Cambodia s new outdoor power supply

Cambodia could pay a premium on current prices and struggle to access affordable LNG supplies because it''''s a new market entrant with limited bargaining power, uncertain gas requirements

Get Price

Cambodia Power Supply Market (2024-2030)

As Cambodia seeks to meet its growing electricity demand and reduce dependence on imported energy, there`s a focus on diversifying the power generation mix and expanding transmission

Get Price

Cambodia

There is tremendous demand in Cambodia for diesel generators as backup power, on-site power plants, and power generation in rural areas not served by public utilities.

Get Price

Mit technology-energy-pre final

A power market is a commodity exchange where electricity is traded at prices determined by supply and demand. In addition to this spot market, there is a need for a futures market to

Get Price

Cambodia Strong Outdoor Power Supply Reliable Solutions for

As Cambodia''s infrastructure expands, demand for robust outdoor power solutions surges. From agricultural operations to eco-tourism sites, businesses need electricity systems that withstand

Get Price

Integrating pop up power units into existing outdoor spaces

2 days ago· Outdoor Pop Up Power Units benefit refurbished infrastructure developments. Due to their retractable nature, the Pop Up Units can be raised and lowered on demand.

Get Price

PowerPoint Presentation

The promotion of power generation from renewable energy is focused on the areas where the demand existed in EDL''s system to ensure adequate power supply and stability, reduce power

Get Price

Opinion: Cambodia''s LNG Plans Face Energy

Cambodia could pay a premium on current prices and struggle to access affordable LNG supplies because it''s a new market entrant with limited

Get Price

Cambodia''s Energy Future: What''s Changing in 2025 and Beyond?

By setting clear electrical efficiency standards, Cambodia aims to minimize wasteful energy consumption, potentially eliminating the need for additional power plants.

Get Price

Cambodia Electricity Production, 2004 – 2024 | CEIC Data

What was Cambodia''s Electricity Production in 2024? Electricity Production in Cambodia reached 17,851 GWh in Dec 2024, compared with 15,920 GWh in the previous year. See the table

Get Price

Status and Challenges of Rural Electrification in Cambodia

The Parliamentary Institute of Cambodia (PIC) is an independent parliamentary support institution for the clients Parliament which, upon request of the parliamentarians and

Get Price

Power Outages and Infrastructure Reliability in Cambodia –

Power outages in Cambodia remain a pressing concern as demand outpaces supply and infrastructure struggles to keep up. Learn about the causes, impacts, and strategic

Get Price

Cambodia: Outdoor Equipment Market

The report provides a strategic analysis of the outdoor equipment market in Cambodia and describes the main market participants, growth and demand drivers, challenges, and all other

Get Price

Electricity infrastructure

The electricity distributed in Cambodia is partly generated within the country and partly imported. For many years, local generation was on a relatively small scale, and was

Get Price

Report | Global Portable Outdoor Power Supply Market 2023 by

Portable Outdoor Power Supply refers to the storage of electrical energy generated from renewable sources or the grid in an outdoor setting. It involves the use of energy storage

Get Price

Cambodia Outdoor Power Equipment Market (2025-2031) | Share

Cambodia Outdoor Power Equipment Industry Life Cycle Historical Data and Forecast of Cambodia Outdoor Power Equipment Market Revenues & Volume By Equipment Type for the

Get Price

Outdoor Power Supply Market Report 2026–2033: Innovations

The Outdoor Power Supply Market is projected to witness consistent growth over the coming years, propelled by the widespread adoption of digital technologies and increased

Get Price

Cambodia''s Energy Future: What''s Changing in 2025

By setting clear electrical efficiency standards, Cambodia aims to minimize wasteful energy consumption, potentially eliminating the need for

Get Price

Cambodia Solar Panel Manufacturing | Market

Cambodia''s power supply grid faces significant reliability challenges, including frequent outages and voltage fluctuations. Despite these

Get Price

Powering Up: Cambodia''s Power Development Plan

While hydropower dominates Cambodia''s energy landscape, there are opportunities for expansion and innovation. The government''s commitment to developing large

Get Price

Demand Patterns in Portable Outdoor Power Supplies Market:

The portable outdoor power supply market is experiencing robust growth, driven by the increasing demand for reliable power sources in recreational activities, emergency situations, and off-grid

Get Price

Plug Types and Power Info for Visiting Cambodia

Power Outages in Cambodia Power outages can occur unexpectedly in certain areas of Cambodia, particularly in rural regions. While cities like Phnom Penh and Siem Reap have a

Get Price

Powering Up: Cambodia''s Power Development Plan

While hydropower dominates Cambodia''s energy landscape, there are opportunities for expansion and innovation. The government''s

Get Price

Cambodia can place outdoor power supply

Why is Power Supply Surging in Cambodia? Despite the rapid expansion of the national grid, there remain areas in Cambodia that lack reliable access to electricity.

