What is portable energy storage power supply? | NenPower

Portable energy storage power supply refers to compact, versatile systems designed to store electrical energy for use in various applications. 1. These systems are

Get Price

How to Claim the Energy Storage Tax Credit

Navigate the federal tax credit for battery storage systems. Understand the key financial considerations and procedural steps to successfully claim this incentive.

Get Price

Self Generation Incentive Program (SGIP) | SCE

Home Energy Storage Solutions Save on Energy Storage Systems to Keep Your Home Powered To help our customers be better prepared for outages and Public Safety Power Shutoffs

Get Price

How about portable energy storage power supply | NenPower

3. The flexibility to power devices off-grid, coupled with advancements in battery technology and renewable energy sources, positions portable energy storage solutions as an

Get Price

CHINT''s New Portable Energy Storage, Safeguarding

At the core, CHINT''s portable energy storage power supply employs automotive-grade power cells – lithium iron phosphate cells. These

Get Price

Energy Storage Power Station Tax Policy: What Investors and

Let''s face it – tax policies aren''t exactly the sexiest part of renewable energy discussions. But here''s the kicker: understanding these policies could mean the difference

Get Price

Battery Energy Storage Tax Credits in 2024 | Alsym Energy

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity of at least 3 kilowatt-hours

Get Price

Do Portable Power Stations Qualify for Tax Credit?

The short answer is: sometimes. Portable power stations may qualify for tax credits, but only under specific conditions tied to renewable energy incentives. With 42% of U.S.

Get Price

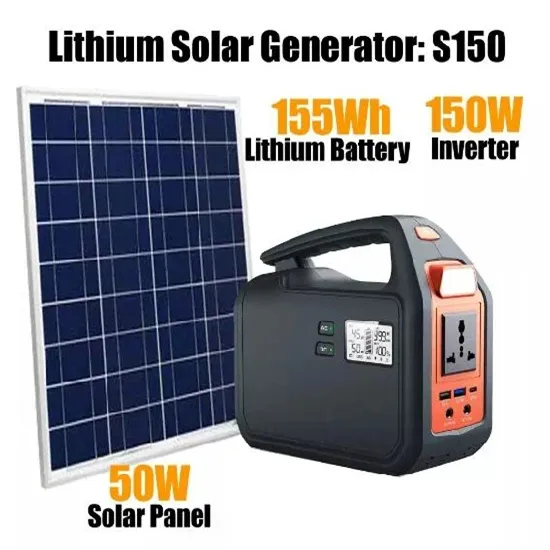

Portable and environmentally friendly energy storage power supply

Portable and environmentally friendly energy storage power supplies have become an ideal choice for outdoor activities and emergency backup due to their small size, lightweight, diverse

Get Price

What is the tax rate for energy storage power station income?

The tax rate applicable to income generated by energy storage power stations varies based on several factors including the jurisdiction, the nature of the business entity, and

Get Price

What is the tax rate for energy storage electricity?

Tax rates for energy storage electricity indeed vary significantly by geographical location. Some areas may impose favorable taxation for

Get Price

Battery Energy Storage Tax Credits in 2024 | Alsym

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity

Get Price

Battery Energy Storage Tax Credits in 2024 | Alsym

By reducing the upfront costs of energy storage systems, these tax credits make it more affordable to enhance energy security, improve grid

Get Price

Portable Energy Storage System Market Size, 2025

The portable energy storage system market size crossed USD 4.4 billion in 2024 and is set to grow at a CAGR of 24.2% from 2025 to 2034, driven by the rsing

Get Price

Do Portable Power Stations Qualify for Tax Credit

No, portable power stations generally do not qualify for federal tax credits—but there are exceptions. As renewable energy gains popularity, many consumers assume all eco

Get Price

Portable energy storage overseas growth rate

3 Market Competition, by Players 3.1 Global Portable Energy Storage Power Supply Revenue and Share by Players (2019,2020,2021, and 2023) 3.2 Market Concentration Rate 3.2.1 Top3

Get Price

What is the tax rate for energy storage electricity? | NenPower

Tax rates for energy storage electricity indeed vary significantly by geographical location. Some areas may impose favorable taxation for renewable technologies, while others

Get Price

Residential Clean Energy Credit & Home Battery Systems

Home battery systems or portable power stations that store at least 3 kilowatt-hours (kWh) of energy can qualify for the 30% tax credit, whether they are used as standalone

