Achieving the Promise of Low-Cost Long Duration Energy Storage

Executive Summary Long Duration Energy Storage (LDES) provides flexibility and reliability in a future decarbonized power system. A variety of mature and nascent LDES technologies hold

Get Price

Energy Storage Project Cost Budget: Breaking Down the

This article targets professionals who need actionable data on energy storage costs, whether for grid-scale projects, solar+storage hybrids, or portable systems.

Get Price

Cost Analysis for Energy Storage: A Comprehensive Step-by

Addressing these challenges requires a comprehensive strategy that includes cost analysis for energy storage projects, aligning them with shifting regulatory requirements and

Get Price

ENERGY STORAGE PROJECTS

The Department of Energy (DOE) Loan Programs Office (LPO) is working to support deployment of energy storage solutions in the United States to

Get Price

How much does an energy storage project cost? | NenPower

Costing a venture centered on energy storage varies with numerous factors including technology employed, scale of the project, geographical location, and regulatory

Get Price

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get Price

2022 Grid Energy Storage Technology Cost and Performance

Foundational to these efforts is the need to fully understand the current cost structure of energy storage technologies and identify the research and development opportunities that can impact

Get Price

What the budget bill means for energy storage tax

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit

Get Price

European Investment Bank supports thermal, gravity

A total of 311 applications were received for clean energy or decarbonisation projects after the call for submissions opened last summer. Of

Get Price

2022 Grid Energy Storage Technology Cost and

Foundational to these efforts is the need to fully understand the current cost structure of energy storage technologies and identify the research and

Get Price

What Investors Want to Know: Project-Financed Battery Energy Storage

Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

Get Price

Energy Storage Projects: a global overview of trends and

Consumers are demanding more options. Expert commentators like Navigant Research estimate that energy storage will be a US$50 billion global industry by 2020 with an installed capacity of

Get Price

Big Battery Investment Charges Up in Q1 2025: $2.4 Billion

Australia''s energy storage sector is off to a strong start in 2025, with the Clean Energy Council reporting $2.4 billion in financial commitments to large-scale Battery Energy

Get Price

How much does it cost to build a battery energy storage system

Modo Energy''s industry survey reveals key Capex, O&M, and connection cost benchmarks for BESS projects.

Get Price

How much does it cost to build a battery energy

Modo Energy''s industry survey reveals key Capex, O&M, and connection cost benchmarks for BESS projects.

Get Price

Big battery investment charges up in Q1 2025

The first quarter of 2025 was the second best on record for investment in large-scale Battery Energy Storage Systems (BESS) in Australia, with six projects worth $2.4 billion

Get Price

Energy Storage Project Finance Guide

Project finance is commonly used in infrastructure projects, including energy storage, as it allows developers to isolate the project''s risks and rewards from their other

Get Price

Energy Storage Cost and Performance Database

DOE''s Energy Storage Grand Challenge supports detailed cost and performance analysis for a variety of energy storage technologies to accelerate their development and deployment.

Get Price

Microsoft Word

ERCIP Construction Project Totals (18 Projects) ERCIP P&D Funds Total ERCIP Program Total $548,000 86,250 $634,250 ER and WR is for Energy/Water Resilience projects; EC and WC is

Get Price

Sector Spotlight: Energy Storage

Finally, the Tribal Energy Financing program can support energy storage technologies in eligible projects to federally recognized tribes and

Get Price

Cost Analysis for Energy Storage: A Comprehensive

Addressing these challenges requires a comprehensive strategy that includes cost analysis for energy storage projects, aligning them with

Get Price

Incentive Rates | SGIP

Incentive Duration Decrease Energy storage incentives are reduced as the duration of energy storage (Wh) increases. Projects may qualify for a reduced incentive duration decrease for

Get Price

Energy Storage Cost and Performance Database

DOE''s Energy Storage Grand Challenge supports detailed cost and performance analysis for a variety of energy storage technologies to accelerate their

Get Price

Investment Insights into Energy Storage Power Stations: Cost

11 hours ago· Explore how to invest in energy storage systems efficiently. Learn about cost components, battery technologies, ROI factors, and global market trends shaping

