Top 20 Solar Power System Manufacturers in the USA (2025)

Discover the leading 20 U.S. solar manufacturers driving clean energy in 2025. Explore company info, specialties, and contact details.

Get Price

Best Solar Power Stocks Of 2025 – Forbes Advisor

Solar stocks have a lot of long-term potential in the age of climate change. Currently, less than 4% of all U.S. power generation comes from solar, so there''s plenty of room for growth in the...

Get Price

SOUTH KOREA''S SOLAR POWER INDUSTRY: STATUS

Introduction China''s growing global market dominance in solar photovoltaic (PV) supply chains has created considerable challenges for South Korea''s PV industry in various value chain

Get Price

Best Solar Energy Stocks in India | 5paisa

The combination of rising energy demand, India''s climate goals, and falling solar panel costs has made solar energy far more than just a green alternative. Investors looking for

Get Price

5 Best Solar Stocks to Buy Today | Investing | U.S. News

Solar energy is a challenging industry, but these five solar stocks are managing the changes well. With the levelized cost of energy for utility-scale solar down around $30 to $60

Get Price

Best Solar Energy Stocks to Invest In 2025 | The Motley Fool

Learn to make money while investing in green energy companies like these solar stock industry leaders. Profit while investing for the world you want to see.

Get Price

Top 10 Solar Panel Manufacturers in Turkey | Price

Production Capacity: 1.8 GW Founded: 2008 Rank: 408th biggest company in Turkey Services: Solar power plant investment, technical

Get Price

3 Solar Stocks to Buy Now or Regret Missing the Next Big Boom

Enphase Energy (ENPH) makes the necessary ingredients to turn solar energy into energy that powers your home. First Solar (FSLR) is one of America''s leading producers of

Get Price

US market''s top 10 solar panel brands

SolarReviews ranks the top 10 solar panel manufacturers in a new report, based on weighted metrics such as value, quality, and US investment. From pv magazine USA.

Get Price

US market''s top 10 solar panel brands

SolarReviews ranks the top 10 solar panel manufacturers in a new report, based on weighted metrics such as value, quality, and US investment.

Get Price

How to Invest in the Solar Industry

Solar Panels: Companies that produce photovoltaic (PV) panels, which convert sunlight into electricity. This includes the creation of silicon wafers, cells, and modules.

Get Price

How to Setup a Solar Panel Manufacturing Plant in India

Why Invest in Solar Panel Manufacturing in India? India''s solar energy sector has experienced rapid growth due to supportive government

Get Price

Top 5 American solar panel manufacturers in 2025

Key takeaways The top five solar panel manufacturers in the U.S. are First Solar, Qcells, Canadian Solar, Illuminate USA, and T1 Energy. These companies

Get Price

5 Best Solar Stocks to Buy Today | Investing | U.S. News

Solar energy is a challenging industry, but these five solar stocks are managing the changes well. With the levelized cost of energy for utility

Get Price

China finalises stricter investment guidelines for solar

China''s solar panel manufacturers have been calling for the government to step in and curb over-investment in the industry that has led to

Get Price

Top 4 Solar Stocks to Watch in 2025 and Why They Matter

Here are four leading solar companies that are helping advance the clean energy transition: 1. First Solar (FSLR): Scaling Sustainable Solar with Advanced Thin-Film Tech.

Get Price

Top 11 Solar Panel Manufacturers in China : 2025

Explore top solar panel manufacturers in China, production centers, and decisions on sourcing the best solar panels made in china.

Get Price

Investing in Solar Panel Manufacturing: A Complete Guide

Thinking of investing in solar? This guide covers the benefits, startup costs, and key steps for launching a solar panel manufacturing business.

Get Price

Top 10 Solar Panel Manufacturers in China

2 days ago· In the global pursuit of renewable energy, China stands as an undisputed titan in the solar panel manufacturing industry. The country''s immense production capacity, relentless

Get Price

How to Start a Solar Panel Manufacturing Plant: Complete Guide

Solar Panel Manufacturing Plant Complete Guide is your go-to resource for diving into the world of solar panel production. This guide will take you through every aspect of setting up and

Get Price

Ohio will soon be home to the largest solar factory complex outside

The $680 million investment by First Solar (FSLR), the only US-headquartered major manufacturer of solar panels, will be the company''s third factory in the Toledo area.

Get Price

Top 4 Solar Stocks to Watch in 2025 and Why They

Here are the top solar stocks to watch in 2025: First Solar, Enphase Energy, Daqo New Energy, SolarBank, and their role in energy

Get Price

"Renewable Energy Stocks: Should You Invest in Solar Panel

In this comprehensive guide, we delve into the intricacies of investing in solar panel manufacturers, providing insights, analysis, and guidance to help you make informed

Get Price

Top 14 Solar Companies in Malaysia

In the following sections, we will delve into the backgrounds, accomplishments, and commitments of these 14 remarkable solar companies that have made a significant mark on

Get Price

Investing in Solar Panel Manufacturing Stocks: Trends and

Discover key insights into Solar Panel Manufacturing Stocks and their role in green energy investments, including market trends, financial metrics, and future prospects.

