Is Latin America ready for 5G?

Despite opposition from the three rival companies Entel, Movistar and WOM, the regulator assessed that having four operators in the 5G space

Get Price

Is Latin America ready for 5G?

Despite opposition from the three rival companies Entel, Movistar and WOM, the regulator assessed that having four operators in the 5G space would improve competition and

Get Price

Analysis of 5G Smart Communication Base Station

With the continuous development of mobile communication and satellite navigation technologies, the positioning requirements of 5G smart

Get Price

Movistar El Salvador Expands and Modernizes Its

Investment in LTE Network and 5G Ready Infrastructure elevates user experiences. Movistar''s eco-friendly technology lowers energy

Get Price

A New Breed Of 5G-ready Base Stations

Since 5G is becoming a recurring theme of discussion among telecoms executives, TowerXchange analyses some of the implications for base stations and their design with the

Get Price

Optimizing the ultra-dense 5G base stations in urban outdoor

The developed model can facilitate the rollout of 5G technology. Due to the high propagation loss and blockage-sensitive characteristics of millimeter waves (mmWaves),

Get Price

Experimenta el futuro

a. Es la nueva infraestructura tecnológica que estamos implementando y que se convertirá en la más moderna de El Salvador. Nuestra red 5G Ready está diseñada para proveer la mejor

Get Price

Lento avance de la red 5G en El Salvador

La red 5G avanza en la región, pero en El Salvador todavía faltan varios procesos que completar. El país todavía no ha desarrollado la red 5G

Get Price

Quick guide: components for 5G base stations and antennas

Base stations A 5G network base-station connects other wireless devices to a central hub. A look at 5G base-station architecture includes various equipment, such as a 5G

Get Price

El Salvador, June 2022, Mobile Network Experience Report

In this first Opensignal report on El Salvador, we examine the mobile network experience of the four main mobile network operators: Claro, Digicel, Movistar and Tigo, over

Get Price

Mobile Communication Network Base Station Deployment Under 5G

This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

Get Price

What is 5G Base Station?

A 5G base station is a crucial component of the fifth - generation (5G) mobile network infrastructure. Here''s a more in - depth look at what it is: 1. Definition

Get Price

Movistar El Salvador Expands and Modernizes Its Network for 5G

Investment in LTE Network and 5G Ready Infrastructure elevates user experiences. Movistar''s eco-friendly technology lowers energy consumption and reduces CO2

Get Price

Movistar rolls out 5G network in El Salvador; pledges

Movistar is aiming to extend the 5G network to 95% of El Salvador''s population. "Our new 5G-ready network is a true reflection of the

Get Price

El Salvador is preparing for the arrival of 5G

Since that date, different state institutions and companies have begun to develop different strategies to increase Internet speed in the country, according to Siget''s

Get Price

El Salvador 5G Infrastructure Market (2025-2031) | Industry

El Salvador 5G Infrastructure Industry Life Cycle Historical Data and Forecast of El Salvador 5G Infrastructure Market Revenues & Volume By Communication Infrastructure for the Period

Get Price

Movistar rolls out 5G network in El Salvador; pledges further

Movistar is aiming to extend the 5G network to 95% of El Salvador''s population. "Our new 5G-ready network is a true reflection of the confidence we have in the country''s

Get Price

5G Network Evolution and Dual-mode 5G Base Station

The fifth generation (5G) networks can provide lower latency, higher capacity and will be commercialized on a large scale worldwide. In order to efficiently deploy 5G networks on the

Get Price

Lento avance de la red 5G en El Salvador

La red 5G avanza en la región, pero en El Salvador todavía faltan varios procesos que completar. El país todavía no ha desarrollado la red 5G de manera operativa, pero las

Get Price

China claims first 5G base stations for military use

The 5G base station was developed by China Mobile Communications Group and the Chinese People''s Liberation Army China has

Get Price

Base Station Location Modeling and Signal Coverage

for communication, the development of the new generation of communication technology 5G, its large bandwidth and small base station

