Latest Solar Panel And Energy Advancements Across US

This article explores recent advancements in solar panel technology, policies encouraging adoption, leading states, and prospects for solar energy in the US by 2025.

Get Price

China becomes solar energy superpower, dominates

A new report by Wood Mackenzie reveals that China will control over 80 percent of the world''s production of polysilicon, wafers, cells, and

Get Price

Hanwha Qcells'' new Cartersville factory set for 3.3

Official launch of module production in Cartersville, Georgia in April will add 3.3 GW to annual U.S. solar capacity Establishing itself as the

Get Price

The exponential growth of solar power will change the world

It could equally be enhanced if America released pent up demand, by making it easier to install panels on homes and to join the grid—the country has a terawatt of new solar

Get Price

Solar Market Insight Report – SEIA

4 days ago· learn more About the Report U.S. Solar Market Insight® is a quarterly publication of the Solar Energy Industries Association (SEIA)® and

Get Price

United States Surpasses 50 GW of Solar Module Manufacturing

In 2020, SEIA set a goal for 50 GW of U.S. solar manufacturing capacity by 2030, equivalent to the power output from 27 Hoover Dams. This bold target focuses on all levels of

Get Price

US solar manufacturing soars, but gaps and uncertainty persist

First Solar in late September opened a $1.1 billion, 3.5-GW panel production hub in Alabama, pushing its domestic manufacturing footprint to nearly 11 GW -- more than all US module

Get Price

US Solar Panel Manufacturing capacity grows by 11 GW in 2024

During the first quarter of 2024, the United States witnessed a groundbreaking addition of 11 gigawatts (GW) of new solar panel manufacturing capacity, marking the most

Get Price

New solar plants expected to support most U.S. electric

In our latest Short-Term Energy Outlook (STEO), we expect that U.S. renewable capacity additions—especially solar—will continue to drive the growth of U.S. power

Get Price

Quarterly Solar Industry Update

On October 1, 2024, the U.S. Department of Commerce issued a preliminary decision to impose countervailing duties on c-Si panels and cells produced in Vietnam, Malaysia, Thailand, and

Get Price

Solar power in China

The expansion of the solar sector in China has been criticized due to the large quantities of waste being produced and improperly disposed of from the

Get Price

U.S. Solar Manufacturing Capacity: Q2 2024 Analysis

U.S. solar module manufacturing capacity reaches over 31 GW in Q2 2024 under new federal incentives but continues to face resistance. This report explores the ongoing

Get Price

Solar power installations hit new highs

A worker inspects solar photovoltaic panels in Huaibei, Anhui province, on Dec 16. LI XIN/FOR CHINA DAILY China is on track to set a new

Get Price

First Solar announces fifth U.S. factory as Inflation Reduction Act

First Solar, the nation''s largest solar panel manufacturer, announced Thursday that it will build its fifth U.S. factory as the Inflation Reduction Act spurs a domestic manufacturing

Get Price

Latest Solar Panel And Energy Advancements Across

This article explores recent advancements in solar panel technology, policies encouraging adoption, leading states, and prospects for

Get Price

U.S. solar manufacturing boom "real — but fragile," said CEA

The United States is now the third-largest solar module manufacturer in the world, and more growth is on the way. Clean Energy Associates (CEA) projects that the U.S. will

Get Price

First Solar plans $1.1 billion investment in fifth U.S. panel factory

First Solar Inc on Thursday announced plans to spend up to $1.1 billion on what will be its fifth U.S. factory to meet booming demand for American-made solar panels.

Get Price

Quarterly Solar Industry Update

On October 1, 2024, the U.S. Department of Commerce issued a preliminary decision to impose countervailing duties on c-Si panels and cells produced in

Get Price

Solar Panel Expansion

ZNshine Solar''s expansion plan includes bolstering its PV module output capacity by 10 GW or more. The solar module manufacturer will build a

Get Price

U.S. solar panel manufacturing capacity grew 4x since climate

Solar module manufacturing capacity in the United States now exceeds 31 gigawatts (GW) — a nearly four-fold increase since the Inflation Reduction Act (IRA) became

Get Price

US solar panel manufacturing jumps 4-fold after Inflation

U.S. solar panel manufacturing capacity has increased 4-fold s ince the passage of the Inflation Reduction Act, up by over 10 GW to now surpass 31 GW nationwide, according