Get Price

What the budget bill means for energy storage tax credit eligibility

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit (ITC) and production tax credit (PTC)

Get Price

The 2025 Ontario budget: Takeaways for the energy sector

On April 15, 2025, the Ontario government published its 2025 Budget—A Plan to Protect Ontario (the "budget"). This budget, shaped by ongoing trade pressures and surging

Get Price

Spain Energy Storage Growth: How €699M Funding is

Spain''s energy storage sector is set to expand with €699M in funding, supporting up to 3.5GW of capacity. Discover key opportunities and

Get Price

Western Australia state budget commits funding

Rendering of the Kwinana BESS currently nearing commercial operations in WA. Image: Synergy/NHOA. Western Australia (WA) has said it will provide funding for two battery

Get Price

India''s expanding battery energy storage ecosystem

An SBICAPS report says funding of the battery energy storage ecosystem in India (spanning the project as well as the upstream level)

Get Price

6 FAQs about [Energy Storage Project Investment Budget]

Are energy storage systems a good investment?

This is understandable as energy storage technologies possess a number of inter-related cost, performance, and operating characteristics that and impart feed-back to impacts to the other project aspects. However, this complexity is the heart of the value potential for energy storage systems.

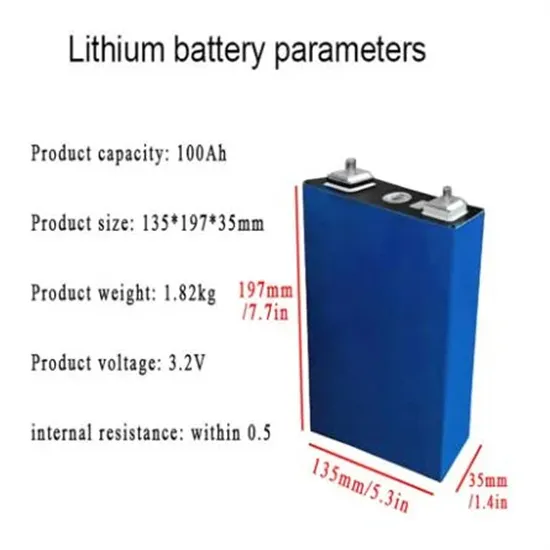

What is the capital cost of an energy storage system?

Capital Costs The capital cost of an energy storage system is the total value of all of the initial equipment purchased for the project. This is derived from adding the cost of all of the subassemblies and components needed to construct the final version of the product, many times described internally as a Bill of Material (BOM).

Should energy storage projects be developed?

However, energy storage project development does bring with it a greater number of moving parts to the projects, so developers must consider storage’s unique technology, policy and regulatory mandates, and market issues—as they exist now, and as the market continues to evolve.

Which energy storage technologies are included in the 2020 cost and performance assessment?

The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox flow batteries, pumped storage hydro, compressed-air energy storage, and hydrogen energy storage.

Are energy storage costs over-runs?

Engineering, Procurement, and Construction (EPC) costs have historically been subject to significant over-runs due to the small body of experience deploying energy storage systems. Overall, the base expense and the variance in possible costs ranges are expected to continue to decline as experience grows. 2.4.4.1. Project Development

Are energy storage projects different than power industry project finance?

Most groups involved with project development usually agree that energy storage projects are not necessarily different than a typical power industry project finance transaction, especially with regards to risk allocation.

More related information

-

Personal energy storage project investment

Personal energy storage project investment

-

German Energy Investment Wind Solar and Storage Project

German Energy Investment Wind Solar and Storage Project

-

Israel Energy Investment Energy Storage Project

Israel Energy Investment Energy Storage Project

-

Four Danish energy storage project investment companies

Four Danish energy storage project investment companies

-

The world s largest energy storage investment project

The world s largest energy storage investment project

-

Huawei s energy storage project investment model

Huawei s energy storage project investment model

-

Container Energy Storage Investment Project

Container Energy Storage Investment Project

-

New energy storage project investment

New energy storage project investment

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.