Timor-Leste Energy Situation

Timor-Leste''s energy landscape is characterized by a growing demand for electricity and a heavy reliance on imported fossil fuels. In 2022, almost all of the electricity being generated came

Get Price

DLA Piper advised Eletricidade de Timor-Leste on power

DLA Piper advised Eletricidade de Timor-Leste on its first utility-scale solar PV and battery storage project with a 100MW capacity, marking a major milestone in the country''s

Get Price

ENERGY PROFILE TIMOR LESTE

What is energy storage performance testing? Performance testing is a critical component of safe and reliable deployment of energy storage systems on the electric power grid. Specific

Get Price

ENERGY PROFILE Timor-Leste

newable resource potential Solar PV: Solar resource potential has been divided into seven classes, each representing a range of annual PV output per uni. of capacity (kWh/kWp/yr).

Get Price

Timor-Leste: Energy System Overview

Energy Overview of Timor-Leste CAUTION: The summaries provided below are based on the data in GEO which may be incomplete.

Get Price

Timor-Leste Energy Situation

Timor-Leste''s energy landscape is characterized by a growing demand for electricity and a heavy reliance on imported fossil fuels. In 2022, almost all of

Get Price

Energy in Timor-Leste

Timor-Leste consumes 125 GWh of electricity per annum, an average of 95 kWh per person. [1] The country has about 270 MW of electricity capacity, 119 MW in the city of Hera.

Get Price

Downstream Projects

Developing LNG capabilities would help Timor-Leste''s plan to achieve a significant reduction of both fuel supply cost and greenhouse gas emissions while also converting its main power

Get Price

PRICES AND COST OF LIVING IN TIMOR LESTE

A typical three-bedroom house with a 4.5kW system could save up to £871 per year at the current energy prices, allowing homeowners to break even in approximately eight years.

Get Price

NEGATIVE ELECTRICITY PRICE ENERGY STORAGE EAST TIMOR

East Timor Power Grid Energy Storage Production Base consumes 125 GWh of electricity per annum, an average of 95 kWh per person. The country has about 270 MW of electricity

Get Price

DOES TIMOR LESTE HAVE A HIGH ELECTRICITY ACCESS

East Timor Power Grid Energy Storage Production Base consumes 125 GWh of electricity per annum, an average of 95 kWh per person. The country has about 270 MW of electricity

Get Price

Timor-Leste residential battery storage cost per kwh

We develop an algorithm for stand-alone residential BESS cost as a function of power and energy storage capacity using the NREL bottom-up residential BESS cost model (Ramasamy et al.,

Get Price

DLA Piper advises Eletricidade de Timor-Leste on a power

The landmark project includes drafting and negotiating a power purchase agreement (PPA) and an implementation agreement with the Ministry of Finance, marking a

Get Price

Timor-Leste micro grid energy storage

High electricity costs and readily available solar radiation mean that the average payback period for a rooftop photovoltaic (PV) solar energy system in Timor-Leste is only 1.5 to 3 yearsinstead

Get Price

Battery energy storage system price trend in Timor-Leste

The global battery energy storage system market was valued at more than US$12 Bn in 2021; The largest battery energy storage system company globally is Tesla Inc. Lithium-ion batteries

Get Price

Energy storage solar power generation in Timor-Leste

In addition, most of Timor-Leste''s electricity is generated through costly and polluting diesel generators. Australia''s Market Development Facility (MDF) and ITP Renewables conducted an

Get Price

World Bank Document

Consumer price inflation remained high, averaging 8.4 percent during 2023, driven by escalating prices of food, non-alco-holic beverages, alcohol, and tobacco. Price pressures were

Get Price

Going Green

High electricity costs and readily available solar radiation mean that the average payback period for a rooftop photovoltaic (PV) solar energy system in Timor-Leste is only 1.5 to 3 years

Get Price

(PDF) Policy Recommendation on Green Energy

PDF | On Jun 18, 2023, Joaquim Da Costa and others published Policy Recommendation on Green Energy Access for FutureSustainability in Timor

Get Price

Timor-leste energy storage battery contract

Electricidade de Timor-Leste Empresa Pública (EDTL, E.P.), Timor-Leste''''s State-Owned Company in Electricity and Energy Sector, is seeking to award a power purchase agreement

Get Price

ENERGY PROFILE TIMOR LESTE

East Timor Power Grid Energy Storage Production Base consumes 125 GWh of electricity per annum, an average of 95 kWh per person. The country has about 270 MW of electricity

