pv magazine USA: pv magazine USA, the leading

pv magazine USA, the leading solar and energy storage trade media platform. Industry news covering market trends, technological

Get Price

Solar Industry Research Data – SEIA

Solar energy in the United States is booming. Along with our partners at Wood Mackenzie Power & Renewables, SEIA tracks trends and trajectories in the

Get Price

Top 10 Energy Storage Companies in North America | PF Nexus

Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

The Booming Future of Solar and Battery Storage in North

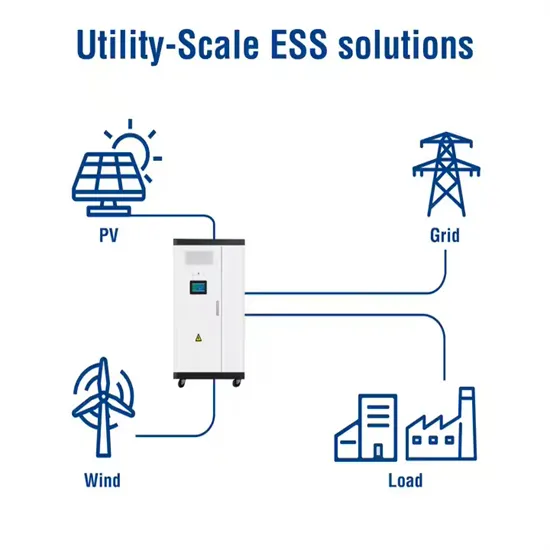

The market is now structured around three segments: utility-scale storage, residential storage, and commercial & industrial (C&I) storage. States like California and Texas

Get Price

North America Solar PV Market Size, Growth Outlook

The North America solar PV market size crossed USD 29.3 billion in 2023 and is projected to observe around 6.2% CAGR between 2024 and 2032, due to

Get Price

North America Solar PV Market Size, Growth Outlook 2024-2032

The market size of North America solar PV was reached USD 29.3 billion in 2023 and is anticipated to witness 6.2% CAGR from 2024 to 2032, due to higher usage to power various

Get Price

The Solar and Battery Storage Revolution: Powering North America

Discover how solar and battery storage are revolutionizing North America''s energy future. Learn about market trends, benefits, incentives, and what''s next for clean power.

Get Price

The Solar and Battery Storage Revolution: Powering North

Discover how solar and battery storage are revolutionizing North America''s energy future. Learn about market trends, benefits, incentives, and what''s next for clean power.

Get Price

Minnesota Solar Guide

Each MW of solar PV installed in Minnesota supports 13 installation jobs. Based on the funding commited by the Minnesota Department of Commerce through the Made in Minnesota Solar

Get Price

The state of the domestic solar and energy storage

Anza, a subscription-based data and analytics software platform, released a Q1 2025 report that reveals trends in domestic manufacturing of

Get Price

US energy storage installations grow 33% year-over-year

Storage deployment in the United States grew across all segments and is forecast to grow another 25% in 2025, according to Wood

Get Price

Best Practices for Operation and Maintenance of

National Renewable Energy Laboratory, Sandia National Laboratory, SunSpec Alliance, and the SunShot National Laboratory Multiyear Partnership (SuNLaMP) PV O&M Best Practices

Get Price

Residential Energy Storage: U.S. Manufacturing and Imports

The results of this analysis indicate that the U.S. residential market was dominated by domestic producers in 2020, largely due to the large share of the market accounted for by Tesla, but

Get Price

US energy storage installations grow 33% year-over-year

Storage deployment in the United States grew across all segments and is forecast to grow another 25% in 2025, according to Wood Mackenzie.

Get Price

US energy storage installations grow 33% year-over-year

US energy storage installations grow 33% year-over-year Storage deployment in the United States grew across all segments and is forecast to grow another 25% in 2025,

Get Price

Solar Energy Storage Market Size & Share Report, 2025 – 2034

The North America solar energy storage market will witness a CAGR of over 13% in 2034. The sector is inspired by increasing energy demand caused by urbanization and expansion in

Get Price

Top 10 Solar Companies in North America | PF Nexus

Solar PV is the preferred technology for developers of utility-scale solar farms, distributed commercial and industrial (C&I) rooftop projects, and

Get Price

Major Solar Projects List – SEIA

There are over 1,200 major energy storage projects currently in the database, representing more than 92,500 MWh of capacity. The list shows

Get Price

U.S. Solar Photovoltaic System and Energy Storage Cost

The National Renewable Energy Laboratory (NREL) publishes benchmark reports that disaggregate photovoltaic (PV) and energy storage (battery) system installation costs to inform

Get Price

Residential Energy Storage: U.S. Manufacturing and Imports

Abstract The U.S. residential energy storage market grew rapidly during 2017–20, driven by homeowners seeking to increase resiliency, changes in net metering programs, and the

Get Price

Solar and battery storage to make up 81% of new U.S.

