Digging into China''s solar capacity numbers

For provinces without direct project suspensions, authorities have introduced market-driven measures such as adjusting floor and peak

Get Price

China''s Energy Transition at Odds With Solar Glut, Cheap

Shandong province, home to China''s largest solar fleet, has been forced to curtail rooftop projects due to grid constraints. Its three-year-old spot market saw prices settle below

Get Price

China''s FIT Policy End To Push Up Prices Across PV

As the Chinese government strikes down its popular fixed feed-in-tariff (FIT) scheme for solar from mid-2025, TrendForce analysts forecast an

Get Price

Solar panel prices increase nearly 5% as China tightens oversight

For now, opportunistic price increases linked to new tariffs are being observed, while Chinese producers explore shifting cell production to Africa to bypass restrictions.

Get Price

China''s Solar power Surge Fuels Renewable Energy Future

In an astonishing leap for the energy sector, China recently installed a record-breaking 93 gigawatts (GW) of solar capacity in just one month—May 2025. This figure

Get Price

China''s solar growth sends module prices plummeting

In solar, China''s increased manufacturing capacity has sent prices tumbling. Wood Mackenzie''s new monthly PV Pulse note puts the price of

Get Price

Tariffs to ''significantly'' increase costs for US solar,

Tariffs on US imports will increase the cost of US solar PV and energy storage technologies and slow the rate of project development.

Get Price

The opportunity in China''s solar ''overcapacity''

Over the past few years, Chinese solar manufacturers have undertaken an extraordinary investment surge that''s given a big boost to global green energy deployment and

Get Price

China''s Solar Sector Seen Facing Years of Oversupply, Low Prices

Analysts say that China''s solar power sector faces a major shakeout because of vast production overcapacity. Smaller manufacturers are likely to be forced out of the market,

Get Price

Solar boom in China turns electricity prices negative

The News Electricity prices have gone negative in parts of China as renewable energy overwhelms the grid. The country is building twice as much wind and solar as the rest

Get Price

China''s Surging Solar Energy: The Shift to Negative Electricity Prices

China''s Unmatched Renewable Energy Growth China is currently setting records, constructing wind and solar energy facilities at an astonishing rate. Reports indicate that the

Get Price

China Module Prices Decline Amid Weak Demand and

Looking ahead in the Free-on-Board (FOB) China market, prevailing bearish conditions are expected to prevent any immediate price increases in modules. However,

Get Price

China''s solar industry losses balloon on falling prices

Losses at China''s top solar manufacturers mostly widened in the first half of 2025, but analysts said restructuring to cut oversupply could help return the industry to profitability.

Get Price

MONTHLY CHINA ENERGY UPDATE | February 2025

Combined total solar and wind power capacity hit a new record at 1,407GW, exceeding China''s 14th Five Year Plan for Renewable Energy Development 2030 target of 1,200GW six years

Get Price

IRENA – International Renewable Energy Agency

The International Renewable Energy Agency (IRENA) is an intergovernmental organisation supporting countries in their transition to a sustainable energy future.

Get Price

China Module Prices Decline Amid Weak Demand

Looking ahead in the Free-on-Board (FOB) China market, prevailing bearish conditions are expected to prevent any immediate price increases in

Get Price

China Module Prices Decline Amid Weak Demand

Prices for Chinese solar modules have reached record lows, according to the latest data from OPIS. The benchmark assessment for

Get Price

PV Price Watch: China''s module prices reach

China''s latest tender results show the spot price of n-type modules increasing from RMB0.7/W to as much as RMB0.75/W.

Get Price

China''s Solar Sector Seen Facing Years of

Analysts say that China''s solar power sector faces a major shakeout because of vast production overcapacity. Smaller manufacturers are likely to

Get Price

China Energy Transition Review 2025

3 days ago· China Energy Transition Review 2025 China''s surge in renewables and whole-economy electrification is rapidly reshaping energy choices for the rest of the world, creating

Get Price

China Tackles Price Wars as Bloated Solar Sector Amasses

China is actively addressing overcapacity and severe price wars within its solar manufacturing sector, which have led to significant financial losses for major companies.

Get Price

China solar energy pricing: 5 Essential Changes by June 2025

China solar energy pricing to shift by June 2025 as the nation adopts a market-driven model. Discover how this change could reshape global solar trends—read now!

