Energy arbitrage: selling electricity back to the National Grid for a

It only takes a minute! Discharging energy back into the grid through a Powerwall requires you to use the battery''s time-based user controls. The system will learn the patterns

Get Price

Utilities report batteries are most commonly used for arbitrage and

Electricity utilities increasingly report using batteries to move electricity from periods of low prices to periods of high prices, a strategy known as arbitrage, according to new

Get Price

What Is Energy Arbitrage in Battery Storage?

For utilities, using battery storage to perform energy arbitrage is becoming a widely adopted practice. In this blog post, we''ll explain what energy arbitrage is, how it works in

Get Price

Energy arbitrage: selling electricity back to the

It only takes a minute! Discharging energy back into the grid through a Powerwall requires you to use the battery''s time-based user

Get Price

How Much Solar Battery Capacity Do I Need

4 days ago· Determining your ideal solar battery capacity isn''t one-size-fits-all—it depends on your energy needs, usage patterns, and goals. But with the right approach, you can unlock

Get Price

What Is Energy Arbitrage?

Energy Storage: Battery storage technologies, such as lithium-ion or flow batteries, are increasingly used for energy arbitrage. These systems

Get Price

Issues in Focus: Drivers for Standalone Battery Storage

Our study assumes that standalone battery storage provides energy arbitrage or capacity reserve, receiving energy payments for energy arbitrage use and capacity payments for capacity

Get Price

Payback with a home battery: What to expect

Depending on the rebates and incentives available, your electricity rate plan, and the cost of installing storage, you can expect a range of energy storage payback periods. On

Get Price

What Is Energy Arbitrage and How Does It Work?

What is the future of energy arbitrage? Smarter battery and energy management technologies will continue to transform the future of energy arbitrage around

Get Price

Energy Arbitrage and Battery Storage: Revolutionizing

In utility-scale applications, such as at the PJM Interconnection, battery storage systems can take advantage of price spreads by charging

Get Price

Energy Storage Myths: #1 Arbitrage

For the past few years energy storage companies have touted arbitrage as the Messiah of the industry. We are going to show you how to avoid misconceptions and

Get Price

Battery Energy Storage Systems – Power Arbitrage

So how does power arbitrage work with a battery storage system work? This is best understood with an example. First, we start with the basic

Get Price

X-Market Arbitrage for Battery Storage

We now charge the battery at the lowest point across all price curves and discharge it in the most expensive four quarter hours. As long as the battery runs this schedule

Get Price

Backup vs. Arbitrage Battery: Differences, Pros, and Cons

The difference between a backup and arbitrage battery, pros and cons or both types, and when each is most valuable.

Get Price

Energy Arbitrage and Battery Storage: Revolutionizing the

In utility-scale applications, such as at the PJM Interconnection, battery storage systems can take advantage of price spreads by charging during low price hours and

Get Price

What Is Energy Arbitrage in Battery Storage?

For utilities, using battery storage to perform energy arbitrage is becoming a widely adopted practice. In this blog post, we''ll explain what

Get Price

ERCOT battery energy storage revenues: how has

From 2022 to 2023, the proportion of battery energy storage revenues from Energy arbitrage in the Day-Ahead and Real-Time Markets has doubled. This

Get Price

Arbitrage on the Power Market | Definition | Examples

Arbitrage in the power market refers to the trading of electrical energy by taking advantage of price differences across various markets, times, or regions to

Get Price

What Is Energy Arbitrage? Energy Efficiency Without Solar Power

Plus, it''s even better for the environment, making it a real win-win. Get Solar Credits So, what is energy arbitrage? A great way to save on energy if you don''t have solar

Get Price

Self Generation Incentive Program (SGIP) | SCE

Explore SCE''s Self Generation Incentive Program, which offers rebates for battery storage systems to help manage energy use and costs efficiently.

Get Price

Batteries had a profitable run in ERCOT this spring.