With a planned photovoltaic capacity of 690 megawatts (MW) and battery storage of 380 MW, it is expected to be the largest solar project in the

Get Price

Sungrow unveils modular inverter, battery energy storage systems – pv

2 days ago· Sungrow announced three new products at RE+ 2025, the largest solar and energy storage trade show in North America. The company is displaying the new products at Booth

Get Price

Major Solar Projects List – SEIA

There are over 1,200 major energy storage projects currently in the database, representing more than 92,500 MWh of capacity. The list shows that there are more than 176

Get Price

North America represents 21% of global energy storage market

The energy storage market is growing at a strong 23% compound annual growth rate, with annual additions projected to reach 88GW/278GWh in 2030, or 5.3 times the

Get Price

The Booming Future of Solar and Battery Storage in North America

The market is now structured around three segments: utility-scale storage, residential storage, and commercial & industrial (C&I) storage. States like California and Texas

Get Price

North America represents 21% of global energy

The energy storage market is growing at a strong 23% compound annual growth rate, with annual additions projected to reach 88GW/278GWh

Get Price

North America Solar Energy Storage Market Analysis

The North America solar energy storage market is experiencing robust growth driven by favorable government policies, declining battery costs, technological advancements, and increasing

Get Price

6 FAQs about [Photovoltaic energy storage system installations in North America]

How big is the North America solar PV market?

The North America solar PV market size crossed USD 29.3 billion in 2023 and is projected to observe around 6.2% CAGR between 2024 and 2032, due to higher usage to power various electrical devices or fed into the grid for broader distribution.

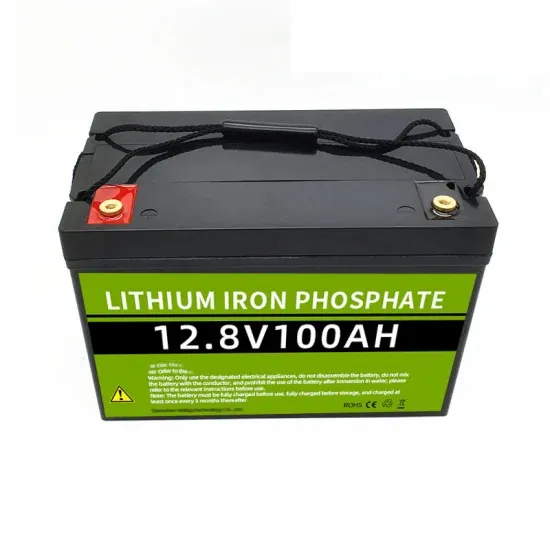

How many MWh is a residential energy storage system?

The data set totals 263 MWh, and covers all or a portion of installations in 20 states and the District of Columbia. WoodMac estimated that U.S. residential energy storage installations were 540 MWh in 2020, though an exact share of the market is not calculated here due to differences in the data such as when systems are considered installed.

What is the future of solar PV?

In addition, ongoing innovations and product advancements comprising of higher efficiency solar cells, bifacial panels, smart inverters, and energy storage integration will propel the business scenario. Looking for region specific data? U.S. solar PV market revenue to cross USD 68.5 billion by 2032.

Why do solar PV manufacturers invest in research and development?

Solar PV manufacturers invest in research and development activities to improve the efficiency, performance, and durability of the solar PV modules and components. Collaborations between various solar PV manufacturers and local partners will support the market expansion into new geographic regions and segments.

Can energy storage be used in small nonresidential systems?

While this paper focuses on residential energy storage, some of the same ESSs may be used in small nonresidential systems. Nonresidential installations include installations at industrial sites, commercial buildings, nonprofits, government buildings, and similar locations, and do not include utility installations.

How much does a PV system cost?

