5G base station rollout in the U.S. and China 2021

The United States (U.S.) and China are both rolling out ** infrastructure at a rapid rate, growing approximately *** times in size from

Get Price

5G Base Station Market By Share, Size and Forecast 2028

The Global 5G Base Station Market is experiencing rapid growth and transformation as it plays a pivotal role in ushering in the era of 5G connectivity.

Get Price

5G Base Station Market Analysis, Industry Trends

Smart Cities to Witness Major Growth 5G technology is an enabling technology for IoT, and as smart cities essentially rely on IoT, the demand for

Get Price

Which RF Technologies Are Shaping 5G Base Stations?

5G base stations are the backbone of the 5G network, transmitting and receiving radio signals across various frequency bands to provide connectivity to mobile devices.

Get Price

Europe 5G Base Station Market Size & Outlook, 2030

This continent databook contains high-level insights into Europe 5g base station market from 2018 to 2030, including revenue numbers, major trends, and

Get Price

Europe 5G Base Station Market

Strategic insights for the Europe 5G Base Station provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances.

Get Price

Accelerating 5G in the Nordic and Baltic region

This publication investigates the challenges, potentials and opportunities in a differentiated 5G regional landscape based on a SWOT analysis and mapping of the most

Get Price

UK 5G Base Station Construction MarketGrowth in Sweden

Emerging Private 5G Network Projects: Growth in smart cities, healthcare digitization, and advanced manufacturing supports robust private 5G base station installation,

Get Price

The Envy of Europe: Nordics Lead in 5G Availability and Network

In Q4 2024, Nordic countries claimed three of the top five positions in Europe for 5G Availability—the percentage of users with 5G-capable devices spending most of their time

Get Price

5G Base Station Market Report 2025

What Is Covered Under 5G Base Station Market? A 5G base station is a network infrastructure component that enables wireless communication in a 5G network by connecting mobile

Get Price

ACCELERATING 5G IN THE NORDIC AND BALTIC

Nordic and Baltic countries feature a vast range of testbeds and other test activities for 5G. This report lists almost 50 such testbeds,2 s. rving a range of purposes from network research to

Get Price

Global 5G Communication Base Station Antenna Market: Size

5G Communication Base Station Antenna Market size was valued at USD 4.2 Billion in 2024 and is forecasted to grow at a CAGR of 14.

Get Price

Europe 5G Base Station Market Size & Outlook, 2030

This continent databook contains high-level insights into Europe 5g base station market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Get Price

5G COUNTRY PROFILE

In February 2019, ice Norway announced that it was building a 5G-ready network in urban areas across Norway based on Nokia AirScale Radio Access technology, with approximately 1000

Get Price

5G in Nordics: Sweden Leads on Speeds, Denmark

Using Speedtest Intelligence, we compared 5G Availability, which refers to the percentage of users on 5G-capable devices that spend most of

Get Price

Global 5G Base Station Chips Market 2025

5G Base Station Chips are specialized semiconductor components designed to power the hardware of 5G base stations. These chips handle tasks such as signal processing, data

Get Price

5G Base Station Market is estimated to record a CAGR of 15.6

Increased Demand for Low Latency and High-Speed Data Drives 5G Base Station Market Growth Low latency 5G networks create new possibilities for services that demand

Get Price

DECT NR+

DECT NR+ (NR+) is a non-cellular radio standard recently included as part of the 5G standards by the ITU. Thus, making it the world''s first non-cellular

Get Price

5g Base Station Market Size & Share Analysis

The increasing sophistication of smartphone applications, combined with users'' growing expectations for instantaneous connectivity, continues to drive the deployment of 5G

Get Price

5G Base Station Market Size

The 5G base station market has witnessed remarkable growth in recent years, driven by the global demand for faster, more reliable, and low-latency wireless

Get Price

5G in China

5G CAPEX investments in China 2023, by telecom company Breakdown of 5G base stations in China 2022, by region Breakdown of newly constructed 5G base stations in

Get Price

Telecommunication industry in selected Nordic countries

The Nordic region is one of the world''s most digitized and advanced in telecommunications. It houses large telecom providers such as Nokia and Ericsson, both

Get Price

Accelerating 5G in the Nordic and Baltic region

This publication investigates the challenges, potentials and opportunities in a differentiated 5G regional landscape based on a SWOT

Get Price

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Get Price

5G in Nordics: Sweden Leads on Speeds, Denmark on 5G

Using Speedtest Intelligence, we compared 5G Availability, which refers to the percentage of users on 5G-capable devices that spend most of the time with access to 5G

Get Price

4G & 5G Base Station Antennas Market Analysis and Forecast

The report delves into recent significant developments in the 4G & 5G Base Station Antennas Market, highlighting leading vendors and their innovative profiles. These

Get Price

6 FAQs about [5G base stations in the Nordic communications market]

Are Nordic operators celebrating 5G availability?

Analysis of Speedtest Intelligence ® data confirms that Nordic operators have much to celebrate. In Q4 2024, Nordic countries claimed three of the top five positions in Europe for 5G Availability—the percentage of users with 5G-capable devices spending most of their time connected to 5G networks.

What makes the Nordics a great 5G country?

Within Europe, the Nordics stand out on 5G performance. Part of this is because of 5G spectrum availability as all four of the Nordic countries on the continent have already assigned low-band and mid-band spectrum. This is ahead of the rest of Europe, as we have reflected on the 5G progress across Europe.

Is the Nordic region a good place to invest in 5G?

Home to two of the world’s largest radio vendors, Ericsson and Nokia, and characterised by markedly higher operator profitability than much of the rest of Europe, the Nordic region remains a key bright spot in Europe’s struggle for competitiveness against the Middle East, North America and Asia in 5G.

