Photovoltaic modules and laminates: Measures in force

"Photovoltaic modules and laminates consisting of crystalline silicon photovoltaic cells, including laminates shipped or packaged with other components of photovoltaic

Get Price

Photovoltaic panels – transportation and customs duties

According to TARIC, customs duty for photosensitive semiconductor devices, including photovoltaic cells whether or not assembled in modules or made up into panels; light-emitting

Get Price

CSMS #50263965

Proclamation 10101 made two modifications to the Section 201 Action with regards to solar cells and panels: (1) The duty rate of the safeguard tariff for solar cells (over quota

Get Price

Photovoltaic energy storage battery customs declaration

In other words, the intermittent feature of renewable energy sources indicates that it is essential to connect solar PV system to the grid or battery energy storage (BES) to ensure

Get Price

How to declare customs for solar power generation system

Successfully declaring customs for a solar power generation system requires meticulous planning and adherence to regulatory demands. Key considerations include the

Get Price

Customs code for photovoltaic panels

What is customs duty on solar panels? According to TARIC, customs duty for photosensitive semiconductor devices, including photovoltaic cells whether or not assembled in modules or

Get Price

Federal Register :: Antidumping and Countervailing Duty Orders

The U.S. Department of Commerce (Commerce) determines that, except as noted below, imports of certain crystalline silicon photovoltaic cells, whether or not assembled into

Get Price

India Lowers Customs Duties For Solar Cells & Modules

India has officially lowered the Basic Customs Duty (BCD) on imported solar cells from 25% to 20%, and on solar modules from 40% to 20% which should boost the country''s

Get Price

Importing solar panels from China to the European Union

Below we present an example of customs duty rates on photovoltaic panels along with the applicable HS codes: Photosensitive semiconductor devices,

Get Price

HS Code 85414300

Photovoltaic cells assembled in modules or made up into panels; Examples: - Photovoltaic cells assembled in modules (500 watts, 1200mm x 600mm x 40mm)

Get Price

QB 25-507 2025 Solar Cells and Modules

Such duty shall be imposed on the declared value of such modules, including the cost or value of the non-cell portions thereof (such as aluminum

Get Price

CBP Set to Enforce Solar Utilization Rules, Notifies Importers of

U.S. Customs and Border Protection (CBP) released Cargo System Messaging Service (CSMS) #59311800 on February 9 reminding importers of their compliance obligations

Get Price

CSMS # 61775059

Filers can continue to enter solar cells for quota using the same HTS sequence noted in the quota bulletin. The expanded limit does not modify quota procedures.

Get Price

US Department of Commerce Determines that Imports from

On August 18, 2023, the US Department of Commerce ("Commerce") issued its final affirmative determinations that solar cells and modules completed in Cambodia, Malaysia, Thailand, or

Get Price

Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled

Based on affirmative final determinations by the U.S. Department of Commerce (Commerce) and the U.S. International Trade Commission (ITC), Commerce is issuing

Get Price

DHL Imoprt CS Guide

Exclusion Criteria Solar cells and products with solar cells manufactured in China which are not subject to this anti-dumping case must comply with one of the following criteria in order to be

Get Price

Section 201 – Imported Solar Cells and Modules

A Proclamation to Continue Facilitating Positive Adjustment to Competition From Imports of Certain Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled Into

Get Price

Photovoltaic panels – transportation and customs

According to TARIC, customs duty for photosensitive semiconductor devices, including photovoltaic cells whether or not assembled in modules or made up

Get Price

HS Code 85414200

Photovoltaic cells not assembled in modules or made up into panels; Examples: - Photovoltaic cells with an area of 15 cm x 10 cm, used for prototype

Get Price

How to declare customs for solar power generation

Successfully declaring customs for a solar power generation system requires meticulous planning and adherence to regulatory demands.

Get Price

Bifacial solar panel exclusion ends for solar cells Section 201

President Biden issued Proclamation 10779 on June 21, 2024 removing the exemption from Section 201 duties on solar cells for ''bifacial solar panels'' that are imported on

Get Price

QB 25-507 2025 Solar Cells and Modules

Such duty shall be imposed on the declared value of such modules, including the cost or value of the non-cell portions thereof (such as aluminum frames), as Customs in its

Get Price

Commerce Issues Circumvention Investigation Preliminary

On December 1, 2022, the US Department of Commerce (Commerce) published its preliminary determination in the circumvention investigation into whether imports of crystalline silicon

Get Price

From Emergency Measures to Enforcement: The Solar

Two years after declaring a national emergency and instructing the US Department of Commerce (Commerce) to pause the imposition of AD/CVD duties applicable to certain

Get Price

6 FAQs about [Photovoltaic cell module customs declaration]

Who imports the solar cells &/or solar modules covered by this certification?