Get Price

Oversupply in China Weighs on Prices across the Solar Value Chain

Operating rate cuts and bouts of sell-offs were already common across the solar supply chain during the fourth quarter of 2023, with prices in all segments falling to a hair''s

Get Price

Explainer: How China''s renewable pricing reforms will affect its

China''s solar and windfarms would no longer be guaranteed sales at a fixed price linked to coal benchmarks, under a new policy released by the central government. The policy

Get Price

China to switch from FITs to market-oriented

China will replace its feed-in tariff (FIT) system with a fully market-driven renewable energy pricing model by June 2025, shifting wind and solar

Get Price

Explainer: How China''s renewable pricing reforms will

China''s solar and windfarms would no longer be guaranteed sales at a fixed price linked to coal benchmarks, under a new policy released by the

Get Price

Global Cost of Renewables to Continue Falling in

New York/ London, February 6, 2025 – The cost of clean power technologies such as wind, solar and battery technologies are expected to fall further by 2

Get Price

China''s solar growth sends module prices plummeting

In solar, China''s increased manufacturing capacity has sent prices tumbling. Wood Mackenzie''s new monthly PV Pulse note puts the price of modules in China at just 11 US

Get Price

6 FAQs about [Solar China on-site energy prices]

How much are Chinese solar modules worth?

Prices for Chinese solar modules have reached record lows, according to the latest data from OPIS. The benchmark assessment for TOPCon modules from China has fallen to $0.100 per watt, a decline of $0.005 per watt compared to the previous week. Similarly, Mono PERC module prices have also dropped by $0.005 per watt, now standing at $0.090 per watt.

Will China's top solar manufacturers restructure in 2025?

Our Standards: The Thomson Reuters Trust Principles. Losses at China's top solar manufacturers mostly widened in the first half of 2025, but analysts said restructuring to cut oversupply could help return the industry to profitability.

How much does Intersolar cost in China?

During Intersolar, market prices showed little movement, holding steady at around $0.10 per watt Free-on-Board (FOB) China, with minor fluctuations of up to +/-0.3 cents. Observers noted that despite the onset of the high installation season, demand for utility-scale projects in Europe appears subdued this year.

How much do Topcon solar modules cost in China?

The current tradable indications for TOPCon modules are being reported at $0.10 per watt Free-on-Board (FOB) China. As the market struggles with low demand, these new record low prices highlight the ongoing challenges faced by Chinese solar module makers.

How will China determine the price of solar and wind energy?

From 2026, China has announced that the price of electricity generated from solar and wind schemes will be determined according to competitive auctions.

Will restructuring help China's top solar manufacturers return to profitability?

BEIJING, Aug 26 (Reuters) - Losses at China's top solar manufacturers mostly widened in the first half of 2025, but analysts said restructuring to cut oversupply could help return the industry to profitability.

More related information

-

Solar charging on-site energy prices

Solar charging on-site energy prices

-

Solar On-site Energy Installation in China

Solar On-site Energy Installation in China

-

China Solar On-site Energy

China Solar On-site Energy

-

China Solar Energy Storage Container Prices

China Solar Energy Storage Container Prices

-

China s solar energy storage cabinet manufacturers

China s solar energy storage cabinet manufacturers

-

How to match solar power supply system with on-site energy

How to match solar power supply system with on-site energy

-

China Solar Energy Storage Cabinet Manufacturing

China Solar Energy Storage Cabinet Manufacturing

-

Energy storage cabinet installation solar panels China

Energy storage cabinet installation solar panels China

Commercial & Industrial Solar Storage Market Growth

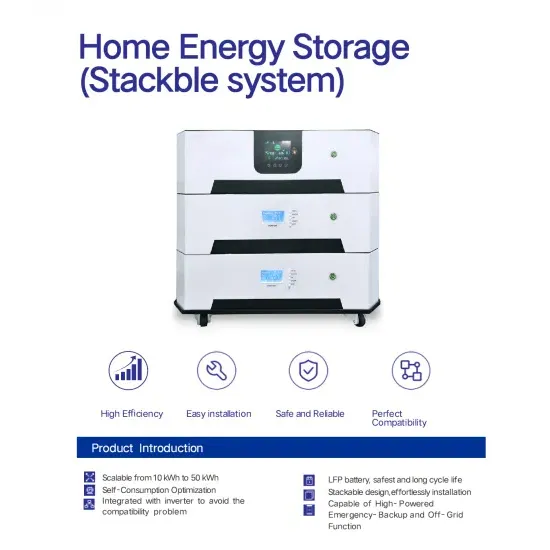

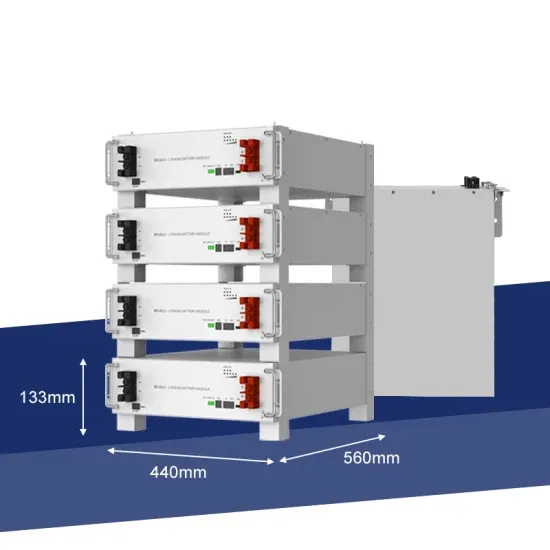

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.