Profitability of energy storage plants

The profit model of the energy storage system is divided into three ways: peak and valley arbitrage (household system), capacity leasing (shared power station), auxiliary function fee

Get Price

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get Price

what are the profit analysis of industrial energy storage power stations

Peak shaving benefit assessment considering the joint operation of nuclear and battery energy storage power stations At present, the utilization of the pumped storage is the main scheme

Get Price

How does an air energy storage power station make a profit?

1. The profitability of an air energy storage power station hinges on several mechanisms: 1) The sale of stored energy during peak demand periods, 2) Participation in

Get Price

Analysis of energy storage power station investment and benefit

Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three

Get Price

Energy storage power station profitability

Energy storage stations have different benefits in different scenarios. In scenario 1, energy storage stations achieve profits through peak shaving and frequency modulation, auxiliary

Get Price

How do energy storage power stations make money?

1. Energy storage power stations generate income through multiple revenue streams, including: 1) participation in ancillary services markets, 2)

Get Price

How is the profit of energy storage power station? | NenPower

In summary, addressing the profitability of energy storage power stations entails a multifaceted exploration of investment strategies, market dynamics, and regulatory landscapes.

Get Price

How does a liquid-cooled energy storage power station make

A liquid-cooled energy storage power station generates revenue through multiple avenues, including energy arbitrage, grid services, ancillary services, and capacity payments.

Get Price

How much profit does Jintan Energy Storage Power Station make?

PROFITABILITY FACTORS Energy storage systems have become pivotal in modern electricity grids, especially with the increase of renewable energy sources like solar

Get Price

Business Models and Profitability of Energy Storage

Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Get Price

How is the profit model of energy storage power station

1. The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Get Price

Analytics Can Help Energy Storage Operators Find More Revenue

6 days ago· Using modeling through analytics, battery energy storage system operators can determine exactly what size system they need for their site with advanced predictive software.

Get Price

How many billions of profits does the energy storage power station

The inquiry into the financial returns of energy storage power stations reveals that they can yield profits in the tens to hundreds of billions of dollars annually. This profitability

Get Price

What is the annual income of energy storage power

The annual income of an energy storage power station varies based on several factors, including the size of the facility, the technology employed,

Get Price

How do small energy storage power stations make money?

Innovative approaches, such as hybrid storage solutions that leverage various technologies, can also enhance profitability. As energy markets mature and integration

Get Price

Economic Analysis of Energy Storage Stations: Costs, Profits,

The energy storage world is buzzing about sodium-ion batteries - think of them as lithium''s cheaper cousin. With theoretical costs 30% lower [8] and none of the fire risks, they''re

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a

Get Price

How much money can energy storage power stations make?

Energy storage power stations can generate significant revenue, driven by multiple factors including demand response opportunities, ancillary services, and peak shaving

Get Price

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get Price

How is the profit of base station energy storage battery

1. Profitability of base station energy storage batteries is driven by several key factors: 1) decreasing operational costs, 2) increased efficiency in energy management, 3)

Get Price

Profit model of overseas energy storage power stations

Therefore, this article analyzes three common profit models that are identified when EES participates in peak-valley arbitrage, peak-shaving, and demand response. On

Get Price

How is the income of energy storage power station? | NenPower

Within the financial ecosystem of energy storage power stations, operational costs represent a substantial factor influencing profitability. These costs encompass maintenance,

Get Price

6 FAQs about [Profitability of Energy Storage Power Stations]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Can energy storage provide multiple services?

The California Public Utilities Commission (CPUC) took a first step and published a framework of eleven rules prescribing when energy storage is allowed to provide multiple services. The framework delineates which combinations are permitted and how business models should be prioritized (American Public Power Association, 2018).

What is a power storage facility?

In the first three applications (i.e., provide frequency containment, short-/long-term frequency restoration, and voltage control), a storage facility would provide either power supply or power demand for certain periods of time to support the stable operation of the power grid.

