ENERGY STORAGE PROJECTS

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors,

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get Price

Why Investment Banks Are Betting on Energy Storage Deals?

This article examines why investment banks are betting heavily on energy storage, the latest M&A trends, and the financial strategies shaping the industry''s future.

Get Price

Shell, Equinor, TotalEnergies to invest $714 million in

Shell, Equinor and TotalEnergies said on Thursday they will invest 7.5 billion Norwegian crowns ($713.66 million) into expanding their

Get Price

Fidra Energy reaches financial close on the UK''s largest battery energy

2 days ago· Fidra Energy, a European battery energy storage system (BESS) platform headquartered in Edinburgh, UK, today announced it has secured up to £445 million of new

Get Price

Fidra Energy secures £445m financing for Thorpe Marsh BESS project

19 hours ago· Fidra Energy has received up to £445m ($601.1m) in equity investment from EIG and the National Wealth Fund (NWF) for the Thorpe Marsh battery energy storage system

Get Price

12 Best Energy Storage Stocks to Buy in 2025

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals

Get Price

Top 19 Energy Storage Investors in the US

With federal incentives and increasing investments, the sector is poised for growth, targeting not only commercial applications but also residential energy savings, making clean energy more

Get Price

The 10 most attractive energy storage investment

ENERGY STORAGE The 10 most attractive energy storage investment markets Reliable electricity grids backed up by battery energy

Get Price

12 Best Energy Storage Stocks to Buy in 2025

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth as the demand for renewable energy

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

Which companies are investing in energy storage projects?

The energy sector is undergoing a transformative phase marked by intensive investments in energy storage systems (ESS). These innovations are largely driven by the

Get Price

Fieldvest Insights: U.S. Renewable Energy Spending.

The investment in energy storage systems aims to overcome the intermittent nature of renewable energy, ensuring a steady power supply. Recent funding initiatives focus

Get Price

DOE Invests $68 Million in Innovative Heavy-Duty

As part of the U.S. Department of Energy''s (DOE) continued commitment to electrified commercial road transport, DOE today announced a

Get Price

Gravitricity, Energy Vault progress gravity energy

Gravitricity and Energy Vault have progressed their gravity energy storage solutions, with project updates in USA/Germany and China.

Get Price

BESS in North America_Whitepaper_Final Draft

Introduction Battery energy storage presents a USD 24 billion investment opportunity in the United States and Canada through 2025. More than half of US states have adopted renewable

Get Price

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get Price

New Data Shows Investments to Build California''s

Ahead of National Infrastructure Week, the CEC and California Public Utilities Commission (CPUC) are highlighting the state''s progress to

Get Price

Energy Storage Investments – Publications

Key diligence areas when considering energy storage projects include evaluating the battery technology as well as the supplier and country of origin of the batteries and other

Get Price

Major supercapacitor hybrid energy storage project

The project adopts supercapacitor hybrid energy storage assisted frequency regulation technology, consisting of 60 sets of 3.35 MW/6.7 MWh

Get Price

A to Z of key players driving UK storage deployment in

CES, which describes itself as a "grid-scale battery energy storage platform supporting the energy transition", has said it will invest more than

Get Price

United States: Eolus sells a 100 MW/400 MWh energy storage project

An expanding sector in the United States Since 2015, Eolus has been investing in renewable energy and storage projects across the U.S. The Pome project represents its fourth

Get Price

Top 10 New Energy Storage Investments Shaping 2025 (and

As we ride this storage tsunami into 2026, remember: the energy transition isn''t just about saving the planet – it''s about making your portfolio bulletproof. The question is:

Get Price

Seven Reasons Why Utilities Are Investing In Energy Storage

Energy storage plays a central part in distributed energy systems, so it is little wonder that utilities have been investing quite heavily in this area as well.

Get Price

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get Price

How much does it cost to invest in energy storage power stations?

Regulatory frameworks and incentives can significantly influence both initial capital expenditure and the ongoing profitability of storage projects. Policies aimed at promoting

Get Price

6 FAQs about [Invest heavily in energy storage projects]

Is investing in energy storage stocks a good idea?

Given the global shift from fossil fuels to renewable energy, which is expected to take about three decades and require massive investment, investing in energy storage stocks has become an attractive option for investors seeking safer returns.

Should you invest in battery storage stocks?

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth. As the demand for renewable energy continues to expand, investing in well-known energy storage companies like Tesla, Panasonic, and LG Chem can be a strategic move.

Are battery storage systems a good investment?

