CHINA''S ACCELERATING GROWTH IN NEW TYPE

Research fields will focus on long-life and high-safety battery, large-scale, high-capacity, and high-efficiency energy storage, mobile energy storage for vehicles, etc.3 For promoting the entry of

Get Price

New report: European battery storage grows 15% in 2024, EU energy

21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing

Get Price

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get Price

Grid Storage Battery Capacity by Country in 2023 | NPUC

The Energy Institute''s annual Statistical Review of World Energy reveals the grid storage battery capacity of every country in 2023. This treemap, created in partnership with

Get Price

2025 energy storage power station ranking

Developers and power plant owners plan to significantly increaseutility-scale battery storage capacity in the United States over the next three years,reaching 30.0 gigawatts (GW) by the

Get Price

Electricity generation, capacity, and sales in the United States

Most electric power plants use some of the electricity they produce to operate the power plant. Net generation excludes the electricity used to operate the power plant. Energy

Get Price

List of largest power stations

List of largest power stations Three Gorges Dam in China, currently the world''s largest hydroelectric power station, and the largest power-producing facility

Get Price

Energy storage industry put on fast track in China

NANJING, Feb. 14 -- At an energy storage station in eastern Chinese city of Nanjing, a total of 88 white battery cartridges with a storage capacity of nearly 200,000 kilowatt-hours are

Get Price

Research on Location and Capacity Planning Method of Distributed Energy

Aiming at the planning problems of distributed energy storage stations accessing distribution networks, a multi-objective optimization method for the location and capacity of

Get Price

Capacity of Energy Storage Power Stations: The Backbone of

The global energy storage market hit $33 billion recently, churning out 100 gigawatt-hours annually [1]. But here''s the kicker – we''ll need 50 times that capacity by 2040 to meet

Get Price

Uniper recommissions Happurg pumped-storage plant

Especially in southern Germany, with its strong industrial demand, there is a lack of predictable power plant capacity. With the Happurg pumped-storage plant,

Get Price

EIA Annual Energy Outlook

We assume that a battery storage facility can receive two sources of revenue payment: an energy payment (from selling electricity generation to

Get Price

Solar and battery storage to make up 81% of new U.S.

Texas, with an expected 6.4 GW, and California, with an expected 5.2 GW, will account for 82% of the new U.S. battery storage capacity.

Get Price

Global installed energy storage capacity by scenario, 2023 and 2030

Global installed energy storage capacity by scenario, 2023 and 2030 - Chart and data by the International Energy Agency.

Get Price

Pumped Storage Power Station Capacity Standards: Why Size

Ever wondered how renewable energy grids avoid becoming "all sunshine and rainbows until the wind stops blowing"? Enter pumped storage hydropower plants – the Swiss

Get Price

Uniper recommissions Happurg pumped-storage plant for around

Especially in southern Germany, with its strong industrial demand, there is a lack of predictable power plant capacity. With the Happurg pumped-storage plant, we want to make more storage

Get Price

REPORT: Energy Storage''s Meteoric Rise Breaks Another Record

Texas and California continue to lead the market, with 61% of the total installed capacity in Q4, while the remaining 39% was installed across 13 states, expanding storage

Get Price

Energy storage power station annual summary

Aiming at the planning problems of distributed energy storage stations accessing distribution networks, a multi-objective optimization method for the location and capacity of distributed

Get Price

EIA expands data on capacity and usage of power

The U.S. Energy Information Administration''s (EIA) Electric Power Monthly now includes more information on usage factors for utility-scale

Get Price

How much electricity does the energy storage station store

Estimates suggest the energy storage market is growing rapidly, with storage stations expected to contribute to over 200 gigawatt-hours of energy annually by 2030, driven

Get Price

Global installed energy storage capacity by scenario,

Global installed energy storage capacity by scenario, 2023 and 2030 - Chart and data by the International Energy Agency.

Get Price

How much electricity does the energy storage station store

1. Energy storage stations have a significant capacity for electricity storage annually. 2. Their capacity often exceeds several hundred megawatt-hours to gigawatt-hours,

Get Price

Solar and battery storage to make up 81% of new U.S. electric

In 2023, 6.4 GW of new battery storage capacity was added to the U.S. grid, a 70% annual increase. Texas, with an expected 6.4 GW, and California, with an expected 5.2

Get Price

China''s Battery Storage Capacity Doubles in 2024

China''s electrochemical energy storage industry experienced significant growth in 2024, with installed capacity surging past previous records. A report from the China Electricity

Get Price

Solar and battery storage to make up 81% of new U.S.

In 2023, 6.4 GW of new battery storage capacity was added to the U.S. grid, a 70% annual increase. Texas, with an expected 6.4 GW, and

Get Price

How much electricity can a storage power station store in a year?

