Critical Components of BESS: Inverter, Transformer, and

Discover how inverters, transformers, and switchgear work together in Battery Energy Storage Systems (BESS) to optimize energy storage, grid integration, and system

Get Price

BESS | Batería solar residencial Energía

BESS Technology es una empresa innovadora que se centra en la tecnología de baterías de litio con nueva energía. La compañía ofrece soluciones integrales

Get Price

Spain Battery Energy Storage Systems Market Report

The fourth quarter of 2024 highlights significant developments in the Battery Energy Storage Systems (BESS) market in Spain, driven by the nation''s strategic focus on

Get Price

Spain & Italy | BESS Premium Opportunities in Renewables

Spain and Italy present a €45 million opportunity for BESS insurance premiums. Discover how NARDAC supports renewable energy projects in these regions.

Get Price

Evolving BESS market in 2024: Safety, new tech, and long-duration

Along with advancements in safety, BESS will also see innovative developments in technology this year. The BESS industry has been dominated by lithium-ion batteries, but the

Get Price

BESS Potential Market in Spain

The document discusses the potential market for battery energy storage systems (BESS) in Spain. Key drivers of the BESS market in Spain include the growing

Get Price

Ingeteam supplied full BESS solution to Spain''s first

Ingeteam has announced that it was supplier of the full battery energy storage system (BESS) solution to Spain''s first-ever solar PV plant

Get Price

Iberia: Why are there no batteries in Spain?

Daily price spreads hit a record €94/MWh in 2025 as rising solar production crashes midday prices Spain has allocated €700M through the European Regional Development Fund

Get Price

BESS prices in US market to fall a further 18% in 2024, says CEA

China-headquartered Sungrow provided the BESS units for this project in Texas, US. Image: Revolution BESS / Spearmint Energy. After coming down last year, the cost of

Get Price

Everything You Need to Know About Utility-Scale

Learn how to develop utility-scale BESS: site selection, grid access, layout design, and faster feasibility, all in one platform with Glint Solar.

Get Price

to acquire power electronics business of Gamesa

The offering is acquiring is focused on electrical products for power conversion and includes Doubly-fed induction generator (DFIG) wind

Get Price

Iberia: Why are there no batteries in Spain?

Extreme negative prices are rare. Until 2024, Spain had never experienced negative wholesale electricity prices. However, that is changing, and the number of negative price hours is

Get Price

What is the Cost of BESS per MW? Trends and 2025 Forecast

As of most recent estimates, the cost of a BESS by MW is between $200,000 and $450,000, varying by location, system size, and market conditions. This translates to around

Get Price

Cost, shipping, energy density drive move to 5MWh

Clean Energy Associates (CEA) has released its latest pricing survey for the BESS supply landscape, touching on price, products and policy.

Get Price

Pexapark: European BESS marketplace maturing as

Utility-scale batteries are beginning to "flatten" the renewable energy production curve in parts of Europe, enabled by financial structures

Get Price

The Silverlining: BESS and the Future of Renewables in Spain –

The captured prices for photovoltaic energy have experienced a significant downturn, a scenario attributed to an abundance of sunlight and unusually mild temperatures across the Iberian

Get Price

FLEXINVERTER

Enable reliable, cost effective and dispatchable power for your Battery Energy Storage Systems (BESS) project GE Vernova has accumulated more than 30

Get Price

Outlook 2025: The future of the utility-scale BESS market

The rapid evolution of the utility-scale battery energy storage systems (BESS) market in Australia, Europe and the US has seen the

Get Price

Unlocking Opportunity

Spanish wholesale markets have offered increasing revenues due to recent price volatility which rewards BESS through power trading. However, sustained investment in batteries will be

Get Price

BESS in Spain: the situation of the energy storage market

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic and accelerated evolution.

Get Price

BESS | Batería solar residencial Energía almacenamiento

BESS Technology es una empresa innovadora que se centra en la tecnología de baterías de litio con nueva energía. La compañía ofrece soluciones integrales integradas de batería y

Get Price

Spanish price forecast update: S1 2025 Insights for BESS

Key updates from the Spanish BESS price forecast for S1 2025, including CAPEX trends, revenue changes, and market developments.

Get Price

part 4: Spain''s BESS market is heating up

Unlike most of the other countries in our study, Spain had not seen any negative prices prior to last year. But in 2024, the number of negative price hours exceeded those in the

