5G Base Station Hybrid Power Supply | HuiJue Group E-Site

As 5G base stations multiply globally, their energy appetite threatens to devour operational efficiency. Did you know a single 5G site consumes 3x more power than 4G? With

Get Price

Research on Performance of Power Saving Technology for 5G Base Station

Compared with the fourth generation (4G) technology, the fifth generation (5G) network possesses higher transmission rate, larger system capacity and lower tran

Get Price

Strategy of 5G Base Station Energy Storage Participating in the Power

The proportion of traditional frequency regulation units decreases as renewable energy increases, posing new challenges to the frequency stability of the power system. The

Get Price

The Future of Energy-Efficient 5G Base Station Design

The advent of 5G technology marks a significant leap in telecommunications, promising unprecedented data speeds, reduced latency, and enhanced connectivity for a

Get Price

Multi‐objective interval planning for 5G base station virtual

As an emerging load, 5G base stations belong to typical distributed resources [7]. The in‐depth development of flexi-bility resources for 5G base stations, including their internal energy

Get Price

5G Base Station

The main energy consumption of 5G base stations is concentrated in the four parts of base station, transmission, power supply and computer

Get Price

5g base station power supply and energy storage

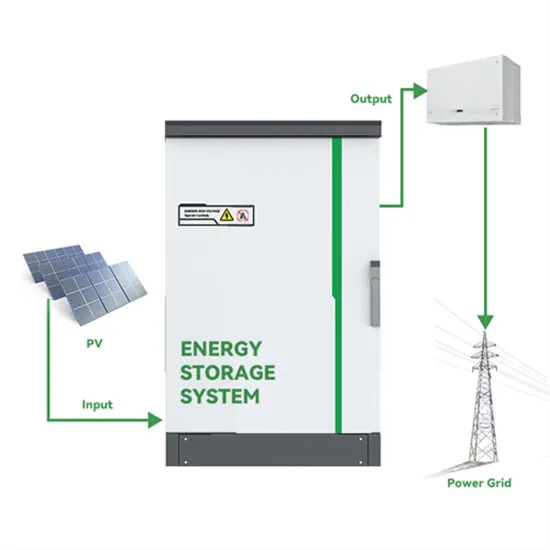

This strategy facilitates various forms of energy coordination output in 5G base station multi-source power supply systems, enhances the on-site utilization of PV energy,

Get Price

The 5G Revolution: How Base Stations Are Powering the Future

The 5G era is reshaping industries, lifestyles, and global economies with unprecedented advancements in connectivity. At the core of this revolution lies the 5G base

Get Price

The power supply design considerations for 5G base

Leveraging integrated architecture, using advanced techniques such as power pulse, and reducing the size and weight of equipment can cut power

Get Price

Key Technologies and Solutions for 5G Base Station Power Supply

As 5G networks proliferate globally, a critical question emerges: How can we sustainably power 5G base stations that consume 3× more energy than 4G infrastructure? With over 13 million

Get Price

The business model of 5G base station energy storage

1 Introduction 5G communication base stations have high requirements on the reliability of power supply of the distribution network. During planning and construction, 5G base stations are

Get Price

5G Base Station Growth: How Many Are Active? | PatentPC

Explore the rise of 5G base stations worldwide. Get key stats on active installations and how they impact network coverage.

Get Price

5G in Madagascar leads the way in propelling socio-economic

The precedent set in nurturing partnerships between Ericsson and telecommunications service providers like Telma Madagascar has critical implications for the

Get Price

Research on Performance of Power Saving Technology for 5G

Compared with the fourth generation (4G) technology, the fifth generation (5G) network possesses higher transmission rate, larger system capacity and lower tran

Get Price

Synergetic renewable generation allocation and 5G base station

To tackle this issue, this paper proposes a synergetic planning framework for renewable energy generation (REG) and 5G BS allocation to support decarbonizing

