Introduction to Battery Energy Storage Markets: Spain and

This blog post forms part of our new series, "Introduction to BESS (Battery Energy Storage Systems) Markets", which will cover the drivers and revenue streams of different EU

Get Price

5 factors that will drive Spanish capacity pricing

New build batteries and existing CCGTs are likely to dominate price setting in the Spanish capacity market across the 2020s, but there will also be other technologies competing

Get Price

5 factors that will drive Spanish capacity pricing

New build batteries and existing CCGTs are likely to dominate price setting in the Spanish capacity market across the 2020s, but there will also be

Get Price

The latest developments in the Spanish energy

Driven by the goal of energy transformation, Spain''s energy storage industry is full of potential, with continuous technological innovation and progress. The

Get Price

Unlocking Opportunity

Providing analysis on the need for long duration energy storage in GB markets and, separately, assessing the value of locational pricing to inform policy decision.

Get Price

Energy Storage Systems Industry Analysis 2019-2024 and

Energy Storage Systems Industry Analysis 2019-2024 and Forecast to 2029 & 2034 - Grid Flexibility and Demand Response Push Energy Storage Systems to New Heights,

Get Price

The latest developments in the Spanish energy storage industry

Driven by the goal of energy transformation, Spain''s energy storage industry is full of potential, with continuous technological innovation and progress. The government has given strong

Get Price

The future of energy in Spain: Trends and forecasts for 2025

The Spanish energy market is at a time of profound transformation, driven by factors such as the energy transition, the growing demand for renewable energy and the volatility of fossil fuel

Get Price

Spain GES2024

In effect, the laws allow co-located energy storage units to capture energy from the renewable generation project at a time point when the grid price may not be economically viable and

Get Price

Battery storage in Spain: Opportunities and challenges for...

On March 12th 2024, a spectacle took place on the Spanish day-ahead market (pool) that will be repeated in this form for days, weeks and perhaps even years to come. The pool price fell to

Get Price

Down 14% This Year, Is Tesla Stock a Buy?

1 day ago· Tesla(NASDAQ: TSLA) shares are down about 14% so far in 2025, despite recent excitement around autonomy and energy storage. The electric-vehicle maker is trying to pivot

Get Price

What is the price of selling energy storage vehicles?

The transaction cost for energy storage vehicles hinges on numerous factors, including 1. battery capacity and technology, 2. manufacturer reputation, 3. vehicle size and

Get Price

SPAIN

Spain''s battery storage market is dominated by customer-sited systems. Utility-scale storage remains nascent. Currently, Spain''s storage market is mainly composed of small-scale

Get Price

Europe faces an unusual problem: ultra-cheap energy

Owing to the rapid spread of solar power, Spanish energy is increasingly cheap. Between 11am and 7pm, the sunniest hours in a sunny

Get Price

EU expects battery pack price of less than $100/kWh by 2026/27

The report focuses on solid-state batteries (SSB), sodium-ion (Na-ion) devices, and considers general battery technology for use in stationary battery energy storage systems

Get Price

From Sun to Storing, Dyness Empowers Spanish Energy Storage

Dyness, as a leading global energy storage technology company, based on long-term market research in Spain and the Iberian Peninsula region, has launched a full range of

Get Price

Top 100 Energy Companies in Spain (2025) | ensun

Top Energy Companies in Spain The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and

Get Price

Spain Energy Storage Market 2024-2030

In Spain Energy Storage Market, ESS with 88MWh capacity was launched by Kyoto Group, one of the biggest owners of cogeneration facilities.

Get Price

Spanish energy storage vehicle sales price

What is the market energy storage in Spain? The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic and

Get Price

A comprehensive review of energy storage technology

Finally, the energy technology of pure electric vehicles is summarized, and the problems faced in the development of energy technology of pure electric vehicles and their

Get Price

eMobility report: Is Spain positioning itself as a powerhouse in

With an investment of more than 7,000 million euros, the national territory will host important projects, among which the gigafactories and assembly plants of PowerCo Spain,

Get Price

Top 10 battery manufacturers in Spain

This article introduces the top 10 battery manufacturers in Spain, including TAB battery, Baterías Tudor, Acumuladores Moura, Cegasa,

Get Price

Iberia: Why are there no batteries in Spain?

However, despite another wet year in 2025, price spreads have risen back to 2022 levels. This effect is due to an increase in solar supply alongside stable year-over-year demand.

