Southeast Asia – World Energy Investment 2025 – Analysis

Given the challenges of accessing international capital markets, Southeast Asia''s capital markets have relied on domestic commercial lending. Commercial finance in clean energy sits above

Get Price

ASEAN''s clean power pathways: 2024 insights | Ember

This report presents strategies to fine-tuning policies to reduce dependence on fossil fuels and start the systemic shift necessary for a clean power sector transition, providing

Get Price

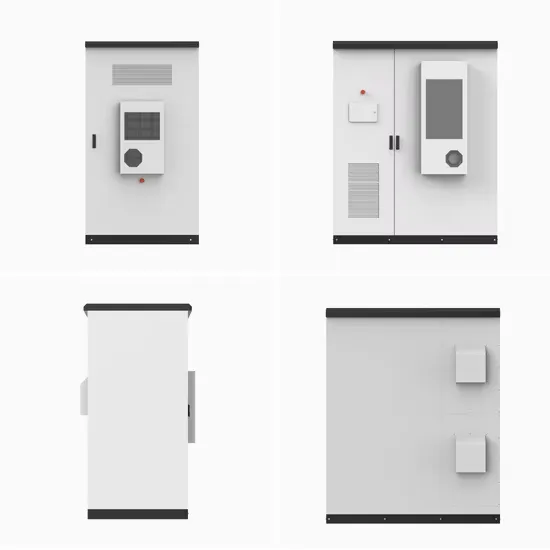

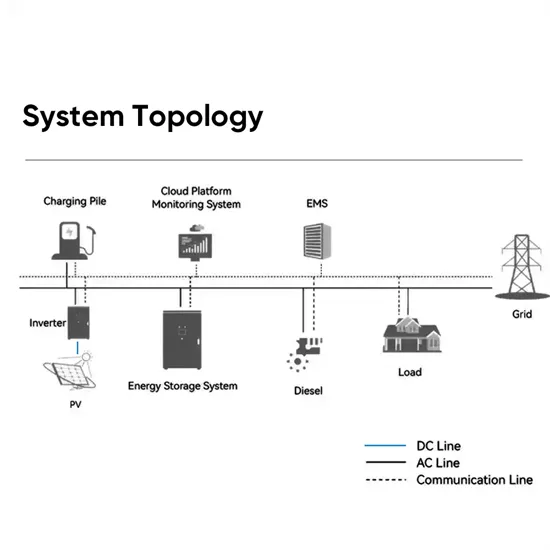

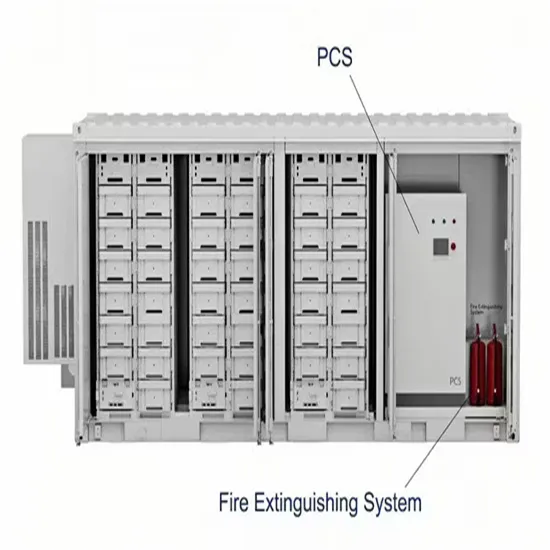

Southeast Asia Energy Storage Container: Powering the Future

Meet the energy storage container – Southeast Asia''s unsung hero in the energy transition. These modular powerhouses are reshaping how the region stores and distributes

Get Price

Powering ASEAN''s Future: Energy Transition

Explore the dynamic landscape of Southeast Asia''s energy sector as we delve into the diverse power mix, renewable energy potential, and the

Get Price

Southeast Asia – World Energy Investment 2025 –

Given the challenges of accessing international capital markets, Southeast Asia''s capital markets have relied on domestic commercial lending. Commercial

Get Price

South East Asia Power Companies

South East Asia Power Company List Mordor Intelligence expert advisors identify the Top 5 South East Asia Power companies and the other top companies based on 2024 market position. Get

Get Price

Energy Transition Roadmap: ASEAN''s focus on expanding

The ASEAN Framework Agreement for Power Trade, which is a key component of the APG MoU, is expected to facilitate the development of protocols on regional institutions,

Get Price

Energy Technologies and Decarbonization in Southeast Asia

To meet Southeast Asia''s ambitious climate goals, the United States and Southeast Asian partners should establish a joint mechanism to improve successful

Get Price

Powering ASEAN''s Future: Energy Transition Challenges and

Explore the dynamic landscape of Southeast Asia''s energy sector as we delve into the diverse power mix, renewable energy potential, and the ambitious ASEAN Power Grid

Get Price

8th ASEAN Energy Outlook

Drawing on historical data from 2005 to 2022, the report provides forward-looking insights into the evolution of the ASEAN energy landscape until 2050.

Get Price

Building the ASEAN Power Grid: Opportunities and Challenges

Without stronger policy action, Southeast Asia''s net oil import bill, which stood at $50 billion in 2020, is set to multiply in size rapidly if high commodity prices endure. It is critical

Get Price

The evolution of Southeast Asia''s power systems

Adopt a holistic approach to power system planning, by integrating cross-sectoral dynamics, incorporating resilience in addition to security and efficiency and leveraging global expertise.

Get Price

Southeast Asia''s Largest Energy Storage System Officially Opens

From renewables to innovative energy and urban solutions, we play our part in creating a sustainable and low-carbon future across Asia and the world.

