Energy Laws and Regulations 2025 – Chile

This chapter discusses oil, gas and electricity regulations, current energy mix, energy situation changes, government policy developments, and

Get Price

LAC CHILE

in Chile. Increasingly, stakeholders are questioning the market design, as zero solar hour prices have caused some projects to go bankrupt. The current infrastructure is insufficient to supply

Get Price

Unleashing The Energy Storage Market in Chile

Today, all energy storage projects in Chile are co-located with renewable energy because it serves to mitigate losses from curtailment and

Get Price

Banking on batteries in Chile

Henrique Ribeiro, principal analyst for batteries and energy storage at S&P Global Commodity Insights, said battery revenues in Chile have, until now, been driven by arbitrage –

Get Price

Chile''s power auction wraps up for average price of

Five renewable energy companies were declared winners in Chile''s technology neutral power auction on Tuesday, after the process to place 2,310

Get Price

Roadmap for the Energy Transition in Chile Final Report

ACKNOWLEDGMENTS This report has been driven by the Enel Group in Chile and prepared by energiE in collaboration with MRC, as an analytical and participative consideration on the

Get Price

Energy Storage Trends and Opportunities in Emerging Markets

A key component of the energy storage value proposition in developed and emerging markets is consuming the majority of energy generated by onsite solar photovoltaic (PV) and other

Get Price

A MILP model for optimising multi-service portfolios of distributed

The model maximises distributed storage''s net profit while providing distribution network congestion management, energy price arbitrage and various reserve and frequency regulation

Get Price

Charting the Future: Chile''s PMGD Stabilized Price Outlook

Unpacking the evolution of Chile''s PMGD scheme. Originally designed to support small-scale generation near demand centers, Chile''s Pequeños Medios de Generación Distribuida

Get Price

Unleashing The Energy Storage Market in Chile

Today, all energy storage projects in Chile are co-located with renewable energy because it serves to mitigate losses from curtailment and zero or negative pricing.

Get Price

Brookfield Renewable U.S.: Renewable Power Solutions

We are one of the world''s largest investors in renewable power, with over 19,000 megawatts of generating capacity. Our assets, located in North and South

Get Price

Chilean Battery Energy Storage Systems Stabilize Energy

We expect price differentials in Chile to fall as BESS-installed capacity grows and new transmission comes online adding more uncertainty to long term arbitrage revenues.

Get Price

Chile Solar Energy Market Analysis, Growth & Forecast [2031]

Market Segment Insights The utility-scale solar energy segment is projected to hold a large market share In terms of deployments, the Chile solar energy market is segmented into

Get Price

Opportunities and challenges for distributed energy resources in Chile

In summary, the successful implementation of new regulations enabling PMGDs with storage capacity could spur industry growth, reduce transmission congestion, and

Get Price

Wartsila_Presentation Chile 2024

The need for thermoelectric facilities in Chile is driven by security constraints, resilience requirements and economic dispatch in periods with low and high demand, even when

Get Price

Opportunities and challenges for distributed energy resources in

In summary, the successful implementation of new regulations enabling PMGDs with storage capacity could spur industry growth, reduce transmission congestion, and

Get Price

Chile moves on storage to ''decarbonize the night''

Chile has emerged as a world leader in hybrid systems and standalone energy storage since implementing its Renewable Energy Storage and Electromobility Act in 2022.

Get Price

Chile releases bidding terms for 5,400 GWh renewables, storage

The Chilean authorities want to contract 5,400 GWh of power from renewable energy, while also including battery storage. The selected developers will secure 20-year

Get Price

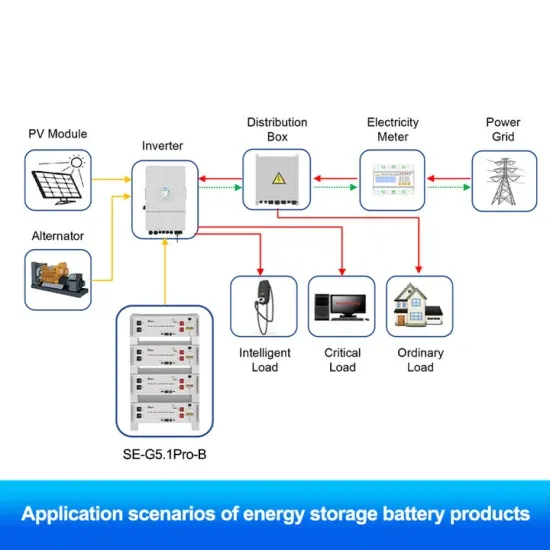

Distributed Energy Storage

Impact Distributed energy storage is an essential enabling technology for many solutions. Microgrids, net zero buildings, grid flexibility, and rooftop solar all

Get Price

Chile Energy Storage

Despite the current low level of installed energy capacity and high cost per MW, the opportunities for battery storage are promising. The Chilean Ministry of Energy projects that

Get Price

Battery Energy Storage Systems (BESS) in Chile

All Chilean energy storage players, ranging from IPPs to PCS providers, are now closely awaiting the publication of the capacity market decree (DS N 62) expected in Q2 of 2024.

