U.S. Hydropower Market Report

Hydropower accounted for 6.6% of all electricity generated and 38% of electricity from renewables produced in the United States in 2019.7 Additionally, 43 PSH plants with a total power capacity

Get Price

Hydroelectric power in the United States

The Hoover Dam, when completed in 1936, was both the world''s largest electric-power generating station and the world''s largest concrete structure. Hoover

Get Price

U.S. battery capacity increased 66% in 2024

In the United States, cumulative utility-scale battery storage capacity exceeded 26 gigawatts (GW) in 2024, according to our January 2025 Preliminary Monthly Electric

Get Price

2022 was another big year for hybrid power

At the end of 2022, there were 374 hybrid plants (>1 MW) operating across the United States (+25% compared to the end of 2021),

Get Price

Renewable Energy Storage Facts | ACP

Energy storage allows us to store clean energy to use at another time, increasing reliability, controlling costs, and helping build a more resilient grid. Get the clean energy storage facts

Get Price

BESS Failure Incident Database

About EPRI''s Battery Energy Storage System Failure Incident Database The database compiles information about stationary battery energy storage system

Get Price

United States energy storage industry

Batteries and pumped hydro are the main storage technologies in use in the U.S., according to the number of storage projects in the country in 2023. Discover all statistics and

Get Price

NHA Unveils New 2021 U.S. Pumped Storage

Today, the United States has 43 existing PSH projects with over 22,800 megawatts of storage capacity, representing more than 94% of all installed

Get Price

Interest in Hybrid and Co-Located Power Plants Continues to

Based in part on Form EIA-860 data, there were at least 226 co-located hybrid plants (>1 MW) operating across the United States at the end of 2020, totaling more than 30 GW of aggregate

Get Price

Electricity explained

1 Utility-scale power plants have at least one MW of electric generation capacity. 2 Includes petroleum coke, petroleum liquids, other gases, other miscellaneous sources not included

Get Price

Hybrid Power Plants: Status of Installed and Proposed Projects

Based in part on EIA Form 860 data, there were at least 125 co-located hybrid plants (>1 MW) already operating across the United States at the end of 2019, totaling over 14 GW of

Get Price

Battery storage boomed last year, and there''s more to come in 2025

Energy storage technologies can be an important part of our electric grid of the future, helping to assure reliable access to electricity while supporting America''s transition to

Get Price

2023 was another big year for newly installed and proposed

80 new hybrid plants (>1 MW) began operating across the United States in 2023, totaling nearly 7.9 GW of generating capacity and 3.6 GW/11.6 GWh of energy storage.

Get Price

U.S. Grid Energy Storage Factsheet

The U.S. powered on 80 new hybrid power plants with 7.9 GW of operational generating capacity and 11.6 GWh of operational storage capacity

Get Price

Hybrid power plants account for majority of proposed US solar, storage

The U.S. powered on 80 new hybrid power plants with 7.9 GW of operational generating capacity and 11.6 GWh of operational storage capacity in 2023, according to the

Get Price

2022 was another big year for hybrid power plants—especially PV+storage

At the end of 2022, there were 374 hybrid plants (>1 MW) operating across the United States (+25% compared to the end of 2021), totaling nearly 41 GW of generating

Get Price

Battery industry in the United States

Batteries became the main energy storage technology in the United States in 2024, surpassing hydro pumped storage. After showing a

Get Price

U.S. electric system is made up of interconnections

Local electricity grids are interconnected to form larger networks for reliability and commercial purposes. At the highest level, the United States

Get Price

Operational hybrid & co-located power plants U.S.| Statista

There were approximately 374 hybrid and co-located power plants in the United States as of the end of 2022.

Get Price

Solar and battery storage to make up 81% of new U.S.

Developers have scheduled the Menifee Power Bank (460.0 MW) at the site of the former Inland Empire Energy Center natural gas-fired power

Get Price

2023 was another big year for newly installed and proposed hybrid power

80 new hybrid plants (>1 MW) began operating across the United States in 2023, totaling nearly 7.9 GW of generating capacity and 3.6 GW/11.6 GWh of energy storage.

Get Price

Electricity sector of the United States

Hydro excludes pumped storage (not an energy source, used by all sources, other than hydro). Total includes net imports. 2021 and 2022 data is from Electric Power Annual 2022 The

Get Price

Solar and battery storage to make up 81% of new U.S. electric

More than half of the new utility-scale solar capacity is planned for three states: Texas (35%), California (10%), and Florida (6%). Outside of these states, the Gemini solar

Get Price

Hybrid Power Plants: Status of Operating and Proposed Plants,

At the end of 2022, there were 374 hybrid plants (>1 MW) operating across the United States (+25% compared to the end of 2021), totaling nearly 41 GW of generating capacity (+15%) and

Get Price

U.S. Grid Energy Storage Factsheet

In 2021, 1,595 energy storage projects were operational globally, with 125 projects in construction. 51% of operational projects are located in the U.S. 10 California leads the U.S. in power

Get Price

Hybrid Power Plants: Status of Operating and Proposed Plants

At the end of 2023, there were 469 hybrid plants (>1 MW) operating across the United States (+21% compared to the end of 2022), totaling nearly 49 GW of generating capacity (+19%) and

Get Price

Frequently Asked Questions (FAQs)

How many power plants are in the United States? As of December 31, 2022, there were 25,378 electric generators at about 12,538 utility-scale electric power plants in the United

Get Price

6 FAQs about [How many hybrid energy storage power stations are there in the United States]

How much storage capacity does a PV+storage hybrid plant have?

