What Is Profit? | Levels, Formula, and Examples

Profit is the money earned by a business when its total revenue exceeds its total expenses. Any profit a company generates goes to its owners, who may choose to distribute

Get Price

GitHub

Project specifications The goal here is to analyze the revenue generation from a battery storage system that is performing energy arbitrage by participating in

Get Price

Proforma Financial Model of BESS – Acelerex

Understanding the intricacies of financial modeling for BESS is essential for developing successful energy storage projects that align with market demands and policy developments.

Get Price

Profit: Definition, How It Works, Types, and Examples

This article explains what profit is, and delves into the three main types of profit: gross, operating, and net profit. By understanding these, investors, business owners, and

Get Price

Profit: Definition, Types, Formula, Motive, and How It Works

Profit is the income remaining after settling all expenses. Three forms of profit are gross profit, operating profit, and net profit. The profit margin shows how well a company uses

Get Price

Profit | Revenue, Cost & Margin | Britannica Money

profit, in business usage, the excess of total revenue over total cost during a specific period of time. In economics, profit is the excess over the returns to capital, land, and labour (interest,

Get Price

Energy Storage Outlook

Global installed energy storage is on a steep upward trajectory. From just under 0.5 terawatts (TW) in 2024, total capacity is expected to rise ninefold to over 4 TW by 2040,

Get Price

How is the profit of energy storage battery industry?

Revenue models can be broadly classified into two categories: direct sales and ancillary services. Direct sales typically encompass the retail and wholesale of energy storage

Get Price

Profit analysis of power battery energy storage equipment

Conclusion Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client''s objectives. It provided a thorough analysis of

Get Price

What Is Profit? Definition and Meaning

Profit is total revenue minus total expenses, costs, and taxes and serves as a key indicator of a business''s financial health and operational efficiency. There are different ways to

Get Price

PROFIT | English meaning

PROFIT definition: 1. money that is earned in trade or business after paying the costs of producing and selling goods. Learn more.

Get Price

A Brief Review of Energy Storage Business Models

All energy storage projects hinge on a successful business model - and there are a growing number of them, as energy storage can provide value in different

Get Price

Energy Storage Financing: Project and Portfolio Valuation

Energy storage project valuation methodology is typical of power sector projects through evaluating various revenue and cost assumptions in a project economic model.

Get Price

Increasing the lifetime profitability of battery energy storage

Furthermore, the lifetime profit from energy arbitrage can be increased by an additional 24.9% when using the linearized calendar degradation model and by 29.3% when

Get Price

Profit maximization for large-scale energy storage systems to

Large-scale integration of battery energy storage systems (BESS) in distribution networks has the potential to enhance the utilization of photovoltaic (PV) power generation

Get Price

The big book of BESS revenue models (with

Building and operating a Battery Energy Storage System (BESS) offers various revenue opportunities. While they might seem complex, here''s a

Get Price

Profit

If the value that remains after expenses have been deducted from revenue is positive, the company is said to have a profit, and if the value is negative, then it is said to have a loss (see:

Get Price

How Gross, Operating, and Net Profit Differ

A profit occurs when a company''s revenue exceeds its expenses. Put simply it''s what a business gets to keep after paying for everything it takes to make or sell its products or

Get Price

Energy storage in China: Development progress and business model

Even though several reviews of energy storage technologies have been published, there are still some gaps that need to be filled, including: a) the development of energy storage

Get Price

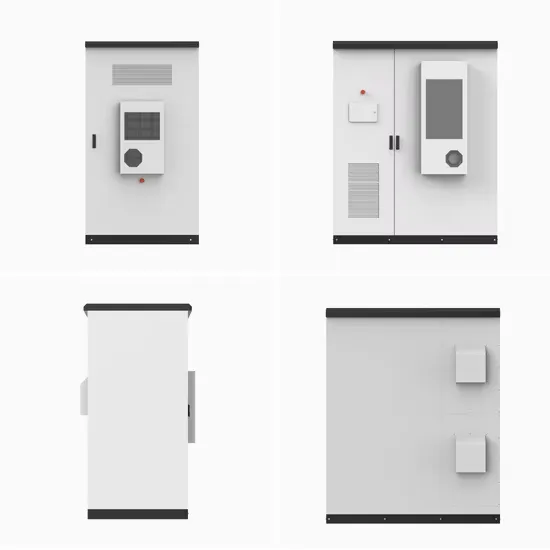

Battery Energy Storage System Production Cost

We have developed a comprehensive financial model for the plant''s setup and operations. The proposed facility of Battery Energy Storage System (BESS) is