The solar cells and/or solar modules covered by this certification were imported by {NAME OF IMPORTING COMPANY} on behalf of {NAME OF U.S. CUSTOMER}, located at {ADDRESS OF U.S. CUSTOMER}. If the importer is not acting on behalf of the first U.S. customer, include the following sentence as paragraph C of this certification:

Are crystalline silicon photovoltaic cells covered by antidumping duty or countervailing duty?

Absent the affirmative determination of circumvention, are not covered by the antidumping duty or countervailing duty orders on crystalline silicon photovoltaic cells, whether or not assembled into modules, from the People's Republic of China; and 4.

How to import photovoltaic panels?

If you want to import photovoltaic panels, you should have at least basic parameters of the goods specified. Based on your requirements, the supplier will be able to suggest you the most suitable product. The country that ranked first in the production of photovoltaic panels in the world is China.

Are solar cells/solar modules exported from Malaysia or Vietnam circumventing the orders?

We determine, pursuant to section 781 (b) of the Act and 19 CFR 351.225 (g), that solar cells/solar modules exported from, and produced in, Malaysia, or Vietnam by the entities listed for each of those countries in Appendix III to this notice, using wafers produced in China that were exported by specific companies are not circumventing the Orders.

Will bifacial solar panels be exempt from tariffs?

In his announcement, the President included an exemption for bifacial solar panels. This decision comes after the ITC recommended in November 2021 to extend the safeguard tariffs for an additional four years. Proclamations

Do photovoltaic panels have CE marking?

Photovoltaic panels are listed under code 20: “Structural Metallic Products and Ancillaries” in Annex IV. The regulation states that products such as solar panels should have CE marking. It means that the declaration of conformity is also required.

More related information

-

East Asian photovoltaic cell module manufacturer

East Asian photovoltaic cell module manufacturer

-

Photovoltaic module cell project

Photovoltaic module cell project

-

550w solar photovoltaic cell module price

550w solar photovoltaic cell module price

-

500w photovoltaic module cell size

500w photovoltaic module cell size

-

1500v photovoltaic cell module

1500v photovoltaic cell module

-

Base station photovoltaic power module Huawei

Base station photovoltaic power module Huawei

-

Azerbaijan photovoltaic module prices

Azerbaijan photovoltaic module prices

-

Latest photovoltaic module equipment prices

Latest photovoltaic module equipment prices

Commercial & Industrial Solar Storage Market Growth

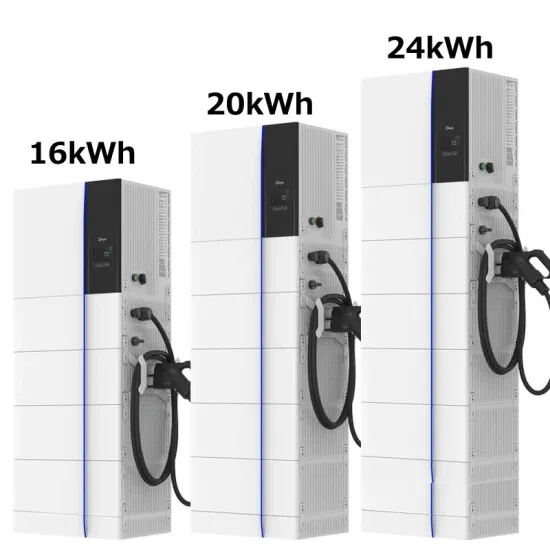

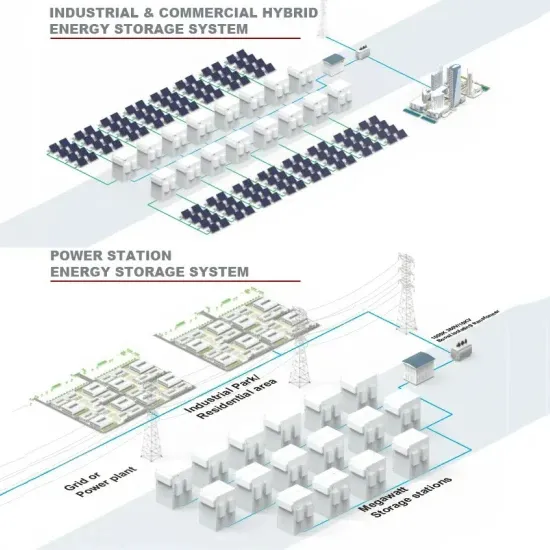

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.