As of the end of 2023, there was roughly as much storage capacity operating within PV+storage hybrid plants as in standalone storage plants (~7.5 GW each). In storage energy terms, however, PV+storage edged out standalone storage by ~7 GWh (24.2 GWh vs. 17.5 GWh, respectively).

How many hybrid plants are there in 2023?

Key findings from the latest briefing include: At the end of 2023, there were 469 hybrid plants (>1 MW) operating across the United States (+21% compared to the end of 2022), totaling nearly 49 GW of generating capacity (+19%) and 3.6 GW/11.1 GWh of energy storage (+59%/+67%).

How many co-located hybrid plants are there?

Based in part on Form EIA-860 data, there were at least 226 co-located hybrid plants (>1 MW) operating across the United States at the end of 2020, totaling more than 30 GW of aggregate capacity (see map below).

Do hybrid PV+storage plants provide energy arbitrage & resource adequacy?

Hybrid plant configurations reflect their primary use cases : The relatively high average storage ratio and duration of PV+storage plants suggest that storage is providing resource adequacy (i.e., capacity firming) and energy arbitrage (i.e., shifting power sales from lower- to higher-priced periods) capabilities to PV+storage plants.

How many hybrid plants are there in 2022?

Last year was another big year for hybrid plants in the United States . At the end of 2022, there were 374 hybrid plants (>1 MW) operating across the United States (+25% compared to the end of 2021), totaling nearly 41 GW of generating capacity (+15%) and 5.4 GW/15.2 GWh of energy storage (+69%/+88%).

Are hybrid and co-located power plants a good investment?

Interest in Hybrid and Co-Located Power Plants Continues to Grow Falling battery prices and the growth of variable renewable generation are driving a surge of interest in “hybrid” power plants that combine, for example, wind or solar generating capacity with co-located batteries.

More related information

-

What are the flywheel energy storage power stations in the United States

What are the flywheel energy storage power stations in the United States

-

How much money can energy storage power stations make

How much money can energy storage power stations make

-

The gap between China and the United States in wind and solar hybrid power supply for communication base stations

The gap between China and the United States in wind and solar hybrid power supply for communication base stations

-

How many wind solar and energy storage power stations are there in Lebanon

How many wind solar and energy storage power stations are there in Lebanon

-

How long is the cooperation period for energy storage power stations

How long is the cooperation period for energy storage power stations

-

How much investment is needed for a 1GW energy storage power station

How much investment is needed for a 1GW energy storage power station

-

Hybrid Energy Storage Power Station Plan

Hybrid Energy Storage Power Station Plan

-

Hybrid Energy Storage Emergency Power Station

Hybrid Energy Storage Emergency Power Station

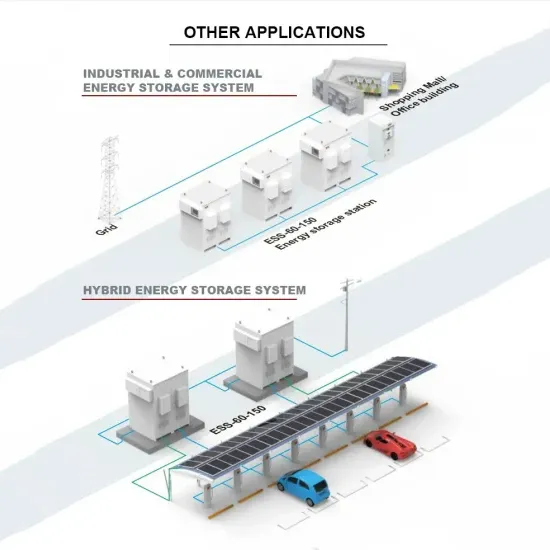

Commercial & Industrial Solar Storage Market Growth

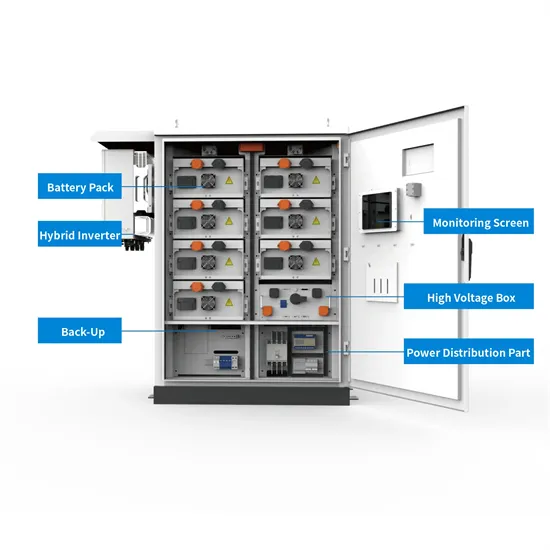

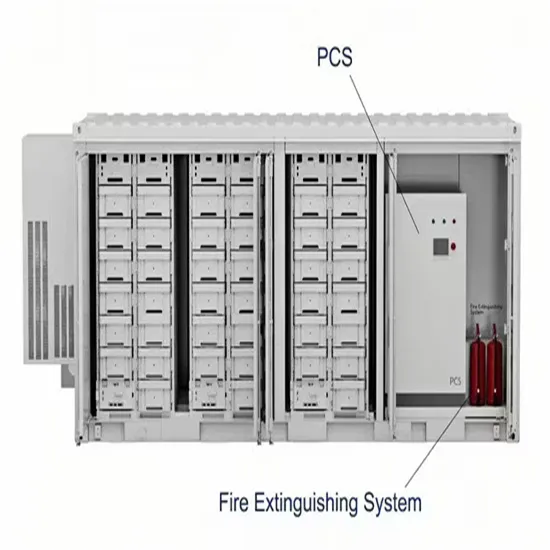

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.