For large-scale installations, this capacity can often reach several hundred megawatt-hours, resulting in substantial annual storage potential. The design and scale of a

Get Price

6 FAQs about [The annual storage capacity of the energy storage power station]

How many GW of energy storage installations are there in 2024?

HOUSTON/WASHINGTON, D.C., March 19, 2025 — The U.S. energy storage market set a new record in 2024 with 12.3 gigawatts (GW) of installations across all segments, according to the latest U.S. Energy Storage Monitor report released today by the American Clean Power Association (ACP) and Wood Mackenzie.

What is the energy storage Grand Challenge?

This report, supported by the U.S. Department of Energy’s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected energy storage technologies in the transportation and stationary markets.

Where is energy storage growing?

“Energy storage has entered a new phase of growth with its first year of double-digit deployment. We are increasingly seeing the industry’s growth diversified across geographic regions, with 30% of storage capacity additions in Q4 2024 represented by New Mexico, Oregon, and Arizona,” said Kelsey Hallahan, ACP Sr. Director of Market Intelligence.

Where will stationary energy storage be available in 2030?

The largest markets for stationary energy storage in 2030 are projected to be in North America (41.1 GWh), China (32.6 GWh), and Europe (31.2 GWh). Excluding China, Japan (2.3 GWh) and South Korea (1.2 GWh) comprise a large part of the rest of the Asian market.

What is the growth rate of industrial energy storage?

The majority of the growth is due to forklifts (8% CAGR). UPS and data centers show moderate growth (4% CAGR) and telecom backup battery demand shows the lowest growth level (2% CAGR) through 2030. Figure 8. Projected global industrial energy storage deployments by application

What types of energy storage are included?

Other storage includes compressed air energy storage, flywheel and thermal storage. Hydrogen electrolysers are not included. Global installed energy storage capacity by scenario, 2023 and 2030 - Chart and data by the International Energy Agency.

More related information

-

Calculation of energy storage capacity of photovoltaic power station

Calculation of energy storage capacity of photovoltaic power station

-

Bahamas Energy Storage Power Station Capacity Electricity Price

Bahamas Energy Storage Power Station Capacity Electricity Price

-

Configuration of energy storage power station capacity

Configuration of energy storage power station capacity

-

Nordic energy storage power station capacity BESS

Nordic energy storage power station capacity BESS

-

BESS energy storage power station capacity out

BESS energy storage power station capacity out

-

Energy storage power station power and capacity

Energy storage power station power and capacity

-

Minimum capacity of energy storage power station

Minimum capacity of energy storage power station

-

Iraq Grid Energy Storage Power Station

Iraq Grid Energy Storage Power Station

Commercial & Industrial Solar Storage Market Growth

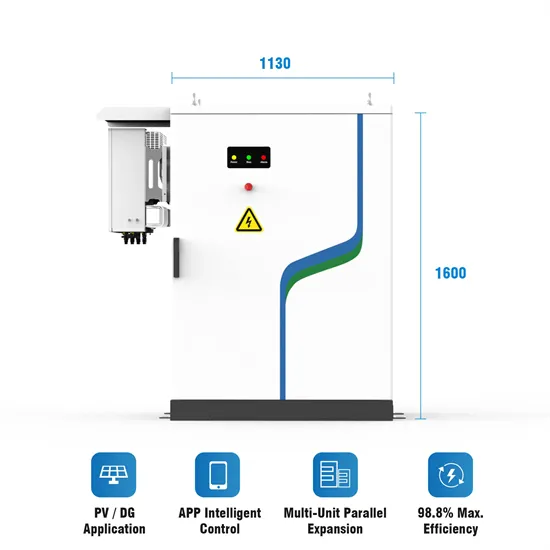

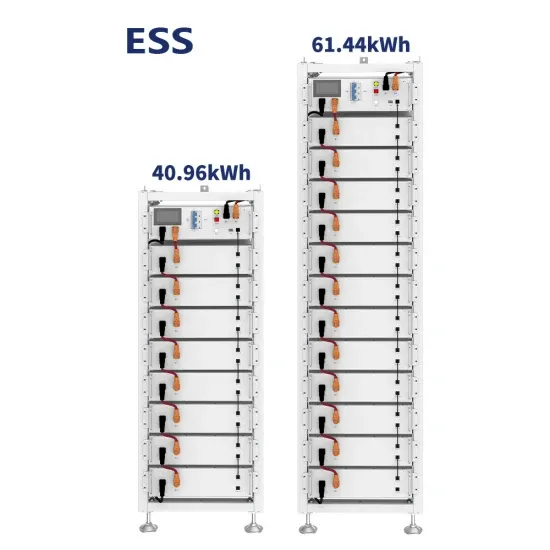

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.