2025 Q1 Global Energy Storage Cell Shipments:

The gap in market share among the second to sixth-ranked companies (EVE Energy, CALB, Hithium, BYD, and Rept Battero) is

Get Price

SINEXCEL Ranked No.1 in Global Third-Party String PCS Shipments

SINEXCEL (300693.SZ) has been ranked No.1 among Chinese companies in global third-party string PCS shipments, according to the "2024 Global Energy Storage Industry Chain Data and

Get Price

Review|China''s Energy Storage Battery Companies with

According to statistics from InfoLink Consulting, REPT ranked third globally in energy storage battery shipments during the first quarter of 2023. Their official website

Get Price

2024 Energy Storage Battery Cell Shipment Rankings

In 2024, BYD ranked fourth globally in energy storage battery shipments. The company not only performed strongly in the domestic market but also achieved significant

Get Price

Commercial And Industrial Energy Storage Market Size, Share

9 hours ago· The Commercial And Industrial Energy Storage Market is expected to reach USD 91.99 billion in 2025 and grow at a CAGR of 12.29% to reach USD 164.23 billion by 2030.

Get Price

Sino-American showdown! The top 10 global energy storage

It is worth noting that CATL, BYD and Haichen Energy Storage are all leading companies in energy storage cells, and CATL and BYD are the first and third in global energy

Get Price

Energy-storage cell shipment ranking: Top five dominates still

The world shipped 196.7 GWh of energy-storage cells in 2023, with utility-scale and C&I energy storage projects accounting for 168.5 GWh and 28.1 GWh, respectively, according

Get Price

Trina Storage Ranked Top 10 by S&P Global Commodity Insights

As of Q3 2024, Trina Storage has cumulatively shipped over 7.5 GWh of energy storage and systems worldwide.

Get Price

Global Energy Storage Cell Shipment Ranking 1Q-3Q24

In the first three quarters of 2024, global utility-scale energy storage cell shipments reached 180 GWh, up 49.4% YoY. The top five

Get Price

Global Energy Storage System Vendor Shipment Rankings 2025

Current market data reveals a fascinating three-way race between established industrial giants, nimble tech startups, and vertically integrated renewable energy providers.

Get Price

Energy storage system supplier shipment ranking

According to InfoLink''''s global lithium-ion battery supply chain database, energy storage cell shipment reached 114.5 GWh in the first half of 2024, of which 101.9 GWh going to

Get Price

2024 Global and non-China shipments of energy storage cell:

In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy,

Get Price

Global energy storage system shipment ranking

The second quarter of 2023 was the first quarter on record in which global residential energy storage shipments have declined year on year, down by 2%, according to S& P Global

Get Price

Sunwoda Debuts 684Ah & 588Ah Energy Storage Cells Globally

2 days ago· LAS VEGAS, Sept. 10, 2025 /PRNewswire/ -- At RE+ 25, Sunwoda (Stock Code: 300207), a global full-scenario energy storage solution provider, unveiled two groundbreaking

Get Price

Sino-American showdown! The top 10 global energy storage

Despite the short-term disruptions caused by geopolitical and other factors, InfoLink expects system shipments to exceed 300GWh in 2025, driven by the rigid demand of

Get Price

Trina Storage Ranked Top 10 by S&P Global Commodity Insights for Global

Amidst the thriving global energy storage market, TrinaStorage has once again earned recognition from authoritative institutions with its outstanding innovation capabilities

Get Price

Top 10 energy storage integrators by shipment volume

MUNICH, Jan. 8, 2024 /PRNewswire/ -- Trina Storage is ranked among global top 5 storage providers and integrators for its solid financial position, high-quality energy storage products

Get Price

SINEXCEL Ranked No.1 in Global Third-Party String PCS Shipments

The EESA rankings assess companies on global presence, technological innovation, and product competitiveness. With a presence in 40+ countries and over 5,000 deployed projects,

Get Price

SINEXCEL Ranked No.1 in Global Third-Party String PCS Shipments

🚀 SINEXCEL Ranked No. 1 in Global Third-Party String #PCS Shipments Among Chinese Companies! 🌍 The Electrical Energy Storage Alliance (EESA) rankings evaluate companies

Get Price

Trina Storage Ranked Top 10 by S&P Global Commodity Insights for Global

As of Q3 2024, Trina Storage has cumulatively shipped over 7.5 GWh of energy storage and systems worldwide.

Get Price

SINEXCEL Ranked No.1 in Global Third-Party String PCS Shipments

The EESA rankings assess companies on global presence, technological innovation, and product competitiveness. With a presence in 40+ countries and over 5,000

Get Price

Global Energy Storage Cell Shipment Ranking 1Q-3Q24

In the first three quarters of 2024, global utility-scale energy storage cell shipments reached 180 GWh, up 49.4% YoY. The top five manufacturers, CATL, EVE Energy, Hithium,

Get Price

Top 10 Global Microinverter Companies Ranked in 2023; China

Data indicates that in 2021, global microinverter shipments reached 3.61GW, growing by 58.3% year-on-year. In 2022, global microinverter shipments reached

Get Price

2024 Global energy storage system (ESS) shipment ranking

InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

Get Price

1Q25 Global energy storage system (ESS) shipment ranking:

InfoLink Consulting has released its 1Q25 global energy storage system (ESS) shipment ranking, based on its energy storage supply chain database.

Get Price

H1 2024 Global Energy Storage Cell Shipments: Retrospect and

A rush to complete installations by June 30 drove utility-scale storage cell shipments in the first half of the year, resulting in a 44.3% year-over-year increase.

