Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get Price

Energy Storage Lithium Battery Supply Channels: A 2024 Guide

Let''s face it – the energy storage game has changed. With global lithium battery demand projected to grow at 14.3% CAGR through 2030 [2], securing reliable energy storage lithium

Get Price

Top 10 Companies in the Southeast Asia Automotive Energy

As the region accelerates its transition to electric mobility, energy storage systems are becoming critical components. This analysis profiles the Top 10 Companies revolutionizing

Get Price

ELECTRIC VEHICLE LITHIUM BATTERY_NEW NATIONAL STANDARD LITHIUM BATTERY

Phylion, a global new energy application service provider, was established in 2003. Based on the technology of the Institute of Physics of the Chinese Academy of Sciences, it is a well-known

Get Price

Sembcorp to expand Southeast Asia''s biggest battery storage site

Singapore''s state-owned energy and urban development company Sembcorp Industries has confirmed that it will be working on the expansion of its existing battery energy

Get Price

Battery energy storage systems: Southeast Asia''s key to

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future. What role will BESS play

Get Price

Hunan Yuneng Chooses Malaysia for its South East Asian lithium Battery

Hunan Yuneng Chooses Malaysia for its South East Asian lithium Battery Manufacturing Hub NEGERI SEMBILAN, 8 AUGUST 2025 – Leading Chinese battery

Get Price

Energy storage systems in Southeast Asia: Four Real-World

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get Price

Malaysia Factory | EVE Energy

He introduced EVE Energy''s global presence, highlighting 58 factories worldwide producing a wide range of products, from consumer

Get Price

Singapore

The first of its kind in Southeast Asia, the facility can recycle up to 14 tonnes of lithium-ion batteries daily—the equivalent of 280,000 smartphone

Get Price

Energy storage and power battery development in Southeast Asia

This article introduces the energy storage and battery development status in Southeast Asia, also why it''s developed and Chinese manufacturers in there.

Get Price

Energy storage battery market in southeast asia

Battery energy storage systems (BESS) have emerged as a solution for mitigating the intermittent nature of solar and wind power with the rise of renewable energy. The application of BESS is

Get Price

Chinese Battery Giants Expand Throughout Southeast Asia

Discover how Chinese lithium battery makers expand across Southeast Asia to overcome challenges and secure strategic advantages.

Get Price

Top 10 Companies in the Southeast Asia Automotive Energy Storage

As the region accelerates its transition to electric mobility, energy storage systems are becoming critical components. This analysis profiles the Top 10 Companies revolutionizing

Get Price

Southeast Asia Rechargeable Battery Market Size & Share

Southeast Asia Rechargeable Battery Market Analysis The Southeast Asia Rechargeable Battery Market size is estimated at USD 4.79 billion in 2025, and is expected to

Get Price

Southeast Asia Solar Storage Solutions: Real Customer Case

12 hours ago· Discover how innovative solar inverters, lithium batteries, and PV systems are powering businesses across Southeast Asia. Explore real-world success stories from the

Get Price

Southeast Asia Battery Market

The lithium-ion battery segment is experiencing rapid growth in the Southeast Asian market, driven by increasing adoption in electric vehicles and

Get Price

Southeast Asia Battery Energy Storage System Market Size

Discover the Southeast Asia Battery Energy Storage System market growth trends, size, demand, and key companies driving innovation and value in the industry.

Get Price

Southeast Asia Battery Market

The lithium-ion battery segment is experiencing rapid growth in the Southeast Asian market, driven by increasing adoption in electric vehicles and energy storage applications.

Get Price

Top 3 Energy Storage Suppliers in Southeast Asia

Luckily for us, most of the world''s best storage companies are in Southeast Asia. These companies store all that new renewable energy and they make sure we can get access

Get Price

Top 3 Energy Storage Suppliers in Southeast Asia

Luckily for us, most of the world''s best storage companies are in Southeast Asia. These companies store all that new renewable energy and

Get Price

ELECTRIC VEHICLE LITHIUM BATTERY_NEW

ESS Battery Solutions Energy Storage Solutions LEV Battery Solutions E-bike Battery Solutions After-sales service Products Golden Brick Series Energy

Get Price

Chinese lithium-ion battery makers accelerate production

Tier-2 lithium-ion battery manufacturers joined the game. The number of Chinese Tier-2 lithium-ion battery manufacturers expanding overseas increased from four in 2022 to six