Get Price

Leadership and Community Engagement in Chile:

Acknowledgments The Net Zero World Chile team would like to acknowledge the contributions to this chapter from the U.S. Department of Energy (DOE) Office of International Affairs, DOE''s

Get Price

Chile smart energy storage battery price

Will Chile be able to develop energy storage projects in 2024? In 2022, Chile passed an energy storage and electromobility bill, which made stand-alone storage projects profitable, but the

Get Price

Charting the Future: Chile''s PMGD Stabilized Price

Unpacking the evolution of Chile''s PMGD scheme. Originally designed to support small-scale generation near demand centers, Chile''s Pequeños Medios de

Get Price

Chile Compressed Air Energy Storage Market (2025-2031)

Historical Data and Forecast of Chile Compressed Air Energy Storage Market Revenues & Volume By Distributed Energy System for the Period 2021- 2031 Historical Data and Forecast

Get Price

BESS Is the distributed energy storage system used a lot

How is Bess compared to other energy storage technologies? BESS can be compared to other energy storage technologies in terms of cost-effectiveness,scalability,and environmental

Get Price

Chile''s Energy Storage Price Trends: Where the Desert Meets

Chile''s energy storage prices aren''t just numbers on a spreadsheet; they''re the heartbeat of South America''s clean energy revolution. Current market data shows vanadium flow batteries

Get Price

6 FAQs about [Distributed energy storage prices in Chile]

How many energy storage projects are in Chile?

Currently, 36 of the 129 large-scale projects Latin America projects with an energy storage component under development are in Chile, including 32 out of 71 of the region’s early works projects. The storage technologies either in use or being considered include:

How much battery storage capacity does Chile have?

According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity. AES Andes, a subsidiary of U.S. company AES Corp. operates all 64MW at their Angamos and Los Andes substations.

Is lithium ion battery storage available in Chile?

While many projects are under development, lithium - ion battery storage is still limited. According to data from Acera, the Chilean Renewable Energy Association, there are only 64MW of battery storage capacity currently active, representing 0.2% of national capacity.

Are battery energy storage systems a viable alternative for Chilean power producers?

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged as a profitable alternative for Chilean power producers.

How much does a battery cost in Chile?

In fact, batteries charged at nearly $0/MWh during the day in the sunny, northern desert regions of Chile, sell energy at night for over $100/MWh. Although projects such as Engie’s BESS Coya are already enjoying these large spreads, this capacity payment will partially de-risk Chile’s dependence on volatile, but still profitable, merchant revenues.

Will new solar assets in Chile have storage components?

New utility-scale renewable and PMGE assets in Chile (most of which are distributed solar plants smaller than 9 MW) will likely all have storage components moving forward.

More related information

-

Distributed energy storage prices in Mozambique

Distributed energy storage prices in Mozambique

-

Distributed photovoltaic energy storage power station in Chile

Distributed photovoltaic energy storage power station in Chile

-

Lithuania energy storage lead-acid battery prices

Lithuania energy storage lead-acid battery prices

-

Canada We Industrial and Commercial Energy Storage Prices

Canada We Industrial and Commercial Energy Storage Prices

-

Kuwait Solar Energy Storage Prices

Kuwait Solar Energy Storage Prices

-

Tunisian energy storage module prices

Tunisian energy storage module prices

-

Huawei Chile Lithium Energy Storage Project

Huawei Chile Lithium Energy Storage Project

-

Honduras Energy Storage Capital Prices

Honduras Energy Storage Capital Prices

Commercial & Industrial Solar Storage Market Growth

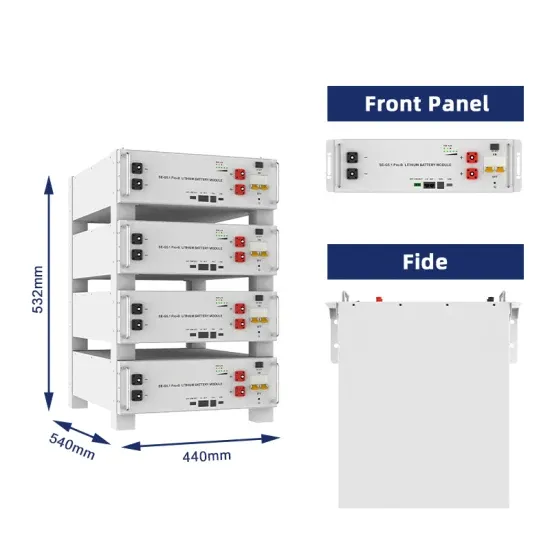

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.