How much is the profit of energy storage power station

The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Get Price

How much profit does an energy storage power station have?

1. An energy storage power station typically generates profit through various avenues, which can vary widely based on market conditions, location, and size.2. These

Get Price

How much do energy storage power station owners earn?

Energy storage power station proprietors can garner substantial income, influenced by various determinants such as 1. operational capacity, 2. regional electricity

Get Price

Electricity storage in Greece: State-of-play & near-term outlook

This article highlights key steps recently taken by the Greek State as regards the legal/regulatory framework and appropriate State aid schemes, to kickstart electricity storage activity and allow

Get Price

How much does a household energy storage power station cost?

The procurement of a household energy storage power station typically incurs significant financial outlay. The average price range lies between $7,000 and $15,000,

Get Price

Greece: 27GW of battery storage projects gear up for auctions

Price expectations will be anchored around the prices achieved in the first auction, and we are likely to see bids around the lower end of the successful range.

Get Price

2022 Grid Energy Storage Technology Cost and

Recycling and decommissioning are included as additional costs for Li-ion, redox flow, and lead-acid technologies. The 2020 Cost and Performance

Get Price

Amfilochia Pumped Storage: Pioneering a new hydropower era

Among these projects is the groundbreaking pumped storage hydropower (PSH) project in Amfilochia. At a development cost of more than €600 million, it is the largest investment in

Get Price

Investing in the Greek Energy, Renewables, Wind and Solar Sector

The energy sector in Greece, particularly renewables, has seen significant foreign direct investment in recent years. This is on the back of developing bilateral and trilateral

Get Price

How much does a grid-connected energy storage

1. The cost of a grid-connected energy storage power station typically ranges from $400 to $1,000 per kWh of installed capacity, varying

Get Price

Introduction to the Greek Energy Storage Power Station

Should Greece invest in energy storage facilities? Currently there is a growing interest for investments in storage facilities in Greece. Licensed projects mostly consist of Li-ion battery

Get Price

How much does a factory energy storage power station cost?

The cost of a factory energy storage power station varies widely depending on several factors, including 1. technology type, 2. scale and capacity, 3. installation and

Get Price

How much does it cost to invest in an energy storage power station

When contemplating the financial implications of establishing an energy storage power station, the initial investment emerges as a focal point. The costs are influenced by

Get Price

How much profit does a large energy storage power station have?

1. Energy storage power stations can generate substantial profits, which can be delineated into diverse facets: 1) Initial capital investment recovery is critical; 2) Revenue

Get Price

How much does a shared energy storage power

1. A shared energy storage power station typically charges between $150 to $500 per megawatt-hour (MWh), depending on various

Get Price

How much does energy storage power station design cost?

In summary, the question of design costs for energy storage power stations does not yield a singular answer, but rather a spectrum of financial considerations influenced by

Get Price

How much does a small energy storage power station cost?

1. The cost of a small energy storage power station generally ranges from $300,000 to $2 million, depending on various factors, such as technology choice, installation

Get Price

How much does it cost to invest in energy storage power stations?

Investing in energy storage power stations involves a range of costs that vary significantly depending on several critical factors. 1. Initial capital expenditure is significant,

Get Price

Greece: 27GW of battery storage projects gear up for

Price expectations will be anchored around the prices achieved in the first auction, and we are likely to see bids around the lower end of the

Get Price

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· How does location affect energy storage station costs? Location directly impacts construction expenses such as land, labor, and permitting. It also influences long-term

Get Price

How much does it cost to invest in an energy storage power

When contemplating the financial implications of establishing an energy storage power station, the initial investment emerges as a focal point. The costs are influenced by

Get Price

Greece Needs Investments in Energy Storage and Grid

A new study by the Center for Liberal Studies (KEFIM), in collaboration with the EPICENTER think tank, highlights the urgent need for investment in energy storage and the

Get Price

How much does the energy storage power station earn?

Moreover, energy storage does not only alleviate the requirement for new power plants; it acts as a competitive alternative to other energy suppliers. The positive impact on

Get Price

Electricity storage in Greece: State-of-play & near

This article highlights key steps recently taken by the Greek State as regards the legal/regulatory framework and appropriate State aid schemes, to kickstart

Get Price

Green energy investment opportunities in Greece

The European Investment Bank offers preferential financing for Greek renewable projects, with interest rates as low as 2.5% for qualified investments. Additionally, the EU''s

Get Price

How much profit does an energy storage power station make?

1. Profit generation for an energy storage power station can vary significantly based on multiple factors, including geographical location, market conditions, technology used,

Get Price

6 FAQs about [How much does it cost to invest in a Greek energy storage power station ]

Should Greece invest in energy storage facilities?

