Project Financing and Energy Storage: Risks and

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to

Get Price

Financial Investment Valuation Models for Photovoltaic and Energy

Energy production through non-conventional renewable sources allows progress towards meeting the Sustainable Development Objectives and constitutes abundant and

Get Price

Financial Investment Valuation Models for

Using the Web of Science (WoS) and Scopus databases, a scientometric analysis was carried out to understand the methods that have

Get Price

Fidra Energy secures £445m financing for Thorpe Marsh BESS project

23 hours ago· Fidra Energy has received up to £445m ($601.1m) in equity investment from EIG and the National Wealth Fund (NWF) for the Thorpe Marsh battery energy storage system

Get Price

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get Price

Overview and key findings – World Energy Investment

Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure.

Get Price

fenrg-2021-629136 1..13

discharging features of the hydrogen-based wind-energy storage systems. Based on the model, simulation results, including the investment value and operation decision of the hydrogen

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

Energy Storage | NJ OCE Web Site

This homepage will provide application materials and a link to Infoshare, through which applicants will submit project proposals for consideration under the Garden State Energy Storage

Get Price

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get Price

Energy storage

After solid growth in 2022, battery energy storage investment is expected to hit another record high and exceed USD 35 billion in 2023, based on the existing

Get Price

Cost Projections for Utility-Scale Battery Storage: 2023

Executive Summary In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour duration

Get Price

The 360 Gigawatts Reason to Boost Finance for Energy Storage

The Climate Investment Funds (CIF) – the world''s largest multilateral fund supporting energy storage in developing countries – is working on bridging this gap. CIF is the

Get Price

A social cost benefit analysis of grid-scale electrical energy storage

In addition, rather than modelling EES from a business case perspective or in a future-state of the power system dominated by renewables and distributed generation, this

Get Price

Project Financing and Energy Storage: Risks and Revenue

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and

Get Price

Energy Storage Valuation: A Review of Use Cases and Modeling

This report was prepared as an account of work sponsored by an agency of the United States government.

Get Price

USAID Energy Storage Decision Guide for Policymakers

Value stacking can help improve overall energy storage utilization and is often discussed as a way to improve the economics of energy storage projects by ensuring storage can seek value

Get Price

Financial Analysis Of Energy Storage

Learn about the powerful financial analysis of energy storage using net present value (NPV). Discover how NPV affects inflation & degradation.

Get Price

Study on the investment and construction models and value

To address the issue, this paper proposes investment and construction models for shared energy-storage that aligns with the present stage of energy storage development.

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

Financial Investment Valuation Models for Photovoltaic and Energy

Using the Web of Science (WoS) and Scopus databases, a scientometric analysis was carried out to understand the methods that have been used in the financial appraisal of

Get Price

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get Price

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get Price

The 360 Gigawatts Reason to Boost Finance for Energy Storage

Storage projects are risky investments: high costs, uncertain returns, and a limited track record. Only smart, large-scale, low-cost financing can lower those risks and clear the

Get Price

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get Price

Financing Energy Storage: A Cheat Sheet

As such, we''re providing this "Cheat Sheet for Energy Storage Finance" based on our work as buy-side and sell-side investment bankers experienced in both energy storage

Get Price

Energy storage ITC requires complex, costly tax

Eolian made the first use of tax equity financing to get the ITC for standalone BESS projects in February. Image: Eolian The investment tax

Get Price

Energy Storage Financing: Project and Portfolio Valuation

There are three general approaches to value an energy storage project: net income, market, or replacement. Each approach has its own merits and is appropriate under different conditions.

Get Price

6 FAQs about [Investment value of energy storage projects]

How do you value energy storage projects?

The central tool for valuing an energy storage project is the project valuation model. Many still use simple Excel models to evaluate projects, but to capture the opportunities in the power market, it is increasing required to utilize something with far greater granularity in time and manage multiple aspects of the hardware.

Does project finance apply to energy storage projects?

The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects. Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and cashflows of an energy storage project.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

What is the importance of valuing an energy storage project?

IMPORTANCE OF VALUATION There are two key aspects of valuing an energy storage project; the methodology used, and the value arrived at. Both components are important, but the complexity of the methodology is many times overlooked (both unintentionally and intentionally).

Are energy storage systems a good investment?

This is understandable as energy storage technologies possess a number of inter-related cost, performance, and operating characteristics that and impart feed-back to impacts to the other project aspects. However, this complexity is the heart of the value potential for energy storage systems.

Should energy storage projects be developed?

However, energy storage project development does bring with it a greater number of moving parts to the projects, so developers must consider storage’s unique technology, policy and regulatory mandates, and market issues—as they exist now, and as the market continues to evolve.

