Huawei won $574 million 5G network procurement

The expansion and centralized procurement of self-built 5G 2.6GHz/4.9GHz base stations. The telecom company co-built and shared 5G

Get Price

HUAWEI DBS3900 Dual-Mode Base Station Hardware

DBS3900 Dual-Mode Base Station is the fourth generation base station developed by Huawei. It features a multi-mode modular design and supports three working modes: GSM mode,

Get Price

Huawei wins lion''s share of China Mobile''s 5G base station

Huawei secured 52 per cent of China Mobile''s 5G base station work, the largest portion of the contracts put out for tender this year.

Get Price

How energy-efficient are Huawei''s 5G base stations compared to

One of the key concerns in the rollout of 5G networks is the energy efficiency of the base stations, as they are critical components in the delivery of high-speed mobile broadband services. In

Get Price

Huawei wins huge share of China Mobile''s 5G base

In total, Huawei has won 52 percent of China Mobile''s 5G base station work, as part of the largest portion of the contracts put out for tender

Get Price

Huawei''s "ONE 5G" Concept Centre Stage at Global MBB Forum

Huawei''s "ONE 5G" Concept Amalgamating multi-band, multi-RAT base stations into single hardware units that can efficiently maximise the use of available spectrum was a major theme

Get Price

Telecom Energy Solution

The solution is based on Huawei''s extensive experience in building the telecommunication networks and our focus on customers'' needs. Huawei

Get Price

Global 5G Base Station Industry Research Report

The 5G base station is the core device of the 5G network, providing wireless coverage and realizing wireless signal transmission between the wired

Get Price

5G Base Station Energy Storage Bidding: What You Need to

With virtual power plants entering the chat [8], tomorrow''s基站储能 (base station storage) might earn money while sleeping! Imagine your neighborhood 5G tower成为 (becoming) a mini

Get Price

Huawei Wins Over Half of China''s Biggest 5G Base Station

(Yicai Global) June 12 -- Huawei Technologies has gained over half of the procurement of China''s largest fifth-generation wireless base station tender this year organized by China Mobile.

Get Price

Huawei 5G base station Teardown!

AboutPressCopyrightContact usCreatorsAdvertiseDevelopersTermsPrivacyPolicy & SafetyHow worksTest new featuresNFL Sunday Ticket© 2025 Google LLC

Get Price

China: Huawei''s successful bids for 5G base stations

In the latest bidding round in June 2023, Huawei secured ** thousand successful bids for ***GHZ/***GHZ 5G base stations and **

Get Price

Huawei BBU5900 Baseband Unit, Base Station

The Huawei BBU5900 designed to handle the processing of baseband signals in a base station. This unit is a crucial component in Huawei''s telecom

Get Price

2021 Huawei Digital Power SUSTAINABILITY REPORT

Founded in June 2021, Huawei Digital Power Technology Co., Ltd. is a wholly-owned subsidiary of Huawei Technology Co. Ltd.and the world''s leading provider of digital power products and

Get Price

Why does 5g base station consume so much power and how to

The power consumption of the 5G base station mainly comes from the AU module processing and conversion and high power-consuming high radio frequency signals, the

Get Price

Huawei won $574 million 5G network procurement contract

The expansion and centralized procurement of self-built 5G 2.6GHz/4.9GHz base stations. The telecom company co-built and shared 5G 700MHz base station equipment (using

Get Price

Huawei Wins Over Half of China''s Biggest 5G Base Station

The bands of 2.6 to 4.9 gigahertz will have around 63,800 stations, divided into two projects. And the 700 megahertz band will be enriched with about 23,100 stations, divided into

Get Price

Wind Load Test & Calculation of Base Station Antenna

White paper on wind load testing and calculation for base station antennas. Covers methods, standards, and Huawei''s approach. Engineering focus.

Get Price

Base Station Huawei BBU5900 Series 5G LTE

The Huawei BBU5900 Series Base Station, equipped with essential modules like UBBPF1, UBBPG2D, UMPTE3, UMPTE5, and UPEUE, stands out as a

Get Price

China: Huawei''s successful bids for 5G base stations 2023| Statista

In the latest bidding round in June 2023, Huawei secured ** thousand successful bids for ***GHZ/***GHZ 5G base stations and ** thousand successful bids for 700M 5G base

Get Price

China Mobile Guangdong and Huawei Set...