Our operations and maintenance (O&M) analysis breaks costs into various categories and provides total annualized O&M costs. The MSP results for PV systems (in units of 2022 real USD/kWdc/yr) are $28.78 (residential), $39.83 (community solar), and $16.12 (utility-scale).

More related information

-

North America Huijue Energy Storage Cabinet Photovoltaic

North America Huijue Energy Storage Cabinet Photovoltaic

-

Which energy storage photovoltaic power generation company is best in North America

Which energy storage photovoltaic power generation company is best in North America

-

North Asia Photovoltaic Energy Storage

North Asia Photovoltaic Energy Storage

-

North Asia Industrial Photovoltaic Energy Storage Power Station

North Asia Industrial Photovoltaic Energy Storage Power Station

-

North Korea s major energy storage photovoltaic brand

North Korea s major energy storage photovoltaic brand

-

Equatorial Guinea s photovoltaic energy storage ratio

Equatorial Guinea s photovoltaic energy storage ratio

-

Photovoltaic power generation 100 million with energy storage

Photovoltaic power generation 100 million with energy storage

-

Photovoltaic energy storage cabinet battery project

Photovoltaic energy storage cabinet battery project

Commercial & Industrial Solar Storage Market Growth

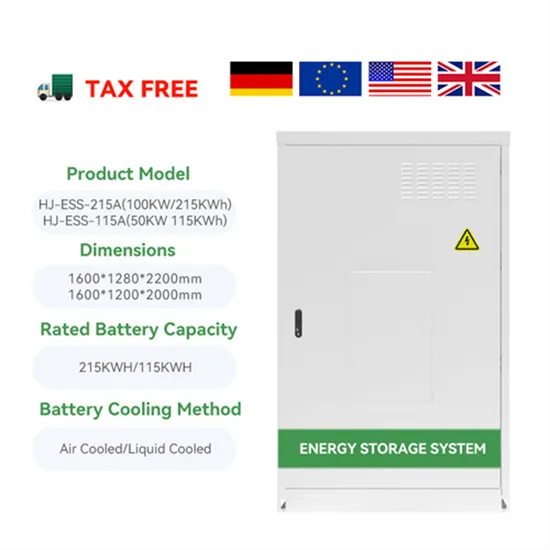

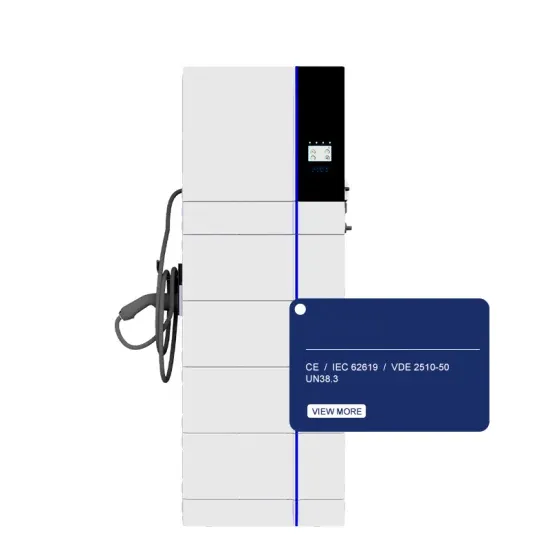

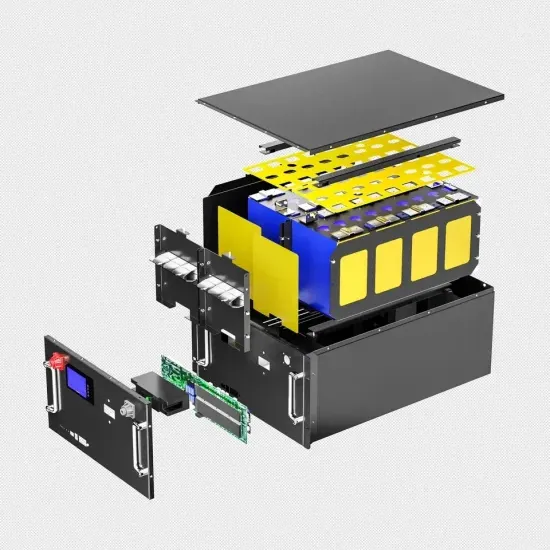

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.