Get Price

5G

Verizon 5G base station utilizing Ericsson equipment in Springfield, Missouri, USA. 5G networks are cellular networks, [5] in which the service area is

Get Price

5G Glass Antenna Turns Windows Into Base Stations

Because 5G networks include spectrum comprising higher frequencies than 4G, base stations for 5G networks serve a smaller coverage footprint. Which means more base

Get Price

El Salvador Wireless Frequency Bands and Carriers

Mobile networks and carriers in El Salvador use 3 GSM bands, 3 UMTS bands, and 3 LTE bands. Find out if your unlocked phone or mobile device will work in El Salvador.

Get Price

China rolls out world''s first military-proof 5G that can connect

China has unveiled the world''s first mobile 5G base station, which, after passing rigorous tests, is now poised for deployment on the battlefield.

Get Price

Base Station''s Role in Wireless Communication Networks

Regular software updates ensure the base station can handle new technologies and provide a better user experience. Can base stations be used in remote areas? Yes, base stations can be

Get Price

6 FAQs about [Which is better El Salvador 5G base station or communication]

Why is Salvador launching a 5G network?

“Our new 5G-ready network is a true reflection of the confidence we have in the country’s future and the desire to provide Salvadorans with access to state-of-the-art services” said Del Cid. “Access to this type of technology is a platform to rapidly boost the competitive capacity of the country’s productive sector.

Why is Movistar launching a 5G network in El Salvador?

Movistar is aiming to extend the 5G network to 95% of El Salvador’s population. “Our new 5G-ready network is a true reflection of the confidence we have in the country’s future and the desire to provide Salvadorans with access to state-of-the-art services” said Del Cid.

Is Telefonica Moviles launching a 5G network in El Salvador?

Telefonica Moviles (Movistar) has commenced its rollout of a 5G-ready network in El Salvador. According to InformaTVX, the operator’s CEO Luis Del Cid pledged an initial investment of around US$280 million. The deployment will continue into 2023, with commercial services scheduled to launch as the necessary spectrum is freed up.

Which countries offer 4G LTE services in El Salvador?

The mobile network covers 93 percent of the territory and 92 percent of the population, with 4G LTE services being introduced in 2019 after the allocation of suitable spectrum by SIGET. Today, América Móvil, Grupo IBW, General International Telecom Limited, and Tigo El Salvador offer high-speed data and internet services.

Why is mobile penetration so high in El Salvador?

Mobile penetration is remarkably high considering El Salvador’s economic indicators, higher than the average for Latin America and the Caribbean. The growth in fixed-line services lowered in the face of mobile-cellular competition; fixed lines were 862,717 in 2022.

Does El Salvador have a mobile network?

By 2018, over 680,000 subscribers had used this service. The telecom penetration rate in El Salvador is approximately 153 percent, indicating a high number of mobile phones relative to the population. By the first quarter of 2016, 82 percent of the country's territory had access to mobile network coverage, mainly in urban areas.

More related information

-

Which is the 5G base station for communication

Which is the 5G base station for communication

-

5G base station of El Salvador Electricity Company

5G base station of El Salvador Electricity Company

-

5G communication energy method base station energy method

5G communication energy method base station energy method

-

Vanuatu 5G Communication Base Station Inverter Construction Project

Vanuatu 5G Communication Base Station Inverter Construction Project

-

Libya 5G communication base station wind and solar complementary construction project

Libya 5G communication base station wind and solar complementary construction project