Get Price

Flexibility Solutions for High

Without energy storage, smart-charging electric vehicles and interconnectors, the Spanish energy transition risks proceeding on a suboptimal path, with a power system reliant on fossil backup

Get Price

eMobility report: Is Spain positioning itself as a

With an investment of more than 7,000 million euros, the national territory will host important projects, among which the gigafactories and

Get Price

Spain Battery Energy Storage Systems Market Report

Executive Summary: Battery Energy Storage Systems Market in Spain - Q4 2024 The fourth quarter of 2024 highlights significant developments in the Battery Energy Storage

Get Price

EU approves Spain''s €700m energy storage subsidy

The European Commission on Monday greenlit a new aid scheme to enable Spain to deploy large-scale energy storage with co-financing of up to

Get Price

6 FAQs about [Spanish energy storage vehicle prices]

Does Spain have a storage market?

Currently, Spain’s storage market is mainly composed of small-scale batteries co-located with solar PV. Spain’s household electricity prices now stand at over EUR 0.30/kWh on average. In addition, Spain’s reliance on fossil gas has increased price volatility in recent years.16,17,18,19

Does Spain need more battery storage?

This means that Spanish storage faces limited competition from cross-border flexibility. The Spanish Government have recognised the need for storage and set a target of 22GW by 2030. We expect this to be predominantly battery storage.

How does Spain's pumped hydro energy storage compete with Bess?

Spain's pumped hydro energy storage competes directly against BESS, limiting the battery storage opportunity in wholesale markets. 3. Missing ancillary markets Unlike Great Britain or Texas, Spain never created ancillary service markets that net-zero systems need:

How will negative energy prices affect Spain?

Two structural factors limit how negative Spanish prices can go: Limited interconnection: Spain's 3 GW link with France is isolating it from the negative price contagion in Central Europe. When German prices reach -€150/MWh, Spain can't import enough energy to bring the price down.

Why is Spain a good place to buy electric cars?

Spain’s notable positioning in this market is undoubtedly due to the winks received from the administration. The Government hopes that it will become a benchmark country both in the production of batteries for electric vehicles and in new forms of green and sustainable mobility.

Why are Spanish wholesale markets opening up a battery market?

Spanish wholesale markets have offered increasing revenues due to recent price volatility which rewards BESS through power trading. However, sustained investment in batteries will be supported by fully opening up markets.

More related information

-

Cook Islands energy storage vehicle prices

Cook Islands energy storage vehicle prices

-

Ghana energy storage vehicle prices

Ghana energy storage vehicle prices

-

Egypt energy storage vehicle prices

Egypt energy storage vehicle prices

-

Kenya household energy storage power supply prices

Kenya household energy storage power supply prices

-

Kenya s latest photovoltaic energy storage prices

Kenya s latest photovoltaic energy storage prices

-

Africa Cabinet Energy Storage System Prices

Africa Cabinet Energy Storage System Prices

-

Latest prices for lithium energy storage power in Egypt

Latest prices for lithium energy storage power in Egypt

-

Features of Energy Storage Power Vehicle

Features of Energy Storage Power Vehicle

Commercial & Industrial Solar Storage Market Growth

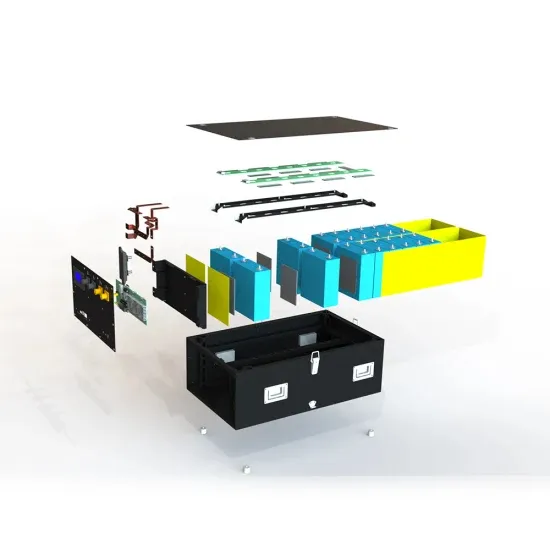

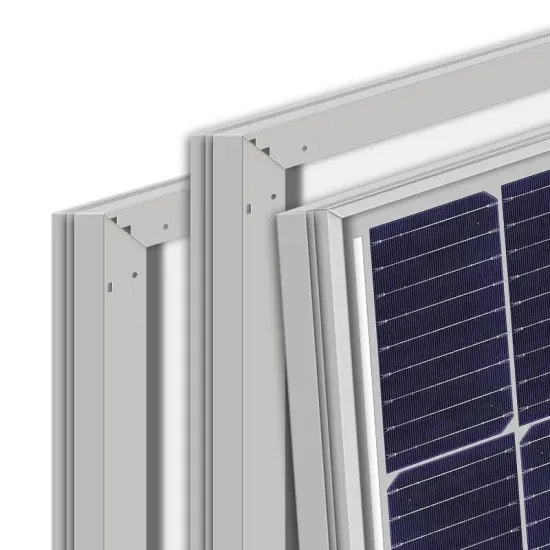

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.