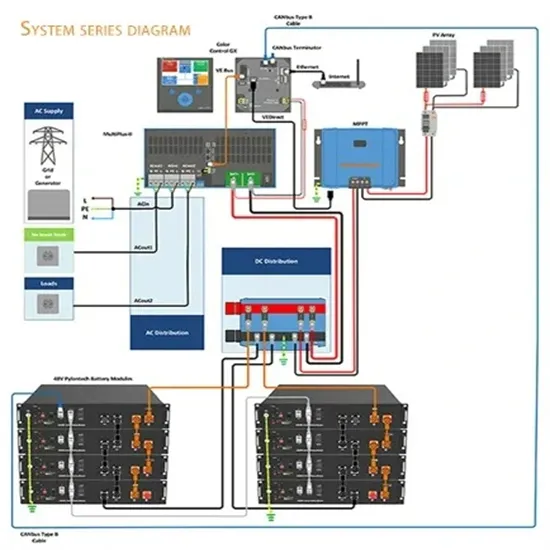

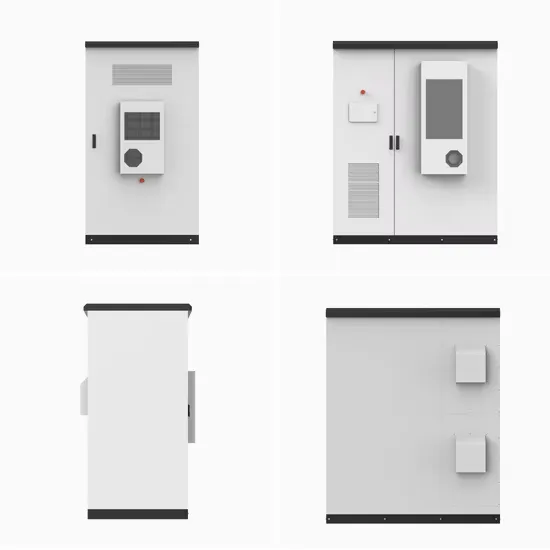

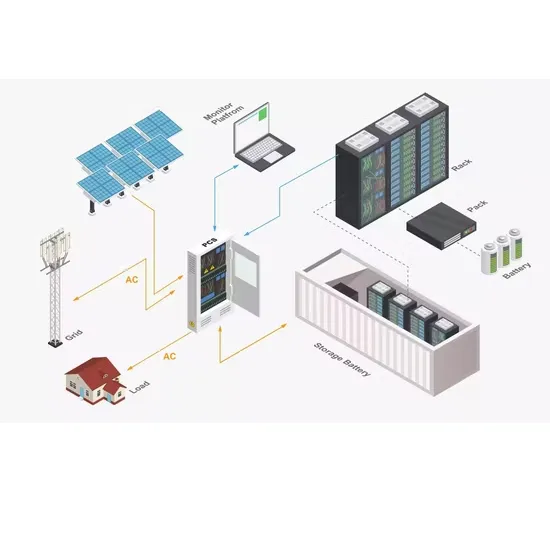

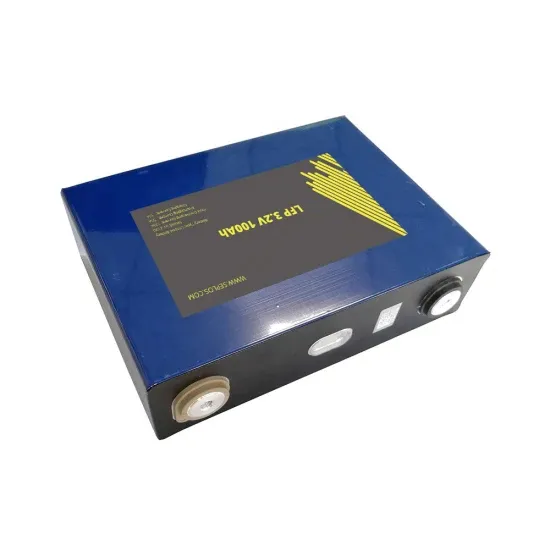

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

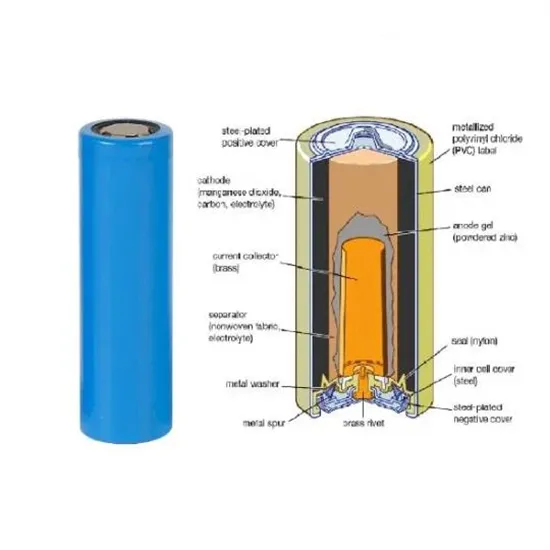

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.