This project extends mobile coverage 20–50 km away from the wind farm and uses digital indoor systems to provide connections inside the

Get Price

Longyuan Power Completes Jiangsu''s First Batch of Offshore 5G

Tests showed the download speed of the network reached 400Mpbs. This marked a remarkable breakthrough in the construction of offshore 5G network in Jiangsu. Workers install

Get Price

5G Power: Creating a green grid that slashes costs, emissions

(Yicai Global) June 12 -- Huawei Technologies has gained over half of the procurement of China''s largest fifth-generation wireless base station tender

Get Price

HUAWEI COMMUNICATE

e station product. The solution is backwards-compatible with 4G and harnesses existing CAT6A network wires or optical cables to achieve indoor 4G and 5G co-deployment with zero cable

Get Price

Enterprise Wireless

For governments and industries such as transportation and energy, our enterprise wireless provides purpose-built mobile communications supported by 4G/5G

Get Price

Huawei wins huge share of China Mobile''s 5G base station

In total, Huawei has won 52 percent of China Mobile''s 5G base station work, as part of the largest portion of the contracts put out for tender this year, according to Yicai Global.

Get Price

5G Power: Creating a green grid that slashes costs, emissions

China Tower and Huawei conducted joint pilot verification in 2018 and found that the 5G Power solution could support effective 5G site deployment without changing the grid, power

Get Price

Power Consumption Modeling of 5G Multi-Carrier Base

However, there is still a need to understand the power consumption behavior of state-of-the-art base station architectures, such as multi-carrier active antenna units (AAUs), as well as the

Get Price

China Mobile Guangdong and Huawei Set...

This project extends mobile coverage 20–50 km away from the wind farm and uses digital indoor systems to provide connections inside the wind turbines. With this project,

Get Price

6 FAQs about [Huawei 5G communication base station wind power bidding]

How much will Huawei buy China mobile's 5G base station?

Huawei secured 52 per cent of China Mobile's 5G base station work, the largest portion of the contracts put out for tender this year. The deal would involve the sale of 45,426 5G base stations worth about 4.1 billion yuan (US$574 million), according to calculations by the South China Morning Post using bid details published by China Mobile.

How many 5G base stations will China Mobile install in 2023?

The successful firms were announced last Friday, about a month after China Mobile solicited equipment suppliers to bid for two contracts for the installation of a total of 86,980 5G base stations between 2023 and 2024, adding to China's existing 5G network, considered the world's largest.

Will China mobile 5G win a boon for Huawei?

The China Mobile 5G win would be a boon for Huawei, whose revenue growth has lost steam in recent years after the US restricted its access to advanced semiconductors.

Will Huawei's 5G deal bolster China's core revenue base?

Huawei Technologies will supply over half of the 5G base stations for China's top telecoms company China Mobile between 2023 and 2024, a deal which analysts say will help shore up its core revenue base after losing its lucrative smartphone business amid tough US sanctions.

How much did ZTE win a 5G bid?

ZTE’s winning bid amount exceeded 2.07 billion yuan ($280 million). The expansion and centralized procurement of self-built 5G 2.6GHz/4.9GHz base stations. The telecom company co-built and shared 5G 700MHz base station equipment (using a single source method), with a total scale of more than 412,700 stations, and Huawei won the bid.

What are the biggest 5G base station contracts awarded this year?

The China Mobile tender represents the biggest 5G base station contracts awarded this year.

More related information

-

Huawei 5G photovoltaic version communication base station wind power

Huawei 5G photovoltaic version communication base station wind power

-

Zimbabwe 5G communication base station wind power bidding

Zimbabwe 5G communication base station wind power bidding

-

Uruguay 5G communication base station wind and solar complementary bidding

Uruguay 5G communication base station wind and solar complementary bidding

-

Iraq 5G communication base station wind power solution

Iraq 5G communication base station wind power solution

-

Maldives 5G communication base station wind and solar complementary

Maldives 5G communication base station wind and solar complementary

-

North Macedonia Mobile Company Communication Base Station Wind Power

North Macedonia Mobile Company Communication Base Station Wind Power

-

Kuwait communication base station wind power and photovoltaic power generation manufacturer

Kuwait communication base station wind power and photovoltaic power generation manufacturer

-

How large is the wind power range of the communication base station

How large is the wind power range of the communication base station

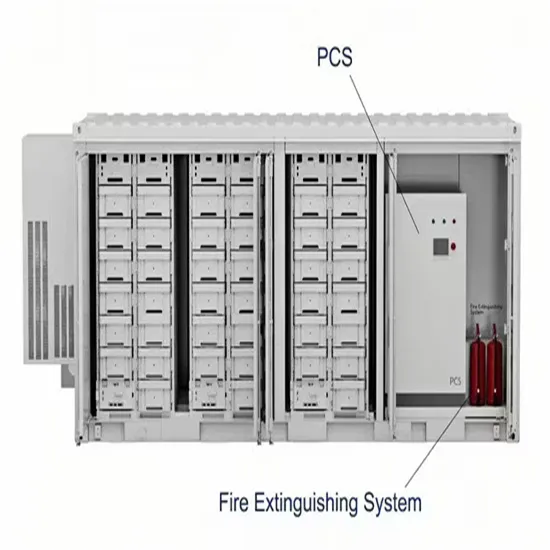

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.