With advancements in technology and decreasing costs, battery storage systems are becoming more accessible and efficient, allowing for greater integration of renewable energy sources into the grid and reducing reliance on fossil fuels. Identifying top energy storage stocks in an industry with many players can be challenging.

What are energy storage stocks?

Energy storage stocks are companies that design and manufacture energy storage technologies. These include battery storage, capacitors, and flywheels. Electric vehicles, generating facilities, and businesses also form this vast industry.

What are the most versatile energy storage stocks?

ABB tops the list of the most versatile energy storage stocks. With a market cap of about 68 billion dollars and a high potential for high revenue growth, ABB LTD is a strong contender. Its products' demand increased by about 18% YoY, indicating significant growth potential.

What are the top energy storage companies?

Energy storage companies specialize in developing and implementing technologies and strategies to store energy for later use. As demand for renewable energy sources like solar and wind power increases, these companies are expected to grow. Some of the top energy storage companies include Tesla, LG Chem, and Fluence Energy.

More related information

-

Central and local governments heavily invest in new energy storage

Central and local governments heavily invest in new energy storage

-

Invest in container energy storage projects

Invest in container energy storage projects

-

Is it possible to invest in South African energy storage projects

Is it possible to invest in South African energy storage projects

-

Wind power projects equipped with energy storage

Wind power projects equipped with energy storage

-

Latest energy storage projects in Seychelles

Latest energy storage projects in Seychelles

-

Denmark s energy storage projects for 2025

Denmark s energy storage projects for 2025

-

French energy storage investment projects

French energy storage investment projects

-

Rwanda s first batch of energy storage projects

Rwanda s first batch of energy storage projects

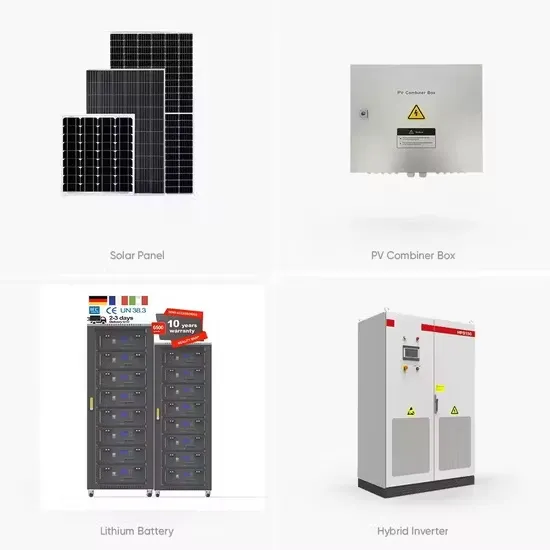

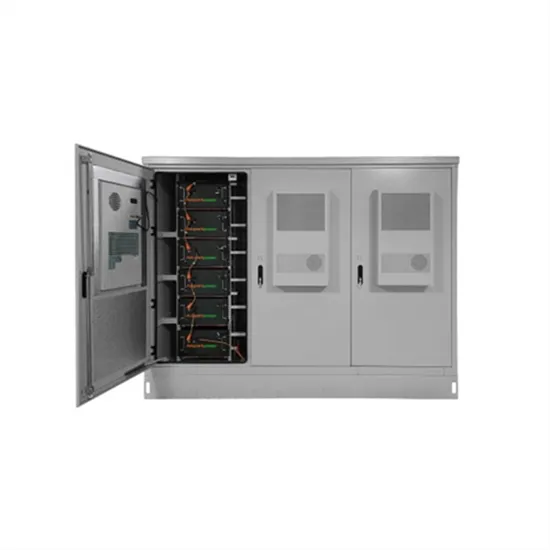

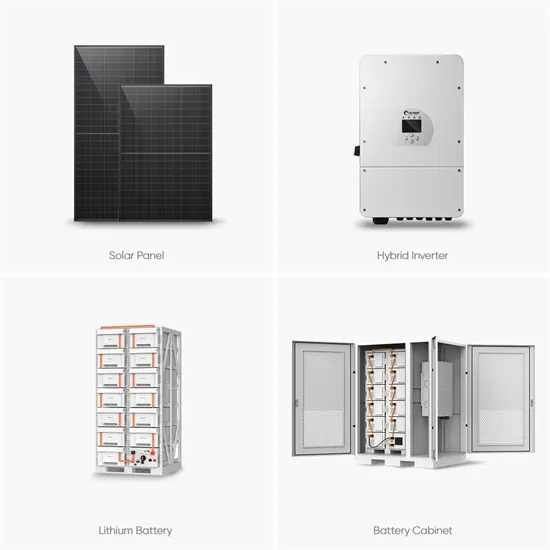

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.