Get Price

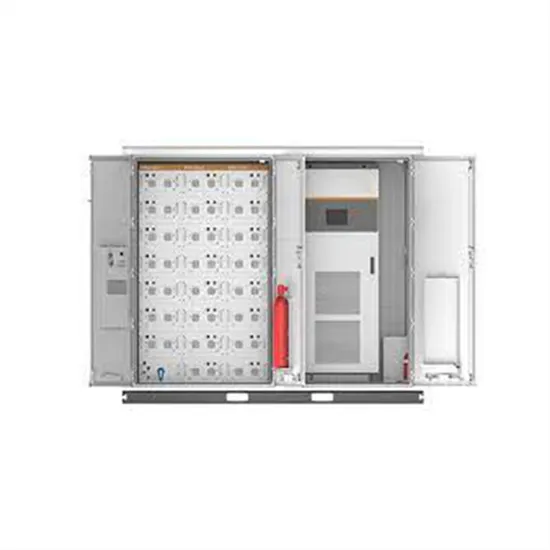

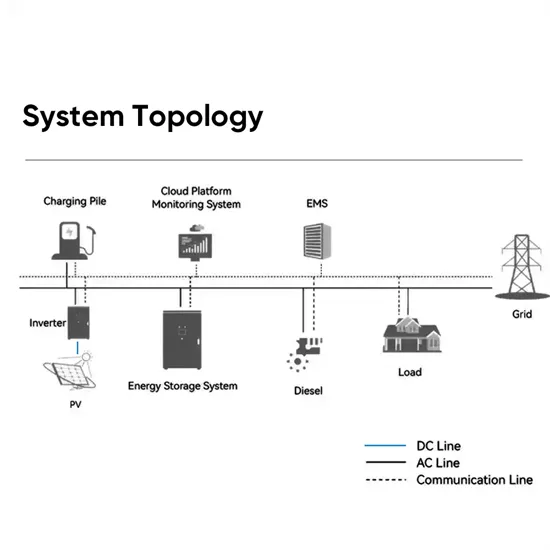

Commercial Energy Storage Systems for Business

Sungrow provides one-stop solutions that are customized to fit your company''s unique requirements for commercial and industrial storage systems with maximum performance and

Get Price

How Italy is Driving BESS Investment

This blog is the latest addition to our new series, "Introduction to BESS (Battery Energy Storage Systems) Markets". In this blog, we review

Get Price

The Silverlining: BESS and the Future of Renewables

The captured prices for photovoltaic energy have experienced a significant downturn, a scenario attributed to an abundance of sunlight and unusually

Get Price

BESS in Spain: the situation of the energy storage

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic

Get Price

6 FAQs about [BESS inverter prices in Spain]

Does Spain need a Bess energy system?

Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European country. As a result, the need for BESS to integrate renewable energy sources into the electricity system is less immediate than in the UK, for example.

How does Spain's pumped hydro energy storage compete with Bess?

Spain's pumped hydro energy storage competes directly against BESS, limiting the battery storage opportunity in wholesale markets. 3. Missing ancillary markets Unlike Great Britain or Texas, Spain never created ancillary service markets that net-zero systems need:

How much does Bess cost in Spain and Italy?

BESS in Spain and Italy: 45 million euros of premium. Tom Harries investigates Spain and Italy as emerging BESS markets.

Could Bess be a catalyst for batteries in Spain?

BESS stands to benefit from the current market dynamics, capitalizing on the opportunity to store energy during low-price periods and release it when prices peak. This arbitrage revenue could redefine the investment landscape for storage in Spain, turning a significant solar challenge into a catalyst for batteries.

How much does Bess cost?

The cost of BESS has fallen significantly over the past decade, with more precipitous drops in recent years: This is nearly a 70% reduction in three years, owing to falling battery pack prices (now as low as $60-70/kWh in China), increased deployment, and improved efficiency.

What is the market energy storage in Spain?

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic and accelerated evolution. This transformation is driven by the growing need to integrate renewable energy sources into the electricity grid, improve supply stability and optimize energy use.

More related information

-

BESS prices for terrace photovoltaic panels in Iceland

BESS prices for terrace photovoltaic panels in Iceland

-

Off-grid inverter prices in the Philippines

Off-grid inverter prices in the Philippines

-

Romania low voltage inverter prices

Romania low voltage inverter prices

-

Gambia grid-connected inverter prices

Gambia grid-connected inverter prices

-

BESS electric drive inverter manufacturer

BESS electric drive inverter manufacturer

-

Solar Inverter New Prices

Solar Inverter New Prices

-

Solar inverter prices in Namibia

Solar inverter prices in Namibia

-

Haiti grid-connected inverter prices

Haiti grid-connected inverter prices

Commercial & Industrial Solar Storage Market Growth

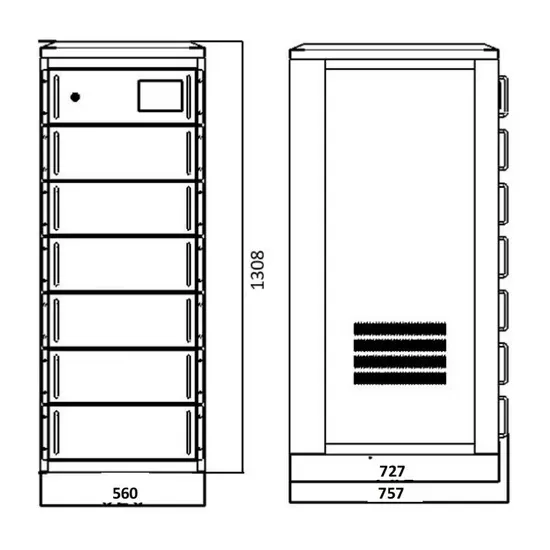

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

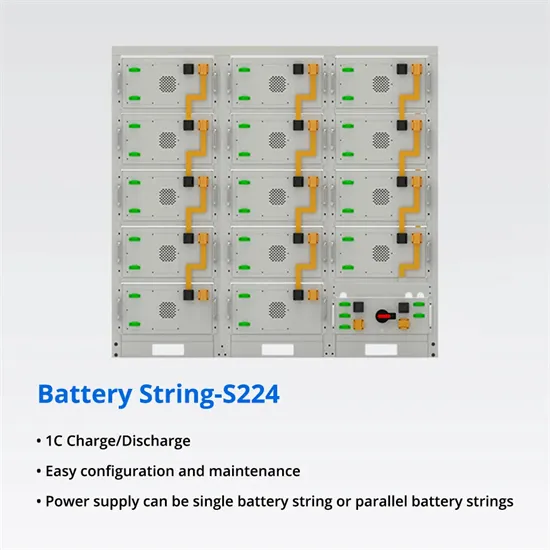

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.