Get Price

How to finance battery energy storage | World

Battery energy storage systems (BESS) can help address the challenge of intermittent renewable energy. Large scale deployment of this

Get Price

Battery storage revenues and routes to market

As covered briefly in our previous article, the "route to market" / offtake arrangements/ revenue contracts are perhaps the key difference

Get Price

US BESS: Pick your revenue model

Project financing in the US battery storage (BESS) market continues to grow. But this is still no vanilla market. There is a litany of BESS revenue models from state to state – all

Get Price

Three Investment Models for Industrial and

In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a

Get Price

GridBeyond on optimising BESS and AI modelling

Optimisers play a vital role for battery energy storage system (BESS) developers by capturing thousands of measurements in real time, comparing data points with forecasts

Get Price

Cracking the Code: Smart Profit Models in the Energy Storage Field

How to make energy storage projects actually profitable. Our target audience ranges from renewable energy investors to grid operators exploring battery storage solutions.

Get Price

Financial Analysis Of Energy Storage

Learn about the powerful financial analysis of energy storage using net present value (NPV). Discover how NPV affects inflation & degradation.

Get Price

In-depth explainer on energy storage revenue and

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for

Get Price

BESS in North America_Whitepaper_Final Draft

This whitepaper reflects on available opportunities across the battery energy storage industry focusing on the market development in the United States and Canada. Highlighting throughout

Get Price

PJM: A complete guide to BESS industry growth and

Battery energy storage in PJM is at an inflection point. State-level clean energy mandates are accelerating the retirement of traditional thermal plants. At the

Get Price

Profit

Profit refers to the total earnings left after settling all direct and indirect expenses. In everyday scenarios, the term does not always equate to financial gain or money earned; there are

Get Price

Project Financing and Energy Storage: Risks and

The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Get Price

More related information

-

Sri Lanka energy storage power station profit model

Sri Lanka energy storage power station profit model

-

Japan vanadium battery energy storage project

Japan vanadium battery energy storage project

-

India lithium battery energy storage project

India lithium battery energy storage project

-

Lithium battery energy storage project under construction

Lithium battery energy storage project under construction

-

Turkmenistan Battery Energy Storage Project

Turkmenistan Battery Energy Storage Project

-

Abkhazia Energy Storage Battery Project

Abkhazia Energy Storage Battery Project

-

Iran energy storage battery container project bidding

Iran energy storage battery container project bidding

-

Argentina 5GW energy storage battery project

Argentina 5GW energy storage battery project

Commercial & Industrial Solar Storage Market Growth

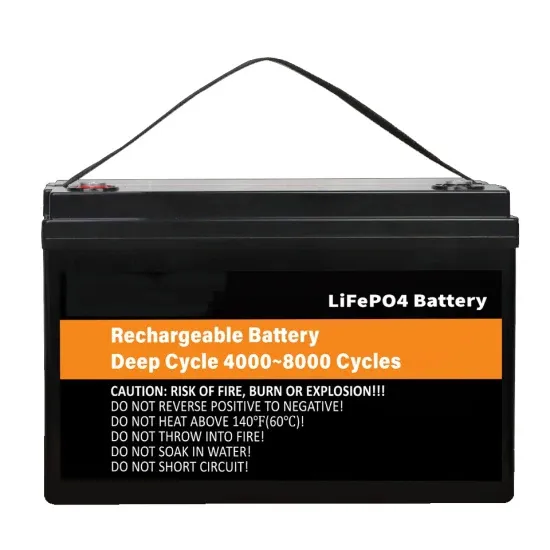

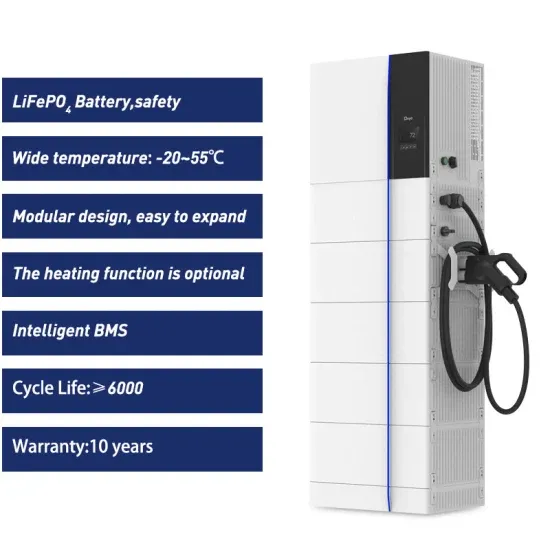

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.