Stonepeak and CHC Form Japanese Battery Energy Storage

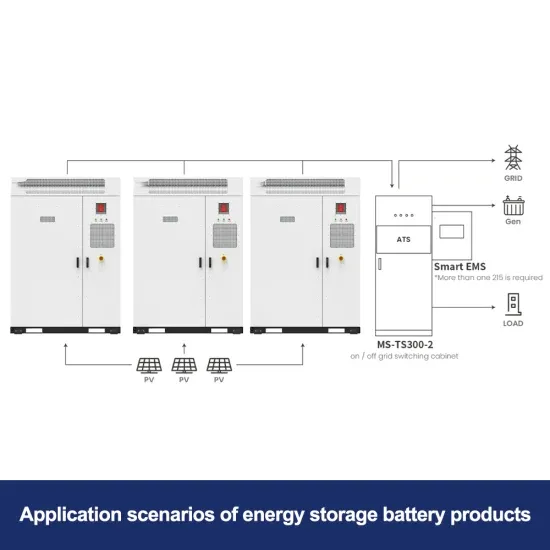

Leveraging Stonepeak''s investment experience in Japan''s renewable sector and CHC''s technical expertise, the platform will focus on developing, constructing, and operating

Get Price

Japan: Electric utilities progress in emerging battery storage

Regional electric utility companies in Japan are playing key roles in the delivery of battery energy storage system (BESS) resources.

Get Price

Top five energy storage projects in Japan

Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData''s power database. GlobalData uses proprietary data and analytics to

Get Price

Is the Japanese energy storage market moving forward?

With multiple revenue streams supporting renewable energy, and extremely high demand for electricity, it may not be surprising that Japan is now ramping up investment in

Get Price

Japan Incentivizes Battery Storage Projects Amid

By 2030, official estimates show variable renewable energy reaching 20% of Japan''s power mix. Noting the demand case and ever

Get Price

Top 28 Energy Storage Companies in Japan (2025) | ensun

The fast-growing Electric Vehicle (EV) and Energy Storage System (ESS) markets are at the forefront of the global transition toward sustainable and efficient energy solutions.

Get Price

Tokyo Electric Power Company

Tokyo Electric Power Company Holdings, Incorporated (Japanese: 東京電力ホールディングス株式会社, Tōkyōdenryoku Hōrudingusu Kabushikigaisha;

Get Price

Top 28 Energy Storage Companies in Japan (2025) | ensun

The company, Elly Power Corporation, offers the "Power Storager 10," a versatile industrial energy storage system designed for both emergency power backup and peak shaving during

Get Price

Japan''s Giant Energy Storage Companies: Key Players and

As Japan races toward its 2050 carbon neutrality goal, energy storage companies are becoming the rock stars of renewable energy. With major projects popping up like solar panels in the

Get Price

Mastering the Future of Energy: How Japanese Innovation Leads

Introduction The future of energy, characterized by clean and renewable sources, hinges largely on the development and perfection of energy storage systems. Over the years,

Get Price

Battery industry in Japan

Capacity of stationary lithium-ion power storage systems shipped Japan FY 2015-2024 Capacity of stationary lithium-ion energy storage

Get Price

Developer commissions first BESS in Japan to trade

Milestone reached in utility-scale battery storage market development in Japan, with Pacifico Energy trading energy from two new

Get Price

Stonepeak and CHC Form Japanese Battery Energy

Leveraging Stonepeak''s investment experience in Japan''s renewable sector and CHC''s technical expertise, the platform will focus on

Get Price

Is the Japanese energy storage market moving forward?