Does the Nordic-Baltic region have a strong 5G network?

regional SWOT analysis to the right, the Nordic-Baltic region features many strong 5G points. The large number of testbeds indicate great in erest from many stakeholders, particularly within the transpo t and man-ufacturing industries. However, the test activities sufer from a lack of termi-nals. The few 5G terminals that have

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

How have Nordic countries positioned themselves in the 5G cycle?

Nordic countries have distinguished themselves in the 5G cycle through the timely release of mid-band spectrum assets, the development of innovative government policies to enable widespread rollout beyond core urban centres and a unique appetite for network sharing.

More related information

-

What are the 5G base stations of Lesotho Communications Company

What are the 5G base stations of Lesotho Communications Company

-

How many base stations are there in Guinea s 5G communications operations

How many base stations are there in Guinea s 5G communications operations

-

China Communications 40 000 5G base stations

China Communications 40 000 5G base stations

-

Uruguay Communications 30 000 5G base stations

Uruguay Communications 30 000 5G base stations

-

Communications are compensated according to 5G small base stations

Communications are compensated according to 5G small base stations

-

Which company is bidding for Asia Communications 5G base stations

Which company is bidding for Asia Communications 5G base stations

-

How many 5G base stations does Estonia Communications have

How many 5G base stations does Estonia Communications have

-

Marshall Islands Communications 30 000 5G base stations

Marshall Islands Communications 30 000 5G base stations

Commercial & Industrial Solar Storage Market Growth

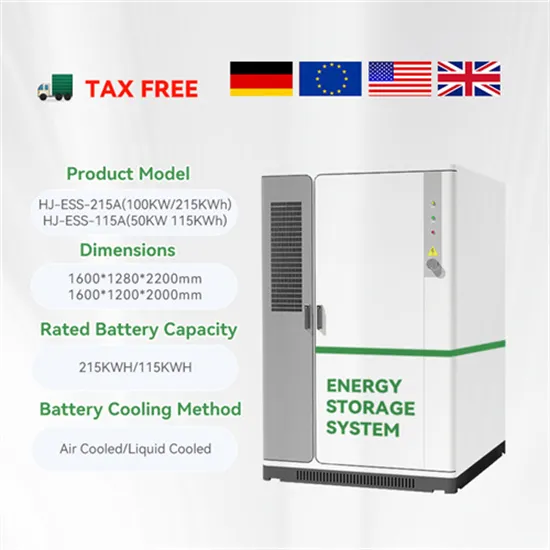

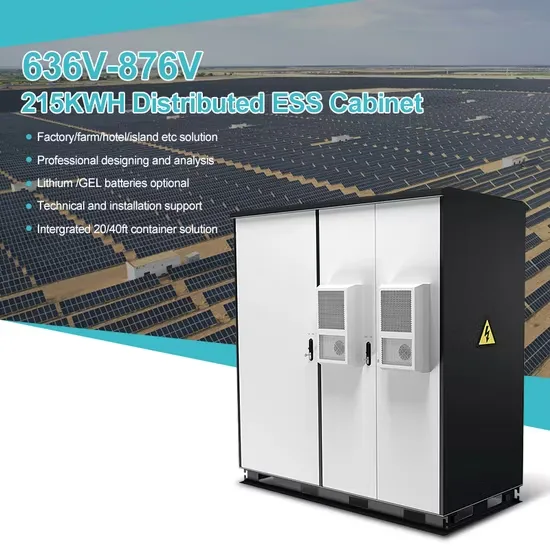

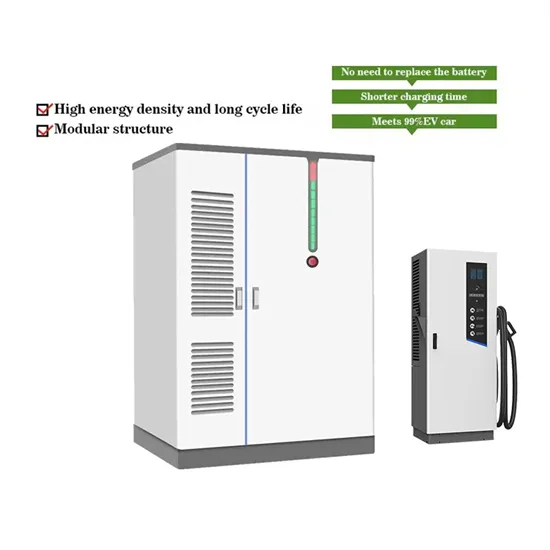

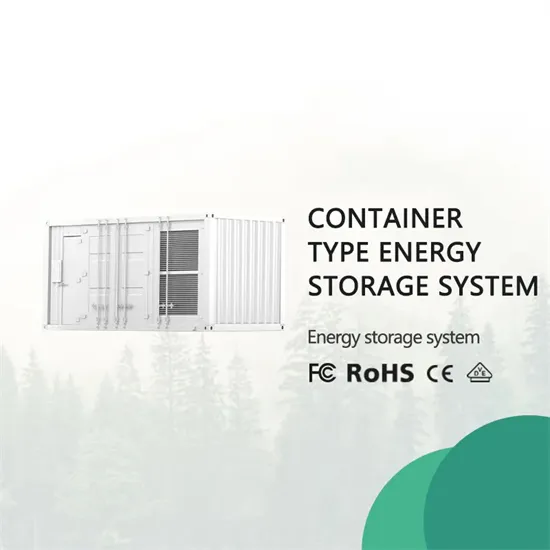

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.