Get Price

SINEXCEL Ranked No.1 in Global Third-Party String PCS Shipments

SHENZHEN, China, April 10, 2025 /PRNewswire/ -- SINEXCEL (300693.SZ), a global pioneer in modular energy storage, EV charging, and power quality solutions, has been ranked No.1

Get Price

6 FAQs about [Energy storage product shipments ranked third globally]

What are the top 5 energy storage cell shipments in 2024?

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients. Stability: With years of industry experience, CATL maintains a clear market advantage and firmly holds the top position in the industry.

Which energy storage cell manufacturers grew the most in 2024?

In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants.

How did energy storage cell shipments perform in 2024?

According to InfoLink’s Global Energy Storage Supply Chain Database, global energy storage cell shipments totaled 314.7 GWh in 2024, up 60% YoY. The market showed a trend of early decline followed by a rebound, with 4Q24 shipments increasing 19.7% QoQ, reaching the annual peak for 2024.

What are the top 5 energy storage manufacturers?

The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants. According to InfoLink, 300Ah+ cells now account for nearly 50% of the global utility-scale energy storage market in a single quarter.

Which Chinese energy storage battery companies performed well?

Chinese energy storage battery companies performed exceptionally well, achieving record-breaking global shipments. CATL maintained its leading position for consecutive years, while other companies such as EVE Energy, HiTHIUM, BYD, and AESC followed closely. TOP 1 CATL

Which countries have commissioned energy storage systems in 2023?

In the U.S., the company successfully delivered and commissioned four grid-scale energy storage systems in Massachusetts, further establishing its presence in North America. Across Europe, key milestones including a 100MWh project in Germany, and the Torre di Pierri standalone energy storage project in Italy, successfully commissioned in late 2023.

More related information

-

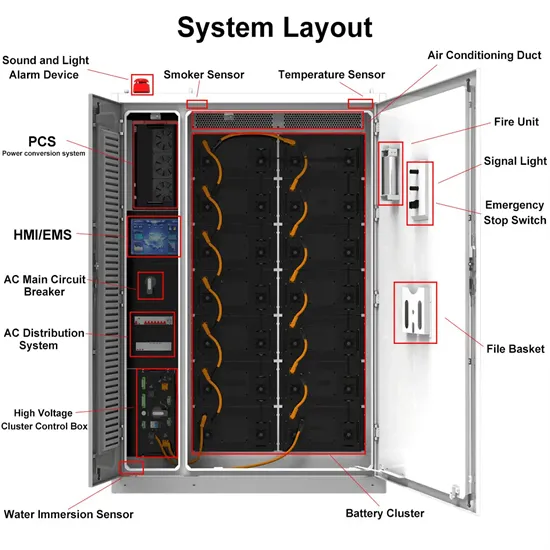

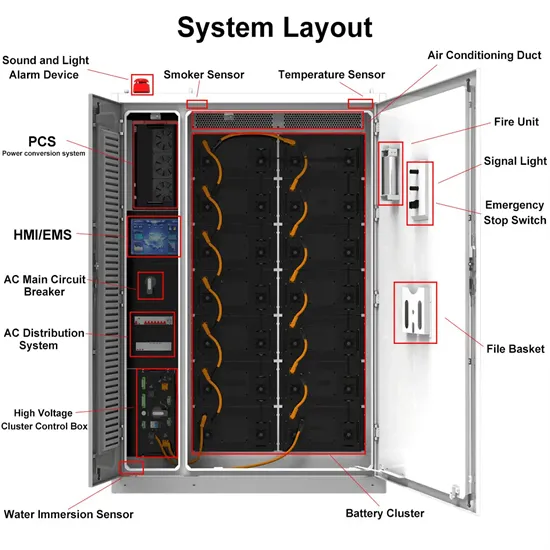

Somali Valley Power Energy Storage Product Introduction

Somali Valley Power Energy Storage Product Introduction

-

Energy Storage Product Warranty

Energy Storage Product Warranty

-

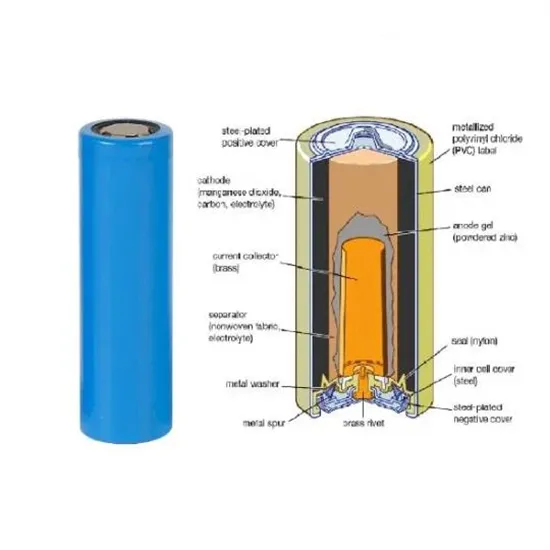

Energy Storage Outdoor Power Supply Product Structure

Energy Storage Outdoor Power Supply Product Structure

-

What is a high-power energy storage BMS product

What is a high-power energy storage BMS product

-

Cybersecurity product sales and energy storage sales

Cybersecurity product sales and energy storage sales

-

Laos energy storage product export companies

Laos energy storage product export companies

-

What is the energy storage power supply product category

What is the energy storage power supply product category

-

Turkmenistan new energy storage product development

Turkmenistan new energy storage product development

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.