Get Price

Southeast Asia Power Generation EPC Market

The Southeast Asia power generation EPC market refers to the sector responsible for the engineering, procurement, and construction (EPC) of

Get Price

Explainer: Challenges Facing SEA''s Energy Planners

Grid planning and investment are beginning to receive due attention in Southeast Asia, following decades of taking a back seat in generation-focused power development

Get Price

Accelerating ASEAN''s energy transition in the power sector

Faced with energy transition objectives, the ten countries of the Association of Southeast Asian Nations (ASEAN) have technology options to decarbonize power sector. This

Get Price

Asia-Pacific Multiple-Element Gas Container Market Report

As China, India, Japan, and Southeast Asian countries adopt alternative fuels - CNG, LNG, and hydrogen - for industrial, power generation, and transportation, the market for

Get Price

Energy

Southeast Asia: In Southeast Asia, electricity generation in the Energy market is projected to reach 1.25tn kWh in 2025. Definition: The energy market is a

Get Price

The Role of Fossil Fuels in Southeast Asia''s Energy Mix

The 2024 IEA report indicates that coal''s share of Southeast Asia''s energy mix rose from 9% in 2000 to 28% in 2023, making it a key energy source for power generation and

Get Price

ASEAN Energy in 2024

"ASEAN Energy in 2024" is a report by the ASEAN Centre for Energy (ACE) that provides key insights into Southeast Asia''s energy situation

Get Price

2020 Regional focus: Southeast Asia – Electricity

One of the ways of reaching that target is regional interconnection and trade. A major project for regional integration is the ASEAN Power Grid – an initiative

Get Price

Southeast Asia Gas Report 2024

Renewable energy is a growing and viable alternative to gas power. Southeast Asia''s planned solar and wind capacity could meet over half of the additional power needed by 2030. Current

Get Price

Asia Pacific – Countries & Regions

CO2 emissions from power generation Power generation, which includes electricity and heat, is one of the largest sources of CO2 emissions globally, primarily from the burning of fossil fuels

Get Price

Explainer: Challenges Facing SEA''s Energy Planners

Grid planning and investment are beginning to receive due attention in Southeast Asia, following decades of taking a back seat in

Get Price

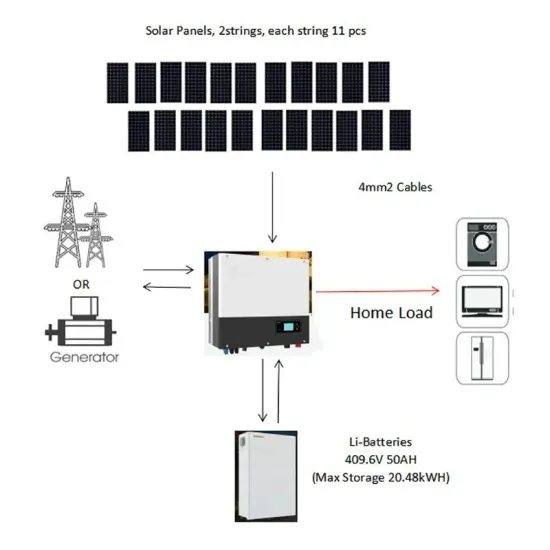

Solar Container Power Generation Systems Market Report 2026

Solar Container Power Generation Systems Market size was valued at USD 1.2 Billion in 2024 and is projected to reach USD 3.

Get Price

Southeast Asia energy trends to watch in 2025

But few markets in Southeast Asia function purely under an energy-only market (which compensates for power produced) or capacity

Get Price

6 FAQs about [Southeast Asia container power generation]

Does ASEAN have technology options to decarbonize power sector?

Faced with energy transition objectives, the ten countries of the Association of Southeast Asian Nations (ASEAN) have technology options to decarbonize power sector. This study investigates the hypothetical decarbonization pathways for ASEAN’s power sector.

How can the ASEAN Power Grid facilitate investments in renewables?

To facilitate investments in renewables in ASEAN, it is critical to overcoming the barriers in renewable energy legislation, energy governance, and business environment. 28 Cooperation through the ASEAN Power Grid brings economic benefits to the region as a whole, and thus improves the affordability for energy transition.

How much money does Southeast Asia Invest in energy?

However, fossil fuel investment decreased from USD 70 billion in 2015 to USD 50 billion in 2025 while clean energy investment reached USD 47 billion, up from 30 billion in 2015. Given the challenges of accessing international capital markets, Southeast Asia’s capital markets have relied on domestic commercial lending.

Does Southeast Asia have a coal-fired power system?

Concurrently, coal-fired power has remained a significant component of Southeast Asia’s energy mix. Investment in coal plants has risen steadily throughout the past 20 years, reaching 121 GW of installed capacity in 2025.

Will the next US administration reinvigorate Southeast Asia's energy transition plans?

With elections in November and President Joe Biden declining to run for another term, the next U.S. administration has an opportunity to reinvigorate and double down on the United States’ critical role in Southeast Asia’s energy transition plans.

Does ASEAN have a high share of decarbonised energy?

Hence, the share of fossil fuels in energy consumption has further increased over the last decade in ASEAN as a whole. Nevertheless, there has been a rapid development of renewables in recent years, and some ASEAN countries already have a high share of decarbonised energy in their power mix.

More related information

-

Southeast Asia Energy Storage Power Generation

Southeast Asia Energy Storage Power Generation

-

North Asia Container Power Generation BESS

North Asia Container Power Generation BESS

-

North Asia Power Generation Equipment Container

North Asia Power Generation Equipment Container

-

Asia Power Generation Container BESS

Asia Power Generation Container BESS

-

Morocco container power generation equipment

Morocco container power generation equipment

-

German container solar power generation for home use

German container solar power generation for home use

-

Container power generation multiple

Container power generation multiple

-

Chad container solar panel power generation

Chad container solar panel power generation

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.