How Will Tariffs Impact the Cost to Go Solar in 2025?

There''s a lot of talk about tariffs these days and as consumers are considering going solar it''s important to understand what the impact of tariffs might be for the solar industry.

Get Price

Q&A | Solar Tariffs and the US Energy Transition

This added supply will likely push down prices, counteracting the effects of the tariffs. But it should be noted that in a world without tariffs, solar

Get Price

Updated Solar Import Tariffs | Norton Rose Fulbright

The countervailing and anti-dumping duties are in addition to existing section 201 solar tariffs that are currently 14%, but are scheduled to end on February 6, 2026, and to

Get Price

How U.S. tariffs will have ripple effects on Canada''s

The escalating U.S.-Canada trade war is now taking direct aim at the solar industry, with new tariffs set to drive up costs and complicate supply

Get Price

US solar builders brace for higher costs as Biden

The Biden administration has raised import tariffs on China and Southeast Asia as plummeting global solar prices hurt U.S. factory expansion

Get Price

inverter replacement

Will changing my inverter change my feed in tariff? Will changing my inverter affect my Feed in Tariff. Changing your inverter will not change your Feed in Tariff rate. You don''t

Get Price

The Ripple Effect of 2025 Tariffs on the U.S. Solar Industry

A Snapshot of the 2025 Tariffs In March 2025, the U.S. government introduced a series of tariffs targeting imports from key trading partners, including Canada, Mexico, and

Get Price

Strategic tariffs delivering results for the American solar industry

For over 12 years, I''ve worked alongside American solar manufacturers to confront illegal dumping and unfair subsidies that have undermined investment, driven companies into

Get Price

April 2025 Tariffs | Solar Equipment | Industry Impact

Overall, while the solar panel price spike is the most pronounced effect of the April tariffs, inverters are seeing a noticeable cost increase as well, on the order of a few cents per

Get Price

Solar is about to get hit with tariffs, but stockpiles give buyers

In addition to tariffs on solar panels and inverters imported from overseas, the new tariffs are expected to greatly increase the cost of home energy storage, which is often

Get Price

US PV inverter market: Inventory and price trends under tariff

Recent U.S. import tariffs on photovoltaic (PV) equipment, including inverters, have not yet precipitated a sharp decline in inverter inventories due to substantial "pre-tariff" stockpiles that

Get Price

Understanding the Impact of 2025 Tariffs on the U.S.

These tariffs, varying between 10% and 50% depending on the country of origin, have introduced new challenges for the solar industry,

Get Price

New Solar Tariffs Explained – Southern Energy Management

What Are the Tariffs Impacting Solar in 2025? The latest tariffs impacting solar focus on imported solar components like inverters and batteries.

Get Price

Trump Tariffs Impact on Solar: Increased Prices and Potential Fraud

Donald Trump''s new tariffs will impact industries globally, including solar. Learn about the potential change to costs and how to avoid fraud.

Get Price

How Trump''s widespread tariffs affect the U.S. solar industry

In December, the Biden Administration doubled tariffs on solar products from China. Section 301 tariffs are 50% for polysilicon, wafers, and solar cells for products imported from

Get Price

The Ripple Effect of 2025 Tariffs on the U.S. Solar Industry

In March 2025, the U.S. government introduced a series of tariffs targeting imports from key trading partners, including Canada, Mexico, and China. These tariffs, ranging from 10% to

Get Price

Will I lose my Feed-in Tariff payments if I retrofit a solar PV

Will having batteries added to your home solar PV system affect how much you get from the Feed-in Tariff? Here''s what to consider.

Get Price

Trump tariffs to have limited effect on US solar imports

The global tariffs announced by Donald Trump last week will have a limited effect on solar imports from Asia, according to a report from BMI.

Get Price

Tariffs on Solar Products

Tariffs have had a net negative impact on the U.S. solar industry and environment by slowing deployment. Tariffs aim to protect domestic firms

Get Price

US government raises tariffs on Chinese solar

From pv magazine USA US President Donald Trump has issued an executive order to add a 10% tariff to certain goods shipped from China. The

Get Price

Solar Tariffs in 2025: What Homeowners Should Know

For solar professionals, the 2025 tariffs present both challenges and opportunities. Sourcing panels, batteries, and inverters may now come at a premium — especially if relying

Get Price

The PV review, Q4 2024: Trump wins, more policies

The US general election and its aftermath, along with struggles from Western inverter manufacturers have dominated Q4 news in 2024.

Get Price

Understanding the Impact of 2025 Tariffs on the U.S. Solar Industry

These tariffs, varying between 10% and 50% depending on the country of origin, have introduced new challenges for the solar industry, impacting both manufacturers and

Get Price

How Trump''s widespread tariffs affect the U.S. solar

In December, the Biden Administration doubled tariffs on solar products from China. Section 301 tariffs are 50% for polysilicon, wafers, and

Get Price

Solar is about to get hit with tariffs, but stockpiles give

In addition to tariffs on solar panels and inverters imported from overseas, the new tariffs are expected to greatly increase the cost of home

Get Price

U.S. Adds Tariffs to Shield Struggling Solar Industry

In the two years since the Biden administration made the decision to pause the tariffs, solar prices have cratered, and solar panel imports have

Get Price

Solar Inverter Guide: Definition, Types, Costs, and

Solar inverters, as the core equipment in a solar PV system, play a key role in efficiently converting the direct current (DC) generated by the PV

Get Price

How Will Tariffs Impact the Cost to Go Solar in 2025?

There''s a lot of talk about tariffs these days and as consumers are considering going solar it''s important to understand what the impact of tariffs

Get Price

6 FAQs about [Does the photovoltaic tariff affect inverters ]

How will April tariffs affect inverters & solar panels?