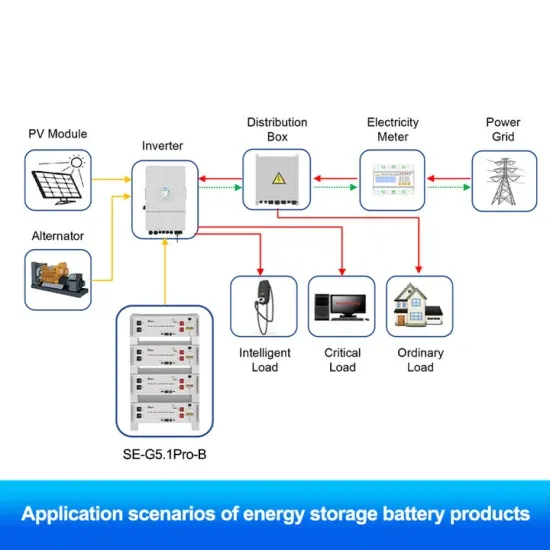

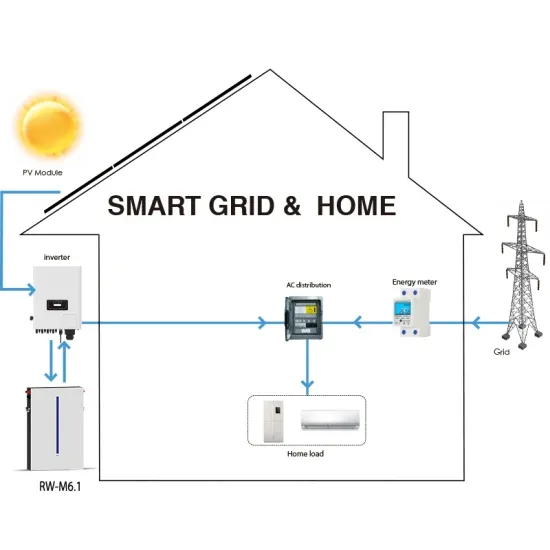

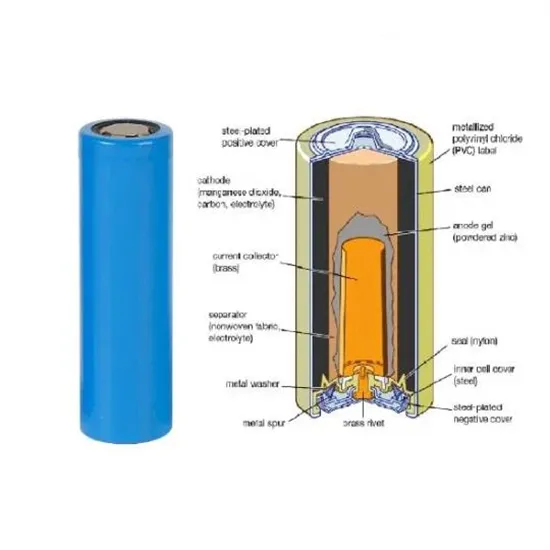

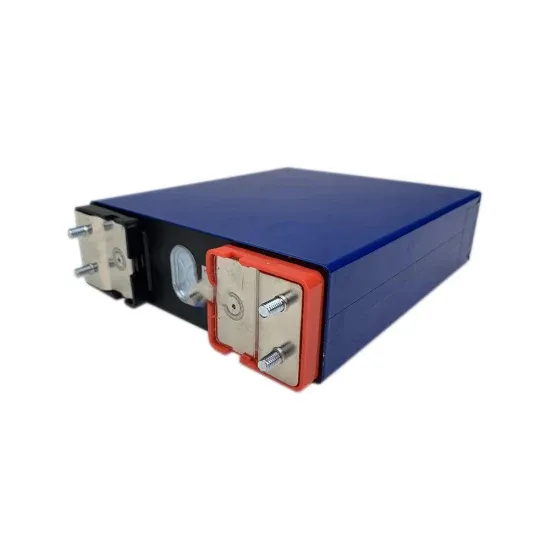

Currently there is a growing interest for investments in storage facilities in Greece. Licensed projects mostly consist of Li-ion battery energy storage systems (BESS), either stand-alone or integrated in PVs, as well as PHS facilities .

Why is Greece launching a battery storage auction?

Initially a response to the COVID 19 pandemic, the focus has pivoted to support Greece’s green energy transition. The storage auctions themselves require further approval under EU State aid rules. The pipeline of prospective battery storage projects now approaches 27GW, with over 500 projects granted a storage license.

Does Greece have a battery storage pipeline?

Greece has emerged as one of the countries with the largest pipeline of battery storage projects, but as yet there has been little activity on the ground. This is changing as the long-awaited storage subsidy auctions have started, with the first projects being awarded support for both investment and operating costs.

How long should energy storage be in a Greek power system?

Considering the energy arbitrage and flexibility needs of the Greek power system, a mix of short (~2 MWh/MW) and longer (>6 MWh/MW) duration storages has been identified as optimal. In the short run, storage is primarily needed for balancing services and to a smaller degree for limited energy arbitrage.

Why does Greece need gas storage?

The need for storage in Greece will accelerate rapidly over the next decade as renewables targets are revised upwards and coal plants are closed. The pivot to gas, a core part of the country’s energy strategy just a couple of years ago, has been upended by the disruption to supplies and price volatility caused by Russia’s invasion of Ukraine.

Why is Greece launching a storage auction in 2021?

Funding was first announced in 2021 as part of the National Recovery and Resilience Plan. Initially a response to the COVID 19 pandemic, the focus has pivoted to support Greece’s green energy transition. The storage auctions themselves require further approval under EU State aid rules.

More related information

-

How much does it cost to invest in an energy storage power station in Algeria

How much does it cost to invest in an energy storage power station in Algeria

-

How much does it cost to invest in building an energy storage power station

How much does it cost to invest in building an energy storage power station

-

How much does an energy storage power station usually cost

How much does an energy storage power station usually cost

-

How to make energy storage power station cost BESS

How to make energy storage power station cost BESS

-

How much does the Turkmenistan energy storage power station cost

How much does the Turkmenistan energy storage power station cost

-

How much does a solar energy storage power station cost

How much does a solar energy storage power station cost

-

How much does the Burundi energy storage power station cost

How much does the Burundi energy storage power station cost

-

How much does flywheel energy storage wind power cost

How much does flywheel energy storage wind power cost

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.