South Sudan Outdoor Living Products Market (2025-2031) | Value

6Wresearch actively monitors the South Sudan Outdoor Living Products Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Get Price

South Sudan

Human development indicators placed the country among the poorest in Africa. The outbreak and continuation of violence since December 2013 have further

Get Price

The World ank

Electricity supply & demand: South Sudan suffers from significant levels of suppressed demand as well as well as one of the world''s lowest access rates – 6.7% as of 2019. About 70% of the

Get Price

South Sudan

Countries that rely heavily on imported energy may be vulnerable to supply disruption from external events such as the Covid-19 pandemic and the war in Ukraine. In countries that

Get Price

South Sudan resumes oil exports after a year of hiatus

South Sudan has fully resumed oil exports through Sudan, nearly a year after the main pipeline transporting crude was damaged during Sudan''s ongoing internal conflict. A

Get Price

Struggles for Electrical Power Supply in Sudan and South

Adequate power supply is an unavoidable requirement to any nation''s development. Industrialization and modernization cannot be achieved without proper access to electricity.

Get Price

South Sudan

Human development indicators placed the country among the poorest in Africa. The outbreak and continuation of violence since December 2013 have further eroded South Sudan''s

Get Price

South Sudan''s Electricity Sector Remains One Of The Fast

Power distribution is primarily localized, with cities like Juba relying on isolated systems. Reliability: Even in areas with access, electricity supply is often unreliable, with

Get Price

Pathways to Electricity Access Expansion in South Sudan

In 2020, the World Bank, in response to South Sudan''s transitional government''s request, set up the Pathways to Electricity Access Expansion in South Sudan project. As part of the initiative,

Get Price

South Sudan: Energy Country Profile

South Sudan: Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on

Get Price

Strengthening primary health care in fragile settings:

In South Sudan, development assistance is crucial as government funding for health is low, at less than 2% of the national budget, and out-of

Get Price

South Sudan on edge as Sudan''s war threatens vital

Sudan''s army says it may be forced to shut down facilities used to export oil from South Sudan as a result of the war.

Get Price

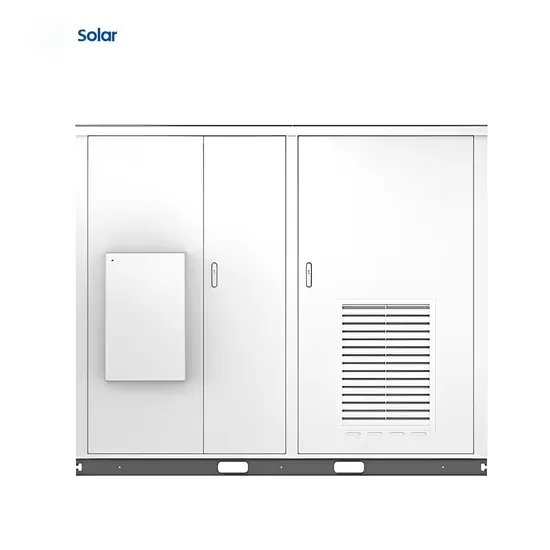

South Sudan Outdoor Power Supply Manufacturer Meeting

As South Sudan''s infrastructure develops, reliable outdoor power solutions become critical. Our manufacturing focus on durability, renewable integration, and local adaptation positions us as

Get Price

South Sudan – a Regional Power Market

Meanwhile, with an installed capacity of approximately 130 MW, the majority of which is used to supply power to the country''s extensive oil

Get Price

Struggles for Electrical Power Supply in Sudan and South

Adequate power supply is an unavoidable requirement to any nation''s development. Industrialization and modernization cannot be achieved without proper access to

Get Price

Renewable energy: A way out for South Sudan''s.

This policy brief sheds light on the potential of renewable energy as a solution to South Sudan''s ongoing electricity crisis. It examines the key

Get Price

South Sudan''s Milestone in Renewable Energy: First

South Sudan has taken a significant step toward renewable energy with the launch of its first large-scale solar power project. The Ezra

Get Price

World Bank Document

According to the study, only 5.4% of the South Sudanese population have access to electricity, slightly higher than the access rate of 4.2% reported in 2017.

Get Price

Energy industry in South Sudan

GDP at purchasing power parity in South Sudan is $7.743 billion in 2023, with a steady decline in GDP observed over recent years [3,4]. South Sudan GDP at purchasing

Get Price

South Sudan Energy Situation

Introduction Energy Situation Find relevant data on energy production, total primary energy supply, electricity consumption and CO2 emissions for South

Get Price

ENERGY PROFILE South Sudan

newable resource potential Solar PV: Solar resource potential has been divided into seven classes, each representing a range of annual PV output per uni. of capacity (kWh/kWp/yr).

Get Price

South Sudan – a Regional Power Market

Meanwhile, with an installed capacity of approximately 130 MW, the majority of which is used to supply power to the country''s extensive oil fields, South Sudan is currently

Get Price

South Sudan parliamentary session disrupted after power supply

South Sudan''s transitional national legislative assembly abruptly adjourned its Monday session after the main power supply generator malfunctioned, disrupting critical technology and raising

Get Price

South Sudan: Energy Country Profile

South Sudan: Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on decarbonizing our energy mix. This page

Get Price

South Sudan launches $53 million energy access project

South Sudan''s Ministry of Energy and Dams, with support from the World Bank, on Thursday launched a USD 53 million electricity access project which also aims to strengthen

Get Price

Struggles for Electrical Power Supply in Sudan and

Adequate power supply is an unavoidable requirement to any nation''s development. Industrialization and modernization cannot be achieved

Get Price

Renewable energy: A way out for South Sudan''s... | F1000Research

This policy brief sheds light on the potential of renewable energy as a solution to South Sudan''s ongoing electricity crisis. It examines the key factors hindering the development

Get Price

6 FAQs about [Is South Sudan s outdoor power supply good ]

How much power does South Sudan need?

