How much does it cost to invest in an energy storage power station

1. The financial requirements to invest in an energy storage power station can vary significantly based on several critical factors.2. On average, initial costs can range from

Get Price

How much is the total price of energy storage power station?

The total price of energy storage power stations varies significantly based on several critical factors. 1. Location influences logistics and installation expenses, leading to

Get Price

How much is the interest on energy storage power station

In addition, the project''s potential returns and risk factors significantly dictate the financial strategies utilized in energy-related investments. Consequently, energy storage

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

Configuration and operation model for integrated

This article first analyses the costs and benefits of integrated wind–PV-storage power stations. Considering the lifespan loss of energy

Get Price

Uniper recommissions Happurg pumped-storage plant

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our

Get Price

Research on investment decision-making of energy storage

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get Price

How about Guohua''s investment in energy storage power station

Guohua''s investment in energy storage power stations represents a forward-thinking approach to energy management, focusing on three key aspects: 1. Financial

Get Price

How much is the investment output of energy storage power station

The investment output of energy storage power stations is invariably subject to fluctuating market dynamics. These dynamics encompass factors like demand and supply,

Get Price

Financial Analysis Of Energy Storage

Learn about the powerful financial analysis of energy storage using net present value (NPV). Discover how NPV affects inflation & degradation.

Get Price

The Peak-Shaving Role of Energy Storage Stations in Power

This article provided by GeePower delves into the importance of energy storage stations in peak-shaving within power systems.

Get Price

Optimal site selection of electrochemical energy storage station

With the large-scale connection of new energy in the future, a new power system will be built rapidly. However, the intermittent and volatility of these new energy sources will

Get Price

Capital Cost and Performance Characteristics for Utility

To accurately reflect the changing cost of new electric power generators in the Annual Energy Outlook 2025 (AEO2025), EIA commissioned Sargent & Lundy (S&L) to evaluate the overnight

Get Price

Capacity investment decisions of energy storage power stations

To this end, this paper constructs a decision-making model for the capacity investment of energy storage power stations under time-of-use pricing, which is intended to

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

How much investment can be recovered from energy storage power stations

Investments in energy storage can have cascading positive effects on emissions reduction by enabling greater utilization of renewable energy sources. Thus, these

Get Price

How much investment can be recovered from energy storage

Investments in energy storage can have cascading positive effects on emissions reduction by enabling greater utilization of renewable energy sources. Thus, these

Get Price

Uniper recommissions Happurg pumped-storage plant for around

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our previously announced strategy to invest in

Get Price

Research on investment decision-making of energy storage power station

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get Price

The Peak-Shaving Role of Energy Storage Stations in

This article provided by GeePower delves into the importance of energy storage stations in peak-shaving within power systems.

Get Price

How much is the profit of energy storage power station

The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Get Price

ENERGY STORAGE POWER STATION INVESTMENT COST

Analysis and calculation of investment returns of energy storage power station Abstract: In order to promote the deployment of large-scale energy storage power stations in the power grid, the

Get Price

Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage

In the context of China''s new power system, various regions have implemented policies mandating the integration of new energy sources with energy storage, while also

Get Price

Energy Storage Power Station Investment Insights: Breaking

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get Price

Understanding the Return of Investment (ROI) of Energy Storage

Tailoring the system to meet the unique needs of different sectors can further optimize returns. As energy storage becomes increasingly essential for modern energy management,

Get Price

Profit Analysis and Power Storage Investment: A 2025 Guide for

Let''s face it – everyone from Elon Musk''s interns to your neighbor with solar panels is talking about power storage investment. But who actually needs a deep dive into profit

Get Price

How much is the investment in energy storage power station?

Investment in energy storage power stations typically ranges from 1.5 to 3 million dollars per megawatt (MW) of installed capacity, influenced by factors such as technology

Get Price

Economic evaluation of battery energy storage system

In view of the time value of funds, we select typical economic indexes such as dynamic investment payback period, return rate on

Get Price

6 FAQs about [Energy Storage Power Station Investment and Returns]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

Why should we invest in a pumped storage power plant?

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our previously announced strategy to invest in growth and transformation towards a greener business.

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

How will a pumped storage power plant contribute to the energy transition?