More related information

-

The price of charging and discharging energy storage power stations

The price of charging and discharging energy storage power stations

-

What are the energy storage power stations in apartments

What are the energy storage power stations in apartments

-

What are the functions of large energy storage power stations

What are the functions of large energy storage power stations

-

The role of energy storage batteries in solar power stations

The role of energy storage batteries in solar power stations

-

Eastern European energy storage power stations participate in frequency regulation

Eastern European energy storage power stations participate in frequency regulation

-

The impact of energy storage stations on the power grid

The impact of energy storage stations on the power grid

-

Companies investing in energy storage power stations in Colombia

Companies investing in energy storage power stations in Colombia

-

Latvia s first batch of energy storage power stations

Latvia s first batch of energy storage power stations

Commercial & Industrial Solar Storage Market Growth

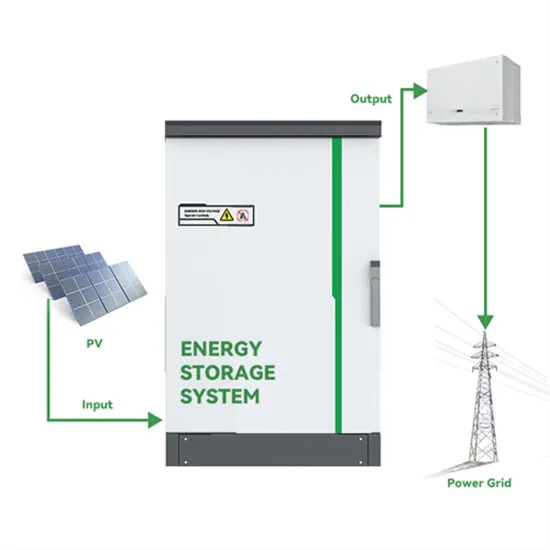

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

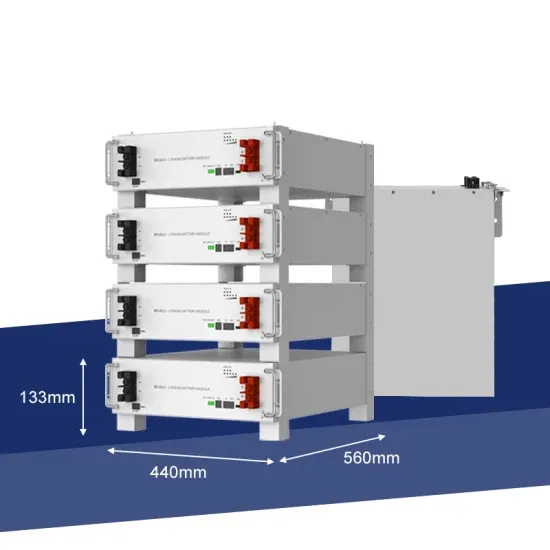

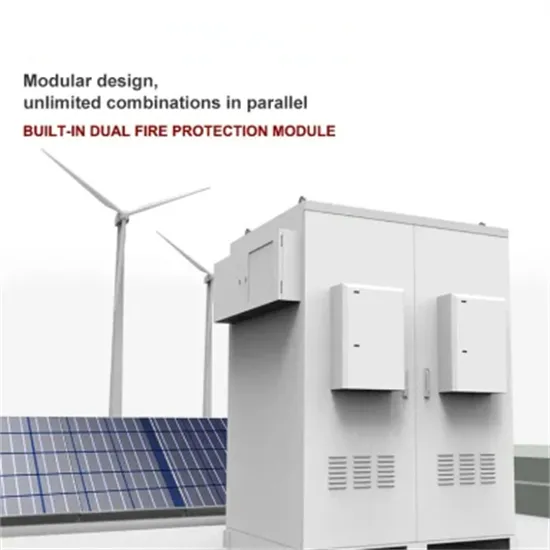

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.