Get Price

Solar, battery storage to lead new U.S. generating capacity

We expect 63 gigawatts (GW) of new utility-scale electric-generating capacity to be added to the U.S. power grid in 2025 in our latest Preliminary Monthly Electric Generator

Get Price

China is Set to Produce Half the World''s Renewables

China''s pioneering role in solar energy China''s pivotal role in solar energy expansion is underscored by its massive investment and robust

Get Price

Solar power sets record in the US with 50 GW added

Texas led the nation in new solar capacity additions, installing 11.6 GW, while 21 states set new annual records, and 13 states added over 1 GW

Get Price

U.S. solar manufacturing boom "real — but fragile,"

The United States is now the third-largest solar module manufacturer in the world, and more growth is on the way. Clean Energy

Get Price

Solar Industry Research Data – SEIA

Solar energy in the United States is booming. Along with our partners at Wood Mackenzie Power & Renewables, SEIA tracks trends and trajectories in the

Get Price

6 FAQs about [Latest expansion of solar panel production]

How many solar modules will the US produce in 2025?

The U.S. is on track to reach 13 GW of cell manufacturing capacity and 65 GW of module assembly in 2025, said a report from Clean Energy Associates. The United States is now the third-largest solar module manufacturer in the world, and more growth is on the way.

How has solar module manufacturing changed over the years?

Solar module manufacturing has grown five-fold after the passage of critical federal energy policies. As a result, the United States is now the 3 rd largest solar module producer in the world. Learn more about the surging American solar manufacturing sector. ### About SEIA®:

How much solar power will the electric power sector add in 2025?

We expect U.S. utilities and independent power producers will add 26 gigawatts (GW) of solar capacity to the U.S. electric power sector in 2025 and 22 GW in 2026. Last year, the electric power sector added a record 37 GW of solar power capacity to the electric power sector, almost double 2023 solar capacity additions.

How big is solar tracker manufacturing capacity?

Solar tracker manufacturing capacity now exceeds 80 GW. “Reaching 50 GW of domestic solar manufacturing capacity is a testament to what we can achieve with smart, business-friendly public policies in place,” said SEIA president and CEO Abigail Ross Hopper.

How many GW of solar cells will a solar tracker produce?

According to the Solar Energy Industries Association’s (SEIA) Supply Chain Dashboard, companies have announced plans for 56 GW of new U.S. solar cell production, as well as 24 GW of wafers and 13 GW of ingots. Solar tracker manufacturing capacity now exceeds 80 GW.

What is a solar supply chain Target?

This bold target focuses on all levels of the solar supply chain, including modules, cells, ingots and wafers, polysilicon, trackers, and inverters. At the time, there was only 7 GW of domestic module manufacturing capacity, 41 metric tons of polysilicon manufacturing capacity, and some inverter and racking manufacturing.

More related information

-

Photovoltaic solar panel production and wholesale

Photovoltaic solar panel production and wholesale

-

Containerized solar equipment photovoltaic panel production

Containerized solar equipment photovoltaic panel production

-

Photovoltaic project solar panel production

Photovoltaic project solar panel production

-

Solar panel factory expansion

Solar panel factory expansion

-

Slovakia solar panel production plant

Slovakia solar panel production plant

-

Estonian solar panel production companies

Estonian solar panel production companies

-

New solar panel production plant

New solar panel production plant

-

Photovoltaic solar panel production in India

Photovoltaic solar panel production in India

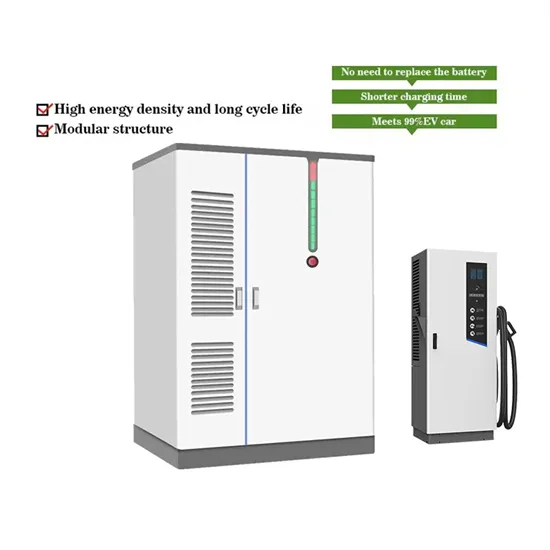

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.