More related information

-

Energy storage battery investment projects under construction

Energy storage battery investment projects under construction

-

Investment in Finnish industrial and commercial energy storage projects

Investment in Finnish industrial and commercial energy storage projects

-

French energy storage investment projects

French energy storage investment projects

-

Factory investment in energy storage projects

Factory investment in energy storage projects

-

New investment projects in Taipei energy storage

New investment projects in Taipei energy storage

-

Construction of wind solar and energy storage projects in the Republic of South Africa

Construction of wind solar and energy storage projects in the Republic of South Africa

-

Should energy storage projects be carried out in a three-in-one manner

Should energy storage projects be carried out in a three-in-one manner

-

Reasons for separate access to Huawei energy storage projects

Reasons for separate access to Huawei energy storage projects

Commercial & Industrial Solar Storage Market Growth

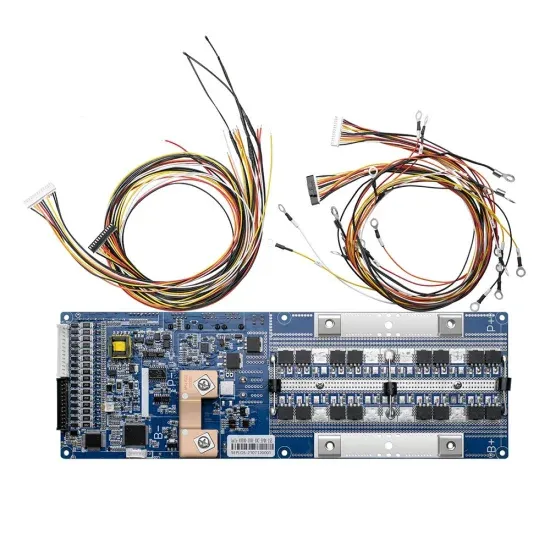

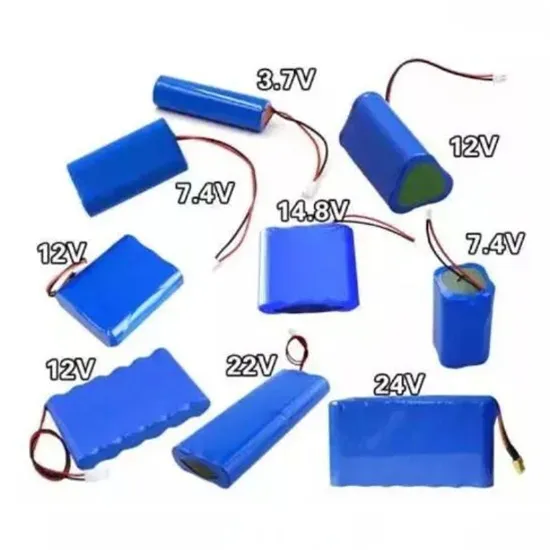

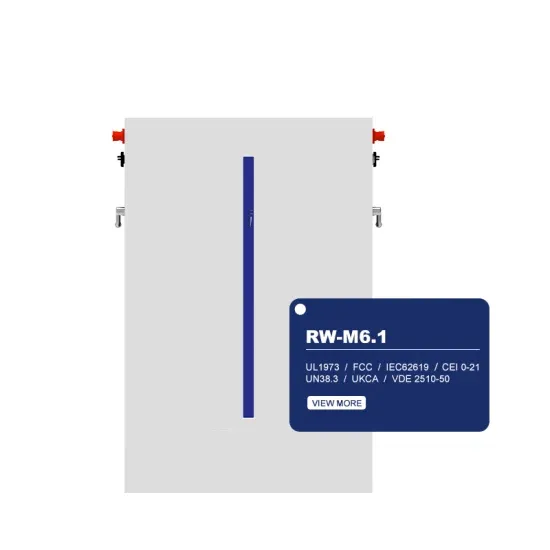

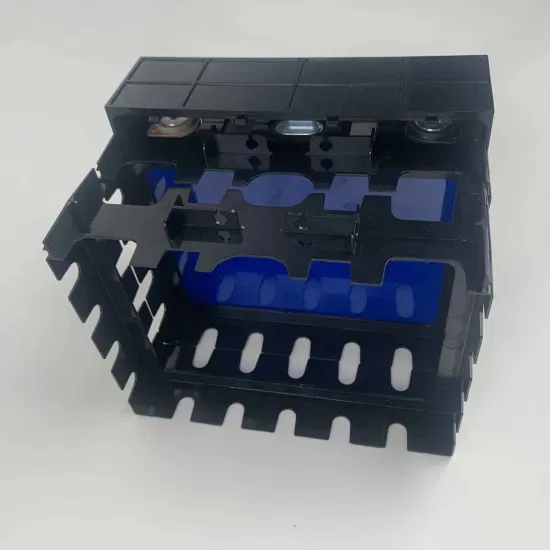

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.