Argentina to Have South America''s Largest Photovoltaic Plant

Argentina has taken another step towards the future of renewable energy. All thanks to the inauguration of the largest photovoltaic plant in South America. Located in the Puna of

Get Price

South America Solar Photovoltaic Market Analysis

Photovoltaic cells, commonly known as solar panels, are installed to capture sunlight and convert it into electricity, which can be used to power homes,

Get Price

Exporting sunshine: Planning South America''s electricity

Our study reveals that South America''s energy transition will rely, in decreasing order, on solar photovoltaic, wind, gas as bridging technology, and also on some concentrated

Get Price

South America''s Energy Storage Revolution: Tackling Grid

While nations like Brazil and Chile lead in photovoltaic installations, their aging grids struggle to handle renewable intermittency, creating an urgent need for battery storage systems (BESS)

Get Price

How is the South American photovoltaic energy

The advancement of energy storage technologies is pivotal to addressing the intermittency challenges posed by solar energy. Innovations in

Get Price

Solar Energy Statistics By Country, Costs And

Solar Energy Statistics: By 2050, solar energy is expected to provide half (50%) of the world''s electricity.

Get Price

Combined solar power and storage as cost

The findings highlight a crucial energy transition point, not only for China but for other countries, at which combined solar power and storage

Get Price

INTERSOLAR SOUTH AMERICA

After years of development, USFULL has achieved remarkable results in the Brazilian new energy market with its excellent product quality and technical

Get Price

Solar market trends and prospects in Latin America

Nevertheless, the Latin American market faces multiple challenges, such as funding issues persistently limiting project development and inadequate grid infrastructure and

Get Price

The smarter E South America 2023

Solar Promotion GmbH and its subsidiary Solar Promotion International GmbH organize global exhibitions and conferences in the fields of renewable energies and energy efficiency. The

Get Price

South America Solar Photovoltaic Market Analysis

Photovoltaic cells, commonly known as solar panels, are installed to capture sunlight and convert it into electricity, which can be used to power homes, businesses, and industries.

Get Price

South America s Photovoltaic Energy Storage Growth Challenges

With abundant solar resources and growing energy demands, the region offers immense potential for solar-plus-storage systems. This article explores market trends, technological

Get Price

South America s Photovoltaic Energy Storage Growth Challenges

South America is rapidly emerging as a hotspot for photovoltaic (PV) energy storage projects. With abundant solar resources and growing energy demands, the region offers immense

Get Price

Photovoltaic energy in South America: Current state and grid

This research aims to highlight a summary of different aspects of connecting photovoltaic systems to the grid in eight countries in South America with similar socioeconomic

Get Price

South America Solar Photovoltaic Market Size,

Government initiatives and favorable policies are key drivers of the South American solar photovoltaic (PV) sector. Countries such as Brazil, Chile, and

Get Price

Solar Manufacturing

The U.S. Solar Photovoltaic Manufacturing Map details active manufacturing sites that contribute to the solar photovoltaic supply chain. Why is Solar Manufacturing Important? Building a

Get Price

The state of the domestic solar and energy storage

Anza, a subscription-based data and analytics software platform, released a Q1 2025 report that reveals trends in domestic manufacturing of

Get Price

State of global solar energy market: Overview, China''s role,

Solar energy is the most common, cheapest, and most mature renewable energy technology. With solar photovoltaics taking over recently, an in-depth look into their supply

Get Price

South America Solar Photovoltaic Industry 2025-2033 Trends:

One of the key trends in the South America Solar Photovoltaic Industry is the increasing demand for ground-mounted solar systems. This is due to the fact that ground

Get Price

A Race to the Top Latin America 2023: Wind and

Latin America has the potential to increase its utility-scale solar and wind power capacity by more than 460% by 2030 if all 319 gigawatts (GW) of prospective

Get Price

Distributed Photovoltaic Systems Design and Technology

The number of distributed solar photovoltaic (PV) installations, in particular, is growing rapidly. As distributed PV and other renewable energy technologies mature, they can provide a significant

Get Price

How is the South American photovoltaic energy storage market?