Get Price

Building better power supplies for 5G base stations

Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies - Technical

Get Price

The power supply design considerations for 5G base stations

Leveraging integrated architecture, using advanced techniques such as power pulse, and reducing the size and weight of equipment can cut power consumption and provide

Get Price

5G Base Station Power Supply Market

The global 5G base station power supply market is shaped by companies specializing in high-efficiency energy solutions, backed by technological innovation, vertical integration, and

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

Additionally, these 5G cells will also include more integrated antennas to apply the massive multiple input, multiple output (MIMO) techniques for reliable connections. As a result, a

Get Price

5G Power Supply Solutions

Vishay 5G Power Supply Solutions are a portfolio of devices that offer the highest efficiency and RF noise levels for 5G mm wave base station

Get Price

Distribution network restoration supply method considers 5G base

This work explores the factors that affect the energy storage reserve capacity of 5G base stations: communication volume of the base station, power consumption of the base

Get Price

Gov''t must prioritise stable electricity to support 5G network

The Government has been urged to prioritise immediate interventions to ensure stable electricity supply to support Ghana''s rollout of the Fifth Generation (5G) mobile broadband services.

Get Price

(PDF) The business model of 5G base station energy

The inner layer optimization considers the energy sharing among the base station microgrids, combines the communication characteristics of

Get Price

5G Base Station Power Supply Market Demand and

The 5G Base Station Power Supply market, valued at $7203 million in 2025, is experiencing robust growth, projected at a 7.3% CAGR from

Get Price

Dynamic Power Management for 5G Small Cell Base Station

5G networks with small cell base stations are attracting significant attention, and their power consumption is a matter of significant concern. As the increase.

Get Price

Telecom Power-5G power, hybrid and iEnergy

ZTE''s Telecom Power solutions mainly includes: 5G power supply, hybrid energy and iEnergy network energy management solutions to fully meet the needs of

Get Price

6 FAQs about [Madagascar 5G base station power supply transformation]

What factors affect the energy storage reserve capacity of 5G base stations?

This work explores the factors that affect the energy storage reserve capacity of 5G base stations: communication volume of the base station, power consumption of the base station, backup time of the base station, and the power supply reliability of the distribution network nodes.

Does 5G base station energy storage participate in distribution network power restoration?

For 5G base station energy storage participation in distribution network power restoration, this paper intends to compare four aspects. 1) Comparison between the fixed base station backup time and the methods in this paper.

Why are 5G base stations important?

The denseness and dispersion of 5G base stations make the distance between base station energy storage and power users closer. When the user's load loses power, the relevant energy storage can be quickly controlled to participate in the power supply of the lost load.

How will China's 5G development affect the use of base stations?

In this regard, the author's next step is to introduce a capacity factor to quantify the usage of base stations in different areas. China's 5G development will still advance rapidly in the future, while the deployment density of 5G base stations will further increase with the rapid development of society.

How many 5G base stations are there in China?

Since China took the first step of 5G commercialization in 2019, by 2022, the number of 5G base stations built in China will reach 2.31 million. The power consumption of 5G base stations will increase by 3–4 times compared with 4G base stations [1, 2], significantly increasing the energy storage capacity configured in 5G base stations.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