The difference came from ECRS, non-Spin, and energy arbitrage, which Modo Energy says shows that longer-duration systems have an

Get Price

Battery systems on the U.S. power grid are increasingly used to

During 2021, 59% of the 4.6 GW of utility-scale U.S. battery capacity was used for price arbitrage, up from 17% in 2019. In certain markets, price arbitrage is more common than

Get Price

Unlocking Profits with Energy Arbitrage: How U.S. States Are

Energy arbitrage is a growing trend in the U.S. energy market that offers both economic and environmental benefits. By capitalizing on price differences in electricity

Get Price

How do different types of energy storage technologies compare in

Different types of energy storage technologies offer varying opportunities for energy arbitrage, which exploits price differences by storing electricity when prices are low and

Get Price

Energy Storage Arbitrage 101

Learn the basics of energy storage arbitrage and how to get started with optimizing your energy storage systems for maximum returns.

Get Price

A Beginner''s Guide to Energy Storage Arbitrage

One strategy to combat this erosion of value is to to pair a battery energy storage system with a solar or wind project, or develop a stand-alone battery energy system.

Get Price

X-Market Arbitrage for Battery Storage

We now charge the battery at the lowest point across all price curves and discharge it in the most expensive four quarter hours. As long as

Get Price

6 FAQs about [How long does it take to get back the money from energy storage battery arbitrage ]

How does energy storage arbitrage work?

Energy storage arbitrage works in a similar way - electricity is stored when the price of electricity is cheap and dispatched when electricity is expensive. Energy storage projects earn revenue from the delta between the price at which power is stored and then sold into the market when the electricity is dispatched.

What is battery arbitrage & how does it work?

Utilities now report that arbitrage is the primary use case for 10,487 MW of battery capacity, making it the most reported primary use. In arbitrage, utilities charge batteries by buying electricity during low-cost periods and then sell that electricity when electricity prices increase.

What is battery storage arbitrage?

The concept of battery storage arbitrage is simple. Let’s use our cell phone as an analogy. We charge our cell phones overnight to then use our phones the next day. Similarly, battery energy storage systems store electricity from the market to use later when the electricity is most needed.

What are energy arbitrage strategies?

Energy arbitrage strategies are increasingly important as renewable energy sources, such as solar and wind, add variability to the grid. By combining energy storage with arbitrage, utilities can help smooth out electricity supply. In the context of battery storage, this practice takes on unique applications.

What is energy arbitrage & why is it important?

Energy arbitrage plays a crucial role in energy markets, particularly in balancing supply and demand and supporting grid stability. For utilities, using battery storage to perform energy arbitrage is becoming a widely adopted practice.

How is energy arbitrage calculated?

Energy arbitrage typically occurs in wholesale electricity markets, and profits are calculated by subtracting the cost of purchasing and storing the electricity (including storage losses and operational costs) from the revenue obtained from selling the electricity at higher prices.

More related information

-

How long does it take to add a battery cabinet to Huijue liquid-cooled energy storage

How long does it take to add a battery cabinet to Huijue liquid-cooled energy storage

-

How long can the base station energy storage battery last

How long can the base station energy storage battery last

-

How long does the energy storage battery cabinet last

How long does the energy storage battery cabinet last

-

How long is the operating period of an energy storage project

How long is the operating period of an energy storage project

-

How many volts does a container battery energy storage system have

How many volts does a container battery energy storage system have

-

How to measure the current of the energy storage battery cabinet

How to measure the current of the energy storage battery cabinet

-

How long will it take to build photovoltaic energy storage

How long will it take to build photovoltaic energy storage

-

How much does an African energy storage battery cost

How much does an African energy storage battery cost

Commercial & Industrial Solar Storage Market Growth

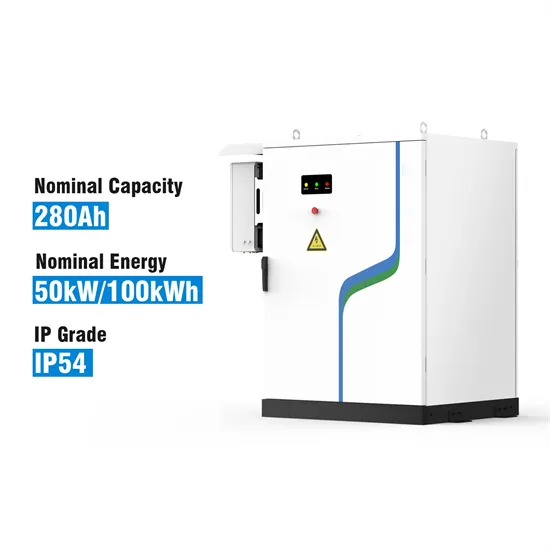

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.