Meanwhile, with an installed capacity of approximately 130 MW, the majority of which is used to supply power to the country’s extensive oil fields, South Sudan is currently evaluating ways to meet its power demand of 300 MW by way of renewable energy prospects.

Does South Sudan have electricity?

South Sudan is one of Eastern Africa's major oil resource holders but exported more than 85% of its production in 2014. Only 1% of the population had access to electricity in the country in 2017.

Is South Sudan a good place to buy energy?

Based on independent sources from consumers and suppliers, most of-grid energy products available in South Sudan are neither standardised nor quality verified. This hinders uptake, as many households reported quality to be a main factor in their purchase decision, especially in urban areas.

What is South Sudan's role as a power utility?

Its role as a power utility is expected to intensify as programmes to increase electricity access in South Sudan are implemented. It is proposed under the Electricity Bill 2015 as the regulatory entity for the electricity sector in South Sudan. It would function as the energy regulator whose functions would include the creation of regulations.

Will Ethiopia provide electricity to South Sudan?

Ethiopia is currently targeting an electricity transmission and distribution capacity of more than 70,000 GW, offering scope to supply much-needed electricity to South Sudan, whose electrification rates are amongst the lowest on the African continent.

How many energy companies are there in South Sudan?

There are about fourteen of-grid energy companies in South Sudan, and their services include i) selling solar products, ii) engineer-ing, procurement, and construction (EPC), iii) indepen-dent power production (IPPs) and iv) developing mini-grids.

More related information

-

Is lithium battery a good choice for outdoor power supply in Iran

Is lithium battery a good choice for outdoor power supply in Iran

-

South Sudan Outdoor Portable Energy Storage Power Bank

South Sudan Outdoor Portable Energy Storage Power Bank

-

South American outdoor power supply manufacturer

South American outdoor power supply manufacturer

-

Which energy storage power supply is best in South Sudan

Which energy storage power supply is best in South Sudan

-

How much does Sudan outdoor power supply cost

How much does Sudan outdoor power supply cost

-

Wind-solar hybrid power supply for communication base stations in South Sudan

Wind-solar hybrid power supply for communication base stations in South Sudan

-

Which manufacturer of outdoor power supply is good

Which manufacturer of outdoor power supply is good

-

South Sudan energy storage power supply manufacturer

South Sudan energy storage power supply manufacturer

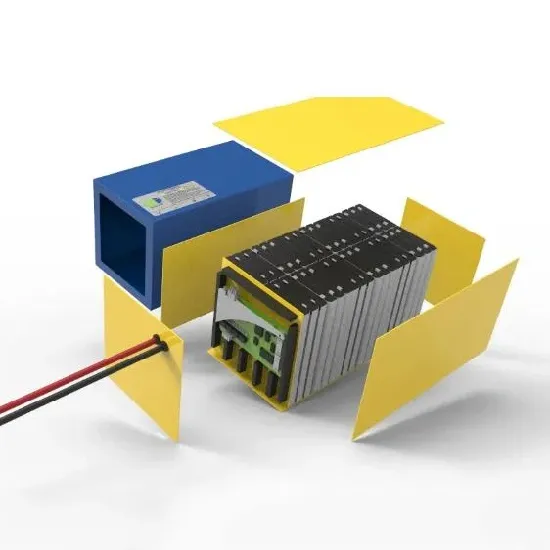

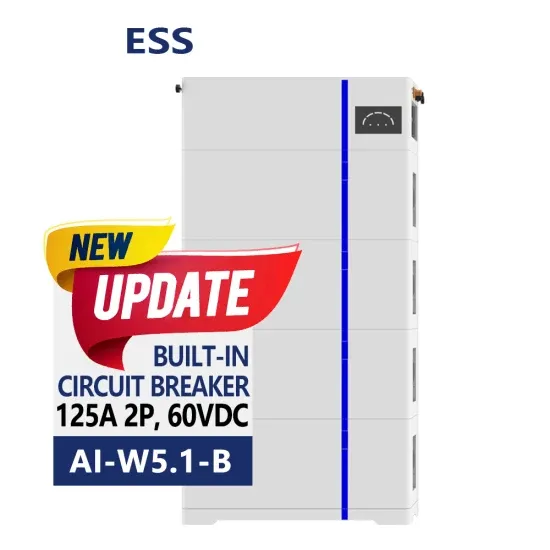

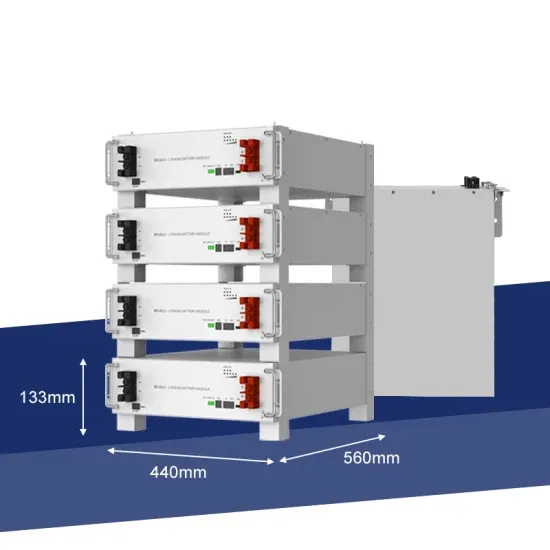

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.