Get Price

Timor-Leste Liquid Cooling Energy Storage Battery Price List

How are lithium-ion energy storage systems changing the power industry? Lithium-ion energy storage systems are changing the power industry landscape. The nature of lithium-ion

Get Price

Latest and best solar panels Timor-Leste

in Timor-Leste,the photovoltaic units (or solar project) implementation project is specially directed for the families that live in remote areas,where difficulties still exist in the national energy

Get Price

Timor-Leste clean energy: 35 MW of Impressive Solar Power

Timor Island, encompassing Timor-Leste and West Timor, holds an impressive estimated solar energy potential of 20.72 GW. Harnessing this potential could transform the

Get Price

6 FAQs about [What is the current price of energy storage power in Timor-Leste ]

What is energy security in Timor-Leste?

1 Energy security is “uninterrupted availability of energy sources at an affordable price”; International Energy Agency. The average payback period for a rooftop PV solar energy system in Timor-Leste is 2.5 years. This is much lower than the global average of 6 to 10 years, due to solar resource and electricity costs:

How long does a solar system last in Timor-Leste?

High electricity costs and readily available solar radiation mean that the average payback period for a rooftop photovoltaic (PV) solar energy system in Timor-Leste is only 1.5 to 3 years instead of the global average of 6-10 years. Transitioning to solar can also help the country meet environmental commitments.

How much does electricity cost in Timor-Leste?

The cost of electricity in Timor-Leste for commercial and industrial consumers is high compared to ASEAN countries. For instance, in Indonesia industrial electricity tariffs are 0.11 USD/kWh, compared to 0.24 USD/kWh in Timor-Leste.

Why is solar energy maintenance important in Timor-Leste?

Maintenance tends to be limited to repairing malfunctioning system components, instead of preventative care or servicing, which can reduce the effectiveness of solar energy systems and increase costs. Technicians in Timor-Leste have experience in small-scale, off-grid solar energy systems.

What type of energy is used in Timor-Leste?

It comprises coal, oil, petroleum, and natural gas products. Timor-Leste's energy landscape is characterized by a growing demand for electricity and a heavy reliance on imported fossil fuels. In 2022, almost all of the electricity being generated came from oil or other fossil sources.

Why should Timor-Leste invest in solar & storage infrastructure?

José added: “The investment in Timor-Leste’s solar and storage infrastructure is transformative. It will help reduce dependence on fossil fuels while improving grid stability and energy access across the country”. José de Ponte was supported by special counsel Marnie Calli, senior associate Lisa Huynh and solicitor Jeraldine Mow.

More related information

-

What is the current price of energy storage power in Iraq

What is the current price of energy storage power in Iraq

-

What is the current price of energy storage power in Austria

What is the current price of energy storage power in Austria

-

Current price of mobile energy storage power supply

Current price of mobile energy storage power supply

-

What is the price of lithium energy storage power in the Solomon Islands

What is the price of lithium energy storage power in the Solomon Islands

-

What is the price of lithium energy storage power supply in Angola

What is the price of lithium energy storage power supply in Angola

-

What kind of energy storage power station has the lowest price

What kind of energy storage power station has the lowest price

-

What is the price of lithium energy storage power supply in Bahrain

What is the price of lithium energy storage power supply in Bahrain

-

What is the price of lithium energy storage power supply in Sierra Leone

What is the price of lithium energy storage power supply in Sierra Leone

Commercial & Industrial Solar Storage Market Growth

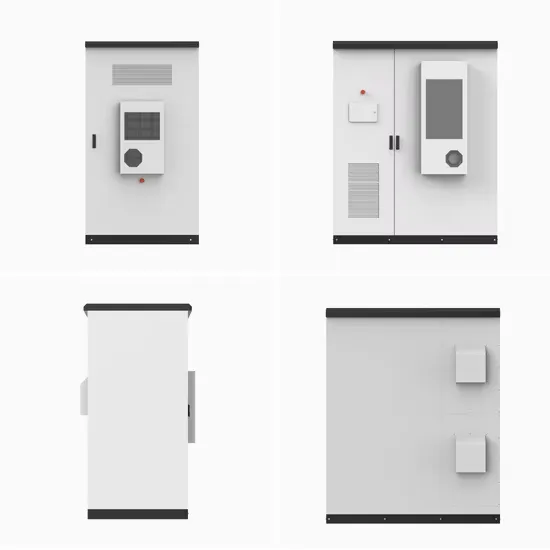

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.