Asia Pacific 5g Base Station Market Size & Outlook

This continent databook contains high-level insights into Asia Pacific 5g base station market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Get Price

How many hurdles do 5G base stations need to overcome to

According to calculations, based on the current average power transfer price of 1.3 yuan/kWh, the annual electricity bill for a 4G base station is 20,280 yuan, and the annual electricity bill for a

Get Price

Asia Pacific 5G Base Station Radiator Market: Regional

5G Base Station Radiator Market Revenue was valued at USD 1.25 Billion in 2024 and is estimated to reach USD 5.

Get Price

Asia Pacific 5g Base Station Market Size & Outlook

This continent databook contains high-level insights into Asia Pacific 5g base station market from 2018 to 2030, including revenue numbers, major trends,

Get Price

5G Base Station Market

The 5G Base Station Market size was valued at USD 28.92 Billion in 2024 and the total 5G Base Station revenue is expected to grow at a CAGR of 37.2%

Get Price

Electricity Price

6 days ago· Electricity Price - Asia - By Country - was last updated on Saturday, September 6, 2025. Trading Economics provides data for 20 million economic indicators from 196 countries

Get Price

Why does 5g base station consume so much power and how to

One advantage of using SUV deployment base stations in the early stages of China''s 5G network construction is that. 5G base stations can be directly installed on the

Get Price

Shanxi to Subsidize Electricity Price for 5G Base Stations

From 2020 to 2022, for 5G base stations participating in market transactions, if their actually paid electricity price exceeds the target price of 0.35 yuan per kilowatt-hour, the amount over the

Get Price

The power supply design considerations for 5G base

An integrated architecture reduces power consumption, which MTN Consulting estimates currently is about 5% to 6 % of opex. This percentage

Get Price

Energy consumption optimization of 5G base stations considering

An energy consumption optimization strategy of 5G base stations (BSs) considering variable threshold sleep mechanism (ECOS-BS) is proposed, which includes the initial

Get Price

Why does 5g base station consume so much power

One advantage of using SUV deployment base stations in the early stages of China''s 5G network construction is that. 5G base stations can be

Get Price

5G Base Station Equipment Market 2025

What is the current market size of Global 5G Base Station Equipment Market? -> 5G Base Station Equipment Market size was valued at US$ 18.45 billion in 2024 and is projected to reach US$

Get Price

5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact,

Get Price

5G Base Station Backup Battery Market Trends and Strategic

The 5G Base Station Backup Battery market is experiencing robust growth, driven by the rapid expansion of 5G networks globally. The increasing demand for reliable and

Get Price

5G Base Stations: The Energy Consumption Challenge

Although the energy consumption of 5G base stations is higher than any previous generations, technology and strategy innovations mentioned above would help MNOs stabilize or even

Get Price

Base Station Microgrid Energy Management in 5G Networks

The number of 5G base stations (BSs) has soared in recent years due to the exponential growth in demand for high data rate mobile communication traffic from various

Get Price

Asia Pacific 5G Base Station Market

By country, the Asia Pacific 5G base station market is segmented into China, Australia, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific 5G base

Get Price

Study on the Temporal and Spacial Characteristics of Electricity

The rapid development of the digital economy has led to a significant increase in the scale and electricity load of 5G base stations. 5G base stations, often equipped with batteries, can also

Get Price

Front Line Data Study about 5G Power Consumption

The two figures above show the actual power consumption test results of 5G base stations from different manufacturers, ZTE and HUAWEI, in Guangzhou and Shenzhen, by an anonymous

Get Price

5G Base Station Market Size to Surpass USD 832.42 Billion by

The global 5G base station market size is calculated at USD 60.08 billion in 2025 and is forecasted to reach around USD 832.42 billion by 2034, accelerating at a CAGR of

Get Price

The business model of 5G base station energy storage

At present, many studies have been conducted at home and abroad on the participation of 5G base station energy storage in grid co-dispatch.

Get Price

Optimal Electricity Dispatch for Base Stations with Battery

The study is based on simulation and optimization of a hybrid system for a GSM base station site located in Abuja (FCT), Nigeria with a daily load of 318 kWh d-1.