Get Price

How to Invest in the Solar Industry

Solar Panels: Companies that produce photovoltaic (PV) panels, which convert sunlight into electricity. This includes the creation of silicon

Get Price

TIER 1 Solar Panels: Complete Guide for Distributors

The term TIER 1, in the context of solar panels, refers to an unofficial but widely recognized industry classification that identifies PV module manufacturers

Get Price

Investing in Solar Panel Manufacturing: A Complete

Thinking of investing in solar? This guide covers the benefits, startup costs, and key steps for launching a solar panel manufacturing business.

Get Price

6 FAQs about [Invest in photovoltaic panel manufacturers]

Which solar panels are the best?

This report ranked solar panels based on performance under a wide set of stress tests in its lab. The top overall performers, in alphabetical order, were Astronergy, JA Solar, JinkoSolar, Longi Solar, Qcells, Runergy, Trina Solar, and Yingli Solar. This content is protected by copyright and may not be reused.

What is building-integrated photovoltaics (BIPV)?

Building-integrated photovoltaics (BIPV) are another area of development. BIPV seamlessly blend solar elements with building materials, like solar windows and solar shingles. This integration not only generates clean energy but also aims to transform structures into eco-friendly powerhouses, revolutionizing urban landscapes.

How are photovoltaic cells transforming the world?

As the backbone of solar technology, photovoltaic cells are undergoing rapid transformation. Engineers are tirelessly working to enhance their efficiency, aiming to convert sunlight into electricity with unprecedented yield. Cutting-edge materials and novel designs are at the forefront of these efforts.

What metrics should investors consider when evaluating solar companies?

Here are five key metrics investors should consider when evaluating companies in the solar sector: Revenue Growth and Profit Margins. Consistent revenue growth indicates rising demand and market share, while healthy profit margins reflect operational efficiency and cost control.

Does SolarEdge sell current inverter systems?

SolarEdge Technologies, Inc. (SEDG) SolarEdge sells current inverter systems for solar installations, allowing the panels to alternate current or AC power that is transmissible across the energy grid. It also offers power optimizers, “smart energy” management tools, energy storage solutions and other add-ons that help make the most of solar arrays.

Does first solar have a growth pipeline?

First Solar also has a lot of growth lined up. In early 2025, the company had 68.5 gigawatts (GW) of total bookings in its backlog, which it expects to deliver over the next several years. Meanwhile, it had another 80.3 GW of booking opportunities in its pipeline.