With multiple revenue streams supporting renewable energy, and extremely high demand for electricity, it may not be surprising that Japan is

Get Price

Kansai EPCO, Kinden, Japan Extensive Infrastructure plan

This article has been updated to include additional information officially released by Kansai Electric Power. Kansai Electric Power, its group company Kinden, and Japan

Get Price

Electricity sector in Japan

Japan''s electricity production is characterized by a diverse energy mix, including nuclear, fossil fuels, renewable energy, and hydroelectric power. Japan has

Get Price

Japan scales up batteries but companies worry rule changes may

3 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Get Price

Japan Energy Storage Policies and Market Overview

Japan''s energy storage policies, market statistics, and trends—from METI''s strategic plans and subsidy programs to deployment challenges.

Get Price

Orix Plans Japan''s Largest Power Storage Plant Using Tesla

The initiative aligns with Japan''s 2022 regulatory changes that opened the market for large-scale battery storage facilities connected to the power grid. The financial services

Get Price

Sumitomo Electric deploys first vanadium flow battery for a

Sumitomo Electric''s 4-hour duration flow battery system in Minamikyushu City, Japan. Image: Sumitomo Electric Sumitomo Electric has inaugurated a vanadium redox flow

Get Price

The Energy Storage Landscape in Japan

In Japan, one of the world''s primary energy – and renewable energy– markets, as well as the current world leader in smart-grid and energy storage technology, the specific idiosyncratic

Get Price

Top Energy Storage Companies In Japan In 2025

Some of the leading energy storage companies in Japan include Panasonic, Toshiba, NEC, and Hitachi. These companies are committed to driving the country''s transition to a more

Get Price

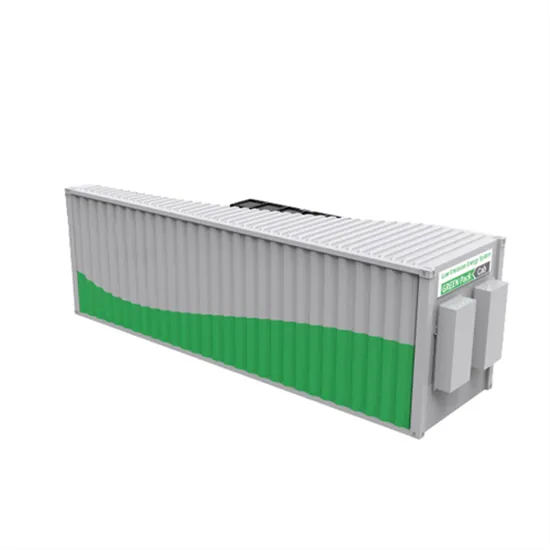

Large-scale energy storage business

Here, we will delve into our path taken to launch a completely new business and start operation of the first large-scale energy storage facility in Japan in 2024, as well as the challenges and

Get Price

Top five energy storage projects in Japan

The fast-growing Electric Vehicle (EV) and Energy Storage System (ESS) markets are at the forefront of the global transition toward sustainable and efficient energy solutions.

Get Price

Japan: Electric utilities progress in emerging battery

Regional electric utility companies in Japan are playing key roles in the delivery of battery energy storage system (BESS) resources.

Get Price

How Japan is Driving BESS Investment

A Growing Need for Energy Storage The increasing generation of renewables on the Japanese grid has led to various support policies and

Get Price

Large-scale energy storage business

Here, we will delve into our path taken to launch a completely new business and start operation of the first large-scale energy storage facility in Japan in 2024,

Get Price

6 FAQs about [Japanese Energy Storage Power Company]

How big is Japan's energy storage capacity?

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Japan had 1,671MW of capacity in 2022 and this is expected to rise to 10,074MW by 2030. Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData’s power database.

What is Japan's first energy storage project?

In 2015, we started Japan's first demonstration project covering energy storage connected to the power grid in the Koshikishima, Satsumasendai City, Kagoshima. This project is still operating in a stable manner today. One feature of our grid energy storage system is that it utilizes reused batteries from EVs.

What is Japan's energy storage policy?

As policy, technology, and decarbonization goals converge, Japan is positioning energy storage as a critical link between its climate targets and energy reliability. Japan’s energy storage policy is anchored by the Ministry of Economy, Trade and Industry (METI), which outlined its ambitions in the 6th Strategic Energy Plan, adopted in 2021.