Get Price

Coordination of Macro Base Stations for 5G Network with User

With the increasing amounts of terminal equipment with higher requirements of communication quality in the emerging fifth generation mobile communication network (5G), the energy

Get Price

5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact, and powerful base station

Get Price

Coordination of Macro Base Stations for 5G Network

With the increasing amounts of terminal equipment with higher requirements of communication quality in the emerging fifth generation mobile

Get Price

5G Base Station Power Supply Market

With 5G base stations consuming up to 3–4 times more power than 4G systems due to higher frequency bands and denser network architectures, operators face surging electricity

Get Price

6 FAQs about [Central Asia 5G base station electricity prices]

How many 5G base stations are there in China?

The market is witnessing significant developments in base station technology and deployment strategies. By September 2023, China had built 3.189 million 5G base stations, with 22.6 5G stations per 10,000 people, demonstrating the scale of infrastructure deployment possible.

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

How much power does a 5G station use?

The power consumption of a single 5G station is 2.5 to 3.5 times higher than that of a single 4G station. The main factor behind this increase in 5G power consumption is the high power usage of the active antenna unit (AAU). Under a full workload, a single station uses nearly 3700W.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is Europe's 5G base station growth rate?

Europe has demonstrated remarkable progress in 5G base station deployment, with a substantial growth rate of approximately 38% from 2019 to 2024. The region's market development is characterized by strong governmental support and strategic initiatives across multiple countries, particularly in the United Kingdom, Germany, France, and Italy.

What is a 5G base station?

A 5G base station is mainly composed of the baseband unit (BBU) and the AAU — in 4G terms, the AAU is the remote radio unit (RRU) plus antenna. The role of the BBU is to handle baseband digital signal processing, while the AAU converts the baseband digital signal into an analog signal, and then modulates it into a high-frequency radio signal.

More related information

-

How much does electricity cost for a 5G base station in Luxembourg

How much does electricity cost for a 5G base station in Luxembourg

-

5G base station electricity market trading

5G base station electricity market trading

-

Huawei s 5g base station electricity consumption

Huawei s 5g base station electricity consumption

-

Micronesia 5G base station peak electricity price

Micronesia 5G base station peak electricity price

-

5G base station electricity safety

5G base station electricity safety

-

5G base station electricity bill per year

5G base station electricity bill per year

-

How much electricity does a 5G base station consume per hour

How much electricity does a 5G base station consume per hour

-

Does a 5G base station consume a lot of electricity

Does a 5G base station consume a lot of electricity

Commercial & Industrial Solar Storage Market Growth

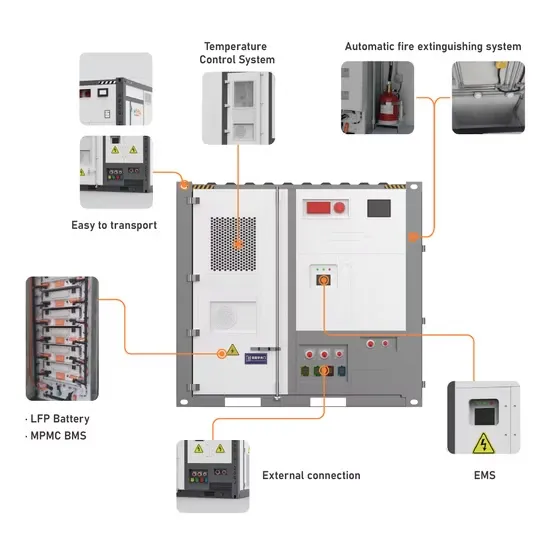

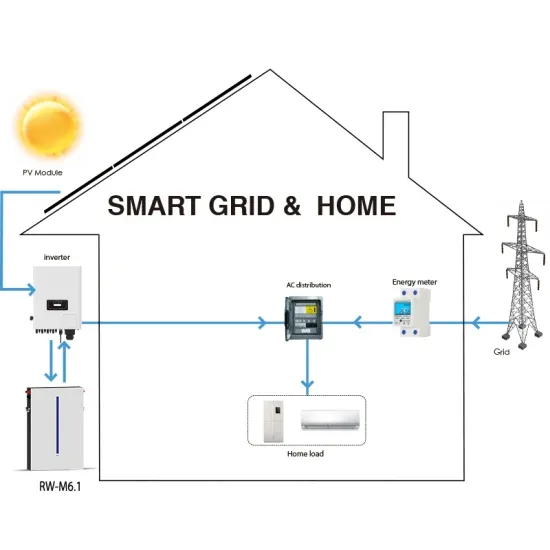

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.