Get Price

Fast-Growing Rack Battery Startups in Southeast Asia

Companies like CATL, EVE Energy, and Gotion High-Tech have launched multi-billion dollar projects in Indonesia, Thailand, and Vietnam, focusing on EV batteries and

Get Price

2024 Guide to Choosing Home Energy Storage Batteries in Southeast Asia

As Southeast Asia continues to embrace renewable energy, home energy storage systems are becoming an essential part of the region''s energy landscape. Whether you''re in Indonesia,

Get Price

Battery energy storage systems: Southeast Asia''s key to

In an article featured on The Business Times, Rodrigo Hernandezvara, Head of Solar C&I at ENGIE highlights how Battery Energy Storage Systems (BESS), combined with renewable

Get Price

6 FAQs about [Southeast Asia energy storage lithium battery distributor]

What is Southeast Asia battery market?

The Southeast Asia Battery Market report segments the industry into Battery Type (Lead-acid Battery, Lithium-ion Battery, Other Battery Types), End-User (Automotive, Data Centers, Telecommunication, Energy Storage, Other End-Users), and Geography (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Myanmar, Rest of Southeast Asia).

Why is the lithium-ion battery segment growing in Southeast Asia?

The lithium-ion battery segment is experiencing rapid growth in the Southeast Asian market, driven by increasing adoption in electric vehicles and energy storage applications. The segment's growth is propelled by its favorable capacity-to-weight ratio technology, which significantly influences market dynamics.

Why is the Southeast Asian battery market undergoing a significant transformation?

The Southeast Asian battery market is undergoing a significant transformation driven by technological advancements and shifting energy priorities. The region has witnessed a dramatic reduction in lithium-ion battery prices, making electric vehicles and energy storage solutions increasingly viable for widespread adoption.

What is the market share of lead acid batteries in Southeast Asia?

Lead acid batteries continue to dominate the Southeast Asian battery market, holding approximately 65% market share in 2024. This dominance is primarily driven by the automotive industry and data centers, which extensively use lead acid batteries for power storage applications.

What are the key players in the Southeast Asian battery market?

The Southeast Asian battery market features prominent global players like BYD Company, Tesla, GS Yuasa, Panasonic, and Samsung SDI alongside regional specialists. These companies are increasingly focusing on product innovation, particularly in lithium-ion technology and energy storage solutions for renewable integration.

Are battery energy storage systems revolutionizing energy solutions?

In an article featured on The Business Times, Rodrigo Hernandezvara, Head of Solar C&I at ENGIE highlights how Battery Energy Storage Systems (BESS), combined with renewable energy sources like solar power, are revolutionizing energy solutions for the region.