Get Price

Cambodia''s power supply up nearly 30 percent as demand

Because of the increasing demand for power consumption and a rise in development activies, power supply in the Kingdom has increased sharply, according to a

Get Price

6 FAQs about [Is there a demand for outdoor power supplies in Cambodia ]

What are the main sources of electricity in Cambodia?

Major sources of local power generation are hydro and coal, and minor sources include diesel, wood, and biomass. In addition to local power generation, Cambodia also buys electricity from neighboring countries, especially during the dry season.

Can US companies use solar energy in Cambodia?

Opportunities exist for power generation and transmission equipment. The Cambodian government encourages usage of solar energy technologies, but U.S. companies are advised to review new regulations that might impact their business practices. Ministry of Mines and Energy

How will electricity efficiency policy work in Cambodia?

The policy will be enforced through the Ministry of Economy and Finance, working alongside customs and tax departments to regulate imports. By setting clear electrical efficiency standards, Cambodia aims to minimize wasteful energy consumption, potentially eliminating the need for additional power plants.

How much money does Cambodia need to build a power plant?

The Cambodian government has stated in its PDP that it will need $9 billion of investment to develop new power plants and expand the national grid, of which $2.5 billion has been approved between 2022 and 2025. Opportunities exist for power generation and transmission equipment.

What is the energy sector like in Cambodia?

Presently, Cambodia’s energy sector is characterised by limited access to electricity in rural areas, reliance on imported energy sources and inadequate infrastructure. Most electricity generation comes from hydropower dams, leaving the country vulnerable to fluctuations in water levels and the impact of climate change.

Why is electricity demand rising in Cambodia?

Cambodia’s electricity demand has skyrocketed in recent years, driven by industrial expansion and a growing urban population. According to the PDP, peak demand rose from 508MW in 2012 to 2,026MW by 2021, an average annual growth rate of 19%. This rapid growth continues, requiring significant further investments in generation capacity.

More related information

-

Outdoor power supplies available in Cambodia

Outdoor power supplies available in Cambodia

-

What are the high-quality outdoor power supplies

What are the high-quality outdoor power supplies

-

Top 10 imported outdoor power supplies

Top 10 imported outdoor power supplies

-

What are the bidirectional outdoor power supplies

What are the bidirectional outdoor power supplies

-

Russian production of outdoor power supplies

Russian production of outdoor power supplies

-

Are batteries good for outdoor power supplies in North Macedonia

Are batteries good for outdoor power supplies in North Macedonia

-

Can outdoor power supplies be used with lead-acid

Can outdoor power supplies be used with lead-acid

-

Are there any production standards for outdoor power supplies

Are there any production standards for outdoor power supplies

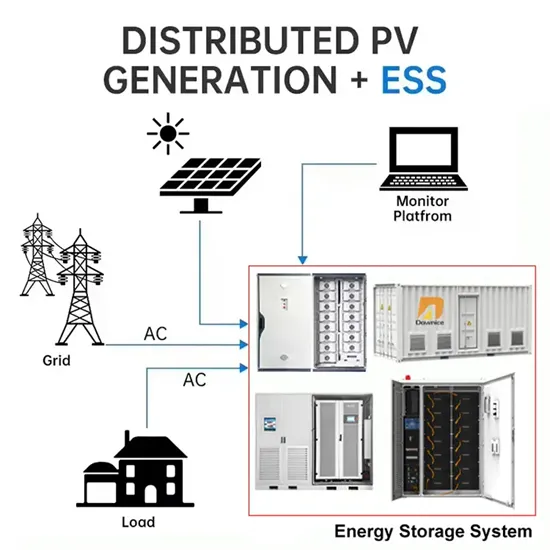

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.