Vanadium Redox Flow Battery Market Size, Growth,

Vanadium Redox Flow Battery Market growth is projected to reach USD 8.47 Billion, at a 19.68% CAGR by driving industry size, share, top company

Get Price

The rise of vanadium redox flow batteries: A game-changer in energy storage

This article explores the role of vanadium redox flow batteries (VRFBs) in energy storage technology. The increasing demand for electricity necessitates a rise in energy

Get Price

Vanadium set for "disruptive" demand growth as battery energy storage

In a report on the metals required for clean energy commissioned by Eurometaux – Europe''s metals association – VRFBs were identified as one of the alternative energy storage

Get Price

Vanadium and Beyond: India''s Push for Storage

India explores vanadium, zinc, and aluminum-air batteries to diversify storage beyond lithium-ion for grid resilience.

Get Price

Vanadium Revolution: The Future Powerhouse of Energy Storage

All-vanadium redox flow batteries, with their unique advantages including high cycle life and safety, emerge as a promising solution for the increasing demand for long-duration storage,

Get Price

The Future of Energy Storage

With renewable energy on the rise, investments in storage technologies have surged, reaching $54 billion worldwide in 2024. This article explores the latest

Get Price

The rise of vanadium redox flow batteries: A game-changer in

This article explores the role of vanadium redox flow batteries (VRFBs) in energy storage technology. The increasing demand for electricity necessitates a rise in energy

Get Price

Vanadium: double-edged demand

But vanadium''s relevance is expanding, in particular, as the active element in vanadium redox flow batteries (VRFBs), a leading non-lithium

Get Price

Exploring the Complexities of Vanadium Batteries

Uncover the complexities of vanadium batteries 🔋. Explore their design, benefits, potential uses, and cutting-edge research shaping future energy storage solutions.

Get Price

Overview of vanadium redox flow battery (VRFB) and supply

Establishment of Flow Batteries Europe, an industry association representing the voice of flow battery stakeholders in Europe While the majority of large VRFB sites and supply chain

Get Price

The Future of Clean Energy in the U.S. | Vanadium Redox Flow Battery

The U.S. clean energy transition is accelerating, and energy storage is at its core. With corporate commitments, technological advancements, and government support, now is

Get Price

Vanadium Redox Flow Battery Market Size & Growth Forecast

In conclusion, the ability of vanadium redox flow battery to offer a reliable and flexible energy storage solution for the power generation industry to reduce reliance on fossil fuels is projected

Get Price

Vanadium: double-edged demand

But vanadium''s relevance is expanding, in particular, as the active element in vanadium redox flow batteries (VRFBs), a leading non-lithium energy storage technology.

Get Price

Why Vanadium Energy Storage Demand is Skyrocketing (And

This article cuts through the noise about vanadium energy storage demand, blending hard data with quirky insights. Let''s get real: Vanadium isn''t just a sci-fi metal anymore. It''s the backbone

Get Price

Vanadium Redox Flow Battery Market Size, Share

Vanadium redox flow battery market to reach $523.7 million by 2030, growing at a CAGR of 15.8% driven by rising grid-scale energy storage demand.

Get Price

Molecular Vanadium Oxides for Energy Conversion and Energy

Molecular vanadium oxides, or polyoxovanadates (POVs), have recently emerged as a new class of molecular energy conversion/storage materials, which combine diverse, chemically tunable

Get Price

Decoding Vanadium Battery Energy Storage Systems''s Market

The vanadium redox flow battery (VRFB) energy storage systems market is experiencing robust growth, driven by the increasing demand for renewable energy integration and grid stabilization.

Get Price

Vanadium Revolution: The Future Powerhouse of Energy

All-vanadium redox flow batteries, with their unique advantages including high cycle life and safety, emerge as a promising solution for the increasing demand for long-duration storage,

Get Price

How to trump the flow battery doubters – pv magazine USA

What is clear is the market potential for flow batteries, whether housed in cheaper, pre-existing oil storage tanks, or based on the more mature vanadium technology. Harper

Get Price

Vanadium Flow Batteries: Industry Growth & Potential

Explore the rise of vanadium flow batteries in energy storage, their advantages, and future potential as discussed by Vanitec CEO John Hilbert.