More related information

-

Central Asia Lithium Battery Energy Storage Power Station Project

Central Asia Lithium Battery Energy Storage Power Station Project

-

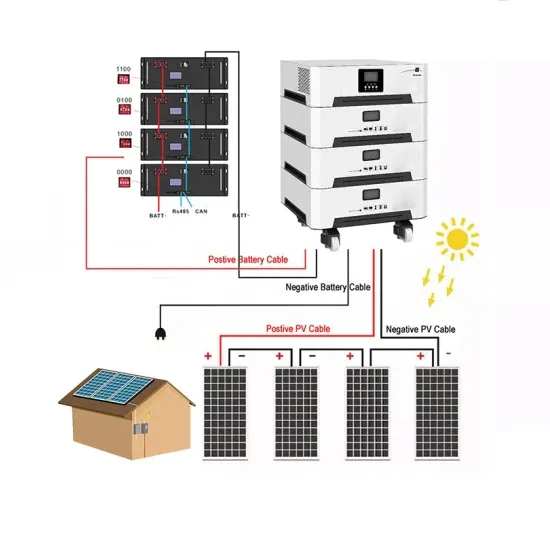

Lithium iron phosphate battery pack for home photovoltaic energy storage

Lithium iron phosphate battery pack for home photovoltaic energy storage

-

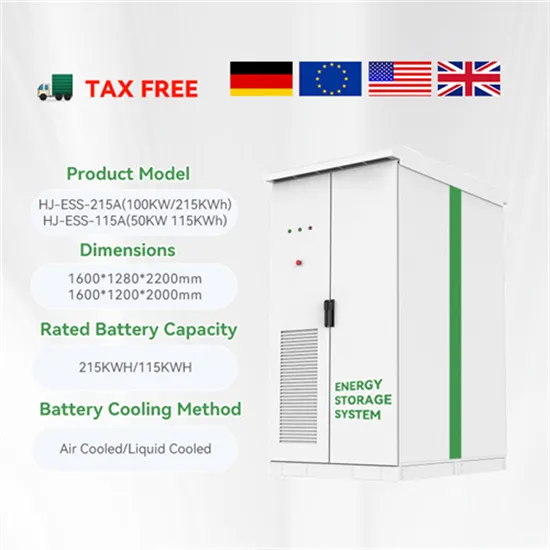

Price of lithium battery energy storage system

Price of lithium battery energy storage system

-

Wind and solar lithium battery energy storage battery price

Wind and solar lithium battery energy storage battery price

-

Guyana energy storage lithium battery price

Guyana energy storage lithium battery price

-

Panama lithium iron phosphate battery energy storage

Panama lithium iron phosphate battery energy storage

-

Malaysia Household Photovoltaic Energy Storage Lithium Battery Station Cabinet

Malaysia Household Photovoltaic Energy Storage Lithium Battery Station Cabinet

-

Explosion-proof lithium battery energy storage cabinet base station

Explosion-proof lithium battery energy storage cabinet base station

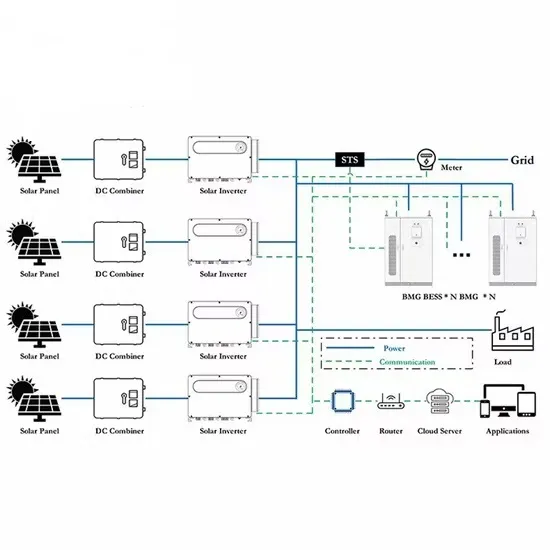

Commercial & Industrial Solar Storage Market Growth

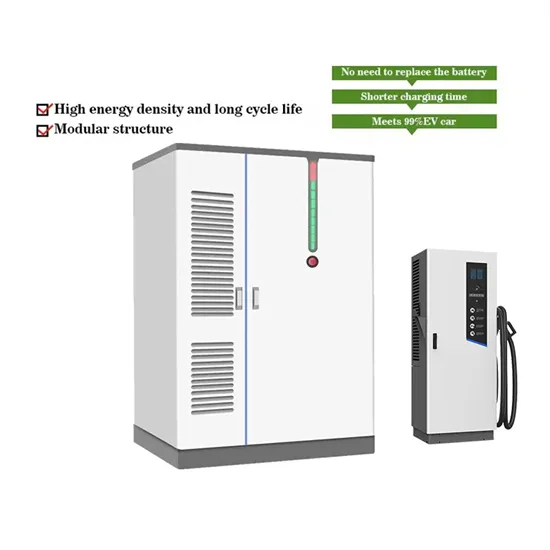

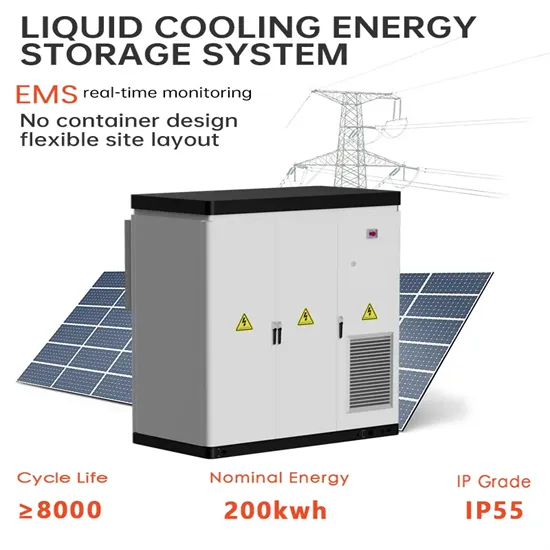

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.