Overall, while the solar panel price spike is the most pronounced effect of the April tariffs, inverters are seeing a noticeable cost increase as well, on the order of a few cents per watt.

Will solar tariffs affect the solar industry?

Tariffs coming into effect tomorrow will certainly impact the industry, but the stockpiles are likely to reduce the impact and give homeowners more time to go solar this year without price increases or with smaller price increases.

Is the solar industry insulated from tariffs?

Although the cost to install solar in the United States is higher than elsewhere in the developed world, the industry continues to grow in the U.S. The good news is that there has been significant investment in solar manufacturing in the U.S., so the industry is somewhat insulated from the impact of tariffs.

What are the'reciprocal day' tariffs affecting solar panels?

Updated April 29, 2025: In addition to the “Reciprocal Day” tariffs (see updates below), the solar industry learned the final determination on rates for the anti-dumping, countervailing duty (AD/CVD) case affecting crystalline silicon cells and solar panel imports from Cambodia, Malaysia, Vietnam and Thailand in late April.

Do solar panels have a tariff?

In 2014, tariffs were expanded to solar panels assembled using Chinese or Taiwanese cells regardless of country of origin (U.S. ITA 2014, 2015). In 2018, a 30% tariff was imposed on all major solar product exporters to the U.S. (U.S. President 2018; U.S. Trade Representative 2019). This tariff declined 5% each year to reach 15% by 2021.

Which solar companies do not incur import tariffs?

Other “Domestic” Suppliers: A few manufacturers with U.S.-based production or assembly – such as Hanwha Qcells (Georgia factories), First Solar (Ohio), Mission Solar (Texas), and Silfab (Washington) – do not incur these import tariffs on their U.S.-made panels. They have an effective price advantage now.

More related information

-

Selling photovoltaic inverters in the Philippines

Selling photovoltaic inverters in the Philippines

-

Popular photovoltaic inverters in Benin

Popular photovoltaic inverters in Benin

-

Top 10 Home Photovoltaic Inverters

Top 10 Home Photovoltaic Inverters

-

Does the photovoltaic industry include inverters

Does the photovoltaic industry include inverters

-

Off-grid and grid-connected photovoltaic inverters

Off-grid and grid-connected photovoltaic inverters

-

Do photovoltaic projects require a lot of inverters

Do photovoltaic projects require a lot of inverters

-

Advantages of Huawei string photovoltaic inverters

Advantages of Huawei string photovoltaic inverters

-

The relationship between photovoltaic inverters and batteries

The relationship between photovoltaic inverters and batteries

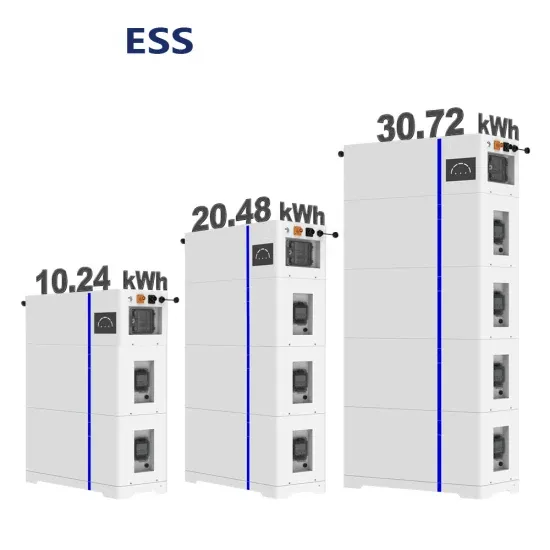

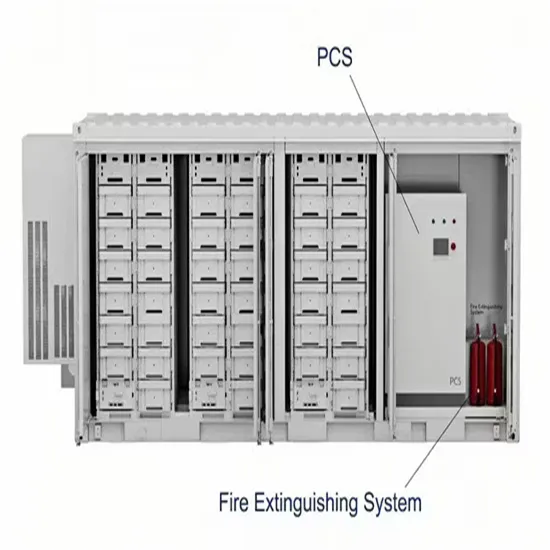

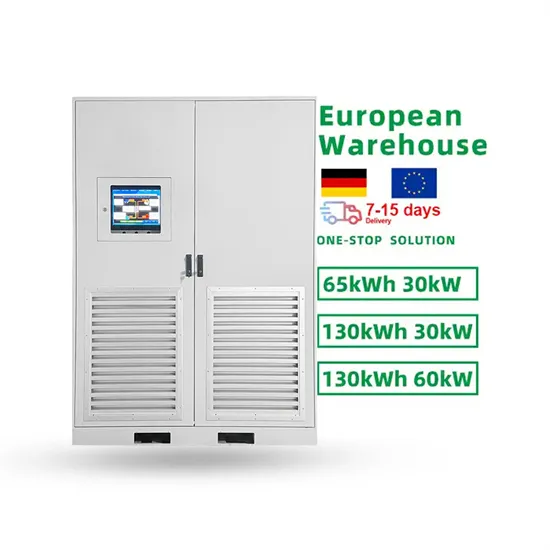

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.