HOW DOES ENERGY STORAGE MAKE MONEY

There are three main ways that grid-scale energy storage resources (ESR''s) can make money: energy price arbitrage, ancillary grid services, and resource adequacy.

Get Price

How much is the grid-connected electricity price of energy storage

The grid-connected electricity price of energy storage power stations varies significantly based on several key factors. 1. Location and Market Dynamics: Prices can differ

Get Price

How much tax does the energy storage power station earn?

1. Taxation on energy storage power stations varies significantly by jurisdiction, 2. Factors such as infrastructure, investment incentives, and operational costs influence

Get Price

How Storage Makes Money

There are two main ways that grid-scale energy storage resources (ESR''s) can make money: energy price arbitrage and ancillary grid services. In several

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

How do centralized energy storage power stations make money?

1. Centralized energy storage power stations generate revenue through several avenues, including 1. energy arbitrage, 2. ancillary services, 3. capacity market participation,

Get Price

In-depth explainer on energy storage revenue and effects on

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for storage projects.

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

How much does it cost to build your own energy

Building your own energy storage power station can incur various costs that depend on multiple factors. 1. Initial investment varies significantly

Get Price

How much electricity can a Tesla energy storage

In summary, Tesla energy storage stations represent a formidable advancement in the realm of renewable energy and energy management.

Get Price

In-depth explainer on energy storage revenue and effects on

Learn how much profit an owner can expect from energy storage solutions. Understand key financial factors and market demand.

Get Price

how can energy storage power stations make profits

By interacting with our online customer service, you''ll gain a deep understanding of the various how can energy storage power stations make profits featured in our extensive catalog, such as

Get Price

How do energy storage power stations make money? | NenPower

Energy storage power stations generate income through multiple revenue streams, including: 1) participation in ancillary services markets, 2) energy arbitrage opportunities, and

Get Price

How Do Energy Storage Power Stations Make Money? A

Imagine a world where energy storage is so cheap, utilities pay you to take their excess power. We''re not there yet but bet your bottom dollar someone''s working on it.

Get Price

How much electricity can the energy storage power station be

These factors inform how much electricity can be discharged under optimal conditions. Energy storage systems operate below their maximum output for various reasons,

Get Price

How Energy Storage Power Stations Generate Operating

Imagine renting out your basement storage space, but for electrons. That''s essentially what shared storage operators do, charging annual fees of ¥250-350/kW in most Chinese provinces

Get Price

How Storage Makes Money

There are two main ways that grid-scale energy storage resources (ESR''s) can make money: energy price arbitrage and ancillary grid services. In several markets, energy storage

Get Price

How much is the charging price of energy storage power station?

Moreover, energy storage stations encompass various technologies, including lithium-ion batteries, pumped hydro storage, and flywheels. Each technology can vary in

Get Price

Three Ways Energy Storage Can Generate Revenue In America''s

So how can energy storage plug into these markets? In a word, revenue. Energy storage can collect revenue in America''s organized power markets three ways: platforms,

Get Price

Cost of electricity by source

The calculations also assist governments in making decisions regarding energy policy. On average the levelized cost of electricity from utility scale solar power

Get Price

The Best Portable Power Stations

The best portable power stations are great off-grid or in an emergency. For these reviews, we tested top models to see how they stacked

Get Price

How much money can energy storage power stations make?

Energy storage power stations can generate significant revenue, driven by multiple factors including demand response opportunities, ancillary services, and peak shaving

Get Price

How do investors of energy storage power stations make money?

To understand the financial strategies employed by investors in energy storage power stations, it is crucial to identify several core aspects integral to their profitability. 1.

Get Price

How much is the financial subsidy for energy storage power stations

1. The financial subsidy for energy storage power stations varies significantly based on location, technology, and governmental policy,2. In many regions, subsidies can range from

Get Price

How do energy storage power stations make money?

Energy storage power stations generate income through multiple revenue streams, including: 1) participation in ancillary services markets, 2)

Get Price

Three Ways Energy Storage Can Generate Revenue In

So how can energy storage plug into these markets? In a word, revenue. Energy storage can collect revenue in America''s organized power markets three ways: platforms,

Get Price

How much profit does Jintan Energy Storage Power Station make?