More related information

-

5g base station power supply transformation analysis

5g base station power supply transformation analysis

-

Qatar 5G micro base station power supply solution

Qatar 5G micro base station power supply solution

-

The development of 5G base station power supply

The development of 5G base station power supply

-

New Zealand Communications 5G Base Station Power Supply

New Zealand Communications 5G Base Station Power Supply

-

What does the 5G base station power supply system include

What does the 5G base station power supply system include

-

Gambia 5G communication base station power supply 215KWh

Gambia 5G communication base station power supply 215KWh

-

5G base station power supply scale

5G base station power supply scale

-

5g base station power supply and communication power supply

5g base station power supply and communication power supply

Commercial & Industrial Solar Storage Market Growth

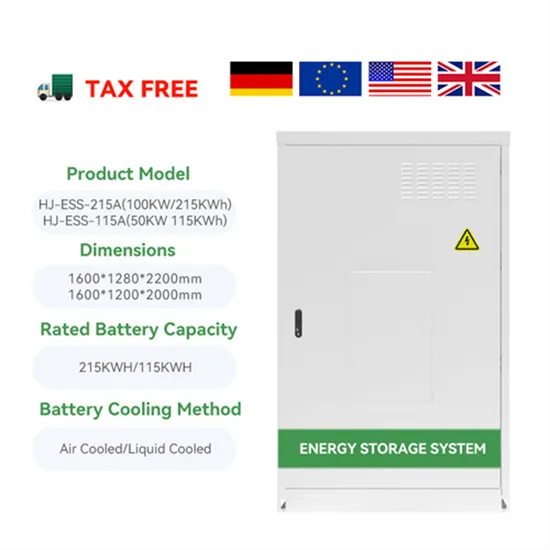

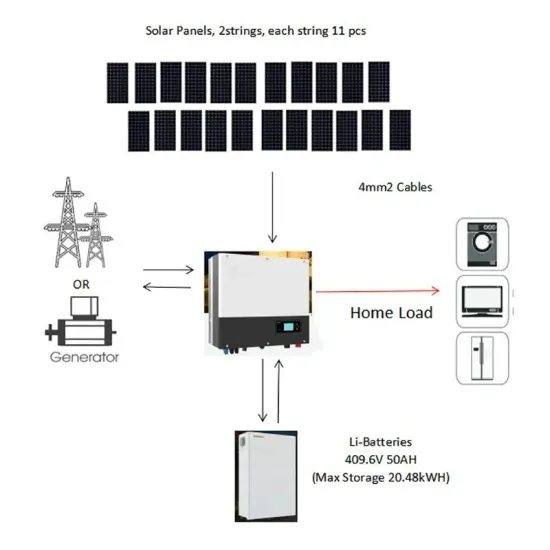

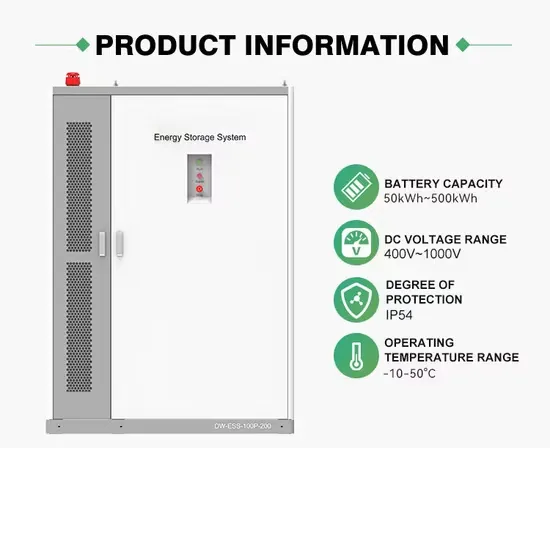

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

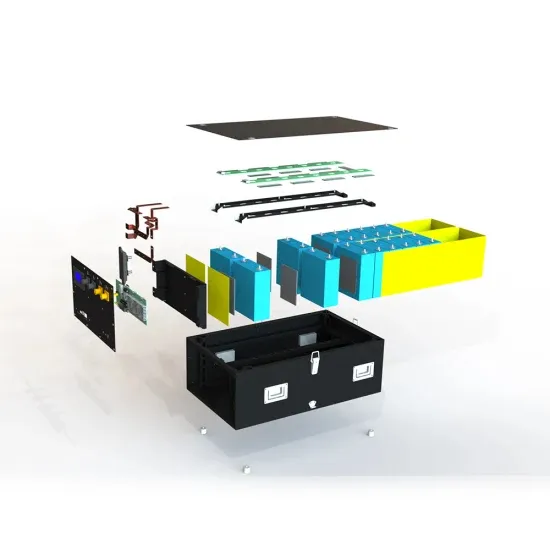

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.