The company is making a significant contribution to the energy transition and is continuing its corporate transformation towards more renewable energy generation. By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

More related information

-

Third-party investment in Vanuatu energy storage power station

Third-party investment in Vanuatu energy storage power station

-

What is the total investment in the Liberian energy storage power station

What is the total investment in the Liberian energy storage power station

-

Heishan Energy Storage Power Station Investment Company

Heishan Energy Storage Power Station Investment Company

-

Ghana energy storage power station investment cost

Ghana energy storage power station investment cost

-

Iceland Energy Investment Energy Storage Power Station

Iceland Energy Investment Energy Storage Power Station

-

How much investment is needed for a 2MW energy storage power station

How much investment is needed for a 2MW energy storage power station

-

Centralized energy storage power station investment

Centralized energy storage power station investment

-

Energy storage photovoltaic power station investment

Energy storage photovoltaic power station investment

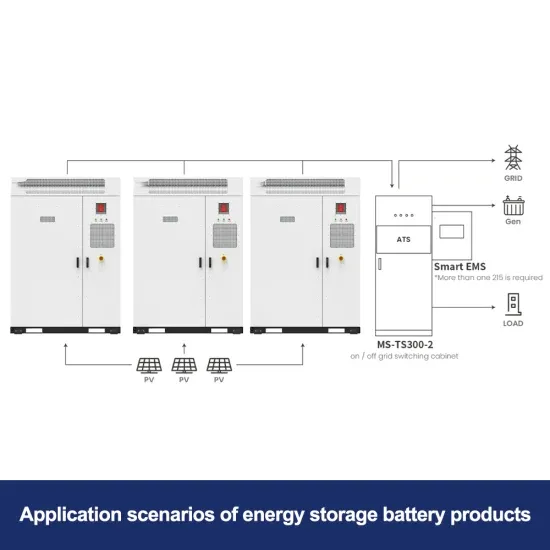

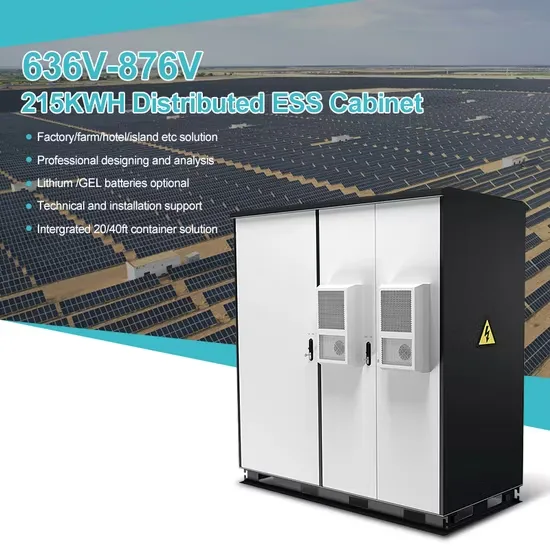

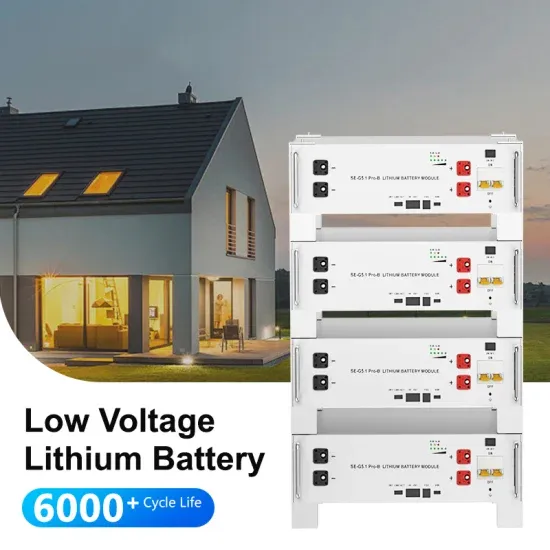

Commercial & Industrial Solar Storage Market Growth

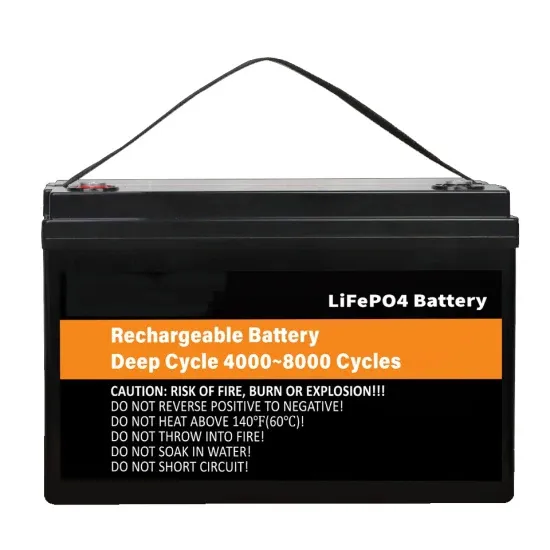

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.