PROFITABILITY FACTORS Energy storage systems have become pivotal in modern electricity grids, especially with the increase of renewable energy sources like solar

Get Price

Pumped Storage Hydropower

Pumped storage hydropower (PSH) is a type of hydroelectric energy storage. It is a configuration of two water reservoirs at different elevations that can generate

Get Price

How Much Does an Owner Make from Energy Storage Solutions?

Learn how much profit an owner can expect from energy storage solutions. Understand key financial factors and market demand.

Get Price

6 FAQs about [How much money can energy storage power stations make ]

How does energy storage generate revenue?

In a word, revenue. Energy storage can collect revenue in America’s organized power markets three ways: platforms, products, and pay-days . However, different projects will tap these potential revenue streams in different ways, and investors should seek nimble developers who can navigate a complex and evolving regulatory and market landscape.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is energy storage on the rise?

This article is more than 4 years old. Energy storage is surging across America. Total installed capacity passed 1,000 megawatt-hours (MWh) during a record-setting 2017, and the U.S. market is forecast to nearly double by adding more than 1,000 MWh new capacity in 2018 - adding as much capacity in one year as it did in the previous four.

What is the 'value stack' in energy storage?

Owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple contracts and generate multiple layers of revenue or 'value stack.' Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

What is a battery energy storage project?

A battery energy storage project is a system that serves a variety of purposes for utilities and other consumers of electricity, including backup power, frequency regulation, and balancing electricity supply with demand.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

More related information

-

How much money can Huawei make from energy storage projects

How much money can Huawei make from energy storage projects

-

How many companies are involved in energy storage power stations in Uzbekistan

How many companies are involved in energy storage power stations in Uzbekistan

-

How many companies in Sweden are doing energy storage power stations

How many companies in Sweden are doing energy storage power stations

-

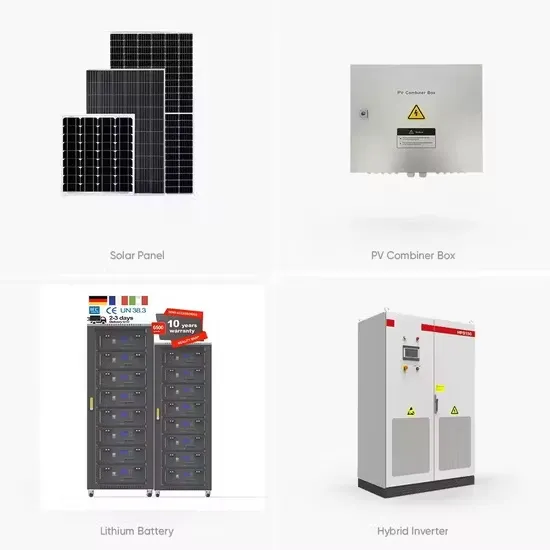

How to make BESS in energy storage power station

How to make BESS in energy storage power station

-

How to make energy storage power station cost BESS

How to make energy storage power station cost BESS

-

How many hybrid energy storage power stations are there in the United States

How many hybrid energy storage power stations are there in the United States

-

The role of distributed energy storage power stations

The role of distributed energy storage power stations

-

Energy storage ESS power supply for 4G communication base stations

Energy storage ESS power supply for 4G communication base stations

Commercial & Industrial Solar Storage Market Growth

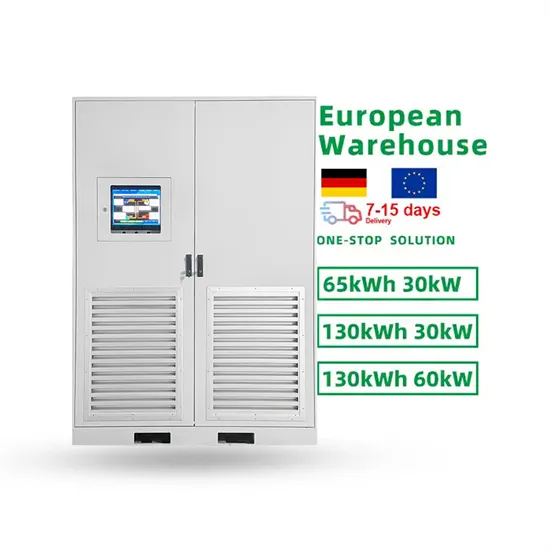

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.