Get Price

Vanadium Redox Flow Battery Market Size, Share & Trends

Vanadium Redox Flow Battery Market Size, Share & Trends Analysis Report By Application (Energy Storage, Uninterrupted Power Supply), By End-use, By Region, And

Get Price

Molecular Vanadium Oxides for Energy Conversion and Energy Storage

Molecular vanadium oxides, or polyoxovanadates (POVs), have recently emerged as a new class of molecular energy conversion/storage materials, which combine diverse, chemically tunable

Get Price

Emerging Markets for Vanadium Redox Flow Battery Energy Storage

The vanadium redox flow battery (VRFB) energy storage system market is experiencing robust growth, driven by the increasing demand for reliable and long-duration

Get Price

Vanadium Battery Energy Storage Systems Trends and

Finally, advancements in battery technology, including improved energy density and reduced costs, are making VRFBs increasingly competitive compared to other energy

Get Price

The Future of Energy Storage

With renewable energy on the rise, investments in storage technologies have surged, reaching $54 billion worldwide in 2024. This article explores the latest trends, from lithium-ion

Get Price

The Future of Clean Energy in the U.S. | Vanadium Redox Flow

The U.S. clean energy transition is accelerating, and energy storage is at its core. With corporate commitments, technological advancements, and government support, now is

Get Price

Energy Storage Vanadium Redox Battery Market | Size & Share

Current Trends in Energy Storage Technologies Energy storage technologies continue to evolve rapidly, driven by the increasing demand for efficient and sustainable solutions to manage

Get Price

Unlocking Growth in Vanadium Battery for Energy Storage

The competitive landscape is dynamic, with both established energy companies and specialized battery manufacturers vying for market share. The ongoing research and development efforts

Get Price

Vanadium set for "disruptive" demand growth as battery energy

In a report on the metals required for clean energy commissioned by Eurometaux – Europe''s metals association – VRFBs were identified as one of the alternative energy storage

Get Price

Energy Storage Vanadium Redox Battery Market Size And Trends

The Global Energy Storage Vanadium Redox Battery market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2032. In 2023, the market is

Get Price

6 FAQs about [Vanadium battery energy storage trends]

Is vanadium a redox flow battery?

But vanadium’s relevance is expanding, in particular, as the active element in vanadium redox flow batteries (VRFBs), a leading non-lithium energy storage technology.

Why are vanadium batteries so popular?

The batteries rely on vanadium’s almost unique ability to exist in four stable oxidation states, which enables energy to be stored and discharged repeatedly without degradation. Historically, vanadium demand has tracked closely with industrial output and infrastructure spending, particularly in emerging markets. The main drivers:

Will vanadium flow battery demand squeeze underlying supply fundamentals?

Instead, it is new demand from the vanadium flow battery market that is expected to squeeze the underlying supply fundamentals.

Are VRFBs a major source of new demand for vanadium?

Many vanadium industry stakeholders see VRFBs as a major source of new demand for the metal that has traditionally been used in steel alloys,” states Mikhail Nikomarov, Chairman of the Vanitec Energy Storage Committee (ESC) and CEO of Bushveld Energy.

How fast will vanadium redox flow batteries grow in 2022?

7 July 2022 According to an independent analysis by market intelligence and advisory firm, Guidehouse Insights, global annual deployments of vanadium redox flow batteries (VRFBs) are expected to reach approximately 32.8 GWh per annum by 2031. This represents a compound annual growth rate (CAGR) of 41% over the forecasted period.

Why is vanadium a volatile metal?

Vanadium’s dual-role in steel and stationary storage means it is simultaneously a mature industrial metal and an emerging technology metal. This makes it volatile, but also strategic.

More related information

-

Colombian vanadium energy storage battery

Colombian vanadium energy storage battery

-

Vanadium Battery Energy Storage Policy

Vanadium Battery Energy Storage Policy

-

Vanadium battery energy storage power station under construction

Vanadium battery energy storage power station under construction

-

The role of vanadium battery energy storage power station

The role of vanadium battery energy storage power station

-

Spanish vanadium battery energy storage project

Spanish vanadium battery energy storage project

-

Characteristics of vanadium battery for energy storage

Characteristics of vanadium battery for energy storage

-

China-Africa Energy Storage Vanadium Battery Station

China-Africa Energy Storage Vanadium Battery Station

-

Vanadium Energy Storage Battery System

Vanadium Energy Storage Battery System

Commercial & Industrial Solar Storage Market Growth

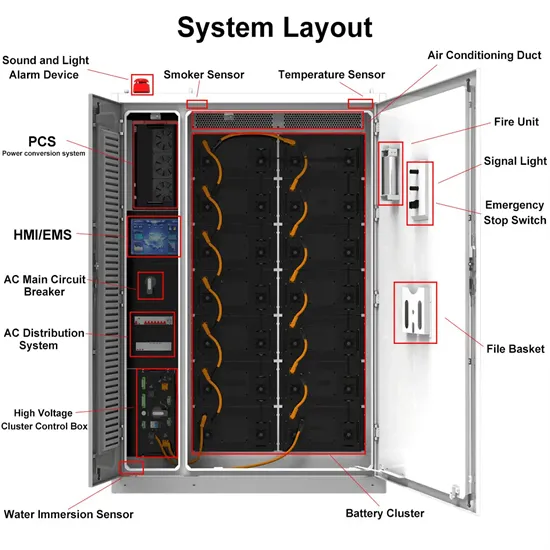

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.