More related information

-

Greek photovoltaic solar panel manufacturers

Greek photovoltaic solar panel manufacturers

-

China photovoltaic panel wholesale and retail manufacturers

China photovoltaic panel wholesale and retail manufacturers

-

Zimbabwe photovoltaic panel inventory manufacturers

Zimbabwe photovoltaic panel inventory manufacturers

-

Kyrgyzstan has photovoltaic panel manufacturers as agents

Kyrgyzstan has photovoltaic panel manufacturers as agents

-

Can 40w invest in a solar photovoltaic panel factory

Can 40w invest in a solar photovoltaic panel factory

-

Chile sends photovoltaic panel manufacturers

Chile sends photovoltaic panel manufacturers

-

Serbia has several photovoltaic panel manufacturers

Serbia has several photovoltaic panel manufacturers

-

Room temperature superconducting photovoltaic panel manufacturers

Room temperature superconducting photovoltaic panel manufacturers

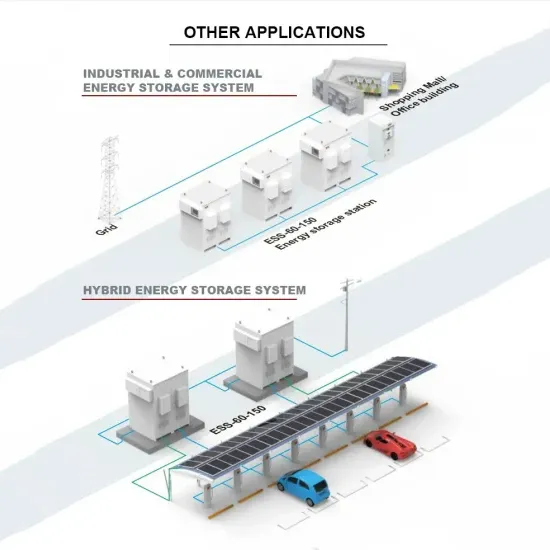

Commercial & Industrial Solar Storage Market Growth

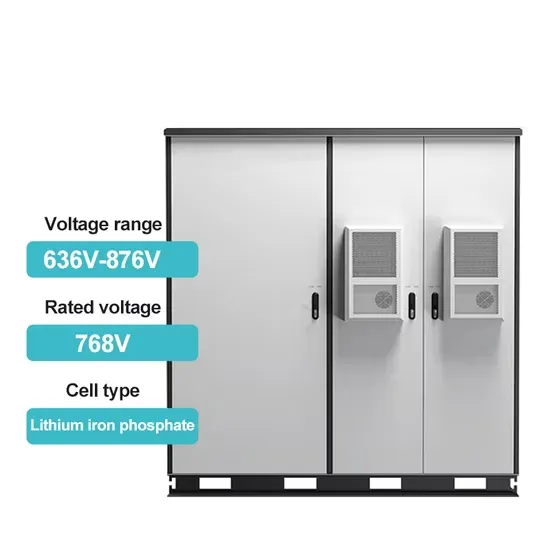

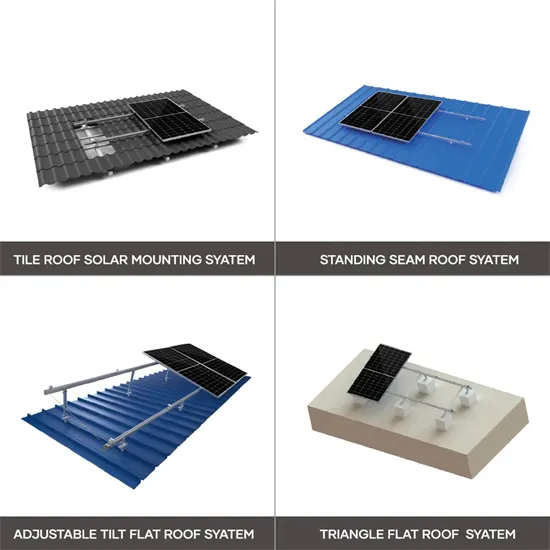

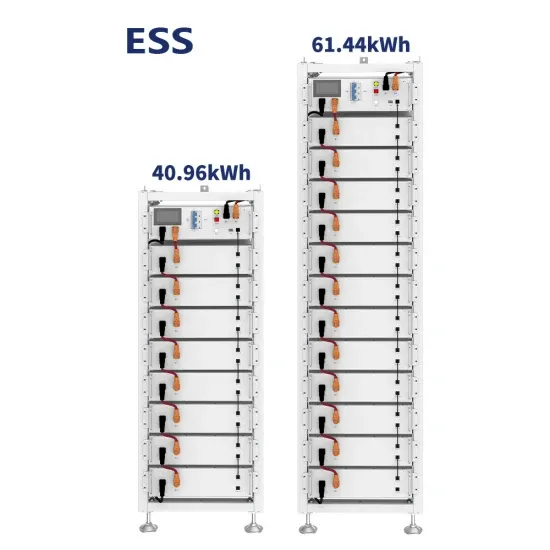

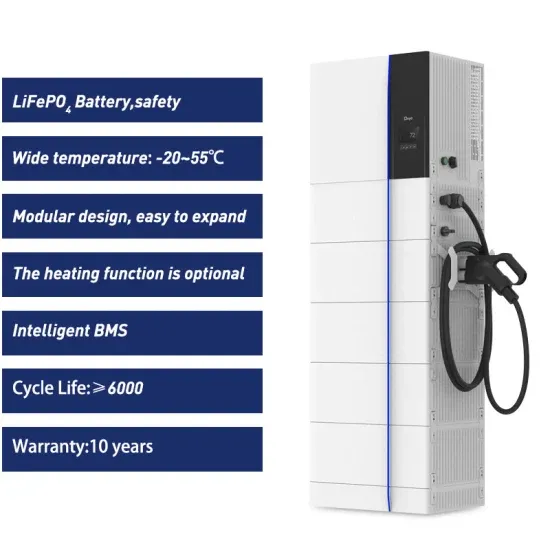

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

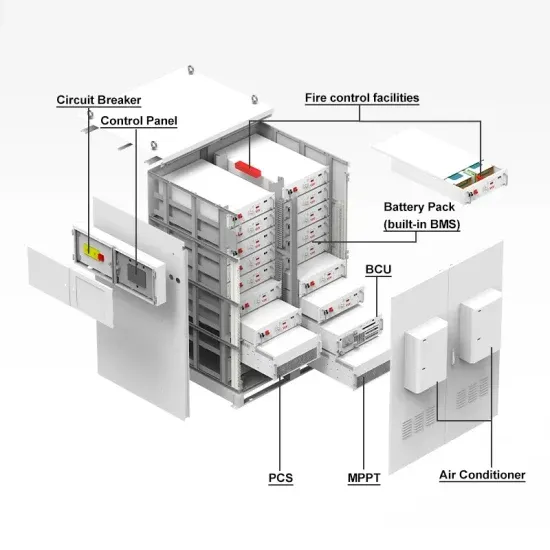

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.