Why are Japanese companies investing in battery energy storage systems?

Sign up here. That is creating surging interest in battery energy storage systems (BESS) to smooth mismatches in supply and demand. Since December 2023, companies have announced investments of at least $2.6 billion in Japanese battery storage projects, according to calculations by Reuters.

Can energy storage improve the reliability of Japan's grid?

“As Japan accelerates the development of renewable energy projects to meet its decarbonization goals, energy storage will have a crucial role to play in enhancing the reliability of the Japanese grid,” said Ryan Chua, Senior Managing Director at Stonepeak.

Why is energy storage important in Japan?

Japan’s government has recognised that energy storage must play a key role in delivering energy supply stability and security and meeting renewable energy targets of 36%-38% of the generation mix by 2030. The target is part of a key Green Transformation (‘GX’) policy strategy toward carbon neutrality by 2050.

More related information

-

Heishan Energy Storage Power Station Investment Company

Heishan Energy Storage Power Station Investment Company

-

Algeria Energy Storage Container Communication Power Supply Company

Algeria Energy Storage Container Communication Power Supply Company

-

Urban Energy Storage Power Station Operation Company

Urban Energy Storage Power Station Operation Company

-

Solar Thermal Power Generation and Energy Storage Company

Solar Thermal Power Generation and Energy Storage Company

-

BYD Energy Storage Power Company in Suriname

BYD Energy Storage Power Company in Suriname

-

El Salvador Energy Storage Power Company

El Salvador Energy Storage Power Company

-

Monaco Energy Storage Photovoltaic Power Company

Monaco Energy Storage Photovoltaic Power Company

-

Power Station Energy Storage Equipment Company

Power Station Energy Storage Equipment Company

Commercial & Industrial Solar Storage Market Growth

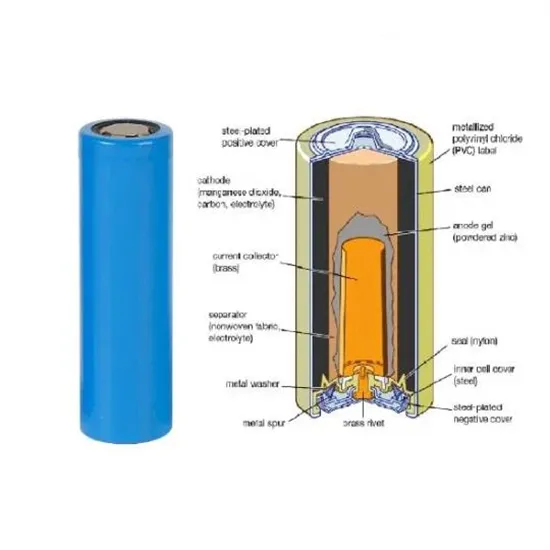

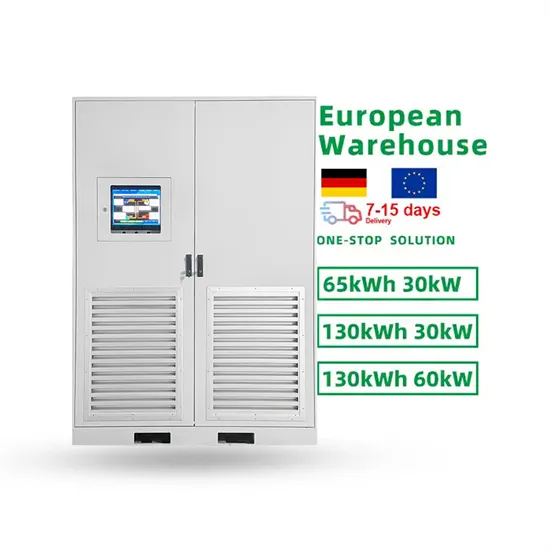

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.