-

Cuba 5G communication base station photovoltaic power generation system

Cuba 5G communication base station photovoltaic power generation system

-

5g communication base station inverter process

5g communication base station inverter process

-

Timor-Leste 5G Communication Base Station Hybrid Energy Construction Project

Timor-Leste 5G Communication Base Station Hybrid Energy Construction Project

Commercial & Industrial Solar Storage Market Growth

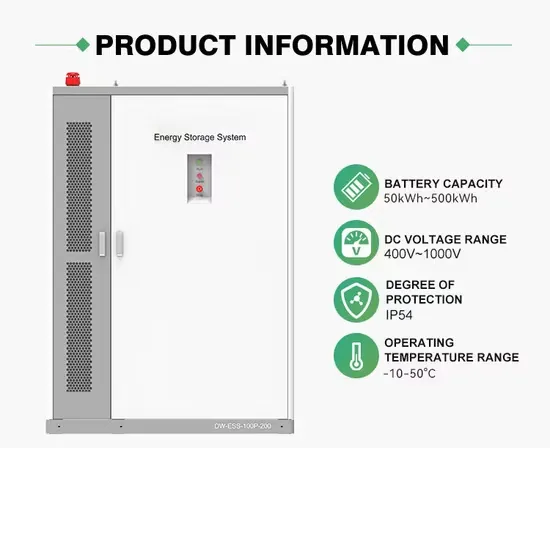

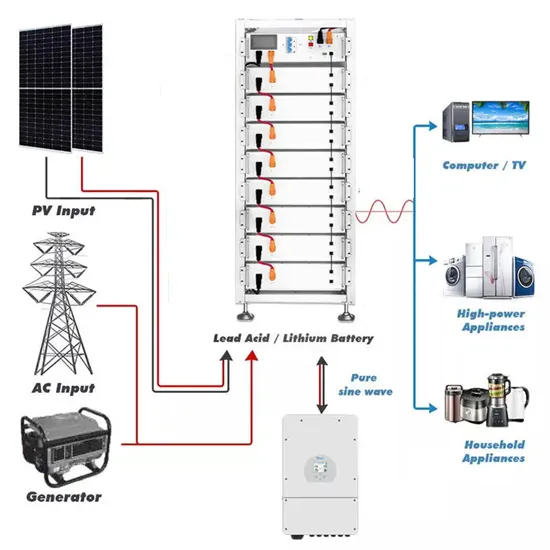

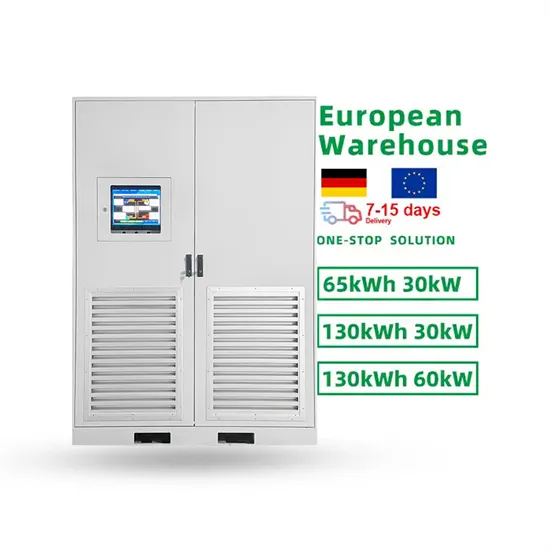

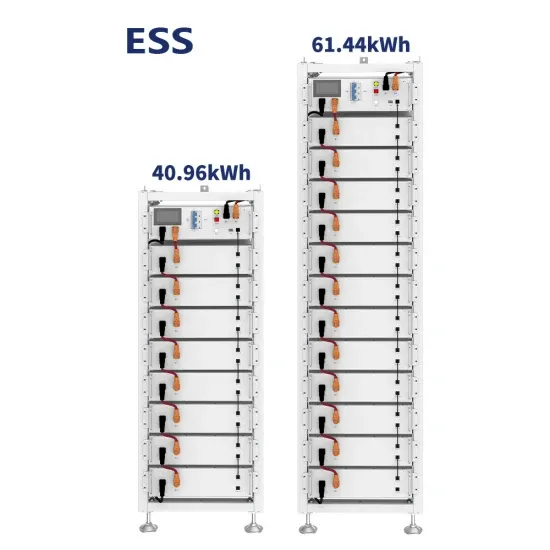

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.