Get Price

Residential Clean Energy Credit & Home Battery

Home battery systems or portable power stations that store at least 3 kilowatt-hours (kWh) of energy can qualify for the 30% tax credit, whether

Get Price

GST on Solar Power based devices & System

The appellant has relied heavily on the guidelines of the Ministry of New and Renewable Energy for Solar Water Pumping Systems to claim that

Get Price

"Portable Energy Storage Power Supply"

Shop for Portable Energy Storage Power Supply at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up

Get Price

BLUETTI | Portable Power Station, Solar Generator,

Explore BLUETTI - the technology pioneer in clean energy for your off-grid solar power solutions. Shop solar generator kits, portable power stations, solar

Get Price

Energy Storage System Supply Tax Rate: How U.S. Tariffs Are

You''re a U.S. solar farm developer racing to meet clean energy targets when suddenly – bam! – your Chinese battery supplier drops a 25% price hike bomb. That''s exactly what the new

Get Price

SALT and Battery: Taxes on Energy Storage | Tax Notes

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

Get Price

6 FAQs about [Tax rate for portable energy storage power supply]

What are battery storage system tax credits?

Among the many provisions of the IRA, the introduction of battery storage system tax credits stands out as a major incentive for individuals and businesses looking to invest in energy storage solutions. These battery storage system tax credits aim to accelerate the adoption of energy storage technologies.

What tax credits are available for energy storage projects?

Commercial/Grid-scale There is also a investment tax credit for larger energy storage projects. The Section 48 Investment Tax Credit offers businesses a similar 30% base tax credit for energy storage systems under 1 MW, or over 1 MW if certain apprenticeship and wage requirements are met.

What is a clean electricity production tax credit?

After that date the Clean Electricity Production Tax Credit and the Clean Electricity Investment Tax Credit will replace the traditional PTC / ITC. By lowering the upfront costs, this credit encourages businesses to integrate energy storage into their asset portfolio, promoting a more resilient and sustainable energy infrastructure.

Do energy storage systems qualify for a manufacturing exemption?

The Texas comptroller has published at least two private letter rulings explaining that energy storage systems do not qualify for the manufacturing exemption because the batteries are for storing the energy, and storage is not essential to generating the energy. 17

What are energy storage systems?

Energy storage systems are technologies that store energy from the electrical grid for later use. These systems can take various forms, including batteries, pumped hydro, flywheels, and thermal storage. Among the types of battery storage technology, lithium-ion batteries are common.

Do lithium batteries qualify for tax credits?

Yes, lithium batteries do qualify for the tax credit under the Inflation Reduction Act (IRA), with the potential for additional federal tax incentives for battery storage systems that can increase the credit up to 40%.

More related information

-

Outdoor Energy Storage Portable Power Supply

Outdoor Energy Storage Portable Power Supply

-

Venezuela bidirectional portable energy storage emergency power supply

Venezuela bidirectional portable energy storage emergency power supply

-

Huawei France Portable Energy Storage Power Supply

Huawei France Portable Energy Storage Power Supply

-

Portable energy storage power supply

Portable energy storage power supply

-

Brunei portable energy storage power supply price

Brunei portable energy storage power supply price

-

Monaco Portable Outdoor Energy Storage Power Supply

Monaco Portable Outdoor Energy Storage Power Supply

-

Heishan portable energy storage power supply manufacturer

Heishan portable energy storage power supply manufacturer

-

Andor Portable Energy Storage Power Supply

Andor Portable Energy Storage Power Supply

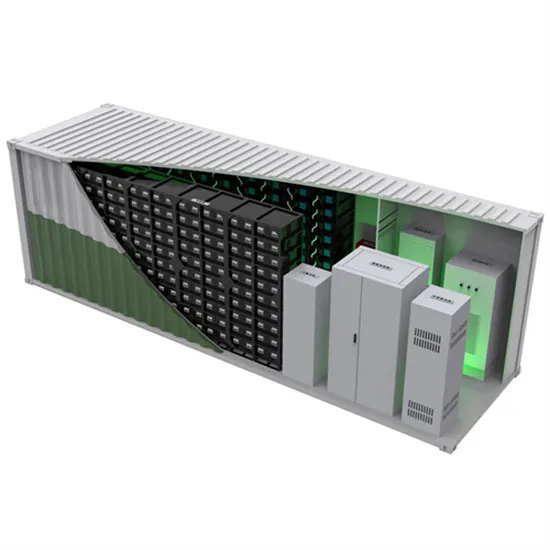

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.