The advancement of energy storage technologies is pivotal to addressing the intermittency challenges posed by solar energy. Innovations in battery technologies and

Get Price

Brazil

Grid connection queues in Brazil are offering new opportunities for energy storage and hybrid systems and opening new energy business models. Renewable energy companies

Get Price

Analysing South America''s progress in boosting

In June 2023, South America`s largest floating solar project was also launched at the Urrá Dam in Colombia, aiming to showcase the potential

Get Price

South America''s energy storage market is surging, BYD, Sunny

Although Brazil is actively developing the local photovoltaic manufacturing industry, but the local production capacity is limited, the industry chain is not complete, still need to rely

Get Price

South America''s energy storage market is surging, BYD, Sunny Power

Although Brazil is actively developing the local photovoltaic manufacturing industry, but the local production capacity is limited, the industry chain is not complete, still need to rely

Get Price

South America Solar Photovoltaic Market Size, & Forecast 2031

Government initiatives and favorable policies are key drivers of the South American solar photovoltaic (PV) sector. Countries such as Brazil, Chile, and Argentina have implemented tax

Get Price

6 FAQs about [South American photovoltaic energy storage power supply production]

Are small-scale photovoltaic systems regulated in South America?

In South America, regulation on the connection of small-scale photovoltaic systems is recent, given that this type of generation has been integrated into the energy matrix for a few years.

Is solar energy a good investment in South America?

As a result, the preliminary energy balance for 2019 showed favorable results, showing that the share of fossil fuels is only 2%, being the smallest percentage in the region and the share of PV solar energy reaches 3%, being the second-largest participation in South America after Chile .

Does South America have privileged solar irradiation?

5. Discussion South America has privileged solar irradiation, with emphasis on the northeast region of Brazil and especially the Atacama Desert region, in northern Chile. Regarding the energy matrices of each country, listed in Table 4, a large percentage of renewable energies is observed in the analyzed countries.

What is a photovoltaic system?

Photovoltaic systems and connection requirements Photovoltaic solar energy consists of transforming solar radiation into electricity through the use of photovoltaic cells. These cells make up the photovoltaic panels, which represent the fundamental element of a photovoltaic generation system.

What is the power factor of a photovoltaic plant in Bolivia?

The legislation of Bolivia similarly presents the operation with power factor above 0.95 inductive or capacitive . 2.2. Distributed photovoltaic generation plants

Can photovoltaic solar power be used in Ecuador?

Ecuador: in the Ecuadorian grid code, unconventional renewable sources, including photovoltaic solar plants, must be able to control the value of the rising and falling ramps according to what is established by the National Electricity Operator.

More related information

-

Zambia photovoltaic energy storage power supply production

Zambia photovoltaic energy storage power supply production

-

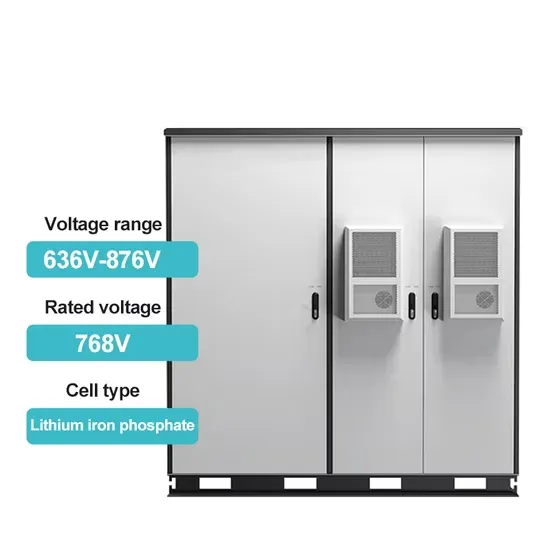

China Photovoltaic Energy Storage Cabinet Solar After-sales Communication Power Supply

China Photovoltaic Energy Storage Cabinet Solar After-sales Communication Power Supply

-

Armenian photovoltaic energy storage power supply manufacturer

Armenian photovoltaic energy storage power supply manufacturer

-

South African portable energy storage power supply manufacturer

South African portable energy storage power supply manufacturer

-

South Sudan energy storage power supply manufacturer

South Sudan energy storage power supply manufacturer

-

Indonesia Mobile Energy Storage Power Supply Production

Indonesia Mobile Energy Storage Power Supply Production

-

Türkiye Huijue Energy Storage Power Supply Production

Türkiye Huijue Energy Storage Power Supply Production

-

Lithium battery energy storage system photovoltaic power supply

Lithium battery energy storage system photovoltaic power supply

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.